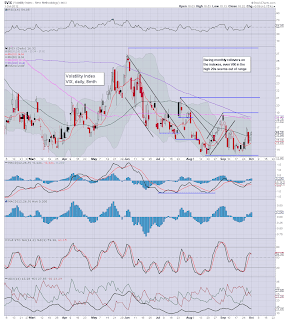

VIX'60min

VIX'daily

So the VIX managed a green close. The hourly cycle is possibly already maxed out though, which is a real problem for the bears on Tuesday. The daily cycle though probably allows a few more days of upside.

Primary remains 18/19, it seems unlikely we can hit the big 20 any time soon. Could be weeks...if not months.