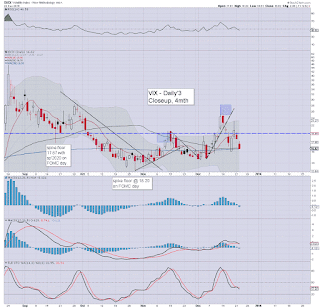

With Santa almost here, equities closed higher for a second consecutive day, and the VIX naturally continued to cool, settling -11.2% @ 16.60. Near term outlook is for continued equity upside into early 2016, and that will likely equate to VIX in the very low teens.

VIX'60min

VIX'daily3

Summary

Little to add.

What should be clear, with the Fed having raised rates last week, a big chunk of uncertainty - and thus volatility, has been removed from the market.

The VIX will likely remain subdued into early 2016.

--

more later... on the indexes

Tuesday, 22 December 2015

Closing Brief

US equity indexes closed broadly higher for the second consecutive day, sp +17pts @ 2038. The two leaders - Trans/R2K, settled higher by 1.5% and 0.9% respectively. Near term outlook offers a lot of chop, but with underlying seasonal upward pressure. Right now, a year end close >2065 looks probable.

sp'60min

Summary

*closing hour action: a little surge to a new intra high of 2042, but then cooling to the mid 2030s.

There is very natural resistance at the hourly upper bollinger.

-

So.. a second day of gains... as we're another day closer to Santa.

We're clearly headed broadly higher into end year, although right now, a year end close in the 2100s looks difficult.. even if Oil pushes upward.

--

more later.. on the indexes

sp'60min

Summary

*closing hour action: a little surge to a new intra high of 2042, but then cooling to the mid 2030s.

There is very natural resistance at the hourly upper bollinger.

-

So.. a second day of gains... as we're another day closer to Santa.

We're clearly headed broadly higher into end year, although right now, a year end close in the 2100s looks difficult.. even if Oil pushes upward.

--

more later.. on the indexes

3pm update - a second day of gains

US equity indexes are set for a second consecutive net daily gain, with the sp' due to settle within the 2030s. Wed' offers construction of a baby bull flag, before the week settles in the 2045/50 zone. More significant strength looks due next week, to close the year above the 50/200 day MAs

sp'60min

USO, daily2

Summary

Little to add.

The gains in Oil are still within a broader down trend. Even if Oil can claw to the $40 threshold within the next few weeks, it will do nothing to suggest the collapse wave from summer 2014 is over.

Indeed, there is still very little industry capitulation in the oil sector.. nor for that matter, in precious metals/mining.

For the drivers out there.. and almost everyone... low oil/energy prices remain one of the distinct good things across this year.

-

back at the close

sp'60min

USO, daily2

Summary

Little to add.

The gains in Oil are still within a broader down trend. Even if Oil can claw to the $40 threshold within the next few weeks, it will do nothing to suggest the collapse wave from summer 2014 is over.

Indeed, there is still very little industry capitulation in the oil sector.. nor for that matter, in precious metals/mining.

For the drivers out there.. and almost everyone... low oil/energy prices remain one of the distinct good things across this year.

-

back at the close

2pm update - building gains

US equities continue to build gains, with the sp +15pts @ 2036. A daily close in the 2040s looks more viable tomorrow.. along with VIX 16/15s. Metals remain weak, Gold -$5, after Gartman has turned bullish shiny things. Oil is holding sig' gains of 1.3%.. and that is certainly helping energy stocks.

sp'60min

VIX'60min

Summary

Hmm. There really isn't much to add.

--

notable strength...

CNX +3.8%

RIG +3.9%

SDRL +4.1%

.. even TWTR is +1.4%

sp'60min

VIX'60min

Summary

Hmm. There really isn't much to add.

--

notable strength...

CNX +3.8%

RIG +3.9%

SDRL +4.1%

.. even TWTR is +1.4%

1pm update - the 2030s

US equities see renewed upside to the sp'2030s, and indeed, a daily close in the 2030s looks probable, along with VIX 17/16s. Seasonally, the equity bears have no realistic opportunity again until mid/late January. Between now and then.. its a case of whether the bulls can break >2134.

sp'weekly1b

GLD, daily

Summary

*Gold is moderately weak, as Gartman is touting it bullish.

For some hilarity.. see: HERE

--

As for equities.. a daily close in the 2030s looks highly probable... with the 2040s tomorrow.

What should be clear....

1. no downside power

2. seasonal upside

3. increasingly subdued

4. If Oil can push higher... equities will be pressured upward

-

back at 2pm

sp'weekly1b

GLD, daily

Summary

*Gold is moderately weak, as Gartman is touting it bullish.

For some hilarity.. see: HERE

--

As for equities.. a daily close in the 2030s looks highly probable... with the 2040s tomorrow.

What should be clear....

1. no downside power

2. seasonal upside

3. increasingly subdued

4. If Oil can push higher... equities will be pressured upward

-

back at 2pm

12pm update - post solstice chop

US equities are seeing continued chop, but still leaning on the upside, as the market is naturally increasingly subdued into the Christmas break. Oil is certainly helping the market hold above the recent series of marginally higher lows, currently +1.5% in the $36s.

sp'daily5

USO'daily2

Summary

*note the 50/200 day MAs.. now both at sp'2061

--

Price action is clearly subdued, but leaning to the upside. An attempt to close in the 2060s will be viable next Mon/Tuesday.

A year end close in the 2100s looks... difficult.

--

Here in London city...

The winter solstice was overnight at 4.49am GMT. So.. the days are finally going to start getting longer again. Only another four months until first chance of some warmth.

--

VIX update from Mr T.

--

time for lunch

sp'daily5

USO'daily2

Summary

*note the 50/200 day MAs.. now both at sp'2061

--

Price action is clearly subdued, but leaning to the upside. An attempt to close in the 2060s will be viable next Mon/Tuesday.

A year end close in the 2100s looks... difficult.

--

Here in London city...

The winter solstice was overnight at 4.49am GMT. So.. the days are finally going to start getting longer again. Only another four months until first chance of some warmth.

--

VIX update from Mr T.

--

time for lunch

11am update - clawing upward

After a rather messy open, US equities have resumed clawing upward, and look set for a close in the 2030s.. along with VIX 17/16s. Oil is battling to build sig' gains, currently +1.1% in the $36s. If Oil can climb to the $40 threshold in Jan'2016, that sure would help negate any threat of downside in the short term.

sp'60min

USO, daily2

Summary

Little to add.

Again, it remains the case, where are all those who were touting a crash wave last week? Are the tylers busy editing posts on Zerohedge to make it appear as though they were never getting hysterical about a quad-opex crash?

Santa is almost here... want to be short ahead of him?

--

back at 12pm

sp'60min

USO, daily2

Summary

Little to add.

Again, it remains the case, where are all those who were touting a crash wave last week? Are the tylers busy editing posts on Zerohedge to make it appear as though they were never getting hysterical about a quad-opex crash?

Santa is almost here... want to be short ahead of him?

--

back at 12pm

10am update - opening reversal

Equities open moderately higher to sp'2029, but the gains have faded rather quickly, with a clear black-fail candle for equities, and a classic hollow red reversal candle for the VIX. However, in such holiday trading conditions, bears are unlikely to muster any sustained downside.

sp'60min

VIX'60min

Summary

Its a very messy open.

All things considered though... we've a rather secure double floor of sp'2005... and we still look set to claw upward to the 50/200 day MAs in the 2060s.

A year end close in the 2100s is STILL viable, but new historic highs are not.

--

notable mover...

DIS. For the third consecutive day, opening gains quickly turn to losses as another sell program hits. Are they really intent on dragging it to the $90 target that BTIG recently issued?

-

stay tuned

sp'60min

VIX'60min

Summary

Its a very messy open.

All things considered though... we've a rather secure double floor of sp'2005... and we still look set to claw upward to the 50/200 day MAs in the 2060s.

A year end close in the 2100s is STILL viable, but new historic highs are not.

--

notable mover...

DIS. For the third consecutive day, opening gains quickly turn to losses as another sell program hits. Are they really intent on dragging it to the $90 target that BTIG recently issued?

-

stay tuned

Pre-Market Brief

Good morning. US equity futures are a little higher, sp +6pts, we're set to open at 2027. USD continues to cool, -0.2% in the DXY 98.10s. Gold -$3. Oil +0.7%.

sp'60min

Summary

*Q3 GDP: revised fractionally lower to 2.0%

--

Little to add.

A second day of gains look due. The sp'2040s are certainly within range today.

-

Update from Oscar

-

Have a good Tuesday

sp'60min

Summary

*Q3 GDP: revised fractionally lower to 2.0%

--

Little to add.

A second day of gains look due. The sp'2040s are certainly within range today.

-

Update from Oscar

-

Have a good Tuesday

A year end close above the 10MA?

It was a naturally rather subdued start to Christmas week. Regardless of the near term moves, what is far more important is how the leading world equity markets close the year. Can the US Dow/sp'500, the German DAX, the Japanese Nikkei, and the Chinese Shanghai comp' close above their respective monthly 10MAs ?

US - Dow, monthly

Germany, DAX

Japan

China

Summary

*I'll cover the year end closes in the world markets... the weekend of Jan'2/3.

--

Not much to add.

Merely to highlight that equity bulls should be desperate to see at least the leading markets break/hold their respective monthly 10MAs.

A December fail would be bad.

A January fail would be REALLY bad.. and bode for the August lows to be tested.. and broken.

--

Update from Mr C.

--

Looking ahead

Tuesday will see the second/final rev' for Q3 GDP. Market is expecting a fractionally weaker 2.0%. Any number >2.1% would bode reasonably okay for the economic bulls.

Other data: house price index, existing home sales.

--

Goodnight from London

US - Dow, monthly

Germany, DAX

Japan

China

Summary

*I'll cover the year end closes in the world markets... the weekend of Jan'2/3.

--

Not much to add.

Merely to highlight that equity bulls should be desperate to see at least the leading markets break/hold their respective monthly 10MAs.

A December fail would be bad.

A January fail would be REALLY bad.. and bode for the August lows to be tested.. and broken.

--

Update from Mr C.

--

Looking ahead

Tuesday will see the second/final rev' for Q3 GDP. Market is expecting a fractionally weaker 2.0%. Any number >2.1% would bode reasonably okay for the economic bulls.

Other data: house price index, existing home sales.

--

Goodnight from London

Daily Index Cycle update

US equities closed moderately higher sp

+15pts @ 2021. The two leaders - Trans/R2K, settled higher by 0.7% and

0.6% respectively. Near term outlook is for seasonal upside, at least to

2050/60s, but an attempt to close the year in the 2100s remains very

viable.

sp'daily5

Trans

Summary

A short term double floor of sp'2005 looks in place. First soft target are the 50/200 day MA's in the sp'2060s... and then the resistance zone of 2075/80.

There are just 6.5 trading days left of the year, but a year end close in the sp'2100s remains very viable.

-

Update from Riley

-

a little more later...

sp'daily5

Trans

Summary

A short term double floor of sp'2005 looks in place. First soft target are the 50/200 day MA's in the sp'2060s... and then the resistance zone of 2075/80.

There are just 6.5 trading days left of the year, but a year end close in the sp'2100s remains very viable.

-

Update from Riley

-

a little more later...

Subscribe to:

Comments (Atom)