Whilst equities closed moderately mixed, the VIX was battling across the day to hold minor gains, settling +1.9% @ 14.91 (intra high 15.46). Near term outlook offers an equity snap under soft rising support, with first target of the VIX 18/20 zone next week.

VIX'60min

VIX'daily3

Summary

Little to add.

VIX remains broadly subdued, and it is clearly going to take an sp -30pt day to give the VIX the first opportunity to make an attempt to clear the key 20 threshold.

--

more later... on the indexes

Thursday, 29 October 2015

Closing Brief

US equities closed somewhat mixed, sp -0.9pts @ 2089. The two leaders - Trans/R2K, settled +0.8% and -1.1% respectively. Near term outlook remains seeking a break lower... with at least the sp'2050s viable next week. Primary target by Nov' opex will be around the sp'2000 threshold.

sp'60min

Summary

*closing hour action: a sporadic nano-scale burst to the upside... breaking a fractional new cycle high of sp'2092.

--

A surprisingly subdued day after the FOMC swings, with the sp'500 trading within a tight range of just 9pts.

Frankly, I wish it was Friday afternoon.. but then... I try not to wish my life away.

--

more later.. on the VIX

sp'60min

Summary

*closing hour action: a sporadic nano-scale burst to the upside... breaking a fractional new cycle high of sp'2092.

--

A surprisingly subdued day after the FOMC swings, with the sp'500 trading within a tight range of just 9pts.

Frankly, I wish it was Friday afternoon.. but then... I try not to wish my life away.

--

more later.. on the VIX

3pm update - 7.2 points

US equities remain in a rather bizarrely tight trading range of a mere 7.2pts. Price structure is arguably still one of a topping formation.. snap level at the Friday open will be sp'2075. VIX is holding minor gains of 2.6% in the 14.70s.

sp'60min

Summary

So.. err... 7.2pts... its not exactly exciting, is it?

Tomorrow can only be more dynamic.. yes?

--

notable strength...

AAPL, +1% in the $120s

AAPL is managing to continue climbing after good earnings.... but it looks way over stretched.. and will be vulnerable as the broader market rolls over into next week.

--

back at the close.

sp'60min

Summary

So.. err... 7.2pts... its not exactly exciting, is it?

Tomorrow can only be more dynamic.. yes?

--

notable strength...

AAPL, +1% in the $120s

AAPL is managing to continue climbing after good earnings.... but it looks way over stretched.. and will be vulnerable as the broader market rolls over into next week.

--

back at the close.

2pm update - metals having real problems

Whilst US equities remain moderately weak (awaiting a snap <sp'2075)... there is notable weakness in the precious metals. Gold -$10, with Silver -2.6%, having seen a powerful reversal yesterday at the 200dma. Outlook is bearish.. and if correct, that sure doesn't bode well for the related mining stocks.

GLD, daily

GDX, daily

Summary

Broadler price structure on the weekly charts is a giant bear flag.. and is highly suggestive of new multi-year lows.

Gold looks set for the $1000 threshold.. and frankly.. if interest rates are raised at the Dec' FOMC, the gold bugs are going to end the year being utterly destroyed.

-

*there will come a grand turning point in the metals/miners.. and I'll sure as hell be the first to tout it.. but for now... it remains a waiting game.

-

back at 3pm

GLD, daily

GDX, daily

Summary

Broadler price structure on the weekly charts is a giant bear flag.. and is highly suggestive of new multi-year lows.

Gold looks set for the $1000 threshold.. and frankly.. if interest rates are raised at the Dec' FOMC, the gold bugs are going to end the year being utterly destroyed.

-

*there will come a grand turning point in the metals/miners.. and I'll sure as hell be the first to tout it.. but for now... it remains a waiting game.

-

back at 3pm

1pm update - the micro battle continues

US equities remain a touch weak, as some of the bull maniacs still believe we'll see further highs before a retrace begins. Price action is extremely tight, with the snap level currently at soft rising support @ sp'2075. VIX remains holding gains of almost 5%.. around 15. The 16s look due.

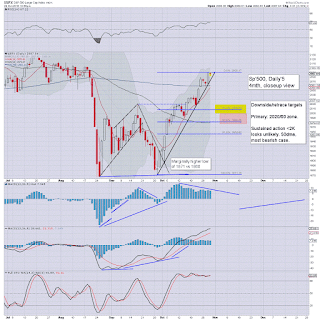

sp'daily5

VIX'daily3

Summary

*brief highlight of the daily charts...

---

Market looks tired, and with the FOMC and key GDP data out of the way.... we're set to see a break lower.

Its just a case of when the first snap occurs.

-

notable weakness: TWTR -5.3% in the $29s... ugly price action...

GDX -3.9%.. as the metals continue to cool

-

*metals are increasingly weak, Gold -$8, with Silver -2.6%.. but more on those... in the next hour.

sp'daily5

VIX'daily3

Summary

*brief highlight of the daily charts...

---

Market looks tired, and with the FOMC and key GDP data out of the way.... we're set to see a break lower.

Its just a case of when the first snap occurs.

-

notable weakness: TWTR -5.3% in the $29s... ugly price action...

GDX -3.9%.. as the metals continue to cool

-

*metals are increasingly weak, Gold -$8, with Silver -2.6%.. but more on those... in the next hour.

12pm update - leaning on the weak side

US equities remain on the slightly weaker side, having seen a morning low of sp'2082. The VIX is battling for a move into the 16s.. which will open up 18/20. Metals are weak (despite a cooling USD), Gold -$6. Oil is seeing some swings... currently back to +0.4%.

sp'60min

VIX'60min

Summary

The market sure is trying to hold together, but the underlying pressure is increasingly bearish.. as reflected in a VIX which is creeping upward.

-

notable weakness..

miners, GDX -2.8%.. as the metals are unable to bounce from yesterdays powerful reversal (at the 200dma)

TWTR -4.5%.. momo chasers are likely in trouble in that one.

--

VIX update from Mr T.

--

time for lunch

sp'60min

VIX'60min

Summary

The market sure is trying to hold together, but the underlying pressure is increasingly bearish.. as reflected in a VIX which is creeping upward.

-

notable weakness..

miners, GDX -2.8%.. as the metals are unable to bounce from yesterdays powerful reversal (at the 200dma)

TWTR -4.5%.. momo chasers are likely in trouble in that one.

--

VIX update from Mr T.

--

time for lunch

11am update - increasing downward pressure

US equities remain only a little lower, but price momentum is in the process of turning toward the bears. Net daily declines look due. Equity bears should be seeking a break of soft rising support.. with a daily close <sp'2075.. along with VIX 16s.

sp'60min

VIX'60min

Summary

Suffice to add... the market has seen a few vain attempts to break back upward.. but is failing.

It would appear just a matter of when we get the first sig' net daily decline... although unlikely today...

First target is the 2020/00 zone... where there are all manner of supports.

-

Eyes on the VIX... which does have a VERY clear fed day spike-floor of 12.80. We ain't likely going that low again until December.

-

notable weakness...

F, -2.1%.

INTC -1.7%

TWTR -5.5%.. as the momo chasers bail... once again.

sp'60min

VIX'60min

Summary

Suffice to add... the market has seen a few vain attempts to break back upward.. but is failing.

It would appear just a matter of when we get the first sig' net daily decline... although unlikely today...

First target is the 2020/00 zone... where there are all manner of supports.

-

Eyes on the VIX... which does have a VERY clear fed day spike-floor of 12.80. We ain't likely going that low again until December.

-

notable weakness...

F, -2.1%.

INTC -1.7%

TWTR -5.5%.. as the momo chasers bail... once again.

10am update - opening weakness

US equities open lower, but so far the declines barely rate as moderate. With the USD -0.3% in the DXY 97.50s, metals are weak, Gold -$5. Oil has seen an early reversal, swinging from -1.5% to +1.0%.

sp'60min

VIX'60min

Summary

Long day ahead... and broadly.... it should result in net daily declines.

As many in the mainstream are starting to finally realise though, equity indexes are set for rather extreme net monthly gains.

Even if we slip a full 2% between now and the weekly close, the equity bulls will manage a rather hyper-bullish close above the monthly 10MA.

-

notable weakness...

INTC -2.3%... a key leader stock.... leading the way lower.

TWTR -3.1%... as reality sets in again

10.01am.. Pending home sales index , -2.3% ... lousy number for September.

Indexes weakening... with VIX +4% in the 15s.

sp'60min

VIX'60min

Summary

Long day ahead... and broadly.... it should result in net daily declines.

As many in the mainstream are starting to finally realise though, equity indexes are set for rather extreme net monthly gains.

Even if we slip a full 2% between now and the weekly close, the equity bulls will manage a rather hyper-bullish close above the monthly 10MA.

-

notable weakness...

INTC -2.3%... a key leader stock.... leading the way lower.

TWTR -3.1%... as reality sets in again

10.01am.. Pending home sales index , -2.3% ... lousy number for September.

Indexes weakening... with VIX +4% in the 15s.

Pre-Market Brief

Good morning. US equity futures are moderately lower, sp -8pts, we're set to open at 2082. USD is -0.3% in the DXY 97.40s. Metals are flat, whilst Oil is -1.0%.

sp'daily5

Summary

So... was the closing high of 2090 the cycle peak?

Probably... I shall dare say.

A retrace to around 2000/1980 seems highly probable. Sustained action in the 1900s looks difficult.

--

Overnight Asia action

Japan: +0.2% @ 18935

China: +0.4% @ 3387... a monthly close in the 3400s remains real close.

--

Awaiting Q3 GDP data....

8.31am... GDP: 1.5%... a touch under expectations.

The equity bull maniacs will need at least 2.5/3.0% for Q4... but that is a long way out... to be posted in late January.

sp' remains -8pts @ 2082

sp'daily5

Summary

So... was the closing high of 2090 the cycle peak?

Probably... I shall dare say.

A retrace to around 2000/1980 seems highly probable. Sustained action in the 1900s looks difficult.

--

Overnight Asia action

Japan: +0.2% @ 18935

China: +0.4% @ 3387... a monthly close in the 3400s remains real close.

--

Awaiting Q3 GDP data....

8.31am... GDP: 1.5%... a touch under expectations.

The equity bull maniacs will need at least 2.5/3.0% for Q4... but that is a long way out... to be posted in late January.

sp' remains -8pts @ 2082

The threatening Fed

With the FOMC announcement containing another threat of an interest rate hike at the December FOMC, the situation is somewhat like late July. First downside target is the sp'2K threshold, and that will no doubt spook a few of the weaker equity bull maniacs.

sp'weekly1b

sp'monthly1b

Summary

It won't take much to attain a net weekly decline.. and that would be my guess right now.

-

re: monthly1b. We're currently net higher by a rather insane 170pts (8.9%). An Oct' close above the key 10MA - currently @ 2050.. looks probable. Any such Friday close >2050 would be a massive bullish signal into next year.

--

Looking ahead

Thursday will see the usual weekly jobs, and pending home sales.

Central to the day.. Q3 GDP data (due 8.30am). Market is expecting 1.7% growth..which is a pretty conservative target. Anything much <1.5% would be a viable excuse for equity weakness.

--

More fedspeak nonsense

A few words were added to the latest Fed statement.. a few words were taken away. The cheerleaders on clown finance TV were of course obsessing over such things.

To me.. it is all utterly farcical... but more so... sickening. Savers remain destroyed with such artificially low rates, and there remain ever worse distortions across much of the world capital markets.

Even if rates were to somehow reach 2-3% by 2017, it won't negate much of the damage that has been already been done.

Goodnight from London

sp'weekly1b

sp'monthly1b

Summary

It won't take much to attain a net weekly decline.. and that would be my guess right now.

-

re: monthly1b. We're currently net higher by a rather insane 170pts (8.9%). An Oct' close above the key 10MA - currently @ 2050.. looks probable. Any such Friday close >2050 would be a massive bullish signal into next year.

--

Looking ahead

Thursday will see the usual weekly jobs, and pending home sales.

Central to the day.. Q3 GDP data (due 8.30am). Market is expecting 1.7% growth..which is a pretty conservative target. Anything much <1.5% would be a viable excuse for equity weakness.

--

More fedspeak nonsense

A few words were added to the latest Fed statement.. a few words were taken away. The cheerleaders on clown finance TV were of course obsessing over such things.

To me.. it is all utterly farcical... but more so... sickening. Savers remain destroyed with such artificially low rates, and there remain ever worse distortions across much of the world capital markets.

Even if rates were to somehow reach 2-3% by 2017, it won't negate much of the damage that has been already been done.

Goodnight from London

Daily Index Cycle update

US equity indexes closed significantly higher, sp +24pts @ 2090. The two

leaders - Trans/R2K, settled higher by 0.1% and 2.9% respectively. Near

term outlook is now bearish, with first downside target of the sp'2K

threshold, and that should equate to VIX in the 18/20 zone.

sp'daily5

R2K

Trans

Summary

Suffice to add, there were new cycle highs in a number of indexes as the market continues to battle upward from the marginally higher low of sp'1871.. now 219pts lower!

Near term outlook is bearish.. as a retrace is due, the sp'2K threshold remains a rather natural target into mid November.

--

a little more later...

sp'daily5

R2K

Trans

Summary

Suffice to add, there were new cycle highs in a number of indexes as the market continues to battle upward from the marginally higher low of sp'1871.. now 219pts lower!

Near term outlook is bearish.. as a retrace is due, the sp'2K threshold remains a rather natural target into mid November.

--

a little more later...

Subscribe to:

Comments (Atom)