With equities battling higher into the sp'1880s, the VIX was unable to hold the very minor gains in early morning, settling -1.9% @ 13.71. Near term outlook is for the VIX to slip into the 12/11s, not least if the sp' can break into the 1900s.

vix'60min

VIX'daily3

Summary

Little to add.

VIX looks set to remain low, and the big 20 threshold looks unlikely to be tested for some weeks.

-

more later..on the indexes

Tuesday, 29 April 2014

Closing Brief

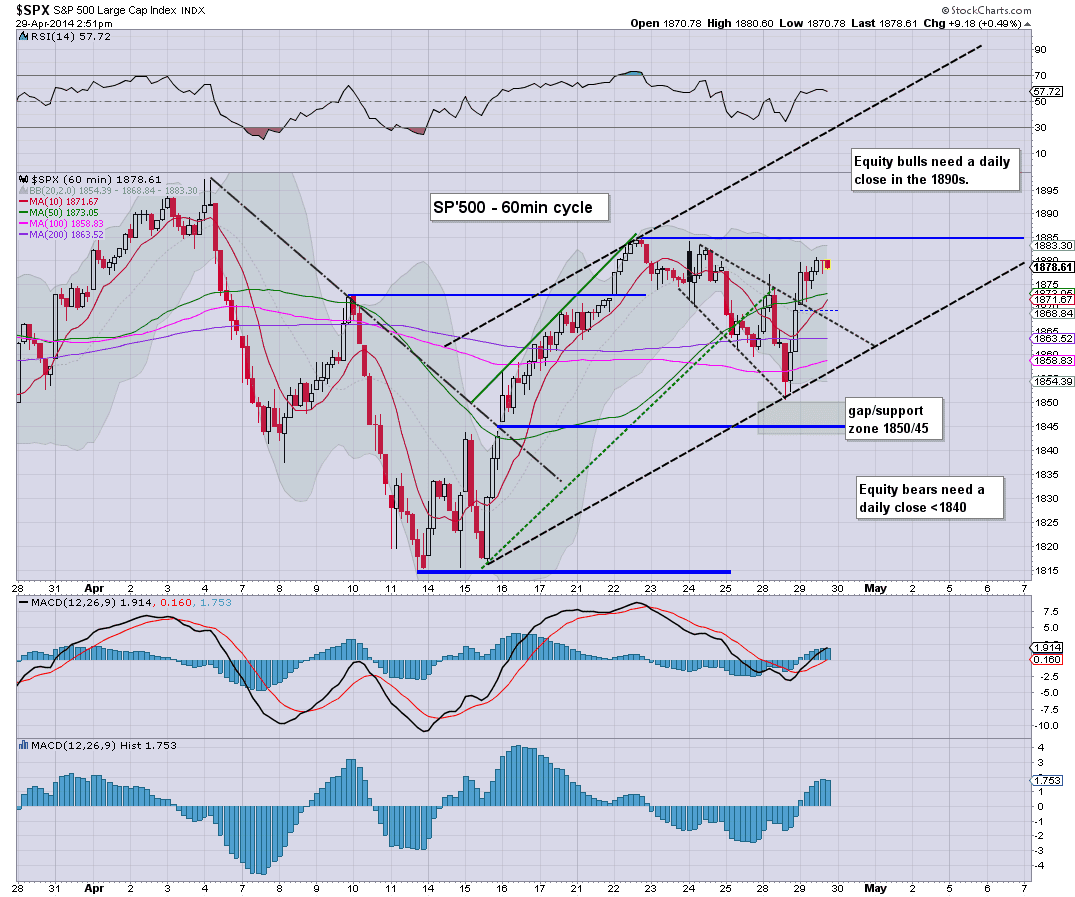

US equities closed higher, sp +8pts @ 1878. The two leaders - Trans/R2K, settled higher by 0.4% and 0.3% respectively. Near term outlook is bullish, with both the daily/weekly charts offering the 1895/1900 zone as early as late Wednesday afternoon.

sp'60min

Summary

*awaiting earnings from EBAY, TWTR, and STX

--

The spike floor of sp'1850 is now looking a fair way lower, and if we do manage to claw into the 1900s - whether this week or next, April will have just been another little tease to the equity bears.

Just reflect on all the bearish hysteria, and yet the sp' only declined 4.4% from 1897 to 1814. It barely ranks as a minor retracement.

Yes, there were more significant declines in the R2K/Nasdaq - never mind the carnage in the momo stocks, but I try to deal with the broader market, not just the weakest parts.

Have a good evening

-

more later..on the VIX

-

4.11pm.. TWTR earnings were fine, but market is still not pleased, and have taken the stock to the 38.50s. This is actually a NEW historic trading low for TWTR.

There is nothing but empty air until the IPO level of $26.

-

STX, beat... $1.34.. vs 1.26 exp..... should rally tomorrow morning..the $55s look viable.

--

EBAY earnings..a touch above, but market is selling the stock a little lower.

-

sp'60min

Summary

*awaiting earnings from EBAY, TWTR, and STX

--

The spike floor of sp'1850 is now looking a fair way lower, and if we do manage to claw into the 1900s - whether this week or next, April will have just been another little tease to the equity bears.

Just reflect on all the bearish hysteria, and yet the sp' only declined 4.4% from 1897 to 1814. It barely ranks as a minor retracement.

Yes, there were more significant declines in the R2K/Nasdaq - never mind the carnage in the momo stocks, but I try to deal with the broader market, not just the weakest parts.

Have a good evening

-

more later..on the VIX

-

4.11pm.. TWTR earnings were fine, but market is still not pleased, and have taken the stock to the 38.50s. This is actually a NEW historic trading low for TWTR.

There is nothing but empty air until the IPO level of $26.

-

STX, beat... $1.34.. vs 1.26 exp..... should rally tomorrow morning..the $55s look viable.

--

EBAY earnings..a touch above, but market is selling the stock a little lower.

-

3pm update - churn into the close

US equities look set to hold moderate gains into the close, with Mr Market comfortably above the Monday spike floor of sp'1850. A weekly close in the 1885/95 zone looks very probable, barring any especially weak econ-data - but as ever, market 'interpretation' of such data is even more important.

sp'60min

Nasdaq, daily

Summary

Well, it has been a day where the equity bears failed to show up.

Daily/weekly cycles are all supportive of the bulls, even for those scenarios calling for a H/S formation on the R2K/Nasdaq.

--

Aside from that, there really isn't much to add.

We do have earnings at the close, EBAY, TWTR, and STX.

--

*I will hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX

-

3.18pm... There is some very significant buying in TWTR and STX ahead of earnings. Both stocks have been somewhat battered lately, so some of the gains are part of a natural recovery bounce.

Certainly, earnings at the close are worth watching.

STX is in the 53s, I would like an exit in the 56/57s but that is probably a very hopeful outlook. 55s would be far more reasonable.

TWTR is a real wild card, and I'd not be surprised to see the big $50 threshold test in AH as the equity bears cover at 'ANY PRICE!'.

sp'60min

Nasdaq, daily

Summary

Well, it has been a day where the equity bears failed to show up.

Daily/weekly cycles are all supportive of the bulls, even for those scenarios calling for a H/S formation on the R2K/Nasdaq.

--

Aside from that, there really isn't much to add.

We do have earnings at the close, EBAY, TWTR, and STX.

--

*I will hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX

-

3.18pm... There is some very significant buying in TWTR and STX ahead of earnings. Both stocks have been somewhat battered lately, so some of the gains are part of a natural recovery bounce.

Certainly, earnings at the close are worth watching.

STX is in the 53s, I would like an exit in the 56/57s but that is probably a very hopeful outlook. 55s would be far more reasonable.

TWTR is a real wild card, and I'd not be surprised to see the big $50 threshold test in AH as the equity bears cover at 'ANY PRICE!'.

2pm update - holding the gains

Today is most certainly different than the dynamic swings of yesterday. With the break >sp'1875, there is no sign of any underlying weakness, and we have a VIX that is quietly melting lower. Equities look set to react favourably to the Wed' morning GDP reading, before minor churn ahead of the FOMC.

sp'daily5

Summary

There is little to add.

Normally we'd see churn from late Tuesday, all the way into Wed' afternoon - on a Fed day, but..with ADP jobs and GDP tomorrow morning, Mr Market will have another opportunity to push higher.

-

Weekly charts are prone to give a clearer bullish signal on a break >1890.

-

Unlike yesterday, there is notable strength in all the momo stocks, with TWTR +4% ahead of earnings at the close.

sp'daily5

Summary

There is little to add.

Normally we'd see churn from late Tuesday, all the way into Wed' afternoon - on a Fed day, but..with ADP jobs and GDP tomorrow morning, Mr Market will have another opportunity to push higher.

-

Weekly charts are prone to give a clearer bullish signal on a break >1890.

-

Unlike yesterday, there is notable strength in all the momo stocks, with TWTR +4% ahead of earnings at the close.

1pm update - Nasdaq set to break higher

Even the battered Nasdaq is set to break significantly higher across the rest of this week. First target is decending resistance around 4150. Once broken, easy upside to 4200/50 within a day or two. Meanwhile, the VIX is once again in melt-lower mode. The 12/11s are coming.

Nasdaq Comp', daily

Summary

*earnings at the close, EBAY, TWTR, and STX (the latter of which I'm long).

---

Suffice to say, regardless of ANY minor intraday chop, we're seeing this steamroller of a market turning back upward.

With sp' in the 1880s...bulls are back in control. All that is necessary now, a daily close >1884, whether today, tomorrow..or later this week...makes little difference.

-

yours.. still heavy long..and having a 'reasonable', if tiresome day.

Nasdaq Comp', daily

Summary

*earnings at the close, EBAY, TWTR, and STX (the latter of which I'm long).

---

Suffice to say, regardless of ANY minor intraday chop, we're seeing this steamroller of a market turning back upward.

With sp' in the 1880s...bulls are back in control. All that is necessary now, a daily close >1884, whether today, tomorrow..or later this week...makes little difference.

-

yours.. still heavy long..and having a 'reasonable', if tiresome day.

12pm update - daily cycle offering the 1900s

Whilst there continues to be some minor chop, it is most notable that the upper bollinger on the daily cycle is offering the low sp'1900s in the immediate term. A brief foray into the 1900s does indeed look viable tomorrow, if Mr Market is relieved at a 'better than expected' GDP data point.

sp'daily5

Dow, daily

Summary

*it is also notable that the Dow is around 100pts from breaking a new high. The 16700/800s are coming.

--

Without getting lost in the minor noise/nonsense, the daily charts are looking reasonably strong for the rest of this week.

We have daily cycle offering the 1900/05 range, whilst the weekly cycle will be somewhat more restrictive to the 1895/1900 zone.

--

VIX update from Mr T

--

time for..tea

sp'daily5

Dow, daily

Summary

*it is also notable that the Dow is around 100pts from breaking a new high. The 16700/800s are coming.

--

Without getting lost in the minor noise/nonsense, the daily charts are looking reasonably strong for the rest of this week.

We have daily cycle offering the 1900/05 range, whilst the weekly cycle will be somewhat more restrictive to the 1895/1900 zone.

--

VIX update from Mr T

--

time for..tea

11am update - go stare at this for an hour

Equity bears would do well to spend the next hour taking a look at the monthly cycle for the sp'500. Despite all the bearish hysteria this month, we currently look set to close April with minor gains. Price momentum is itself still weakening, but..primary trend remains... UP!

sp'monthly

Summary

*Tuesday is indeed proving once again to be a difficult day for yours truly. I am tired.

The one solace...I've 5 long positions...all are green this morning. What a twisted world it is when even yours truly is meddling on the dark side.

Notable strength: CHK, SDRL, ohh yeah, I've both of those. ;)

--

back at 12pm

sp'monthly

Summary

*Tuesday is indeed proving once again to be a difficult day for yours truly. I am tired.

The one solace...I've 5 long positions...all are green this morning. What a twisted world it is when even yours truly is meddling on the dark side.

Notable strength: CHK, SDRL, ohh yeah, I've both of those. ;)

--

back at 12pm

10am update - bears losing complete control

With the market breaking >sp'1875, the bears are losing what little control they had. A break into the 1880s looks likely this morning, and that will offer the first attempt to break the 1884 high. Whether that is taken out today, tomorrow..or later this week, doesn't really matter.

sp'60min

Summary

*I remain content on the long side, via CHK, DO, RIG, SDRL, and STX,

--

No doubt there will be increasing minor chop into tomorrow afternoon, but the underlying pressure should remain to the upside.

-

10.20am..minor chop in the mid 1870s, but unlike yesterday, we're not seeing a reversal. The gains look set to build.

A daily close in the 1880s...and perhaps a brief attempt to clear 1900 tomorrow afternoon.

sp'60min

Summary

*I remain content on the long side, via CHK, DO, RIG, SDRL, and STX,

--

No doubt there will be increasing minor chop into tomorrow afternoon, but the underlying pressure should remain to the upside.

-

10.20am..minor chop in the mid 1870s, but unlike yesterday, we're not seeing a reversal. The gains look set to build.

A daily close in the 1880s...and perhaps a brief attempt to clear 1900 tomorrow afternoon.

Pre-Market Brief

Good morning. Futures are higher, sp +8pts, we're set to open around 1877. Precious metals are weak, Gold -$6, Silver -1.3%. Equity bulls should be pushing to break last weeks high of 1884, late today/tomorrow. A weekly close in the 1885/95 zone looks... likely.

sp'daily5

Summary

The recent high of 1884 is indeed the next objective for the bull maniacs.

Any daily close >1884, and it'll be a near certainty that we'll be trading in the low 1900s within the very near term.

From there, the only issue is where do we get stuck..somewhere in the 1925/50 zone.

--

*I am holding HEAVY long, and I will be seeking to lighten up late today/tomorrow, ahead of the FOMC, although there is no doubt that QE-taper'4 will be announced. However, the market might use it as an excuse to briefly sell lower (if only 0.5/1.0%, for a few hours).

Regardless, I'm seeking to remain on the long side for at least another few weeks.

9.14am.. well, it won't take much of a kick to get into the low 1880s this morning. Considering the hourly cycles, very reasonable chance to break the recent 1884 high, and that will really clarify things.

Notable early weakness: DRYS, -2.4% in the $2.80s. The low 2s look a given by late summer. I just wonder whether the company will go under, or can survive into the next commodity ramp of 2015/16.

sp'daily5

Summary

The recent high of 1884 is indeed the next objective for the bull maniacs.

Any daily close >1884, and it'll be a near certainty that we'll be trading in the low 1900s within the very near term.

From there, the only issue is where do we get stuck..somewhere in the 1925/50 zone.

--

*I am holding HEAVY long, and I will be seeking to lighten up late today/tomorrow, ahead of the FOMC, although there is no doubt that QE-taper'4 will be announced. However, the market might use it as an excuse to briefly sell lower (if only 0.5/1.0%, for a few hours).

Regardless, I'm seeking to remain on the long side for at least another few weeks.

9.14am.. well, it won't take much of a kick to get into the low 1880s this morning. Considering the hourly cycles, very reasonable chance to break the recent 1884 high, and that will really clarify things.

Notable early weakness: DRYS, -2.4% in the $2.80s. The low 2s look a given by late summer. I just wonder whether the company will go under, or can survive into the next commodity ramp of 2015/16.

Equity bears teased again

It was an interesting day to start the week, with the market swinging from opening gains - sp'1877, down to 1850, but then a rather typical latter day recovery. Equity bears have probably seen the low of the week, and the bull maniacs should now charge for 1880/90s by late Wednesday (Fed day).

sp'weekly8b

Summary

It is notable that we now have the third consecutive green candle on the weekly 'rainbow' charts - although it did flip briefly blue with the sp'1850s today. The broader upward trend remains intact. I could only consider the bears to have any hope, on a weekly close <1840, and that does seem unlikely.

Regardless of whether the micro count is even remotely correct, right now, the trend is still broadly UP!

Looking ahead

We have case shiller HPI and consumer confidence. If those come in at least reasonable, the market should be fine to rally - and unlike today...hold the gains.

*there is sig' QE-pomo of $2bn.

--

Permabear covered in too much Oil ?

I hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX. I dropped an annoying Silver short early in the day, although I might pick that back up Wednesday at the next hourly cycle peak.

Considering the hourly and weekly index cycles, I remain highly dubious that the equity bears can break below sp'1840 this week. Indeed, I'd not be surprised if we put in a weekly close somewhere in the 1880/1900 zone.

If the market can cope with QE-taper'4, and at least 'reasonable' GDP/monthly jobs data, then there is little reason why we won't really into May.

Goodnight from London

sp'weekly8b

Summary

It is notable that we now have the third consecutive green candle on the weekly 'rainbow' charts - although it did flip briefly blue with the sp'1850s today. The broader upward trend remains intact. I could only consider the bears to have any hope, on a weekly close <1840, and that does seem unlikely.

Regardless of whether the micro count is even remotely correct, right now, the trend is still broadly UP!

Looking ahead

We have case shiller HPI and consumer confidence. If those come in at least reasonable, the market should be fine to rally - and unlike today...hold the gains.

*there is sig' QE-pomo of $2bn.

--

Permabear covered in too much Oil ?

I hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX. I dropped an annoying Silver short early in the day, although I might pick that back up Wednesday at the next hourly cycle peak.

Considering the hourly and weekly index cycles, I remain highly dubious that the equity bears can break below sp'1840 this week. Indeed, I'd not be surprised if we put in a weekly close somewhere in the 1880/1900 zone.

If the market can cope with QE-taper'4, and at least 'reasonable' GDP/monthly jobs data, then there is little reason why we won't really into May.

Goodnight from London

Daily Index Cycle update

US equities opened higher, but unraveled into the early afternoon - swinging from sp'1877 to 1850. With a latter day recovery, the sp' settled +6pts @ 1869. The two leaders - Trans/R2K, closed u/c, and -0.5% respectively. Outlook is bullish into early May.

sp'daily5

R2K

Trans

Summary

Suffice to say, the broader up trends are STILL holding. The daily candle on the sp'500 is somewhat bullish for Tuesday.

The two leaders remain especially weak, but the equity bears really haven't managed to display much real downside power in the broader market.

Indeed, considering the hourly index cycles, there looks to be viable upside to the sp'1880/90s by late Wednesday.

--

Closing update from Mr TopStep

--

a little more later...

sp'daily5

R2K

Trans

Summary

Suffice to say, the broader up trends are STILL holding. The daily candle on the sp'500 is somewhat bullish for Tuesday.

The two leaders remain especially weak, but the equity bears really haven't managed to display much real downside power in the broader market.

Indeed, considering the hourly index cycles, there looks to be viable upside to the sp'1880/90s by late Wednesday.

--

Closing update from Mr TopStep

--

a little more later...

Subscribe to:

Comments (Atom)