After holding the high teens for the past three trading days - with a brief break into the 21s, the VIX looks poised for its next surge, closing +4.4% @ 19.95. If sp'1710/1690, VIX should at least be 22/23 - surpassing the 2013 high of 21.91, if not even higher..in the 25/27 zone.

vix'60min

vix'daily3

Summary

Suffice to say, the price structure looks VERY bullish on the hourly charts. With daily/weekly charts also bullish, VIX looks set to take out the 2013 high of 21.91 in the next few days.

The big unknown is how high the VIX might spike if sp'1710/1690. Best guess remains 22/23, but..if the market is really in a bad mood, then 25/27 is briefly possible.

more later..on the indexes

Wednesday, 5 February 2014

Closing Brief

It was a choppy day for the US equity market, with the sp' settling -3pts @ 1751. The two leaders - Trans/R2K, both closed -0.8%. There looks to be high probability of a further strong wave lower in the remainder of the week. Primary target zone remains 1710/1690.

sp'60min

Summary

*awaiting earnings from TWTR

--

The important thing to take away from today...a lower low..sp'1737. We had another instance where the market tried to vainly rally on 'better than expected' news (in this case, ISM non-manu), but quickly failed.

The Friday jobs data will be...decisive. Considering the bigger daily/weekly cycles..along with the style of recent price action, I'm holding to the original target zone of 1710/1690.

-

more later..on the VIX

-

4.08pm... TWTR earnings, 2 cent EPS, vs expected loss of 2 cents..hmm

Stock spikes to the $71s..but then flips marginally negative.....now -6%

...market...as I thought is selling the stock lower...even though the earnings were 'better than expected'.

currently -11%...at the lower end of my target range

Ohh the hilarity

sp'60min

Summary

*awaiting earnings from TWTR

--

The important thing to take away from today...a lower low..sp'1737. We had another instance where the market tried to vainly rally on 'better than expected' news (in this case, ISM non-manu), but quickly failed.

The Friday jobs data will be...decisive. Considering the bigger daily/weekly cycles..along with the style of recent price action, I'm holding to the original target zone of 1710/1690.

-

more later..on the VIX

-

4.08pm... TWTR earnings, 2 cent EPS, vs expected loss of 2 cents..hmm

Stock spikes to the $71s..but then flips marginally negative.....now -6%

...market...as I thought is selling the stock lower...even though the earnings were 'better than expected'.

currently -11%...at the lower end of my target range

Ohh the hilarity

3pm update - rats bailing into the close?

The equity bulls have had the best part of two trading days to exit in the 1750s. There is a clear 40pts of downside to the 200 day MA of sp'1709. There can be no excuses for anyone complaining this Thurs/Friday that 'ohh..we're so surprised at another big fall!'.

sp'60min

Summary

*TWTR earnings at the close, which might be kinda fun to watch

The daily chart is a bit of a mess...

Upside looks difficult, natural downside would be 60/55. I've no idea on what earnings might be, but my guess would be that the market sells TWTR lower on a good..or bad number.

Since its one of the 'hysteria' momo stocks, I'd never trade it, but I'll sure watch it for entertainment purposes ;0

--

As for the main market...we will have a hard resistance wall of sp'1760 at the close - via the hourly upper bollinger. Frankly, I can't see the 1720/10s not being hit by the Friday close.

-

...updates into the close...

3.10pm.. chop continues. Just who is going to want to go here?

VIX looks primed on the hourly charts.

-

The important thing about today..we did break a new low of sp'1737, and that certainly bodes well for the bears in the remainder of the week.

TWTR : -0.3% , ahead of earnings...

-

3.19pm... chop chop chop...but the weakness IS there. VIX looks so primed, its gonna be real important to the equity bears to break into the 22s (above the 2013 high of 21.91) in the next two days.

It should give complete clarification of the bigger bearish picture for the next few months.

Coal miners ...real stinky today.. BTU -3.6%

3.32pm... everyone getting a chance to be positioned (however they wish) during this continued chop.

There can be no excuses tomorrow..or more importantly...the Friday open. VIX holding minor gains of 2%, a third day..holding the upper teens.

3.40pm... VIX hourly update...

There is minor risk of downside to the mid 18s tomorrow, whilst upside is a clear break into the 22s, above the 2013 high. Considering the bigger daily/weekly trends..it looks a very positive setup.

3.49pm I realise some are still seeking a back test of the old 1770 support..but really, that seems..difficult. 15pts upside..vs 45/50pts downside. Risk/reward really favours the bears.

back at the close!

sp'60min

Summary

*TWTR earnings at the close, which might be kinda fun to watch

The daily chart is a bit of a mess...

Upside looks difficult, natural downside would be 60/55. I've no idea on what earnings might be, but my guess would be that the market sells TWTR lower on a good..or bad number.

Since its one of the 'hysteria' momo stocks, I'd never trade it, but I'll sure watch it for entertainment purposes ;0

--

As for the main market...we will have a hard resistance wall of sp'1760 at the close - via the hourly upper bollinger. Frankly, I can't see the 1720/10s not being hit by the Friday close.

-

...updates into the close...

3.10pm.. chop continues. Just who is going to want to go here?

VIX looks primed on the hourly charts.

-

The important thing about today..we did break a new low of sp'1737, and that certainly bodes well for the bears in the remainder of the week.

TWTR : -0.3% , ahead of earnings...

-

3.19pm... chop chop chop...but the weakness IS there. VIX looks so primed, its gonna be real important to the equity bears to break into the 22s (above the 2013 high of 21.91) in the next two days.

It should give complete clarification of the bigger bearish picture for the next few months.

Coal miners ...real stinky today.. BTU -3.6%

3.32pm... everyone getting a chance to be positioned (however they wish) during this continued chop.

There can be no excuses tomorrow..or more importantly...the Friday open. VIX holding minor gains of 2%, a third day..holding the upper teens.

3.40pm... VIX hourly update...

There is minor risk of downside to the mid 18s tomorrow, whilst upside is a clear break into the 22s, above the 2013 high. Considering the bigger daily/weekly trends..it looks a very positive setup.

3.49pm I realise some are still seeking a back test of the old 1770 support..but really, that seems..difficult. 15pts upside..vs 45/50pts downside. Risk/reward really favours the bears.

back at the close!

2pm update - VIX coiling up

Whilst the indexes continue to see minor weak chop, for those closely watching, the VIX is arguably coiling up for the next surge. For the first time since late 2012, the VIX is comfortably holding the upper teens, with near term upside to at least 22/23, if not 25/27.

vix'60min

sp'60min

Summary

So..yes..I'm really bullish VIX right now at these levels. If we do end up in the 25/27 range in the coming days, no one can say they didn't have ample opportunity to jump aboard, on any of the 'minor pull backs'.

--

Notable resistance on index charts - the hourly upper bollinger, which is tumbling down..as the indexes see minor chop.

The bulls should lose ANY hope of a re-break into the 1770s..at the close of today.

-

Awaiting TWTR earnings at the close..but infinitely more exciting..the jobs data on Friday.

-

2.33pm.. minor chop continues...bulls sure don't look like they can manage the 1760s now.

There is NO more sig' QE for the remainder of the week...bears have a free reign from here.

UGAZ continues to slump... -15%..after being up 20/25% in pre-market.

2.40pm. weak weak weak. hourly MACD cycle will probably be rolling over into the close.

Tomorrow.. and Friday sure look ugly. Bulls...beware! ;0

vix'60min

sp'60min

Summary

So..yes..I'm really bullish VIX right now at these levels. If we do end up in the 25/27 range in the coming days, no one can say they didn't have ample opportunity to jump aboard, on any of the 'minor pull backs'.

--

Notable resistance on index charts - the hourly upper bollinger, which is tumbling down..as the indexes see minor chop.

The bulls should lose ANY hope of a re-break into the 1770s..at the close of today.

-

Awaiting TWTR earnings at the close..but infinitely more exciting..the jobs data on Friday.

-

2.33pm.. minor chop continues...bulls sure don't look like they can manage the 1760s now.

There is NO more sig' QE for the remainder of the week...bears have a free reign from here.

UGAZ continues to slump... -15%..after being up 20/25% in pre-market.

2.40pm. weak weak weak. hourly MACD cycle will probably be rolling over into the close.

Tomorrow.. and Friday sure look ugly. Bulls...beware! ;0

1pm update - VIX and the weekly 200 MA

As some have noticed, the VIX has tended to get stuck..and fail, at the weekly 200 MA, currently in the mid 19s. Equity bears seeking much lower levels this spring/summer, should be seeking a weekly close above this 200 MA..which would be the first time since Dec'2012.

VIX'weekly

Summary

*minor moves in the market, I'm sticking to the bigger charts for now.

--

For the bears, the good thing is that we have already broken the 'lower peaks' trend, and we have of course broken into the 20s, for the first time since last October.

Best guess...sp'1710/1690, which should equate to VIX 22/23..possibly 25/27. The high will be dependent upon the style of price action, not so much the sp' level itself.

-

TWTR earnings at the close..that will be one to watch.

-

UGAZ, -5%, after being up around 20/25% in pre-market

Certainly a wild day for gas traders, with the EIA gas report due tomorrow morning.

-

1.08pm. there is a secondary QE this afternoon of around $2-3bn..but after this past this afternoon...bears should be in full control for the remainder of the week..with nothing to fear.

1.35pm.. minor chop....no excuses here...everyone is getting the chance to re-position, before the next wave hits.

VIX'weekly

Summary

*minor moves in the market, I'm sticking to the bigger charts for now.

--

For the bears, the good thing is that we have already broken the 'lower peaks' trend, and we have of course broken into the 20s, for the first time since last October.

Best guess...sp'1710/1690, which should equate to VIX 22/23..possibly 25/27. The high will be dependent upon the style of price action, not so much the sp' level itself.

-

TWTR earnings at the close..that will be one to watch.

-

UGAZ, -5%, after being up around 20/25% in pre-market

Certainly a wild day for gas traders, with the EIA gas report due tomorrow morning.

-

1.08pm. there is a secondary QE this afternoon of around $2-3bn..but after this past this afternoon...bears should be in full control for the remainder of the week..with nothing to fear.

1.35pm.. minor chop....no excuses here...everyone is getting the chance to re-position, before the next wave hits.

12pm update - vain bounces

The market continues to attempt to bounce, but faces powerful downside momentum from the bigger weekly index cycles. Mainstream consensus is now to a test of the 200 day MA..currently sp'1709, which will likely at least equate to VIX 22/23 - breaking the 2013 high.

sp'weekly7

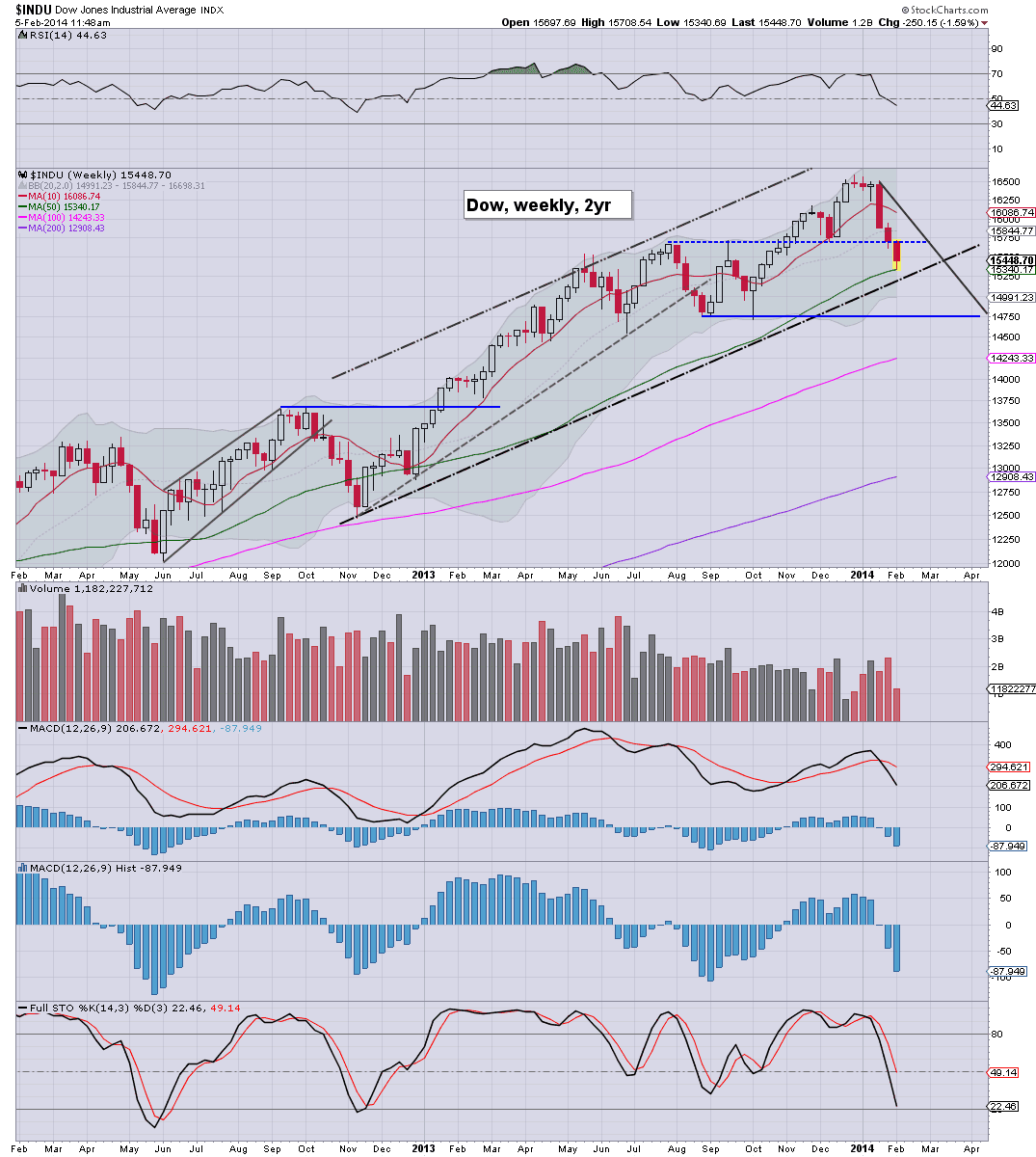

Dow' weekly

Summary

*ignoring the smaller cycles for an hour or two.

--

A hit of the 200 day MA on the sp' would surely equate to Dow 15k - lower bollinger. However, it'd not surprise me to see 14750 - which would equate to the sp'1680s - where my primary target remains of the lower weekly bol'.

Again, I should note, if I see a hit of the lower weekly bol', I'll conclusively call 1850 an inter'3 top...which makes shorting the next multi-week bounce..the best shorting opportunity since July 2011.

-

VIX update from Mr T.

--

time for tea :)

sp'weekly7

Dow' weekly

Summary

*ignoring the smaller cycles for an hour or two.

--

A hit of the 200 day MA on the sp' would surely equate to Dow 15k - lower bollinger. However, it'd not surprise me to see 14750 - which would equate to the sp'1680s - where my primary target remains of the lower weekly bol'.

Again, I should note, if I see a hit of the lower weekly bol', I'll conclusively call 1850 an inter'3 top...which makes shorting the next multi-week bounce..the best shorting opportunity since July 2011.

-

VIX update from Mr T.

--

time for tea :)

11am update - breaking new lows

The market vainly tried to bounce on a fractionally better than expected ISM number, but very quickly failed. The bigger daily/weekly index cycles - both bearish, continue to assert themselves, and the target zone of 1710/1690 looks on track by the end of this week.

sp'daily5

vix'daily3

Summary

So.. a bit of a messy opening hour, even pre-market action was choppy...

Anyway..we've broken new lows, and continue broadly lower on a multi-week basis.

-

I continue to wonder about the Friday jobs data, what if it comes in negative? Its been over 3.5 yrs since a negative number (I think), and that'd give the market the excuse to wash everyone out on a huge daily decline into the weekend.

-

Long day still ahead...

*bears will have it easier after today..there is no sig' QE for the remainder of this week.

11.27am... so..err...who wants to go long here ?

You can see market trying to hold the 1740s.. but really, this is all minor noise....I will try to highlight some of the bigger trends this afternoon.

Notable weakness: coal miners, BTU, -3%..back in the $16s...

sp'daily5

vix'daily3

Summary

So.. a bit of a messy opening hour, even pre-market action was choppy...

Anyway..we've broken new lows, and continue broadly lower on a multi-week basis.

-

I continue to wonder about the Friday jobs data, what if it comes in negative? Its been over 3.5 yrs since a negative number (I think), and that'd give the market the excuse to wash everyone out on a huge daily decline into the weekend.

-

Long day still ahead...

*bears will have it easier after today..there is no sig' QE for the remainder of this week.

11.27am... so..err...who wants to go long here ?

You can see market trying to hold the 1740s.. but really, this is all minor noise....I will try to highlight some of the bigger trends this afternoon.

Notable weakness: coal miners, BTU, -3%..back in the $16s...

10am update - opening moderate weakness

US equity indexes open moderately lower, and we already have a provisional confirmation of the latest bear flag (see hourly charts). Metals are slightly higher, but well below their pre-market highs (Gold was +$16), Gold +$3.

sp'60min

sp'daily5

Summary

*awaiting ISM non-manu' data @ 10am

---

The bigger daily charts still look especially ugly, and the door remains wide open to the 200 day MA, now @ 1709.

--

VIX is not showing any market concern right now, but looks set to break into the 20s late today...or early tomorrow.

The question remains..who wants to go long in the 1750/40s?

-

Eyes to the VIX, equity bears seeking new lows need 20s again.

-

10.01am.. ISM non manu 54.0 , slightly better than expected..market jumps..a little.

Overall though, the bigger trends remain strongly bearish to 1710/1690.

10.32am..well, I'm back from the shops...what I miss? lol

New multi-week cycle lows...everything looking good.

Patience..bears.....patience.

*there is one count that would offer 1680s tomorrow..but I'm trying to refrain from getting lost in bearish hysteria.

VIX comfortably in the 20s again....this is good!

sp'60min

sp'daily5

Summary

*awaiting ISM non-manu' data @ 10am

---

The bigger daily charts still look especially ugly, and the door remains wide open to the 200 day MA, now @ 1709.

--

VIX is not showing any market concern right now, but looks set to break into the 20s late today...or early tomorrow.

The question remains..who wants to go long in the 1750/40s?

-

Eyes to the VIX, equity bears seeking new lows need 20s again.

-

10.01am.. ISM non manu 54.0 , slightly better than expected..market jumps..a little.

Overall though, the bigger trends remain strongly bearish to 1710/1690.

10.32am..well, I'm back from the shops...what I miss? lol

New multi-week cycle lows...everything looking good.

Patience..bears.....patience.

*there is one count that would offer 1680s tomorrow..but I'm trying to refrain from getting lost in bearish hysteria.

VIX comfortably in the 20s again....this is good!

Pre-Market Brief

Good morning. Futures are lower, sp -14pts ,we're set to open at 1741. This just about confirms the bear flag seen on the hourly index charts. VIX looks set to jump back into the 20s. Equity bears remain in control this week, and the primary downside target zone remains 1710/1690.

sp'60min

Summary

*ADP jobs: 175k, a touch above market expectations of 170k, but certainly nothing for the equity bulls to get overly excited about.

-

So..we're set to open somewhat lower. Nothing too dramatic, but it will kinda confirm the bear flags on the hourly charts.

notable movers: UGAZ +20%...and this comes on top of yesterdays similar gain!

*metals are picking up..as the market unravels. .. Gold +$16, Silver +2.8%

8.59am..choppy...market recovers... sp -6...so..thats 1749..

UGAZ now +24%... bullish consumer utility bills!

-

9.32am...watching the Cramer on clown TV...talking about 1650...1500....'the chartists and machines'.

Ironic how a moderate multi-week decline, and all the cheer leaders are getting real rattled.

9.45am.. weak weak weak, although VIX is showing no real concern yet

Who wants to go long here? lol Urghhh.

sp'60min

Summary

*ADP jobs: 175k, a touch above market expectations of 170k, but certainly nothing for the equity bulls to get overly excited about.

-

So..we're set to open somewhat lower. Nothing too dramatic, but it will kinda confirm the bear flags on the hourly charts.

notable movers: UGAZ +20%...and this comes on top of yesterdays similar gain!

*metals are picking up..as the market unravels. .. Gold +$16, Silver +2.8%

8.59am..choppy...market recovers... sp -6...so..thats 1749..

UGAZ now +24%... bullish consumer utility bills!

-

9.32am...watching the Cramer on clown TV...talking about 1650...1500....'the chartists and machines'.

Ironic how a moderate multi-week decline, and all the cheer leaders are getting real rattled.

9.45am.. weak weak weak, although VIX is showing no real concern yet

Who wants to go long here? lol Urghhh.

Crash callers and bull maniacs

With the market slipping from sp'1850 to the Monday low of 1739, the two broad trading/analytical groups are as polarised as ever. The remainder of this week should give one side a real scare, whether a re-take of 1770, or a further 50/70pts lower to test/break the 200 day MA.

sp'weekly7b

Summary

Since the sp'1850 micro double top high, we've seen two major daily drops. First, the Friday (Jan'24) drop of -38pts, and yesterdays move of -40pts. The price action we've seen in the past few weeks is new. It is something we never saw in 2013..or for much of 2012.

As a result of the recent downside, we are again seeing some calling an all out market crash. Others - most notably the guests on clown finance TV, are merely calling it as the latest 'buying opportunity'.

As it is, I think they are both wrong. Price action is different from the last year, but..we're sure not going to crash whilst the Fed are STILL throwing $65bn of QE at the capital markets each month.

--

Update on the Nikkei

We're only two trading days into the month, but the Nikkei sure is looking ugly. We have strong initial downside follow through from the January decline.

The next real support isn't until around 12k. Clearly, the JCB need to spool up the printers another few notches. That will solve everything...not least the demographic problems.

Looking ahead

There is the ADP jobs report in pre-market, with ISM non-manu' at 10am. There are also a trio of fed officials on the loose tomorrow, and there is high risk some of the comments could upset Mr Market.

*there is sig' QE of around $4bn..bears need to be cautious...but the broader weekly trends should at least hold any bounce under the old broken floor of 1770.

--

On track to hit the 200 day MA

All things considered, since the break of sp'1815 - which was indeed a key failure, the equity bears have been in control. Last week saw the bulls battle hard..only to again fail yesterday, with the break <1770. Now..the soft support is 1739..but really, it makes no technical sense for that to be a key multi-week floor.

Market looks set for another few days of declines, probably into the Friday morning jobs data. Whether we floor then...well, one day at a time...right? As for the crash callers, or those bull maniacs who believe in the 'new world economy', I continue to strive to find a place in between. Perhaps, I'm making progress.

Goodnight from London

sp'weekly7b

Summary

Since the sp'1850 micro double top high, we've seen two major daily drops. First, the Friday (Jan'24) drop of -38pts, and yesterdays move of -40pts. The price action we've seen in the past few weeks is new. It is something we never saw in 2013..or for much of 2012.

As a result of the recent downside, we are again seeing some calling an all out market crash. Others - most notably the guests on clown finance TV, are merely calling it as the latest 'buying opportunity'.

As it is, I think they are both wrong. Price action is different from the last year, but..we're sure not going to crash whilst the Fed are STILL throwing $65bn of QE at the capital markets each month.

--

Update on the Nikkei

We're only two trading days into the month, but the Nikkei sure is looking ugly. We have strong initial downside follow through from the January decline.

Looking ahead

There is the ADP jobs report in pre-market, with ISM non-manu' at 10am. There are also a trio of fed officials on the loose tomorrow, and there is high risk some of the comments could upset Mr Market.

*there is sig' QE of around $4bn..bears need to be cautious...but the broader weekly trends should at least hold any bounce under the old broken floor of 1770.

--

On track to hit the 200 day MA

All things considered, since the break of sp'1815 - which was indeed a key failure, the equity bears have been in control. Last week saw the bulls battle hard..only to again fail yesterday, with the break <1770. Now..the soft support is 1739..but really, it makes no technical sense for that to be a key multi-week floor.

Market looks set for another few days of declines, probably into the Friday morning jobs data. Whether we floor then...well, one day at a time...right? As for the crash callers, or those bull maniacs who believe in the 'new world economy', I continue to strive to find a place in between. Perhaps, I'm making progress.

Goodnight from London

Daily Index Cycle update

Equity indexes saw a moderate bounce, with the sp'500 settling +13pts @ 1755. The two leaders - Trans/R2K, settled higher by 1.2% and 0.8% respectively. The broader trend remains to the downside, with a target zone of 1710/1690.

sp'daily5

R2K

Trans

Summary

So..a bounce for the bull maniacs, but really, it was not significant, and does nothing to negate the recent major declines.

Broader trend remains unchanged, and a hit of the 200 day MA - currently 1708, looks likely within the next few days.

--

Closing update from Mr TopStep

--

a little more later...

sp'daily5

R2K

Trans

Summary

So..a bounce for the bull maniacs, but really, it was not significant, and does nothing to negate the recent major declines.

Broader trend remains unchanged, and a hit of the 200 day MA - currently 1708, looks likely within the next few days.

--

Closing update from Mr TopStep

--

a little more later...

Subscribe to:

Comments (Atom)