With the market coping with QE taper'4, the equity bears were nowhere to be seen, equities held together, and the VIX melted lower, settling -2.1% @ 13.42. Near term outlook is for the VIX to melt lower into the weekend, into the 12/11s.

VIX'60min

VIX'daily3

Summary

Little to add.

VIX is merely in 'melt lower' mode. The 20s do not look viable for some weeks, perhaps even until the latter half of June.

-

More later..on the indexes

Wednesday, 30 April 2014

Closing Brief

US equities closed with moderate gains, sp +5pts @ 1883. The two leaders - Trans/R2K, settled +0.7% and +0.5% respectively. Near term outlook is for the market to push upward into the 1895/1905 zone by the Friday close. VIX continues to reflect a market that has no fear.

sp'60min

Summary

*I dropped all three of my oil/gas drilling stocks - DO, RIG, SDRL, in the late afternoon. I will look to pick at least two of them back up tomorrow, on any minor pull back.

--

So..April trading comes to a close, for the bears...it was a teasing month. Yes, there was some notable declines in the R2K/Nasdaq - and especially the momo stocks, but really, the broader market only fell a maximum of 4-5%.

The fact the sp'500 closed the month with net gains says it all.

Have a good evening

--

more later...on the VIX.

sp'60min

Summary

*I dropped all three of my oil/gas drilling stocks - DO, RIG, SDRL, in the late afternoon. I will look to pick at least two of them back up tomorrow, on any minor pull back.

--

So..April trading comes to a close, for the bears...it was a teasing month. Yes, there was some notable declines in the R2K/Nasdaq - and especially the momo stocks, but really, the broader market only fell a maximum of 4-5%.

The fact the sp'500 closed the month with net gains says it all.

Have a good evening

--

more later...on the VIX.

3pm update - the closing hour of April

With the FOMC (not surprisingly) announcing QE-taper'4, the market is coping very well, and looks set to make a play for the sp'1890s in the remainder of this week. Metals remain choppy, Gold -$4, with Silver -1.8%. VIX is set to melt lower into the 12s.

sp'60min

Summary

*I just earlier dropped one of the 3 driller stocks I have - DO, (very sig' gain), will try to have the patience to hold RIG and SDRL into Friday afternoon.

--

Well, it has been a cruel tease of a month for the equity bears, I'm still hopeful we'll see that down wave this summer.

Market looks set to close the month with moderate gains for the sp'500.

-

3.08pm.. minor chop..and we're back <1884. Hmm

Regardless of the exact close, it has been a day for the equity bulls. Is it pretty noticeable that the equity bears just simply failed to show up today.

VIX reflects it, -1.7% in the 13.40s.

3.22pm.. market a touch weak...still stuck <1884...although it was fractionally broken earlier.

I'm getting a little twitchy..seeking to drop a second driller.. SDRL....

3.39pm.. EXITED SDRL, indexes look moderately vulnerable into tomorrow...I can buy back cheaper!

3.45pm... Hmm...a bit of a messy end to the day..and month. Market now rallying again...making a play to close >1884.

3.49pm.. EXITED RIG... I've dropped all 3 drillers, will look to pick up 2 or 3 tomorrow on ANY pull back.

Market seeing minor chop...a touch of weakness seems likely, but certainly, net monthly gains..overall for the sp'500.

sp'60min

Summary

*I just earlier dropped one of the 3 driller stocks I have - DO, (very sig' gain), will try to have the patience to hold RIG and SDRL into Friday afternoon.

--

Well, it has been a cruel tease of a month for the equity bears, I'm still hopeful we'll see that down wave this summer.

Market looks set to close the month with moderate gains for the sp'500.

-

3.08pm.. minor chop..and we're back <1884. Hmm

Regardless of the exact close, it has been a day for the equity bulls. Is it pretty noticeable that the equity bears just simply failed to show up today.

VIX reflects it, -1.7% in the 13.40s.

3.22pm.. market a touch weak...still stuck <1884...although it was fractionally broken earlier.

I'm getting a little twitchy..seeking to drop a second driller.. SDRL....

3.39pm.. EXITED SDRL, indexes look moderately vulnerable into tomorrow...I can buy back cheaper!

3.45pm... Hmm...a bit of a messy end to the day..and month. Market now rallying again...making a play to close >1884.

3.49pm.. EXITED RIG... I've dropped all 3 drillers, will look to pick up 2 or 3 tomorrow on ANY pull back.

Market seeing minor chop...a touch of weakness seems likely, but certainly, net monthly gains..overall for the sp'500.

2pm update - time for QE taper'4

The Fed is set to announce QE taper'4, taking the QE fuel down by a further $10bn to $45bn a month. Any talk of 'extended period of low interest rates' would likely be used by Mr Market as an excuse to rally into the daily..and monthly close.

sp'daily5

Summary

Best guess..a daily close, somewhere in the sp'1890/95 zone.

First things first though...bulls need to break >1884.

*notable strength: AAPL +1% @ $598. A break into 600s, will offer 620/30s in early May.

--

...standing by!

2pm....QE taper'4.......market a touch twitchy, but really...nothing sig'.

What is impressive - for the equity bull side, is seeing how well the market is coping with QE being reduced.

*QE schedule for May issued at 3pm. I'm curious as to if any QE-pomo Thur/Friday.

2.06pm.. with the uncertainty out of the way, there is buying..and market is making a play to break 1884.

The only concern for the bulls is the Friday monthly jobs data. If that comes in >175k, then market should close the week in the 1890/1900 zone.

2.12pm..minor chop..and we're still set to break 1884 before the close....with the VIX red.

2.22pm.. minor chop continues..and the equity bears just aren't around.

It would seem just a matter of time before we break 1884, which will trigger a fair few short-stops.

2.30pm.. Well, we're 30mins past the announcement, and there is NO downside power.

Anyone on the short side is in high danger of being nailed into the close.. sp'1890s are well within range.

2.34pm EXITED long- DO, very sig' gain, and I'm trying to lighten up a bit.

--

2.41pm.. still stuck under the 1884 threshold...oh well, if not today, then tomorrow or Friday. Makes little difference.

STX, what is up with that today? Getting the smack down, despite reasonable numbers.

2.52pm.. market breaking through.....1885s..due.

sp'daily5

Summary

Best guess..a daily close, somewhere in the sp'1890/95 zone.

First things first though...bulls need to break >1884.

*notable strength: AAPL +1% @ $598. A break into 600s, will offer 620/30s in early May.

--

...standing by!

2pm....QE taper'4.......market a touch twitchy, but really...nothing sig'.

What is impressive - for the equity bull side, is seeing how well the market is coping with QE being reduced.

*QE schedule for May issued at 3pm. I'm curious as to if any QE-pomo Thur/Friday.

2.06pm.. with the uncertainty out of the way, there is buying..and market is making a play to break 1884.

The only concern for the bulls is the Friday monthly jobs data. If that comes in >175k, then market should close the week in the 1890/1900 zone.

2.12pm..minor chop..and we're still set to break 1884 before the close....with the VIX red.

2.22pm.. minor chop continues..and the equity bears just aren't around.

It would seem just a matter of time before we break 1884, which will trigger a fair few short-stops.

2.30pm.. Well, we're 30mins past the announcement, and there is NO downside power.

Anyone on the short side is in high danger of being nailed into the close.. sp'1890s are well within range.

2.34pm EXITED long- DO, very sig' gain, and I'm trying to lighten up a bit.

--

2.41pm.. still stuck under the 1884 threshold...oh well, if not today, then tomorrow or Friday. Makes little difference.

STX, what is up with that today? Getting the smack down, despite reasonable numbers.

2.52pm.. market breaking through.....1885s..due.

1pm update - patiently waiting

US markets (and yours truly) are patiently awaiting the latest FOMC announcement. The Fed is set to reduce the monthly QE fuel by a further $10bn, to $45bn, starting tomorrow (a new QE schedule is due at 3pm today). Metals are weak, but offering a reversal.

sp'daily5

Summary

Little to add.

Taking things slow this hour...

--

intra-hour updates from 2pm..all the way into the close....

*notable reversal in a fair few stocks this morning, not least my own three drillers of DO, RIG, and SDRL. I am curious to see how they close today.

RIG, daily

--

back..just before 2pm !

sp'daily5

Summary

Little to add.

Taking things slow this hour...

--

intra-hour updates from 2pm..all the way into the close....

*notable reversal in a fair few stocks this morning, not least my own three drillers of DO, RIG, and SDRL. I am curious to see how they close today.

RIG, daily

--

back..just before 2pm !

12pm update - minor chop into the afternoon

Equities look set to remain in a holding pattern ahead of the FOMC announcement at 2pm. From there, the big unknown is how will the market cope? Unlike last time though, there is no post Yellen press conf'. Metals have recovered slightly from earlier lows, Gold -$3

sp'daily5

Summary

So..probably two hours of very minor price chop. No doubt we'll likely get a few swings around 2pm..but how will we close the day...and month?

This mornings open was again indicative that the equity bears lack any real downside power, and I would not be surprised if talk of 'extended low interest rates' in the Fed press release will be enough to break >1884...with a daily close in the 1890s.

It remains a nasty market...

As it is, I remain heavy long, and so far today...it has been difficult. Even STX reversed to the downside...urghh.

--

VIX update from Mr T.

--

I should note, from 2pm onward, I'll be posting frequent intra-hour updates...on what is typical the busiest trading hour of any given month.

time for tea

sp'daily5

Summary

So..probably two hours of very minor price chop. No doubt we'll likely get a few swings around 2pm..but how will we close the day...and month?

This mornings open was again indicative that the equity bears lack any real downside power, and I would not be surprised if talk of 'extended low interest rates' in the Fed press release will be enough to break >1884...with a daily close in the 1890s.

It remains a nasty market...

As it is, I remain heavy long, and so far today...it has been difficult. Even STX reversed to the downside...urghh.

--

VIX update from Mr T.

--

I should note, from 2pm onward, I'll be posting frequent intra-hour updates...on what is typical the busiest trading hour of any given month.

time for tea

11am update - bears lacking downside power

US indexes are pushing upward, if slowly. First upside target is the sp'1884 high, a break of that opens up 1895/1900 by the close of today..and the month. Metals are weak, Gold -$7, with Silver -2.0%. Oil is weak, -1%. The VIX is set to turn red.

sp'daily5

Nasdaq, daily

Summary

*I'm more inclined to watch the Nasdaq, as a clearer sign that Monday was a key floor

--

Suffice to say, equity bears should be somewhat dismayed at the markets response to what was a relatively dire GDP number.

Yet, ADP jobs and the Chicago PMI came in okay, so..there was that.

Anyway...the FOMC announcement..2pm...but then..we know what is coming, the unknown is how will the market trade into the daily/monthly close.

Considering the Monday daily closing candle, I'm still inclined to believe we'll keep pushing upwrd.

--

Time for an early lunch

sp'daily5

Nasdaq, daily

Summary

*I'm more inclined to watch the Nasdaq, as a clearer sign that Monday was a key floor

--

Suffice to say, equity bears should be somewhat dismayed at the markets response to what was a relatively dire GDP number.

Yet, ADP jobs and the Chicago PMI came in okay, so..there was that.

Anyway...the FOMC announcement..2pm...but then..we know what is coming, the unknown is how will the market trade into the daily/monthly close.

Considering the Monday daily closing candle, I'm still inclined to believe we'll keep pushing upwrd.

--

Time for an early lunch

10am update - holding together relatively well

Considering what was a borderline recessionary GDP print, the US markets are holding together relatively well. How we close today..and the month is currently very difficult to call, not least with the FOMC announcement. We know that QE taper'4 is likely, but how will the market interpret it?

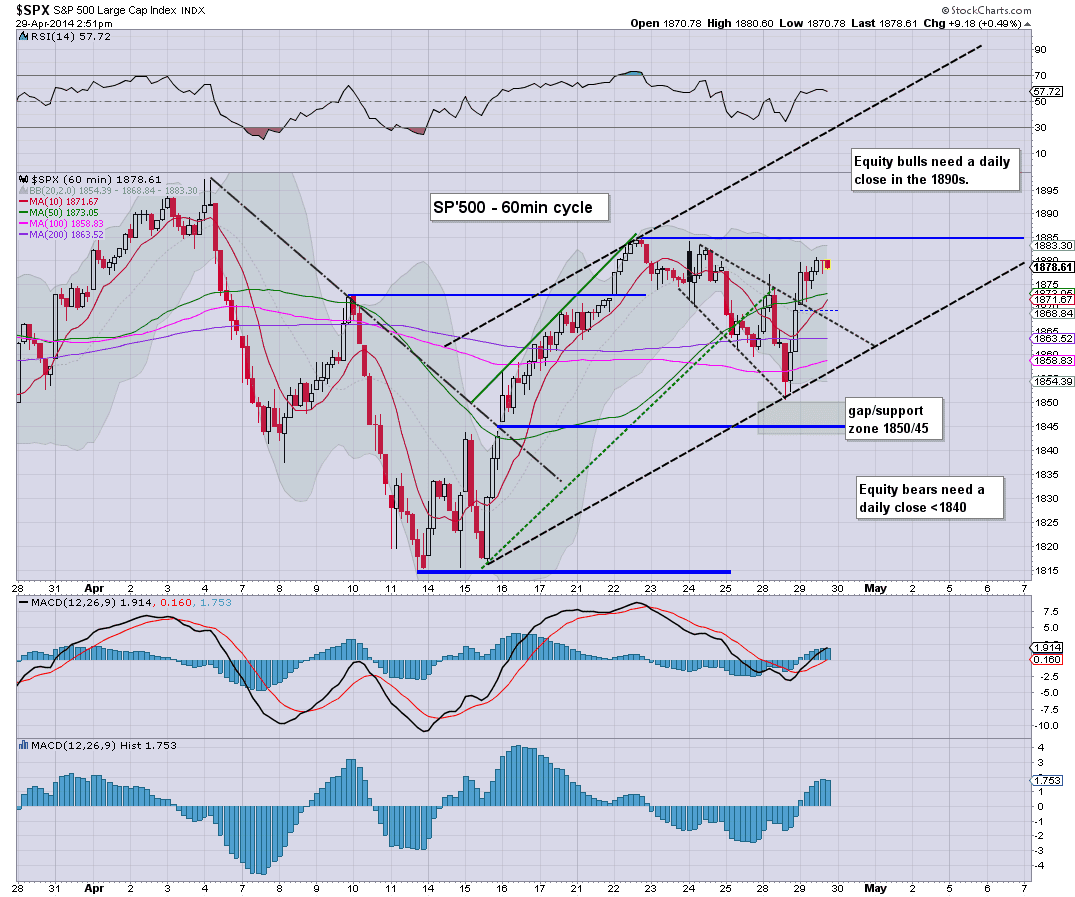

sp'60min

Summary

*Chicago PMI: 63, vs 56.9 expected, this will certainly help to placate the market.

--

Suffice to say, it is going to take some time for many to fully digest this mornings GDP data.

-

STX is doing okay, after reasonable earnings

I am seeking a break above what I believe is a bull flag, first target upside is 56/57..which is possible by the Friday close.

--

time to shop...back soon!

10.23am..back... opening candle on the VIX is a black-fail...does not bode well for equity bears.

Sure is choppy, should quiet down into the early afternoon, ahead of the Fed.

10.30am...no downside power..same old problem...indexes all set to turn positive.

First upside target for the bulls remains a break of the recent 1884 high. If broken, then 1895/1900 by late today.

sp'60min

Summary

*Chicago PMI: 63, vs 56.9 expected, this will certainly help to placate the market.

--

Suffice to say, it is going to take some time for many to fully digest this mornings GDP data.

-

STX is doing okay, after reasonable earnings

I am seeking a break above what I believe is a bull flag, first target upside is 56/57..which is possible by the Friday close.

--

time to shop...back soon!

10.23am..back... opening candle on the VIX is a black-fail...does not bode well for equity bears.

Sure is choppy, should quiet down into the early afternoon, ahead of the Fed.

10.30am...no downside power..same old problem...indexes all set to turn positive.

First upside target for the bulls remains a break of the recent 1884 high. If broken, then 1895/1900 by late today.

Pre-Market Brief

Good morning. Futures are a touch lower - ahead of key econ-data, sp -1pt, we're set to open at 1877. Metals are weak, Gold -$6, with Silver -1.1%. Equity bulls just need to clear >1884, whilst bears should be at the prayer stage by now. April is set to close with minor net monthly equity gains.

sp'60min

Summary

The levels are pretty clear.

Bulls just need a minor kick upward this morning to take out the recent 1884 high, which will open up 1895/1905 as early as today.

-

Awaiting...

ADP jobs

GDP Q1

Chicago PMI

..and the FOMC QE taper'4 announcement

--

Bizarrely, Mr Permabull is actually bearish...

Oscar didn't say it in words, but it looks like he is seeking the recent low of sp'1814 to be taken out in a down wave starting this afternoon. Although he did note, if we instead break higher, they will be major buyers from Thursday onward.

-

Notable early mover: TWTR, -13.6% in the $36s. Next stop would appear to be the IPO issue price of $26.00.

--

Good wishes for Wednesday trading!

8.15am.. ADP jobs, 220k private sector net gains for April... a very reasonable number, but as ever, the more important one will be the BLS monthly on Friday.

8.31am.. GDP for Q1... 0.1% growth...borderline recession....that is real ugly.

Indexes are not snapping particularly lower though. sp -3pts..so far.

8.36am. So..lets get this clear...GDP is effectively zero for Q1, and the Dow is -20pts.

9.25am.. Considering the GDP data, equity bulls should be relieved we aren't opening -150/200pts on the Dow, but hey..its the 'new era' of the market, right?

A long day ahead....

Notable weakness, TWTR, -12% in the $37s, with empty air down to $26

9.37am I see a market where a fair few things are already starting to turn green.

Right now, I just don't see any downside power.

Chicago PMI coming up.....at 9.45am

VIX battling to hold minor gains of just 2%, which should be a concern for the equity bears.

9.45am.. PMI 63.... vs 56.9 exp... MUCH better than expected, and that will help to placate the market.

sp'60min

Summary

The levels are pretty clear.

Bulls just need a minor kick upward this morning to take out the recent 1884 high, which will open up 1895/1905 as early as today.

-

Awaiting...

ADP jobs

GDP Q1

Chicago PMI

..and the FOMC QE taper'4 announcement

--

Bizarrely, Mr Permabull is actually bearish...

Oscar didn't say it in words, but it looks like he is seeking the recent low of sp'1814 to be taken out in a down wave starting this afternoon. Although he did note, if we instead break higher, they will be major buyers from Thursday onward.

-

Notable early mover: TWTR, -13.6% in the $36s. Next stop would appear to be the IPO issue price of $26.00.

--

Good wishes for Wednesday trading!

8.15am.. ADP jobs, 220k private sector net gains for April... a very reasonable number, but as ever, the more important one will be the BLS monthly on Friday.

8.31am.. GDP for Q1... 0.1% growth...borderline recession....that is real ugly.

Indexes are not snapping particularly lower though. sp -3pts..so far.

8.36am. So..lets get this clear...GDP is effectively zero for Q1, and the Dow is -20pts.

9.25am.. Considering the GDP data, equity bulls should be relieved we aren't opening -150/200pts on the Dow, but hey..its the 'new era' of the market, right?

A long day ahead....

Notable weakness, TWTR, -12% in the $37s, with empty air down to $26

9.37am I see a market where a fair few things are already starting to turn green.

Right now, I just don't see any downside power.

Chicago PMI coming up.....at 9.45am

VIX battling to hold minor gains of just 2%, which should be a concern for the equity bears.

9.45am.. PMI 63.... vs 56.9 exp... MUCH better than expected, and that will help to placate the market.

Awaiting another taper

To the surprise of many (not least myself) the US Federal Reserve, lead by the Bernanke, did start to taper QE last December. The fact they have continued is even more surprising. Wednesday looks set for taper'4, taking the monthly QE fuel down to a 'mere' $45bn, an annualised rate of $540bn.

sp'weekly8b

Summary

So, today was more of a bullish day, price action showed no sign of the equity bears. If Mr Market can cope with the next QE taper, and a few pieces of econ-data, we look set to begin May very close to the next psy' level of sp'1900.

Best guess is that we do battle higher into the 1925/50 zone this May, and then get stuck - although we might see a fair few weeks of chop into early June, before the next multi-week down cycle.

To be clear, I am STILL seeking a very significant multi-month down wave this year, with a primary target zone of sp'1625/1575.

Looking ahead

Wednesday is arguably the most important day of this week, there is a lot for the market to digest.

First, we have the ADP jobs, but far more important...

Q1 GDP, market consensus is only seeking 1.1% growth, which frankly I expect to be comfortably met. Indeed, if we see >1.5%, I'd expect the market to be particularly pleased, and use it as an excuse to break back into the 1890s - ahead of the FOMC announcement.

There is also the Chicago PMI at 9.45am.

Indeed, the FOMC are set to announce QE-taper'4 at 2pm. There will not be a post Yellen press conf', which the bulls should be somewhat relieved about.

-

Permabear still.. heavy long

Yours truly is holding five positions, all on the long side. As ever, I will seek to drop them all by the Friday close, not least since I prefer to have no positions across the weekend.

Regardless of how tomorrow goes, there is still the big monthly jobs data on Friday. That will be another possible excuse for the market to break into new historic territory - to be lead by the Dow/SP.

For those on the short side, especially those holding from over two weeks ago, this is indeed a difficult time. A break <1840 (weekly support) looks very unlikely, never mind the key low of 1814.

Goodnight from London

sp'weekly8b

Summary

So, today was more of a bullish day, price action showed no sign of the equity bears. If Mr Market can cope with the next QE taper, and a few pieces of econ-data, we look set to begin May very close to the next psy' level of sp'1900.

Best guess is that we do battle higher into the 1925/50 zone this May, and then get stuck - although we might see a fair few weeks of chop into early June, before the next multi-week down cycle.

To be clear, I am STILL seeking a very significant multi-month down wave this year, with a primary target zone of sp'1625/1575.

Looking ahead

Wednesday is arguably the most important day of this week, there is a lot for the market to digest.

First, we have the ADP jobs, but far more important...

Q1 GDP, market consensus is only seeking 1.1% growth, which frankly I expect to be comfortably met. Indeed, if we see >1.5%, I'd expect the market to be particularly pleased, and use it as an excuse to break back into the 1890s - ahead of the FOMC announcement.

There is also the Chicago PMI at 9.45am.

Indeed, the FOMC are set to announce QE-taper'4 at 2pm. There will not be a post Yellen press conf', which the bulls should be somewhat relieved about.

-

Permabear still.. heavy long

Yours truly is holding five positions, all on the long side. As ever, I will seek to drop them all by the Friday close, not least since I prefer to have no positions across the weekend.

Regardless of how tomorrow goes, there is still the big monthly jobs data on Friday. That will be another possible excuse for the market to break into new historic territory - to be lead by the Dow/SP.

For those on the short side, especially those holding from over two weeks ago, this is indeed a difficult time. A break <1840 (weekly support) looks very unlikely, never mind the key low of 1814.

Goodnight from London

Daily Index Cycle update

US equities closed moderately higher, sp +8pts @ 1878. The two leaders - Trans/R2K, settled higher by 0.4% and 0.3% respectively. Near term outlook is offering the sp'1885/95 zone, with a brief foray into the low 1900s.

sp'daily5

Nasdaq Comp'

Dow

Summary

All things considered, the daily charts - esp' the Dow and SP'500, bode for much higher levels in May. Even the Nasdaq which saw a much deeper retrace, looks set to break upward before the weekend.

Bears had their chance, and all they could manage was sp'1897 to 1814..a mere 4.4% decline.

-

Closing update from Riley

--

a little more later...

sp'daily5

Nasdaq Comp'

Dow

Summary

All things considered, the daily charts - esp' the Dow and SP'500, bode for much higher levels in May. Even the Nasdaq which saw a much deeper retrace, looks set to break upward before the weekend.

Bears had their chance, and all they could manage was sp'1897 to 1814..a mere 4.4% decline.

-

Closing update from Riley

--

a little more later...

Tuesday, 29 April 2014

Volatility melting lower

With equities battling higher into the sp'1880s, the VIX was unable to hold the very minor gains in early morning, settling -1.9% @ 13.71. Near term outlook is for the VIX to slip into the 12/11s, not least if the sp' can break into the 1900s.

vix'60min

VIX'daily3

Summary

Little to add.

VIX looks set to remain low, and the big 20 threshold looks unlikely to be tested for some weeks.

-

more later..on the indexes

vix'60min

VIX'daily3

Summary

Little to add.

VIX looks set to remain low, and the big 20 threshold looks unlikely to be tested for some weeks.

-

more later..on the indexes

Closing Brief

US equities closed higher, sp +8pts @ 1878. The two leaders - Trans/R2K, settled higher by 0.4% and 0.3% respectively. Near term outlook is bullish, with both the daily/weekly charts offering the 1895/1900 zone as early as late Wednesday afternoon.

sp'60min

Summary

*awaiting earnings from EBAY, TWTR, and STX

--

The spike floor of sp'1850 is now looking a fair way lower, and if we do manage to claw into the 1900s - whether this week or next, April will have just been another little tease to the equity bears.

Just reflect on all the bearish hysteria, and yet the sp' only declined 4.4% from 1897 to 1814. It barely ranks as a minor retracement.

Yes, there were more significant declines in the R2K/Nasdaq - never mind the carnage in the momo stocks, but I try to deal with the broader market, not just the weakest parts.

Have a good evening

-

more later..on the VIX

-

4.11pm.. TWTR earnings were fine, but market is still not pleased, and have taken the stock to the 38.50s. This is actually a NEW historic trading low for TWTR.

There is nothing but empty air until the IPO level of $26.

-

STX, beat... $1.34.. vs 1.26 exp..... should rally tomorrow morning..the $55s look viable.

--

EBAY earnings..a touch above, but market is selling the stock a little lower.

-

sp'60min

Summary

*awaiting earnings from EBAY, TWTR, and STX

--

The spike floor of sp'1850 is now looking a fair way lower, and if we do manage to claw into the 1900s - whether this week or next, April will have just been another little tease to the equity bears.

Just reflect on all the bearish hysteria, and yet the sp' only declined 4.4% from 1897 to 1814. It barely ranks as a minor retracement.

Yes, there were more significant declines in the R2K/Nasdaq - never mind the carnage in the momo stocks, but I try to deal with the broader market, not just the weakest parts.

Have a good evening

-

more later..on the VIX

-

4.11pm.. TWTR earnings were fine, but market is still not pleased, and have taken the stock to the 38.50s. This is actually a NEW historic trading low for TWTR.

There is nothing but empty air until the IPO level of $26.

-

STX, beat... $1.34.. vs 1.26 exp..... should rally tomorrow morning..the $55s look viable.

--

EBAY earnings..a touch above, but market is selling the stock a little lower.

-

3pm update - churn into the close

US equities look set to hold moderate gains into the close, with Mr Market comfortably above the Monday spike floor of sp'1850. A weekly close in the 1885/95 zone looks very probable, barring any especially weak econ-data - but as ever, market 'interpretation' of such data is even more important.

sp'60min

Nasdaq, daily

Summary

Well, it has been a day where the equity bears failed to show up.

Daily/weekly cycles are all supportive of the bulls, even for those scenarios calling for a H/S formation on the R2K/Nasdaq.

--

Aside from that, there really isn't much to add.

We do have earnings at the close, EBAY, TWTR, and STX.

--

*I will hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX

-

3.18pm... There is some very significant buying in TWTR and STX ahead of earnings. Both stocks have been somewhat battered lately, so some of the gains are part of a natural recovery bounce.

Certainly, earnings at the close are worth watching.

STX is in the 53s, I would like an exit in the 56/57s but that is probably a very hopeful outlook. 55s would be far more reasonable.

TWTR is a real wild card, and I'd not be surprised to see the big $50 threshold test in AH as the equity bears cover at 'ANY PRICE!'.

sp'60min

Nasdaq, daily

Summary

Well, it has been a day where the equity bears failed to show up.

Daily/weekly cycles are all supportive of the bulls, even for those scenarios calling for a H/S formation on the R2K/Nasdaq.

--

Aside from that, there really isn't much to add.

We do have earnings at the close, EBAY, TWTR, and STX.

--

*I will hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX

-

3.18pm... There is some very significant buying in TWTR and STX ahead of earnings. Both stocks have been somewhat battered lately, so some of the gains are part of a natural recovery bounce.

Certainly, earnings at the close are worth watching.

STX is in the 53s, I would like an exit in the 56/57s but that is probably a very hopeful outlook. 55s would be far more reasonable.

TWTR is a real wild card, and I'd not be surprised to see the big $50 threshold test in AH as the equity bears cover at 'ANY PRICE!'.

2pm update - holding the gains

Today is most certainly different than the dynamic swings of yesterday. With the break >sp'1875, there is no sign of any underlying weakness, and we have a VIX that is quietly melting lower. Equities look set to react favourably to the Wed' morning GDP reading, before minor churn ahead of the FOMC.

sp'daily5

Summary

There is little to add.

Normally we'd see churn from late Tuesday, all the way into Wed' afternoon - on a Fed day, but..with ADP jobs and GDP tomorrow morning, Mr Market will have another opportunity to push higher.

-

Weekly charts are prone to give a clearer bullish signal on a break >1890.

-

Unlike yesterday, there is notable strength in all the momo stocks, with TWTR +4% ahead of earnings at the close.

sp'daily5

Summary

There is little to add.

Normally we'd see churn from late Tuesday, all the way into Wed' afternoon - on a Fed day, but..with ADP jobs and GDP tomorrow morning, Mr Market will have another opportunity to push higher.

-

Weekly charts are prone to give a clearer bullish signal on a break >1890.

-

Unlike yesterday, there is notable strength in all the momo stocks, with TWTR +4% ahead of earnings at the close.

1pm update - Nasdaq set to break higher

Even the battered Nasdaq is set to break significantly higher across the rest of this week. First target is decending resistance around 4150. Once broken, easy upside to 4200/50 within a day or two. Meanwhile, the VIX is once again in melt-lower mode. The 12/11s are coming.

Nasdaq Comp', daily

Summary

*earnings at the close, EBAY, TWTR, and STX (the latter of which I'm long).

---

Suffice to say, regardless of ANY minor intraday chop, we're seeing this steamroller of a market turning back upward.

With sp' in the 1880s...bulls are back in control. All that is necessary now, a daily close >1884, whether today, tomorrow..or later this week...makes little difference.

-

yours.. still heavy long..and having a 'reasonable', if tiresome day.

Nasdaq Comp', daily

Summary

*earnings at the close, EBAY, TWTR, and STX (the latter of which I'm long).

---

Suffice to say, regardless of ANY minor intraday chop, we're seeing this steamroller of a market turning back upward.

With sp' in the 1880s...bulls are back in control. All that is necessary now, a daily close >1884, whether today, tomorrow..or later this week...makes little difference.

-

yours.. still heavy long..and having a 'reasonable', if tiresome day.

12pm update - daily cycle offering the 1900s

Whilst there continues to be some minor chop, it is most notable that the upper bollinger on the daily cycle is offering the low sp'1900s in the immediate term. A brief foray into the 1900s does indeed look viable tomorrow, if Mr Market is relieved at a 'better than expected' GDP data point.

sp'daily5

Dow, daily

Summary

*it is also notable that the Dow is around 100pts from breaking a new high. The 16700/800s are coming.

--

Without getting lost in the minor noise/nonsense, the daily charts are looking reasonably strong for the rest of this week.

We have daily cycle offering the 1900/05 range, whilst the weekly cycle will be somewhat more restrictive to the 1895/1900 zone.

--

VIX update from Mr T

--

time for..tea

sp'daily5

Dow, daily

Summary

*it is also notable that the Dow is around 100pts from breaking a new high. The 16700/800s are coming.

--

Without getting lost in the minor noise/nonsense, the daily charts are looking reasonably strong for the rest of this week.

We have daily cycle offering the 1900/05 range, whilst the weekly cycle will be somewhat more restrictive to the 1895/1900 zone.

--

VIX update from Mr T

--

time for..tea

11am update - go stare at this for an hour

Equity bears would do well to spend the next hour taking a look at the monthly cycle for the sp'500. Despite all the bearish hysteria this month, we currently look set to close April with minor gains. Price momentum is itself still weakening, but..primary trend remains... UP!

sp'monthly

Summary

*Tuesday is indeed proving once again to be a difficult day for yours truly. I am tired.

The one solace...I've 5 long positions...all are green this morning. What a twisted world it is when even yours truly is meddling on the dark side.

Notable strength: CHK, SDRL, ohh yeah, I've both of those. ;)

--

back at 12pm

sp'monthly

Summary

*Tuesday is indeed proving once again to be a difficult day for yours truly. I am tired.

The one solace...I've 5 long positions...all are green this morning. What a twisted world it is when even yours truly is meddling on the dark side.

Notable strength: CHK, SDRL, ohh yeah, I've both of those. ;)

--

back at 12pm

10am update - bears losing complete control

With the market breaking >sp'1875, the bears are losing what little control they had. A break into the 1880s looks likely this morning, and that will offer the first attempt to break the 1884 high. Whether that is taken out today, tomorrow..or later this week, doesn't really matter.

sp'60min

Summary

*I remain content on the long side, via CHK, DO, RIG, SDRL, and STX,

--

No doubt there will be increasing minor chop into tomorrow afternoon, but the underlying pressure should remain to the upside.

-

10.20am..minor chop in the mid 1870s, but unlike yesterday, we're not seeing a reversal. The gains look set to build.

A daily close in the 1880s...and perhaps a brief attempt to clear 1900 tomorrow afternoon.

sp'60min

Summary

*I remain content on the long side, via CHK, DO, RIG, SDRL, and STX,

--

No doubt there will be increasing minor chop into tomorrow afternoon, but the underlying pressure should remain to the upside.

-

10.20am..minor chop in the mid 1870s, but unlike yesterday, we're not seeing a reversal. The gains look set to build.

A daily close in the 1880s...and perhaps a brief attempt to clear 1900 tomorrow afternoon.

Pre-Market Brief

Good morning. Futures are higher, sp +8pts, we're set to open around 1877. Precious metals are weak, Gold -$6, Silver -1.3%. Equity bulls should be pushing to break last weeks high of 1884, late today/tomorrow. A weekly close in the 1885/95 zone looks... likely.

sp'daily5

Summary

The recent high of 1884 is indeed the next objective for the bull maniacs.

Any daily close >1884, and it'll be a near certainty that we'll be trading in the low 1900s within the very near term.

From there, the only issue is where do we get stuck..somewhere in the 1925/50 zone.

--

*I am holding HEAVY long, and I will be seeking to lighten up late today/tomorrow, ahead of the FOMC, although there is no doubt that QE-taper'4 will be announced. However, the market might use it as an excuse to briefly sell lower (if only 0.5/1.0%, for a few hours).

Regardless, I'm seeking to remain on the long side for at least another few weeks.

9.14am.. well, it won't take much of a kick to get into the low 1880s this morning. Considering the hourly cycles, very reasonable chance to break the recent 1884 high, and that will really clarify things.

Notable early weakness: DRYS, -2.4% in the $2.80s. The low 2s look a given by late summer. I just wonder whether the company will go under, or can survive into the next commodity ramp of 2015/16.

sp'daily5

Summary

The recent high of 1884 is indeed the next objective for the bull maniacs.

Any daily close >1884, and it'll be a near certainty that we'll be trading in the low 1900s within the very near term.

From there, the only issue is where do we get stuck..somewhere in the 1925/50 zone.

--

*I am holding HEAVY long, and I will be seeking to lighten up late today/tomorrow, ahead of the FOMC, although there is no doubt that QE-taper'4 will be announced. However, the market might use it as an excuse to briefly sell lower (if only 0.5/1.0%, for a few hours).

Regardless, I'm seeking to remain on the long side for at least another few weeks.

9.14am.. well, it won't take much of a kick to get into the low 1880s this morning. Considering the hourly cycles, very reasonable chance to break the recent 1884 high, and that will really clarify things.

Notable early weakness: DRYS, -2.4% in the $2.80s. The low 2s look a given by late summer. I just wonder whether the company will go under, or can survive into the next commodity ramp of 2015/16.

Equity bears teased again

It was an interesting day to start the week, with the market swinging from opening gains - sp'1877, down to 1850, but then a rather typical latter day recovery. Equity bears have probably seen the low of the week, and the bull maniacs should now charge for 1880/90s by late Wednesday (Fed day).

sp'weekly8b

Summary

It is notable that we now have the third consecutive green candle on the weekly 'rainbow' charts - although it did flip briefly blue with the sp'1850s today. The broader upward trend remains intact. I could only consider the bears to have any hope, on a weekly close <1840, and that does seem unlikely.

Regardless of whether the micro count is even remotely correct, right now, the trend is still broadly UP!

Looking ahead

We have case shiller HPI and consumer confidence. If those come in at least reasonable, the market should be fine to rally - and unlike today...hold the gains.

*there is sig' QE-pomo of $2bn.

--

Permabear covered in too much Oil ?

I hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX. I dropped an annoying Silver short early in the day, although I might pick that back up Wednesday at the next hourly cycle peak.

Considering the hourly and weekly index cycles, I remain highly dubious that the equity bears can break below sp'1840 this week. Indeed, I'd not be surprised if we put in a weekly close somewhere in the 1880/1900 zone.

If the market can cope with QE-taper'4, and at least 'reasonable' GDP/monthly jobs data, then there is little reason why we won't really into May.

Goodnight from London

sp'weekly8b

Summary

It is notable that we now have the third consecutive green candle on the weekly 'rainbow' charts - although it did flip briefly blue with the sp'1850s today. The broader upward trend remains intact. I could only consider the bears to have any hope, on a weekly close <1840, and that does seem unlikely.

Regardless of whether the micro count is even remotely correct, right now, the trend is still broadly UP!

Looking ahead

We have case shiller HPI and consumer confidence. If those come in at least reasonable, the market should be fine to rally - and unlike today...hold the gains.

*there is sig' QE-pomo of $2bn.

--

Permabear covered in too much Oil ?

I hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX. I dropped an annoying Silver short early in the day, although I might pick that back up Wednesday at the next hourly cycle peak.

Considering the hourly and weekly index cycles, I remain highly dubious that the equity bears can break below sp'1840 this week. Indeed, I'd not be surprised if we put in a weekly close somewhere in the 1880/1900 zone.

If the market can cope with QE-taper'4, and at least 'reasonable' GDP/monthly jobs data, then there is little reason why we won't really into May.

Goodnight from London

Daily Index Cycle update

US equities opened higher, but unraveled into the early afternoon - swinging from sp'1877 to 1850. With a latter day recovery, the sp' settled +6pts @ 1869. The two leaders - Trans/R2K, closed u/c, and -0.5% respectively. Outlook is bullish into early May.

sp'daily5

R2K

Trans

Summary

Suffice to say, the broader up trends are STILL holding. The daily candle on the sp'500 is somewhat bullish for Tuesday.

The two leaders remain especially weak, but the equity bears really haven't managed to display much real downside power in the broader market.

Indeed, considering the hourly index cycles, there looks to be viable upside to the sp'1880/90s by late Wednesday.

--

Closing update from Mr TopStep

--

a little more later...

sp'daily5

R2K

Trans

Summary

Suffice to say, the broader up trends are STILL holding. The daily candle on the sp'500 is somewhat bullish for Tuesday.

The two leaders remain especially weak, but the equity bears really haven't managed to display much real downside power in the broader market.

Indeed, considering the hourly index cycles, there looks to be viable upside to the sp'1880/90s by late Wednesday.

--

Closing update from Mr TopStep

--

a little more later...

Monday, 28 April 2014

Volatility peaked in the gap zone

With the market appearing to floor at sp'1850, the VIX maxed out in the gap zone of the 15.20s. With a latter day recovery in equities, the VIX broke lower, settling -0.6% @ 13.97. Near term outlook is for the VIX to melt lower to the 12/11s - if sp'1880/90s.

vix'60min

vix'daily3

Summary

Suffice to say, VIX did finally manage to reach the gap zone, at which point it has got stuck.

I do not expect a higher VIX later this week, and the 20s look out of range for some weeks, perhaps even a few months.

-

more later..on the indexes

vix'60min

vix'daily3

Summary

Suffice to say, VIX did finally manage to reach the gap zone, at which point it has got stuck.

I do not expect a higher VIX later this week, and the 20s look out of range for some weeks, perhaps even a few months.

-

more later..on the indexes

Closing Brief

US equities saw some interesting intraday swings, from opening gains to sp'1877, but being quickly eroded to 1850, and settling +6pts @ 1869. The two leaders - Trans/R2K, closed u/c and -0.5% respectively. Near term outlook is..bullish to another attempt to push >1880.

sp'60min

Summary

Interesting day, and yes, despite the weakness, I'm still resigned to higher levels. Indeed, I even picked up another two long positions.

-

Where now?

Well, the hourly index cycles are offering a floor of sp'1850, and the big issue is can the market cope with QE taper'4 this Wednesday, along with whatever the GDP for Q1 comes in at. Market consensus is only 1.1% growth, which is not exactly a bold target. I'm guessing we'll at least see 1.5% or so, and you know the market will use that an excuse to rally.

-

*I hold heavy long overnight (gods help the bulls now!), via CHK, DO, RIG, SDRL, and STX, the latter of which has earnings at the Tuesday close.

-

more later..on the VIX

sp'60min

Summary

Interesting day, and yes, despite the weakness, I'm still resigned to higher levels. Indeed, I even picked up another two long positions.

-

Where now?

Well, the hourly index cycles are offering a floor of sp'1850, and the big issue is can the market cope with QE taper'4 this Wednesday, along with whatever the GDP for Q1 comes in at. Market consensus is only 1.1% growth, which is not exactly a bold target. I'm guessing we'll at least see 1.5% or so, and you know the market will use that an excuse to rally.

-

*I hold heavy long overnight (gods help the bulls now!), via CHK, DO, RIG, SDRL, and STX, the latter of which has earnings at the Tuesday close.

-

more later..on the VIX

3pm update - battling into the close

The equity bulls have probably held the line - from the recent 4-5 days of 'minor weakness'..at the sp'1850 line. VIX has seemingly maxed out at the gap zone of the 15.20s. Metals remain weak, Gold -$4, but off their earlier lows.

sp'60min

Summary

Well, no one can say today was dull. Bulls opened higher..bears took over, and whacked the market from 1877 to 1850 - pretty impressive.

However, the actual price action is nothing that I'd call particularly bearish, never mind that the broader up trends are still holding on all the main indexes.

-

With further QE tomorrow, the FOMC/GDP on Wednesday, and the latest 'the recovery continues' jobs data from the BLS on Friday, bulls still have a fair opportunity to attain a weekly close in the 1880/90s.

--

Here comes the sun...

--

updates into the close...

3.05pm.. Hourly MACD cycle offering a snap higher tomorrow, the 1880/90s are viable by late Wednesday. Bears...beware!

3.12pm.. Its getting nasty..and the VIX is about to turn red..in the 13s.. .urghhhh. Poor bears :(

--

*I will hold heavy long overnight, via CHK, DO, RIG, SRDL, and STX.

3.19pm.. nasty market..with VIX red..and set to close in the 13s... with sp'1870s

For those on the short side, I realise today has turned into the mini nightmare.

3.27pm.. a 21pt swing so far....pretty intense stuff! VIX 13.80s....the horror!

3.41pm.. pure horror for those in bear land...

Suffice to say, I hold HEAVY long overnight..and am at least on the right side of things today.

sp'60min

Summary

Well, no one can say today was dull. Bulls opened higher..bears took over, and whacked the market from 1877 to 1850 - pretty impressive.

However, the actual price action is nothing that I'd call particularly bearish, never mind that the broader up trends are still holding on all the main indexes.

-

With further QE tomorrow, the FOMC/GDP on Wednesday, and the latest 'the recovery continues' jobs data from the BLS on Friday, bulls still have a fair opportunity to attain a weekly close in the 1880/90s.

--

Here comes the sun...

--

updates into the close...

3.05pm.. Hourly MACD cycle offering a snap higher tomorrow, the 1880/90s are viable by late Wednesday. Bears...beware!

3.12pm.. Its getting nasty..and the VIX is about to turn red..in the 13s.. .urghhhh. Poor bears :(

--

*I will hold heavy long overnight, via CHK, DO, RIG, SRDL, and STX.

3.19pm.. nasty market..with VIX red..and set to close in the 13s... with sp'1870s

For those on the short side, I realise today has turned into the mini nightmare.

3.27pm.. a 21pt swing so far....pretty intense stuff! VIX 13.80s....the horror!

3.41pm.. pure horror for those in bear land...

Suffice to say, I hold HEAVY long overnight..and am at least on the right side of things today.

2pm update - VIX maxed in the gap?

Another minor wave lower, and the VIX has finally broken into the 15s again, where there is a very clear gap zone - equating to sp'1850/45. Equity bears really need a daily close in the low sp'1840s to offer hope that the market is going to break the broader upward trend.

sp'60min

vix'60min

Summary

*rather than pick up an index-long, I went LONG DO (Diamond offshore) a little earlier.

--

So...VIX has reached the gap zone in the low 15s. I suppose sp' could still hit 1845 or so, whilst the VIX churns sideways.

Regardless, price action in my view is just not particularly bearish. Certainly, VIX in the 15s is nothing for the doomer bears to get overly excited about.

Stay tuned.

2.10pm.. market threatening a reversal from 1850, with a second floor-spike hourly candle.

Notable strength remains.. AAPL +2%, as many recognise the split, and a likely Dow inclusion will lead to much higher levels.

2.25pm.. Equity bulls making a play to push this nonsense back up...bears could be in real trouble now.

VIX appears maxed right at the gap zone of 15.20s...already back to 14.50s.

sp'60min

vix'60min

Summary

*rather than pick up an index-long, I went LONG DO (Diamond offshore) a little earlier.

--

So...VIX has reached the gap zone in the low 15s. I suppose sp' could still hit 1845 or so, whilst the VIX churns sideways.

Regardless, price action in my view is just not particularly bearish. Certainly, VIX in the 15s is nothing for the doomer bears to get overly excited about.

Stay tuned.

2.10pm.. market threatening a reversal from 1850, with a second floor-spike hourly candle.

Notable strength remains.. AAPL +2%, as many recognise the split, and a likely Dow inclusion will lead to much higher levels.

2.25pm.. Equity bulls making a play to push this nonsense back up...bears could be in real trouble now.

VIX appears maxed right at the gap zone of 15.20s...already back to 14.50s.

1pm update - equity bears struggling

Despite a clear degree of weakness so far today, the equity bears are still not displaying the downside power that would be necessary to break the next support zone of sp'1850/45. Hourly index cycles are again offering a floor, and for the bears, this might be as good as it gets this week.

sp'60min

Summary

*exited a short silver position just earlier. Might get back with that this Wednesday.

--

Frankly, the price action just looks a choppy mess, but for the bears...that IS a major problem.

Is a 'choppy mess', the best the bears can do? It would seem so. It is now just a matter of when the bulls can launch another up wave.

-

Notable weakness in OPEN

A lousy daily and weekly outlook for those long OPEN.

--

1.03pm...sp'1860... getting kinda close to gap/support...along with VIX 15s.

1.10pm.. VIX gap zone..that is the one to focus on... 15.20/60 zone...we'll likely get stuck there.

1.18pm.. VIX 15s...getting real close now..along with sp'1850/45.

1.26pm...almost there...in both zones..

Keeping mind a typical turn time is 2.30pm...bears will probably max out within next 60mins.

1.34pm.. LONG DO (Diamond offshore), from equiv' of sp'1851.

Anyone notice the Dow, just -45pts.. a mere 0.3%.

-

VIX at the gap zone of 15.20s... high risk of the bears getting stuck here.

sp'60min

Summary

*exited a short silver position just earlier. Might get back with that this Wednesday.

--

Frankly, the price action just looks a choppy mess, but for the bears...that IS a major problem.

Is a 'choppy mess', the best the bears can do? It would seem so. It is now just a matter of when the bulls can launch another up wave.

-

Notable weakness in OPEN

A lousy daily and weekly outlook for those long OPEN.

--

1.03pm...sp'1860... getting kinda close to gap/support...along with VIX 15s.

1.10pm.. VIX gap zone..that is the one to focus on... 15.20/60 zone...we'll likely get stuck there.

1.18pm.. VIX 15s...getting real close now..along with sp'1850/45.

1.26pm...almost there...in both zones..

Keeping mind a typical turn time is 2.30pm...bears will probably max out within next 60mins.

1.34pm.. LONG DO (Diamond offshore), from equiv' of sp'1851.

Anyone notice the Dow, just -45pts.. a mere 0.3%.

-

VIX at the gap zone of 15.20s... high risk of the bears getting stuck here.

12pm update - chop chop chop

The US indexes continue to see some reasonably dynamic price action. However, the equity bears (at least so far) are simply showing a lack of downside power. Metals remain weak, Gold -$8, whilst Oil is a little lower, -0.2%. VIX is battling to hold minor gains of 2% in the low 14s.

sp'weekly8

Summary

*ignoring the smaller cycles this hour.

re: chart'8, bull maniacs should be seeking to hold the 10MA of 1858 this week.

--

If you believe the market can cope with QE'taper'4 this Wednesday, then a push into the 1890s is a given, at which point a weekly close at the 1900 threshold is also likely.

There are plenty of good chartists out there, many of whom are seeking a break >1900, with May/June upside into the 1925/75 zone. So far...few seem to be looking for sp'2000s..well, except Mr Carboni.

--

VIX update from Mr T

--

time for tea!

-

VIX'60min

The gap zone remains an obvious 'best bear case'.

-

Notable weakness: OPEN, -5.5%..falling like a rock.

sp'weekly8

Summary

*ignoring the smaller cycles this hour.

re: chart'8, bull maniacs should be seeking to hold the 10MA of 1858 this week.

--

If you believe the market can cope with QE'taper'4 this Wednesday, then a push into the 1890s is a given, at which point a weekly close at the 1900 threshold is also likely.

There are plenty of good chartists out there, many of whom are seeking a break >1900, with May/June upside into the 1925/75 zone. So far...few seem to be looking for sp'2000s..well, except Mr Carboni.

--

VIX update from Mr T

--

time for tea!

-

VIX'60min

The gap zone remains an obvious 'best bear case'.

-

Notable weakness: OPEN, -5.5%..falling like a rock.

11am update - market pushing back upward

It has been a pretty choppy start to the week, with failing gains..but then another whipsaw to the upside. It is indeed going to be a very dynamic week in terms of price action. Metals remain weak, Gold -$9, with Silver -0.9%. VIX is battling to hold fractional gains, in the low 14s.

sp'60min

Summary

*I picked up two new long positions, RIG, and SDRL, will seek to hold them for at least a day or two.

Currently, LONG CHK, RIG, SDRL, STX, and SHORT, SLV (which I'm seeking to drop today, its annoying me).

--

For me, the action in AAPL is probably a tell. If the giant AAPL is picking up some serious underlying upside, then the broader market should be okay...

AAPL, monthly

The low 600s look pretty easy to hit.

--

11.28am.. suffice to say, it remains a bit of a mess this morning.

Momo stocks having real trouble, with AMZN leading the way lower...but...

AAPL is higher, and there are certainly some stronger sectors in the market.

-

Bears just seem to lack any downside power..despite the current minor weakness.

Hourly index charts.. still offer the bears VIX 15s, with sp'1850/45...but really, that will be real difficult.

-

11.40am.. RIG and SDRL, looking pretty good, and there is noticeable strength in some of the resource stocks out there.

Well, no one can complain..this ain't a dull start to the week!

sp'60min

Summary

*I picked up two new long positions, RIG, and SDRL, will seek to hold them for at least a day or two.

Currently, LONG CHK, RIG, SDRL, STX, and SHORT, SLV (which I'm seeking to drop today, its annoying me).

--

For me, the action in AAPL is probably a tell. If the giant AAPL is picking up some serious underlying upside, then the broader market should be okay...

AAPL, monthly

The low 600s look pretty easy to hit.

--

11.28am.. suffice to say, it remains a bit of a mess this morning.

Momo stocks having real trouble, with AMZN leading the way lower...but...

AAPL is higher, and there are certainly some stronger sectors in the market.

-

Bears just seem to lack any downside power..despite the current minor weakness.

Hourly index charts.. still offer the bears VIX 15s, with sp'1850/45...but really, that will be real difficult.

-

11.40am.. RIG and SDRL, looking pretty good, and there is noticeable strength in some of the resource stocks out there.

Well, no one can complain..this ain't a dull start to the week!

10am update - opening reversal

Mr Market has begun the week with opening gains, but those have already largely failed. Bears should be battling for VIX in the 15s..with sp'1850/45. If equity bulls can hold the line there though, there remains high probability of renewed upside. Metals remain somewhat weak.

sp'60min

vix'60min

Summary

*I have my eyes on RIG and SDRL, on the long side....but first, I want to let the indexes slip lower.

--

We have started the week with some pretty dynamic opening price action....at least its not boring, right?

10.00am... getting messy...indexes rebounding..and VIX cooling.

Will be a lot of confused traders after this open.

-

10.03am.. RIG, SDRL continue to retrace lower...I will look to pick them both up. They are already tempting targets though after last weeks big turn.

10.10am.. Anyone else noticed AAPL ? Its flying..for the low $600s.

10.20am.. LONG RIG from 42.60s

10.24am.. most annoying open for some weeks? Fails opening gains..reversal lower...then whipsaw higher..and VIX turns red.

--

I am now eyeing SDRL for another long block.

10.32am.. LONG SDRL from the 34.50s. - seeking 36/37

10.42am.. RIG and SDRL are starting to fly already.

Anyway..main market is holding together, and with QE tomorrow...bears face same old issues.

sp'60min

vix'60min

Summary

*I have my eyes on RIG and SDRL, on the long side....but first, I want to let the indexes slip lower.

--

We have started the week with some pretty dynamic opening price action....at least its not boring, right?

10.00am... getting messy...indexes rebounding..and VIX cooling.

Will be a lot of confused traders after this open.

-

10.03am.. RIG, SDRL continue to retrace lower...I will look to pick them both up. They are already tempting targets though after last weeks big turn.

10.10am.. Anyone else noticed AAPL ? Its flying..for the low $600s.

10.20am.. LONG RIG from 42.60s

10.24am.. most annoying open for some weeks? Fails opening gains..reversal lower...then whipsaw higher..and VIX turns red.

--

I am now eyeing SDRL for another long block.

10.32am.. LONG SDRL from the 34.50s. - seeking 36/37

10.42am.. RIG and SDRL are starting to fly already.

Anyway..main market is holding together, and with QE tomorrow...bears face same old issues.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +10pts, we're set to open at 1873. Equity bulls need to at least hold above the 1850/45 zone this week. As it is, With sig' QE-pomo today and tomorrow, the bears face the old problem. Metals are a little weak, Gold -$2, Silver -0.8%.

sp'60min

Summary

We have a pretty packed week ahead. Suffice to say....for full details, see the weekend post!

--

Mr Permabull is starting the week...bearish...

Considering the weekly charts, I'm really bemused how Oscar is seemingly spooked. All the indexes are holding well within their broader up trends. For instance, Transports would have to fall 3% just to test rising support.

-

As for me today, well, I have my sights on picking up RIG and SDRL, but those might both open significantly higher, and I'm not particularly in the mood to chase them higher.

-

Good wishes for the week ahead!

-

8.52am.. sp +7pts... 1870.

Notable strength: FCX +1.1%, which is pretty impressive - considering the weak metal prices.

8.56am.. Notable weakness: AMZN -0.8% @ $301. A break <300 would be a warning for the broader market.

Regardless, hourly index charts offering upside into FOMC Wednesday. The fact we have QE today and tomorrow can only help.

9.35am..ohoh, black candles appearing all over the place...just like Friday morning. Bulls..beware.

If we do fail to hold the gains, downside target zone is 1845/50.

9.41am... black-fail candles... it is a problem, and the indexes are starting to slip.

AMZN snaps ....fails to hold $300

9.43am VIX due to snap higher in 10/15mins......kinda interesting open.

I continue to have my eyes on RIG and SDRL...once the smaller 5/15min cycles are floored.

sp'60min

Summary

We have a pretty packed week ahead. Suffice to say....for full details, see the weekend post!

--

Mr Permabull is starting the week...bearish...

Considering the weekly charts, I'm really bemused how Oscar is seemingly spooked. All the indexes are holding well within their broader up trends. For instance, Transports would have to fall 3% just to test rising support.

-

As for me today, well, I have my sights on picking up RIG and SDRL, but those might both open significantly higher, and I'm not particularly in the mood to chase them higher.

-

Good wishes for the week ahead!

-

8.52am.. sp +7pts... 1870.

Notable strength: FCX +1.1%, which is pretty impressive - considering the weak metal prices.

8.56am.. Notable weakness: AMZN -0.8% @ $301. A break <300 would be a warning for the broader market.

Regardless, hourly index charts offering upside into FOMC Wednesday. The fact we have QE today and tomorrow can only help.

9.35am..ohoh, black candles appearing all over the place...just like Friday morning. Bulls..beware.

If we do fail to hold the gains, downside target zone is 1845/50.

9.41am... black-fail candles... it is a problem, and the indexes are starting to slip.

AMZN snaps ....fails to hold $300

9.43am VIX due to snap higher in 10/15mins......kinda interesting open.

I continue to have my eyes on RIG and SDRL...once the smaller 5/15min cycles are floored.

Saturday, 26 April 2014

Weekend update - US weekly indexes

All US equity indexes saw net weekly declines, ranging from just -0.1% (sp'500), to -1.3% (R2K). Barring a break under the recent low of sp'1814, the primary upward trend remains comfortably intact. Best bullish case for late May/early June, remains the sp'1925/50 zone.

Lets take our regular look at six of the main US indexes

sp'500

The sp' was only fractionally lower this week, -0.1%. Equity bulls did achieve a second consecutive close above the weekly 10MA of 1855. Upper bollinger is offering the 1890/1910 zone next week. Underlying MACD (blue bar histogram) cycle ticked higher for a second week, but is still negative cycle.

Barring a break under the recent low of sp'1814, equity bears can't get excited about any of the recent weakness.

Nasdaq Comp'

The tech' slipped a minor -0.5% this past week. The underlying MACD cycle is now deeply negative, although the RSI is still at 50, which is typically half of where it could fall. The rally earlier this week failed to break the weekly 10MA, and that is certainly a somewhat spiky-fail candle.

First downside target for the equity bears should be a break back under 4000 - a mere 2% lower, but that won't be easy.

Dow

The Dow saw a very minor decline of just -0.3%. Importantly, the equity bulls did manage a second consecutive close above the weekly 10MA. Underlying MACD cycle ticker higher, and there is a very viable chance it might turn positive in early May - which would likely equate to new historic highs in the 16700/800s.

Equity bears need to break <16000 to have any justification to get confident about more significant declines this summer.

NYSE Comp'

The master index slipped around a quarter of a percent this week. The weekly close in the 10500s was a reasonable achievement for the equity bulls, and there is near term upside to the 10600/700s within the next week or two.

R2K

The second market leader fell -1.3% this week, and is less than 2% away from causing more serious trouble for the equity bulls. Any break <1100 would be a major break of the primary trend, and open the door to the giant 1000 threshold this late spring/early summer.

There are some chartists who are seeking a H/S formation for the R2K/Nasdaq, and that scenario is still intact. Underlying MACD cycle is deeply negative, and frankly...it would be surprising if we don't see some sort of multi-week bounce from here.

Regardless of any intraday waves next week, the 1100 threshold will be key to keep in mind. Worse case for the bears, a renewed push to new highs..to the 1250/1300 zone.

Trans

The old leader fell -0.6% this week, although notably, the Trans did break a new historic high of 7774. The weekly candle was something of a bearish spiky-top, an inverse hammer. Equity bears will need to break the recent low of 7346 - some 3% lower, before the primary upward trend is broken. That does not look likely.

Summary

So...net declines for all the US indexes, but..the declines really weren't that significant (even after the Friday declines). For me, what is especially notable is that the Trans - the market leader, even made a new high this week.

Unless the equity bears can take out the lows - equiv' to sp'1814, then the primary trend does indeed very much remain...bullish.

Looking ahead

Next week is going to be an action packed week. However, the week begins with just a little housing data. Tuesday will see Case-shiller HPI and consumer confidence.

The big day next week is Wednesday. First, we have the ADP jobs data, but more importantly, the first reading for Q1 GDP. Yet even bigger than that data point is the FOMC announcement - due 2pm. Mainstream consensus - which I agree with, is for QE taper'4, bringing monthly QE down to $45bn a month beginning May'1st. There will NOT be a Yellen press. conf' following the announcement.

Thursday will see Yellen talking in early morning - whose comments might indeed be taken by Mr Market as an excuse to move.

The week concludes with factory orders and the big monthly jobs number. As ever, how Mr Market interprets the data is almost as difficult to guess, as to what the number itself might be. Arguably, anything >175k net gains, would likely be deemed 'acceptable' by the mainstream.

*there is sig' QE-pomo: Mon/Tue, both around $2bn. The new QE schedule will be issued at 3pm on Wednesday.

--

A net monthly gain?

With just 3 trading days left of April, the sp' is only lower by around 9pts.

Even if the bears do manage to hold a net monthly decline by the Wednesday close, the first real support is the 10MA, and that is all the way down at 1778. For the bulls, the upper bol' is offering the sp'1960s, but the weekly cycle will be holding the line at 1900/10 into early May.

Underlying MACD cycle is ticking lower, and price momentum is slipping toward the bears. At the current rate, the indexes are due to turn negative cycle within 2-3 months. So..for those seeking a major inter'3 top, there remains good opportunity this summer.

Looking forward to a very busy week

Yours truly is holding long (and short) across the weekend. I'm long via CHK and STX, and short Silver, via SLV. I'm hopeful those will work out across the next week or two. Further, I'm also seeking to pick up another position in RIG. I hold an upside target of 46/47, so another entry in the low 42s would be very tempting.

As things are, I'm reluctant to meddle in the indexes themselves, and will certainly leave the VIX well alone. Barring a break <sp'1814, I will hold to a near term outlook of further upside, into the sp'1925/50 zone by late May/early June.

As ever, comments are most welcome. Have a restful weekend, next week will be busy!

back on Monday :)

---

Video update from Walker

-

Lets take our regular look at six of the main US indexes

sp'500

The sp' was only fractionally lower this week, -0.1%. Equity bulls did achieve a second consecutive close above the weekly 10MA of 1855. Upper bollinger is offering the 1890/1910 zone next week. Underlying MACD (blue bar histogram) cycle ticked higher for a second week, but is still negative cycle.

Barring a break under the recent low of sp'1814, equity bears can't get excited about any of the recent weakness.

Nasdaq Comp'

The tech' slipped a minor -0.5% this past week. The underlying MACD cycle is now deeply negative, although the RSI is still at 50, which is typically half of where it could fall. The rally earlier this week failed to break the weekly 10MA, and that is certainly a somewhat spiky-fail candle.

First downside target for the equity bears should be a break back under 4000 - a mere 2% lower, but that won't be easy.

Dow

The Dow saw a very minor decline of just -0.3%. Importantly, the equity bulls did manage a second consecutive close above the weekly 10MA. Underlying MACD cycle ticker higher, and there is a very viable chance it might turn positive in early May - which would likely equate to new historic highs in the 16700/800s.

Equity bears need to break <16000 to have any justification to get confident about more significant declines this summer.

NYSE Comp'

The master index slipped around a quarter of a percent this week. The weekly close in the 10500s was a reasonable achievement for the equity bulls, and there is near term upside to the 10600/700s within the next week or two.

R2K

The second market leader fell -1.3% this week, and is less than 2% away from causing more serious trouble for the equity bulls. Any break <1100 would be a major break of the primary trend, and open the door to the giant 1000 threshold this late spring/early summer.

There are some chartists who are seeking a H/S formation for the R2K/Nasdaq, and that scenario is still intact. Underlying MACD cycle is deeply negative, and frankly...it would be surprising if we don't see some sort of multi-week bounce from here.

Regardless of any intraday waves next week, the 1100 threshold will be key to keep in mind. Worse case for the bears, a renewed push to new highs..to the 1250/1300 zone.

Trans

The old leader fell -0.6% this week, although notably, the Trans did break a new historic high of 7774. The weekly candle was something of a bearish spiky-top, an inverse hammer. Equity bears will need to break the recent low of 7346 - some 3% lower, before the primary upward trend is broken. That does not look likely.

Summary

So...net declines for all the US indexes, but..the declines really weren't that significant (even after the Friday declines). For me, what is especially notable is that the Trans - the market leader, even made a new high this week.

Unless the equity bears can take out the lows - equiv' to sp'1814, then the primary trend does indeed very much remain...bullish.

Looking ahead

Next week is going to be an action packed week. However, the week begins with just a little housing data. Tuesday will see Case-shiller HPI and consumer confidence.

The big day next week is Wednesday. First, we have the ADP jobs data, but more importantly, the first reading for Q1 GDP. Yet even bigger than that data point is the FOMC announcement - due 2pm. Mainstream consensus - which I agree with, is for QE taper'4, bringing monthly QE down to $45bn a month beginning May'1st. There will NOT be a Yellen press. conf' following the announcement.

Thursday will see Yellen talking in early morning - whose comments might indeed be taken by Mr Market as an excuse to move.

The week concludes with factory orders and the big monthly jobs number. As ever, how Mr Market interprets the data is almost as difficult to guess, as to what the number itself might be. Arguably, anything >175k net gains, would likely be deemed 'acceptable' by the mainstream.

*there is sig' QE-pomo: Mon/Tue, both around $2bn. The new QE schedule will be issued at 3pm on Wednesday.

--

A net monthly gain?

With just 3 trading days left of April, the sp' is only lower by around 9pts.

Even if the bears do manage to hold a net monthly decline by the Wednesday close, the first real support is the 10MA, and that is all the way down at 1778. For the bulls, the upper bol' is offering the sp'1960s, but the weekly cycle will be holding the line at 1900/10 into early May.

Underlying MACD cycle is ticking lower, and price momentum is slipping toward the bears. At the current rate, the indexes are due to turn negative cycle within 2-3 months. So..for those seeking a major inter'3 top, there remains good opportunity this summer.

Looking forward to a very busy week

Yours truly is holding long (and short) across the weekend. I'm long via CHK and STX, and short Silver, via SLV. I'm hopeful those will work out across the next week or two. Further, I'm also seeking to pick up another position in RIG. I hold an upside target of 46/47, so another entry in the low 42s would be very tempting.

As things are, I'm reluctant to meddle in the indexes themselves, and will certainly leave the VIX well alone. Barring a break <sp'1814, I will hold to a near term outlook of further upside, into the sp'1925/50 zone by late May/early June.

As ever, comments are most welcome. Have a restful weekend, next week will be busy!

back on Monday :)

---

Video update from Walker

-

Subscribe to:

Posts (Atom)