The VIX gained 13% today, but still resides in the lowly 16s. Its a long way up, just to get back to the big 20 level.

VIX'60min

VIX'daily

VIX'weekly

Summary

Today's VIX increase is interesting, but bears should not get even moderately excited yet. VIX'16 is not exactly a volatile market, and until we're over 20, bears should be very cautious.

The down channel on the hourly cycle is conclusively broken though. First support is the 10MA, which will be around 15.25 by the close of tomorrow.

The daily cycle would suggest 18.50 is possible later this week, which is around 15% higher.

-

The bigger weekly cycle remains something of a mess. Last week closed with a giant bearish engulfing candle, today certainly helped to turn things around a bit, but until we break over 19..and arguably 20, the market remains largely fearless.

After all, since everything is fixed in the global economy, why worry?

Monday, 10 September 2012

Closing brief

Moderate declines in the closing hour, but it remains very minor. It still looks we have bull flags setting up on most indexes, and those bodes well for one further up move to around 1445, that could occur as early as tomorrow.

The VIX rise of 11% is interesting, but with the VIX only in the 16s, its to be largely dismissed.

IWM'60min

Dow

Sp

Summary

So, I'm going to guess the bull flag is largely complete.

From a MACD (blue bar histogram) perspective, we are VERY low on the cycle, and we could very easily open considerably higher at the Tuesday open.

Even though I expect a move to 1445, I sure won't be buying this dip, I'd rather wait for a near term top.

With the German court ruling, and the FOMC due, today and tomorrow are going to give everyone the chance to get positioned.

Your resident permabear remains trying to be patient!

More across the evening

The VIX rise of 11% is interesting, but with the VIX only in the 16s, its to be largely dismissed.

IWM'60min

Dow

Sp

Summary

So, I'm going to guess the bull flag is largely complete.

From a MACD (blue bar histogram) perspective, we are VERY low on the cycle, and we could very easily open considerably higher at the Tuesday open.

Even though I expect a move to 1445, I sure won't be buying this dip, I'd rather wait for a near term top.

With the German court ruling, and the FOMC due, today and tomorrow are going to give everyone the chance to get positioned.

Your resident permabear remains trying to be patient!

More across the evening

2pm update - looking upward for Tuesday

Everything remains on track for a further move higher to around sp'1445 tomorrow.

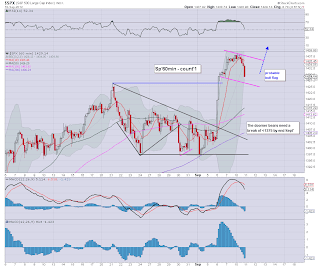

sp'60min

sp'daily5

Summary

Not much to add. Low volume churn, whilst the hourly cycle fully resets, allowing a good sp+10pt move tomorrow.

It remains a near perfect bull flag on the hourly index charts. With the daily trend still cycling higher, those patient bears looking to short a top, don't have to wait too much longer.

Oh, and the transports is having a good day - a probable warning of upside in the dow/sp tomorrow..

yours... patiently waiting.

More after the close

sp'60min

sp'daily5

Summary

Not much to add. Low volume churn, whilst the hourly cycle fully resets, allowing a good sp+10pt move tomorrow.

It remains a near perfect bull flag on the hourly index charts. With the daily trend still cycling higher, those patient bears looking to short a top, don't have to wait too much longer.

Oh, and the transports is having a good day - a probable warning of upside in the dow/sp tomorrow..

yours... patiently waiting.

More after the close

12pm update - holding firm

Market is very content to hold and trade sideways today. It makes for a pretty good bull flag on many of the indexes.

In theory, we should see a further up wave tomorrow, and considering the broader trends, sp'1445 could be the near term top. First downside target would be 1420.

sp'60min

sp'daily5

Summary

I remain patiently awaiting, seeking a re-short around 1445 tomorrow afternoon. I am very tempted to be short ahead of the German court. Not because I assume a 'nein nein nein!', but from a cycle perspective, we are way due at least one major down day.

VIX is a touch higher, but its all noise of course.

back at 2pm

In theory, we should see a further up wave tomorrow, and considering the broader trends, sp'1445 could be the near term top. First downside target would be 1420.

sp'60min

sp'daily5

Summary

I remain patiently awaiting, seeking a re-short around 1445 tomorrow afternoon. I am very tempted to be short ahead of the German court. Not because I assume a 'nein nein nein!', but from a cycle perspective, we are way due at least one major down day.

VIX is a touch higher, but its all noise of course.

back at 2pm

10am update - big week ahead

Good morning. We have a big week ahead, with the German court ruling on the ESM (Wednesday), and the FOMC (Thursday, 12.30pm).

The opening declines are to be treated as noise, near term trend remains UP.

sp'60min

sp'daily5

Summary

Primary target is sp'1445 tomorrow, at which point i'll look to re-short this nonsense market. There seems a very viable likelihood of at least one major down day, if only to shake out the weaker bulls.

I'm not expecting anything today, a flat close, or fractional green closes across 'some' indexes seems likely.

VIX is flat, looking for a jump higher Wed/Thursday.

It does look like today and tomorrow will provide good opportunities for everyone to re-position.

Back at 12pm.

The opening declines are to be treated as noise, near term trend remains UP.

sp'60min

sp'daily5

Summary

Primary target is sp'1445 tomorrow, at which point i'll look to re-short this nonsense market. There seems a very viable likelihood of at least one major down day, if only to shake out the weaker bulls.

I'm not expecting anything today, a flat close, or fractional green closes across 'some' indexes seems likely.

VIX is flat, looking for a jump higher Wed/Thursday.

It does look like today and tomorrow will provide good opportunities for everyone to re-position.

Back at 12pm.

Subscribe to:

Comments (Atom)