Whilst equities saw continued minor weakness across the day, the VIX managed to hold minor gains, settling +6.1% @ 14.12. Near term outlook offers the 15s, before renewed downside.

VIX'60min

VIX'daily3

Summary

Little to add.

VIX remains relatively low.. at best, equity bears might manage the mid 15s, whether tomorrow.. or FOMC-Wednesday.

-

more later... on the indexes

Monday, 15 September 2014

Closing Brief

US equities closed somewhat mixed, sp -1pt @ 1984 (intra low 1978). The two leaders - Trans/R2K, settled -0.4% and -1.2% respectively. Near term outlook is for another micro wave lower to sp'1973/70 zone, before renewed upside.

sp'60min

Summary

Pretty tiresome day....

We're still in a slow down trend, and the low sp'1970s look a reasonably easy target. The only issue is do we floor there... and then a new multi-week up wave...into October.

Right now,..... I'd guess yes.

-

The usual bits and pieces to wrap up the day... across the evening.

---

more later... on the VIX

sp'60min

Summary

Pretty tiresome day....

We're still in a slow down trend, and the low sp'1970s look a reasonably easy target. The only issue is do we floor there... and then a new multi-week up wave...into October.

Right now,..... I'd guess yes.

-

The usual bits and pieces to wrap up the day... across the evening.

---

more later... on the VIX

3pm update - max annoyance

This remains a market that is not so much about max pain.. as max annoyance. A micro cycle has taken the sp'500 fractionally positive, and taken the edge off the momo stocks' declines. Barring a break >1995... the immediate trend remains 'weak'.

sp'60min

Summary

Well, today has been messy....

However, bears did manage another lower low...with the VIX in the 14s.

I'm still seeking the sp'1973/70 zone..with VIX 15s... before a key turn ..back upward.

-

Perhaps more than anything, equity bears should be seeking a VIX daily close in the 14s.

-

3.36pm.. Price action remains 'weak chop'. Certainly, no clear floor yet...not least in the momo stocks or the R2K.

Regardless..still waiting.

sp'60min

Summary

Well, today has been messy....

However, bears did manage another lower low...with the VIX in the 14s.

I'm still seeking the sp'1973/70 zone..with VIX 15s... before a key turn ..back upward.

-

Perhaps more than anything, equity bears should be seeking a VIX daily close in the 14s.

-

3.36pm.. Price action remains 'weak chop'. Certainly, no clear floor yet...not least in the momo stocks or the R2K.

Regardless..still waiting.

2pm update - the weak chop continues

Equities remain seeing the same weak chop that we've seen since the sp'2011 high of Sept'4. VIX is holding minor gains, +4% in the 13.90s. Momo stocks remain under rather severe pressure, with the R2K -1.3%.

sp'60min

Summary

Some real carnage in momo land today...

TSLA -10.0%

TWTR -6.2%

NFLX -4.0%

--

What to make of today? Broader market remains relatively stable.

Still seeking 1973/70.

sp'60min

Summary

Some real carnage in momo land today...

TSLA -10.0%

TWTR -6.2%

NFLX -4.0%

--

What to make of today? Broader market remains relatively stable.

Still seeking 1973/70.

1pm update - still moderately weak

Whilst there is far more significant weakness in the R2K, the broader market is still only moderately lower. Primary downside target remains the low sp'1970s, with VIX 15s (briefly)..before a renewed push higher into October.

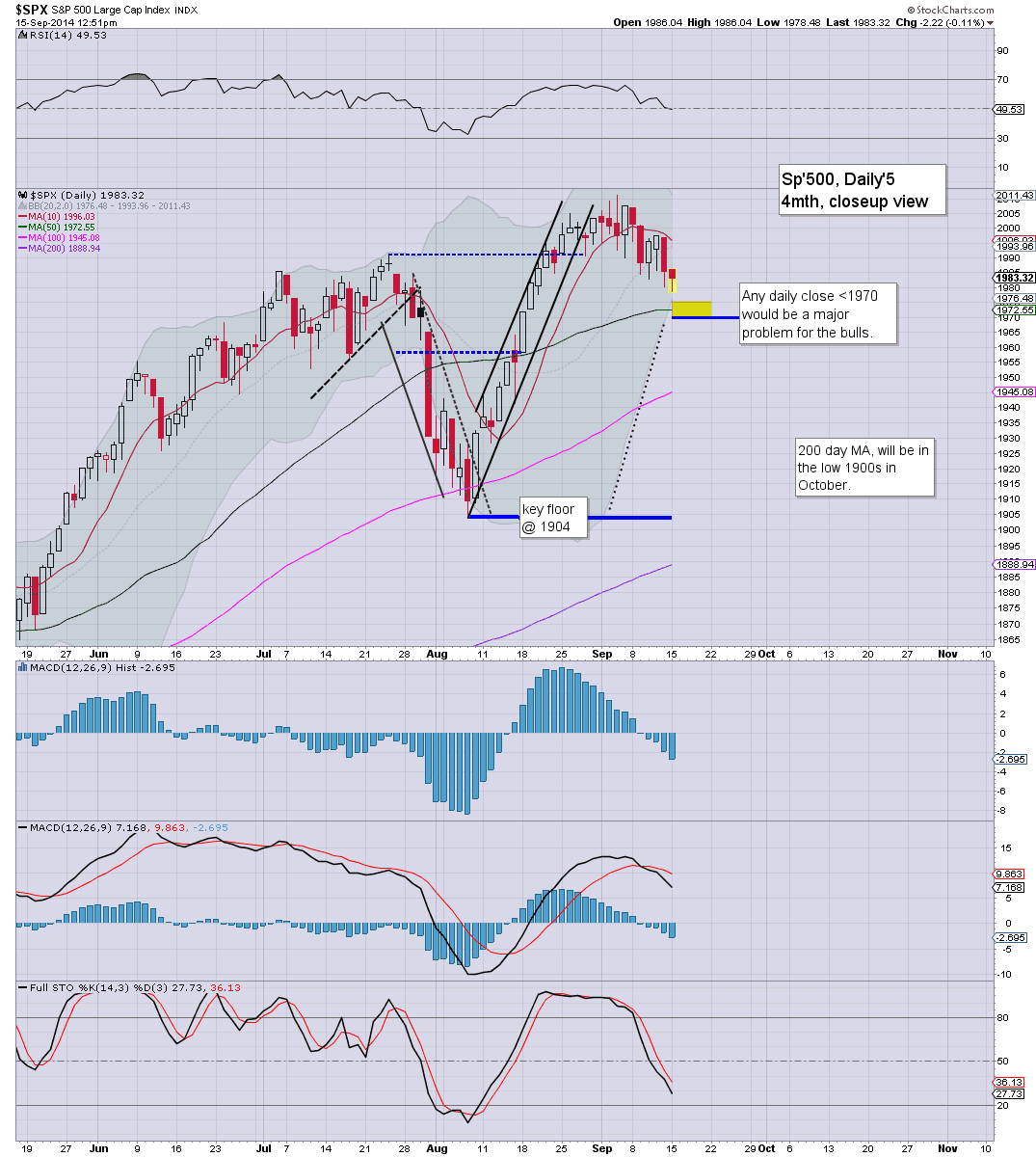

sp'daily5

Summary

The Dow is especially suggestive that the broader market remains comfortably bullish.

Yes, there is sig' selling in the small caps - notably the momo stocks of TSLA, TWTR, etc... but as a whole... the market is looking like it will level out by tomorrow.

-

*I remain seeking to pick up a sig' long-index block.... somewhere in the 1973/70 zone.. with VIX 15s.

For now, there is no hurry.. not least ahead of the Fed.

-

Notable weakness...

SDRL, weekly...

The carnage continues... with increasing talk of 'the dividends will be cut'.

-

1.10pm.. micro rally to evens. sp'1984.

Makes no sense for the floor to be 1976.... still looks to be more weak chop tomorrow....

sp'daily5

Summary

The Dow is especially suggestive that the broader market remains comfortably bullish.

Yes, there is sig' selling in the small caps - notably the momo stocks of TSLA, TWTR, etc... but as a whole... the market is looking like it will level out by tomorrow.

-

*I remain seeking to pick up a sig' long-index block.... somewhere in the 1973/70 zone.. with VIX 15s.

For now, there is no hurry.. not least ahead of the Fed.

-

Notable weakness...

SDRL, weekly...

The carnage continues... with increasing talk of 'the dividends will be cut'.

-

1.10pm.. micro rally to evens. sp'1984.

Makes no sense for the floor to be 1976.... still looks to be more weak chop tomorrow....

12pm update - major disparity

There is some serious disparity between the indexes this morning. We have the Dow fractionally higher, the sp/trans/nyse comp' moderately lower, whilst the R2K - along with the momo stocks.. getting slammed, -1.3%.

sp'60min

R2K, daily

Summary

*ViX holding moderate gains of 5% in the low 14s.

--

I'm not sure what to make of today. Certainly, we're on the weak side, but the headline indexes aren't warning of any trouble.

The only real notable weakness is in the momo stocks, which are getting whacked..

TSLA -7.3%

TWTR -4.7%

A real mess....

--

sp'60min

R2K, daily

Summary

*ViX holding moderate gains of 5% in the low 14s.

--

I'm not sure what to make of today. Certainly, we're on the weak side, but the headline indexes aren't warning of any trouble.

The only real notable weakness is in the momo stocks, which are getting whacked..

TSLA -7.3%

TWTR -4.7%

A real mess....

--

11am update - messy weak chop

Equities remain seeing minor weak chop, and its a bit of a messy start to the week. With the break under the Friday low of sp'1980, it remains the case of lower lows. There remains zero reason why another micro cycle won't take the market to at least 1973.

sp'60min

Summary

A tiresome start to the week... and if you've sent me an email or PM recently... don't expect a reply. My webhosts are a bunch of idiots, and have once again changed the server settings without telling any of their clients.

--

Regardless.. no reason for anyone to be short... there is NO downside power.

..and for the moment, no point being long....until we've at least tested the cluster of support in the low 1970s.

-

Notable weakness, TSLA -6%. I've no idea why, did Musk say anything about it being over-valued again?

-

11.13am.. All the momo stocks are really starting to stink, AMZN -2.9%... FB/TWTR following.

Its not a good sign for the equity bulls.

-

11.22am.. Dow.. +3pts.... R2K -1.3%..... seriously...that is one wacky divergence.

sp'60min

Summary

A tiresome start to the week... and if you've sent me an email or PM recently... don't expect a reply. My webhosts are a bunch of idiots, and have once again changed the server settings without telling any of their clients.

--

Regardless.. no reason for anyone to be short... there is NO downside power.

..and for the moment, no point being long....until we've at least tested the cluster of support in the low 1970s.

-

Notable weakness, TSLA -6%. I've no idea why, did Musk say anything about it being over-valued again?

-

11.13am.. All the momo stocks are really starting to stink, AMZN -2.9%... FB/TWTR following.

Its not a good sign for the equity bulls.

-

11.22am.. Dow.. +3pts.... R2K -1.3%..... seriously...that is one wacky divergence.

10am update - morning weakness

US equities are well on the way to the low sp'1970s, where there are multiple aspects of support. VIX is +6% in the low 14s. The 15s are viable today, and would make for a very natural cyclical top.

sp'60min

vix'60min

Summary

...so... we're on the way.

-

10.34am... ohh great...its already bounce time.

Tiresome. .... and for anyone short.. this is just another waste of time.

sp'60min

vix'60min

Summary

...so... we're on the way.

-

10.34am... ohh great...its already bounce time.

Tiresome. .... and for anyone short.. this is just another waste of time.

Pre-Market Brief

Good morning. Futures are a touch lower , sp -2pts, we're set to open at 1983. USD is starting the week on a positive note, +0.25%. A busy week is ahead, FOMC (QE taper'7), Alibaba IPO, the Scottish vote, and quad-opex on Friday.

sp'60min

Summary

So, equities have largely recovered most of their overnight losses, although even those declines barely amount to 0.5% at the most.

I still think there is a fairly high probability we'll slip to the low 1970s - with VIX 15s...whether late today..tomorrow..or even FOMC-Wednesday. Regardless of when, I'll look to be a buyer then.

--

Update from Oscar

--

Good wishes for the week ahead

-

8.35am. Empire state manu' survey...27s...

Notable weakness: SDRL -1.4%

Oil -0.8%... Gas +1.9%... interesting disparity.

sp'60min

Summary

So, equities have largely recovered most of their overnight losses, although even those declines barely amount to 0.5% at the most.

I still think there is a fairly high probability we'll slip to the low 1970s - with VIX 15s...whether late today..tomorrow..or even FOMC-Wednesday. Regardless of when, I'll look to be a buyer then.

--

Update from Oscar

--

Good wishes for the week ahead

-

8.35am. Empire state manu' survey...27s...

Notable weakness: SDRL -1.4%

Oil -0.8%... Gas +1.9%... interesting disparity.

Subscribe to:

Comments (Atom)