Volatility continues to increase, and we are now starting to ramp up in the very early phase of what is very likely a wave'3.

VIX, weekly

Summary

Holding to mid term target of 35/40.

--

Tuesday, 24 July 2012

Closing Brief - nasty market

A nasty closing hour ramp..urghh. I have great sympathy for those bears who are holding across into tomorrow. I am glad to be merely spectating today.

IWM

Dow

Sp

Summary

Awaiting AAPL earnings

I will look to re-short Wednesday 1345/55

More later..

IWM

Dow

Sp

Summary

Awaiting AAPL earnings

I will look to re-short Wednesday 1345/55

More later..

3pm update - weak market..so very weak

Bulls have the opportunity for a last hour ramp..they need to clear sp'1333..but so far.. they are simply unable to claw even a point higher.

VIX is on the threshold of a major breakout. Eyes sharp for VIX +20.50 !

sp'15min rainbow

Summary

Weak market, still a threat of hitting 1325...or a ramp.

Too uncertain, I'm glad to be out of this today.

--

More after the close, where it will be important to focus on the bigger picture...and not get lost amongst the noise of intra-day moves.

VIX is on the threshold of a major breakout. Eyes sharp for VIX +20.50 !

sp'15min rainbow

Summary

Weak market, still a threat of hitting 1325...or a ramp.

Too uncertain, I'm glad to be out of this today.

--

More after the close, where it will be important to focus on the bigger picture...and not get lost amongst the noise of intra-day moves.

2pm update - tricky Tuesday

It remains a very difficult Tuesday so far. There is pretty strong underlying weakness (see daily charts), and we have already got close to taking out the recent low of 1325. Its still possible we take it out near the close. Look to the VIX, any break over 21..and this market would be in serious trouble.

For the moment, we're too low on the smaller cycles to re-short. I'm merely a spectator today. It is a little frustrating missing out on these declines, but I'll catch the next cycle tomorrow.

sp'15min, rainbow

sp'60min, rainbow

Summary

The hourly cycle - its possible we're forming a descending wedge, and will bounce back into the 1345/50 range early tomorrow..before a fierce further move down to 1325.

I'll look to sit the rest of today out, and re-short tomorrow morning, preferably around 1345/50.

*we have AAPL earnings at the close, that would certainly be the excuse for Mr Market to ramp..or to snap right through 1325.

Either way, it will be high risk to hold overnight.

For the moment, we're too low on the smaller cycles to re-short. I'm merely a spectator today. It is a little frustrating missing out on these declines, but I'll catch the next cycle tomorrow.

sp'15min, rainbow

sp'60min, rainbow

Summary

The hourly cycle - its possible we're forming a descending wedge, and will bounce back into the 1345/50 range early tomorrow..before a fierce further move down to 1325.

I'll look to sit the rest of today out, and re-short tomorrow morning, preferably around 1345/50.

*we have AAPL earnings at the close, that would certainly be the excuse for Mr Market to ramp..or to snap right through 1325.

Either way, it will be high risk to hold overnight.

1pm update - could get ugly..real ugly

Its a mess...clearly. This market is under pressure, and that pressure only seems to be increasing as the day progresses. There seems very little right now to merit going long..and yet at the same time there is a severe threat of a major late day ramp.

I'm sitting this out...too much uncertainty for me.

Sp'60min

vix'60min

Summary

Ugly morning for those who were going long at the open

There is severe risk of latter day/early Wednesday ramp..I'm not getting involved in this nonsense.

--

*look to the VIX, if we break above 21.00..there IS late possibility of major sell off, even a flash lower.

-

Santelli...at his finest.

UPDATE. 1.10pm

Still high risk of flooring at these levels...the 15min cycle...

Look at the MACD cycle...this is NOT a good place to stay short. There is a real risk here.

I won't put myself at risk here. I'd rather miss out on downside.

I'm sitting this out...too much uncertainty for me.

Sp'60min

vix'60min

Summary

Ugly morning for those who were going long at the open

There is severe risk of latter day/early Wednesday ramp..I'm not getting involved in this nonsense.

--

*look to the VIX, if we break above 21.00..there IS late possibility of major sell off, even a flash lower.

-

Santelli...at his finest.

UPDATE. 1.10pm

Still high risk of flooring at these levels...the 15min cycle...

Look at the MACD cycle...this is NOT a good place to stay short. There is a real risk here.

I won't put myself at risk here. I'd rather miss out on downside.

12pm update - waiting

With the daily cycle pushing lower, market is indeed under constant pressure, yet I still think there is a fairly reasonable chance of upside - via a C'wave. VIX is weak, and is not really showing any sign of real concern.

sp'15min

vix'60min

Summary

Market weaker than expected, very close to taking out yesterdays SP' low of 1337.

I still think there is a chance of latter day ramp to 1355/60.

For the moment..I will merely watch..and wait.

sp'15min

vix'60min

Summary

Market weaker than expected, very close to taking out yesterdays SP' low of 1337.

I still think there is a chance of latter day ramp to 1355/60.

For the moment..I will merely watch..and wait.

11am update - Its as easy as ABC

Hmm...moderate morning sell off, but the tone is very different. VIX is up just 3%, and unlike yesterday, there is no sense of panic.

I'm still expecting this to be some sort of micro-wave'2..perhaps in an ABC formation, where the B' was just completed.

sp'15min

sp'60min

Summary

Assuming B' wave near complete...waiting for C wave...target 1355/60..near the close.

I'm still expecting this to be some sort of micro-wave'2..perhaps in an ABC formation, where the B' was just completed.

sp'15min

sp'60min

Summary

Assuming B' wave near complete...waiting for C wave...target 1355/60..near the close.

10am update - crawling higher

Its earnings day for AAPL (at the close)..and Mr Market seems reasonably stable after yesterdays brief bear rampage.

I'm looking for slow crawl higher to around 1355/60 by early afternoon. We might get stuck around then..and rollover into the close.

sp'60min rainbow

sp'daily5

Summary

A quiet open, so its going to be very possible the algo-bots get the chance to melt-up this market again.

I remain looking to re-short later today, with my next exit target being 1325 by late Thursday.

I'm looking for slow crawl higher to around 1355/60 by early afternoon. We might get stuck around then..and rollover into the close.

sp'60min rainbow

sp'daily5

Summary

A quiet open, so its going to be very possible the algo-bots get the chance to melt-up this market again.

I remain looking to re-short later today, with my next exit target being 1325 by late Thursday.

Pre-Market Brief

Good morning. Overnight futures have been relatively quiet, flipping between minor gains and losses. Presently, sp -4pts, and is set to open around 1346. Certainly, its nothing dramatic like yesterday!

sp'60min, rainbow

*I intend to make more use of the Elder Impulse (I call them rainbow) style charts, in the days ahead.

sp'60min july24

sp'daily

vix'60min

Summary

Its possible we have already maxed out, and will simply fall from here. However, I think there is very high chance we'll open a little lower..and level out within a few hours..and then claw quickly higher into the close.

Its possible we'll even close marginally higher, and briefly gap higher on Wednesday.

The hourly MACD (blue bar histogram) cycle is still very low on the indexes, and is far from ideal for those looking to re-short.

--

Regardless, if I can re-short sometime today around 1355/60, I'll take it.

My target for this Friday is 1310/00. We have major GDP data, and I think that will be a further reminder to Mr Market the US is slipping into a recession - as company earnings (revenue/income data) are also suggesting.

Good wishes for Tuesday!

sp'60min, rainbow

*I intend to make more use of the Elder Impulse (I call them rainbow) style charts, in the days ahead.

sp'60min july24

sp'daily

vix'60min

Summary

Its possible we have already maxed out, and will simply fall from here. However, I think there is very high chance we'll open a little lower..and level out within a few hours..and then claw quickly higher into the close.

Its possible we'll even close marginally higher, and briefly gap higher on Wednesday.

The hourly MACD (blue bar histogram) cycle is still very low on the indexes, and is far from ideal for those looking to re-short.

--

Regardless, if I can re-short sometime today around 1355/60, I'll take it.

My target for this Friday is 1310/00. We have major GDP data, and I think that will be a further reminder to Mr Market the US is slipping into a recession - as company earnings (revenue/income data) are also suggesting.

Good wishes for Tuesday!

WTIC Oil, new wave lower - target $60

Oil suffered a very significant turn lower today, and is now probably on its way to testing the recent low of $77. A break under that level will open up a fast multi-week move to $60.

WTIC, daily

WTIC, weekly

WTIC, monthly

Summary

With the main equity indexes weak, amid renewed concerns of a global slowdown, Oil is again back on the slide. Today's move was indeed pretty strong, and there will very likely be some follow through to the downside in the coming days.

--

Looking ahead to Tuesday trading

Considering the hourly index cycles, I'd look for opening minor gains, I would find it somewhat surprising if we can hold over 1355/60 for more than a few hours.

AAPL have earnings at the Tuesday close, and that could easily be the last hurrah the bulls get for some weeks.

I will merely look to re-short sometime Tuesday, and am seeking 1325 for my next short term exit..

Goodnight from London

WTIC, daily

WTIC, weekly

WTIC, monthly

Summary

With the main equity indexes weak, amid renewed concerns of a global slowdown, Oil is again back on the slide. Today's move was indeed pretty strong, and there will very likely be some follow through to the downside in the coming days.

--

Looking ahead to Tuesday trading

Considering the hourly index cycles, I'd look for opening minor gains, I would find it somewhat surprising if we can hold over 1355/60 for more than a few hours.

AAPL have earnings at the Tuesday close, and that could easily be the last hurrah the bulls get for some weeks.

I will merely look to re-short sometime Tuesday, and am seeking 1325 for my next short term exit..

Goodnight from London

Daily Index Cycle update - bearish turn confirmed

The market certainly closed well off the opening hour lows, but still, the declines were a good confirmation of the cycle turn we saw last Friday.

Any gains on Tuesday are arguably to be seen as a bonus opportunity for the bulls to exit, and for the bears to re-short from higher levels.

IWM

Dow

Sp

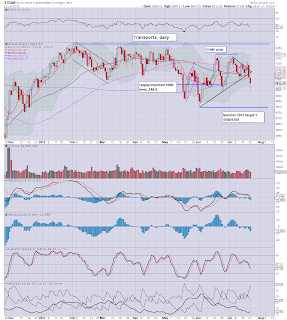

Transports

Summary

Its looking pretty good for the bears now. We have seen the sp'1380 peak start to slip into the distance, and today's initial low of sp'1337 was a great start. The recovery bounce of 13pts was very normal, and its still viable we'll see a further brief spike higher of 5, 7, or even 10pts sometime Tuesday.

On any basis, considering the weekly and monthly cycles, any bounces are arguably to be seen as a bonus shorting opportunities.

Next target level: 1325. If that can be taken out by early Thursday, there is a very viable chance we can close the week around 1310/00.

Once 1300 is broken...that should open a rather exciting move to break the early June low of 1266.

--

A little more later...

Any gains on Tuesday are arguably to be seen as a bonus opportunity for the bulls to exit, and for the bears to re-short from higher levels.

IWM

Dow

Sp

Transports

Summary

Its looking pretty good for the bears now. We have seen the sp'1380 peak start to slip into the distance, and today's initial low of sp'1337 was a great start. The recovery bounce of 13pts was very normal, and its still viable we'll see a further brief spike higher of 5, 7, or even 10pts sometime Tuesday.

On any basis, considering the weekly and monthly cycles, any bounces are arguably to be seen as a bonus shorting opportunities.

Next target level: 1325. If that can be taken out by early Thursday, there is a very viable chance we can close the week around 1310/00.

Once 1300 is broken...that should open a rather exciting move to break the early June low of 1266.

--

A little more later...

Subscribe to:

Comments (Atom)