Despite the sp'500 slipping to 2004 in late morning, the VIX struggled to even hold gains of 1-2% (intra high 21.37). With equities swinging back higher.. the VIX melted lower, settling -5.1% @ 19.89. Equities look set to jump higher after the ECB this Thursday... which should see the VIX begin a trip to the low teens.

VIX'daily3

Summary

*second consecutive daily fall in the VIX... settling back under the key 20 threshold.

--

VIX appears to have hit a wall in the low 20s. I realise some would call it mere consolidation before another jump higher, but it would be truly surprising if the VIX broke into the mid/upper 20s.

Right now, it will take a mute Draghi this Thursday to cause serious market upset.

--

more later... on the indexes

Tuesday, 20 January 2015

Closing Brief

US equities closed moderately mixed, sp +3pts @ 2022 (range 2004/28). The two leaders - Trans/R2K, settled +0.9% and -0.5% respectively. The market looks set for further chop ahead of the Thursday ECB announcement... and then a break to the upside.

sp'60min

Summary

Little to add.. despite the morning drop to 2004... and late afternoon bounce back into the 2020s.

Overall.. its probably a case of 'turn off ya screen until Thursday 7am'.

--

In any case... the usual bits and pieces to wrap up the day.. across the evening

sp'60min

Summary

Little to add.. despite the morning drop to 2004... and late afternoon bounce back into the 2020s.

Overall.. its probably a case of 'turn off ya screen until Thursday 7am'.

--

In any case... the usual bits and pieces to wrap up the day.. across the evening

3pm update - another swing

US equities have seen another swing... from a late morning low of sp'2004 to 2021. Broadly.. the market looks set to see chop into tomorrow's close... ahead of the ECB hitting the giant PRINT key. Gold is holding strong gains of $16. Oil remains under severe pressure, -4.7%

sp'60min

Summary

Suffice to say... the intraday swings are at least keeping me awake.

*NFLX earnings at the close (I believe)

--

sp'60min

Summary

Suffice to say... the intraday swings are at least keeping me awake.

*NFLX earnings at the close (I believe)

--

2pm update - continued minor weakness

US equities remain moderately lower, a flat close appears due.. ahead of what will likely be a similarly choppy Wednesday. Metals are holding strong gains, Gold +$16. Energy prices remain under severe pressure, Nat gas -8.4%, whilst Oil -4.4%.

sp'60min

Summary

Frankly... little to add.

Market should in theory remain in a holding pattern ahead of Thursday mornings ECB announcement (due 7am EST).

Yes.. there are plenty of earnings, but the broader market seems more than likely to just trade choppy.. before a break upward.

-

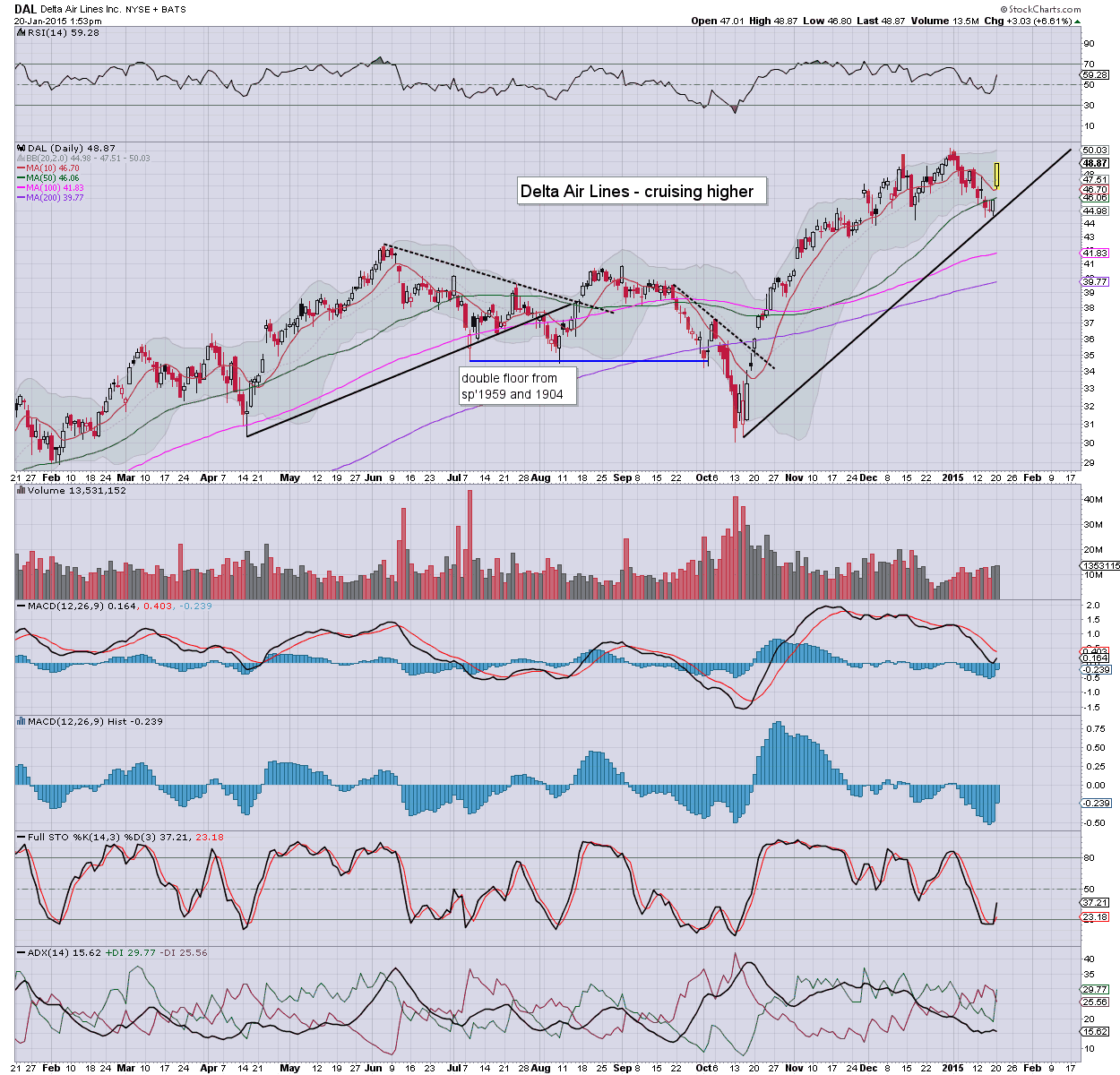

notable strength, airlines, DAL +6.5%

--

stay tuned

sp'60min

Summary

Frankly... little to add.

Market should in theory remain in a holding pattern ahead of Thursday mornings ECB announcement (due 7am EST).

Yes.. there are plenty of earnings, but the broader market seems more than likely to just trade choppy.. before a break upward.

-

notable strength, airlines, DAL +6.5%

--

stay tuned

12pm update - moderately weak

Equities remain moderately lower, with the sp' having seen a somewhat significant swing from sp'2028 to 2004. Despite the declines, VIX is only +1%.. and is certainly not warning of any real trouble. Gold continues to build gains, +$20. Oil remains exceptionally weak, -3.7%

sp'60min

VIX'daily3

Summary

So... red indexes... but the VIX is really not suggestive of any real concern.

Right now.. the only concern would be if Draghi disappoints on Thursday. To me.. that is almost unthinkable... not least after the SNB.

-

VIX update from Mr T.

--

time for tea.. .back at 2pm

sp'60min

VIX'daily3

Summary

So... red indexes... but the VIX is really not suggestive of any real concern.

Right now.. the only concern would be if Draghi disappoints on Thursday. To me.. that is almost unthinkable... not least after the SNB.

-

VIX update from Mr T.

--

time for tea.. .back at 2pm

11am update - it remains messy

US equities remain pretty choppy, with some short term weakness.. although notably not reflected in the VIX.. only a touch higher in the 20.90s. Metals continue the climb, Gold +$16, whilst Oil continues the slide... -3.9%.

sp'60min

GLD, daily

Summary

*Gold is higher by around $150 since early November. Not surprisingly.. many are boldly calling a floor.. with giant upside by year end. Yeah... the same posters... who said the same thing at the start of 2011, 12, 13, and 14.

--

As for equities... it would increasingly seem today and tomorrow will be mostly chop... ahead of the giant stepforwards for the ECB.

I simply can't imagine Draghi not launching some kind of t-bond buying program this Thursday. I realise some believe he will disappoint but then the question is...

WHY would the SNB decouple.. if not for the looming QE ?

--

Notable strength, miners, GDX +3.7% @ $23.00... next level is around $25

sp'60min

GLD, daily

Summary

*Gold is higher by around $150 since early November. Not surprisingly.. many are boldly calling a floor.. with giant upside by year end. Yeah... the same posters... who said the same thing at the start of 2011, 12, 13, and 14.

--

As for equities... it would increasingly seem today and tomorrow will be mostly chop... ahead of the giant step

I simply can't imagine Draghi not launching some kind of t-bond buying program this Thursday. I realise some believe he will disappoint but then the question is...

WHY would the SNB decouple.. if not for the looming QE ?

--

Notable strength, miners, GDX +3.7% @ $23.00... next level is around $25

10am update - failed opening gains

US equities open moderately higher to sp'2028, but quickly fail... already turning a little red. Metals are holding strong gains, Gold +$13. Energy remains exceptionally weak, Nat' gas -5.5%, whilst Oil is -4.5% in the $46s. VIX turns positive... back in the 21s.

sp'60min

VIX'60min

Summary

Hmm... so.. early gains of 0.6% but having completely failed.

VIX is indeed now positive, but with Dow -100pts, VIX was only +2%.. not exactly a great sign for those seeking much stronger downside across the day.

-

Notable weakness... FXCM... -86%

There is still time to open an FX account... I'm sure your money is safe!

Leverage is only 50-1.

$50 account deposit... worse case.... you get a bill for ONLY $2500 the next morning... unless there is an overnight gap up/down.. in which case.... they'll be coming for your house... and anything under your mattress.

-

10.16am... VIX turns red already... does not bode for those seeking major downside.

Notable strength, airlines....no doubt.. due to lower oil

sp'60min

VIX'60min

Summary

Hmm... so.. early gains of 0.6% but having completely failed.

VIX is indeed now positive, but with Dow -100pts, VIX was only +2%.. not exactly a great sign for those seeking much stronger downside across the day.

-

Notable weakness... FXCM... -86%

There is still time to open an FX account... I'm sure your money is safe!

Leverage is only 50-1.

$50 account deposit... worse case.... you get a bill for ONLY $2500 the next morning... unless there is an overnight gap up/down.. in which case.... they'll be coming for your house... and anything under your mattress.

-

10.16am... VIX turns red already... does not bode for those seeking major downside.

Notable strength, airlines....no doubt.. due to lower oil

Pre-Market Brief

Good morning. Futures are moderately higher, sp +12pts, we're set to open at 2031. There will be stiff resistance in the sp'2040s - where the 50dma is lurking, but overall... market should see a positive week. Gold continues to climb, +$14. Energy remains very weak, Nat' gas -6.0%, whilst Oil -2.1%

sp'daily5

Summary

So... its Tuesday already.. a relatively quiet week (not counting corp' earnings)... the big action is Thursday.

The ECB had better not disappoint... and considering the SNB move last week, I'm certain they won't.

*I remain long via the R2K, and am in no hurry to exit.

--

Hunter with Ms. Prins.

Frankly, Nomi Prins makes me feel like a financial prophet. I honestly don't think she has much of a clue what she is talking about lately.

As ever though, it is often useful to hear those (not least the Gold promoters) spouting nonsense/wishful thinking.

*King O' has his State of the Union speech this evening at 9pm EST (I believe). If there is any night when you might think the Fed - via its 'bankster friends' might be buying the ES futures... tonight would be the one.

-

Have a good 4 day week.

sp'daily5

Summary

So... its Tuesday already.. a relatively quiet week (not counting corp' earnings)... the big action is Thursday.

The ECB had better not disappoint... and considering the SNB move last week, I'm certain they won't.

*I remain long via the R2K, and am in no hurry to exit.

--

Hunter with Ms. Prins.

Frankly, Nomi Prins makes me feel like a financial prophet. I honestly don't think she has much of a clue what she is talking about lately.

As ever though, it is often useful to hear those (not least the Gold promoters) spouting nonsense/wishful thinking.

*King O' has his State of the Union speech this evening at 9pm EST (I believe). If there is any night when you might think the Fed - via its 'bankster friends' might be buying the ES futures... tonight would be the one.

-

Have a good 4 day week.

Subscribe to:

Comments (Atom)