It was another wild, but net-bullish week for US equity indexes, with gains ranging from +12.8% (Dow), +12.6% (Trans), +11.5% (NYSE comp'), +10.3% (SPX), to +9.0% (Nasdaq comp').

Lets take our regular look at five of the main US indexes

sp'500

Nasdaq comp'

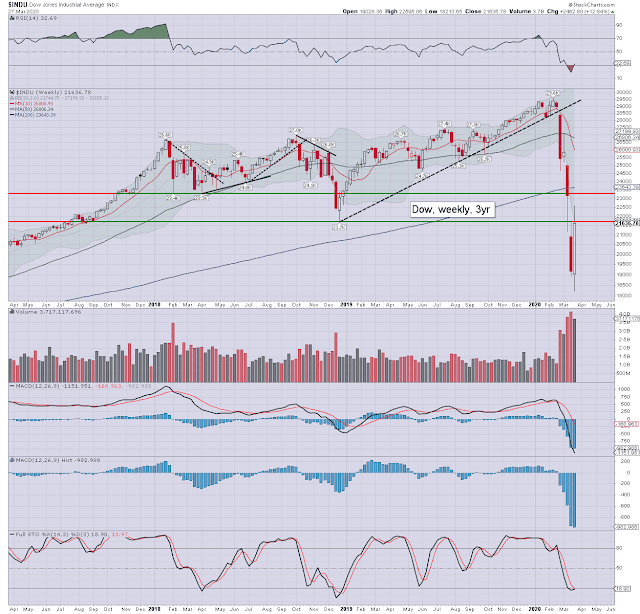

Dow

NYSE comp'

Trans

–

Summary

All five US equity indexes settled very powerfully higher.

Four of the indexes broke new cycle lows on Monday, the Transports being the exception.

The Dow lead the way up, with the Nasdaq a little laggy.

–

Looking ahead

Another very busy week can be expected, not least with literally hundreds of Corona related news headlines each day. The Friday jobs data from the BLS will not be pretty, and will be indicative of the US economy collapsing into an economic depression.

Earnings: RH (Mon'), BB (Tues'), STZ (Fri').

Econ-data:

M - Pending home sales, Dallas Fed manu'

T - Case-Shiller HPI, Chicago PMI (market con: 40, vs 49prior), consumer con'

W - ADP jobs, PMI/ISM manu', construction, EIA Pet'

T - Weekly jobs, intl' trade, vehicle sales, EIA NG', Fed bal' sheet

F - Monthly jobs, PMI/ISM serv'

-

*UK/European clocks jump ahead one hour, the night of Mar'28/29.

**As Tuesday is end month/Q1, I would expect more dynamic price action on extremely high volume.

--

Final note

Last week was wild, swinging from sp'2191 to 2637, for what was a classic 'bear market rally', and such extremely powerful rebounds have to be expected. I could highlight a fair number of monthly charts for some perspective, and after some thought, this sums up what I want to emphasise...

SPX, m1b

February's hyper bearish engulfing candle counts as month'1 down. March has seen severe bearish follow through, notably breaking the l/t upward trend from 2009. Further, I would note the technical divergence that stretches back to Jan'2018.

The grander issue - at least to yours truly, is whether the 10MA can be broken and settled above on a multi-week/month bounce. Even with trillions of QE being thrown at the system, it won't be easy to turn the m/t trend back to outright bullish.

If the bulls can't break and hold >3000 (to be decisive), then a subsequent wave to 1700/1500 could be expected. That is likely some very considerable time away though. First things first... the market needs to find/build a floor, and then push for 2900/3000.

On the Corona, I will merely say... as an onlooker to humanity, its fascinating to see how easy a society/species is willing to give up their freedom on the command of the very same political hacks, who never accepted the virus was a serious problem until just a few weeks ago. UK PM Johnson is a prime example, who chose to shake the hands of known infected patients, and now ranks as the first world leader to have the virus. Am I supposed to have any degree of respect for him? Never mind that he is the same arrogant fool that took away my right to live and work within the EU.

To the older and the ill... stay at home! To the rest of you, I offer the hope that semi-normalcy might occur by June/July. Be careful out there... in the twilight zone.

If you value my work on Blogger and Twitter, subscribe to my

intraday service.

For details/latest offers, see: Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EDT on Monday.