Despite the sp' closing -22pts @ 1628, the VIX failed to close significantly higher, and instead settled +0.2% @ 16.64. It remains a largely fearless market, and today's VIX close bodes badly for those equity bears who are seeking a break <sp'1608/1598 in the days ahead.

VIX'60min

VIX'daily3

Summary

No doubt a lot of amateur traders will be utterly bemused at today's VIX flat close.

Yet, this is something I've seen a fair few times over the last few years.

Usually, such a close means the equity declines are just temporary, and that the market will soon be rebounding.

--

A VIX weekly close in the 14s still looks very viable.

--

more later...on those indexes

Wednesday, 19 June 2013

Closing Brief

Despite the Fed continuing QE at $85bn a month, the market apparently moved into a post-statement depression mood. Most indexes declined by around 1.25/1.5%. Despite the declines the VIX still closed red..and that probably says it all in this bizarre market.

sp'60min

Summary

That was a pretty exciting afternoon!

Certainly, despite the continued QE at max-speed, the market probably just used todays FOMC event to wash out the weaker bulls.

Nothing has changed.

Primary trend remains UP, and I still expect sp'1700s this July.

-

*I will look to go HEAVY long the market early Thursday - unless we break trend support @ 1620.,

Bears should keep in mind, Thursday is a QE day of $3bn

--

sp'60min

Summary

That was a pretty exciting afternoon!

Certainly, despite the continued QE at max-speed, the market probably just used todays FOMC event to wash out the weaker bulls.

Nothing has changed.

Primary trend remains UP, and I still expect sp'1700s this July.

-

*I will look to go HEAVY long the market early Thursday - unless we break trend support @ 1620.,

Bears should keep in mind, Thursday is a QE day of $3bn

--

3pm update - QE continues in full

All those touting taper talk should shut up and go away (again). The Fed not only improved its outlook for inflation and jobless rates, but will continue QE at $85bn a month. Why will it stop...ever? Market remains a choppy mess, but looks set for much higher levels in the weeks ahead.

sp'5min - note the micro-swings

Summary

Indeed...so much for those who are counting on the paper printing to be wound down..even a little.

The fed won't stop...and as some note...perhaps can't stop. Ever.

--

Market remains a choppy mess. Next downside target is around 1635.

-

*I will look to go heavy long the market early tomorrow

2.59pm...rats getting washed again.. sp'1636.....at my target.

There really isn't much support now until 1620..at which point things would get VERY interesting.

3.02pm... you can see CRITICAL trend support @ 1620

Any break <1620..and market in dire trouble

3.13pm.. sp'1637...and stuck. Certainly, we might be floored now, but hourly charts certainly won't be showing a turn until late tomorrow morning.

For those looking to buy the dip...there should be no hurry on that trade.

Despite the weak indexes...VIX is -1%... now THAT is probably the tell for tomorrow..and indeed..another six weeks.

3.23pm...daily charts not looking so great now, but then..todays action is arguably to be seen as a special case.

What is clearly critical now...bulls MUST hold 1620...and with QE continuing, I'm sure they will.

3.29pm.. time for a mini moon ramp.

Bernanke ...concludes (perhaps for the last time). I've suspicion Yellen will take over next month..before Jackson hole.

3.43pm... count 5 micro-waves lower... with a floor early tomorrow..then UP ?

Hmm

3.49pm... Further down wave.. .- tiny 5 ? GLD makes NEW cyclical low.....next level 120..thats $100 lower for the shiny gold.

Fun day huh?

sp'5min - note the micro-swings

Summary

Indeed...so much for those who are counting on the paper printing to be wound down..even a little.

The fed won't stop...and as some note...perhaps can't stop. Ever.

--

Market remains a choppy mess. Next downside target is around 1635.

-

*I will look to go heavy long the market early tomorrow

2.59pm...rats getting washed again.. sp'1636.....at my target.

There really isn't much support now until 1620..at which point things would get VERY interesting.

3.02pm... you can see CRITICAL trend support @ 1620

Any break <1620..and market in dire trouble

3.13pm.. sp'1637...and stuck. Certainly, we might be floored now, but hourly charts certainly won't be showing a turn until late tomorrow morning.

For those looking to buy the dip...there should be no hurry on that trade.

Despite the weak indexes...VIX is -1%... now THAT is probably the tell for tomorrow..and indeed..another six weeks.

3.23pm...daily charts not looking so great now, but then..todays action is arguably to be seen as a special case.

What is clearly critical now...bulls MUST hold 1620...and with QE continuing, I'm sure they will.

3.29pm.. time for a mini moon ramp.

Bernanke ...concludes (perhaps for the last time). I've suspicion Yellen will take over next month..before Jackson hole.

3.43pm... count 5 micro-waves lower... with a floor early tomorrow..then UP ?

Hmm

3.49pm... Further down wave.. .- tiny 5 ? GLD makes NEW cyclical low.....next level 120..thats $100 lower for the shiny gold.

Fun day huh?

2pm update - its time for the Bernanke

FOMC annoucement/policy statement due at 2pm, with the Bernanke set to do a press conference shortly after. Even if the news is 'good', Mr Market could still move into a 'sell the news' event. Yet, even a move to sp'1620s would do little to dent the primary trend.

sp'60min

Summary

15min cycle is arguably fully reset...big upside potencial into the close

60min cycle...half way reset. Certainly, there is easy upside to 1660, but there is equally easy downside to 1640/30s.

--

*I remain...more than pleased to simply sit this out until early tomorrow.

Eyes on the VIX, bonds, and..of course. equities!

2.02pm.. No taper....no nothing. as expected.

Now lets see if the market still decides to sell lower.

Metals WEAK WEAK WEAK.

2.05pm.. market starting to get moody, post-fed statement depression.

Metals remain weak.

First downside is the channel support @ 1645 just broken. Next key support @ 1635

2.10pm.. rats getting washed out.

A Thursday long position, from the 1630s would be rather nice

2.15pm...and a strong spike higher...in just about everything. Even metals are snapping upward.

It remains a real mess, but again..underlying pressure is UP.

All those touting QE-tapering can now shut up for another six weeks.

-

The fact Thursday is $3bn QE-pomo day, thats all we need to know.

2.20pm.. VIX ...we're back to a fearless market, whilst the Fed prints to oblivion.

VIX 14s..by the Friday close, if not even today, lol

--

Bernanke...press conf...imminent.

Indexes still choppy, but as noted...we now have another six weeks of 85bn QE, sp'1700s look a given.

*I will look to take a heavy index-long position early tomorrow, once this nonsense settles down.

2.28pm..urgh..time for another micro-wave lower....amateur traders getting whipsawed amongst this nonsense. What a mess!

2.31pm The Bernanke..speaketh ! Indexes remain in micro-chop mode

2.35pm.. Benny seems even more edgy than normal..which appropriate matches the twitchy market.

sp'1635..first downside target...viable by the close.

2.40pm...5pt sp' swings ...this is pretty fierce chop.

The Bernanke is bullish water!

sp'60min

Summary

15min cycle is arguably fully reset...big upside potencial into the close

60min cycle...half way reset. Certainly, there is easy upside to 1660, but there is equally easy downside to 1640/30s.

--

*I remain...more than pleased to simply sit this out until early tomorrow.

Eyes on the VIX, bonds, and..of course. equities!

2.02pm.. No taper....no nothing. as expected.

Now lets see if the market still decides to sell lower.

Metals WEAK WEAK WEAK.

2.05pm.. market starting to get moody, post-fed statement depression.

Metals remain weak.

First downside is the channel support @ 1645 just broken. Next key support @ 1635

2.10pm.. rats getting washed out.

A Thursday long position, from the 1630s would be rather nice

2.15pm...and a strong spike higher...in just about everything. Even metals are snapping upward.

It remains a real mess, but again..underlying pressure is UP.

All those touting QE-tapering can now shut up for another six weeks.

-

The fact Thursday is $3bn QE-pomo day, thats all we need to know.

2.20pm.. VIX ...we're back to a fearless market, whilst the Fed prints to oblivion.

VIX 14s..by the Friday close, if not even today, lol

--

Bernanke...press conf...imminent.

Indexes still choppy, but as noted...we now have another six weeks of 85bn QE, sp'1700s look a given.

*I will look to take a heavy index-long position early tomorrow, once this nonsense settles down.

2.28pm..urgh..time for another micro-wave lower....amateur traders getting whipsawed amongst this nonsense. What a mess!

2.31pm The Bernanke..speaketh ! Indexes remain in micro-chop mode

2.35pm.. Benny seems even more edgy than normal..which appropriate matches the twitchy market.

sp'1635..first downside target...viable by the close.

2.40pm...5pt sp' swings ...this is pretty fierce chop.

The Bernanke is bullish water!

1pm update - awaiting the Bernanke

Market remains in a very quiet standby mode. Sp' is 2/3pts, although notably, the R2K is -0.5% Metals are holding minor gains, but those could soar later in the day, if the market decides QE will continue well into 2014.

sp'60min

Summary

Enjoy the quiet..it could get busy in an hour!

*VIX is increasingly weak, now -3.6% in the low 16s.

If the market is happy later, then VIX looks set for the 14s by the Friday close.

1.39pm.. VIX update from Mr T

Seems a few crazies are buying VIX July 50, 60s...urghh

sp'60min

Summary

Enjoy the quiet..it could get busy in an hour!

*VIX is increasingly weak, now -3.6% in the low 16s.

If the market is happy later, then VIX looks set for the 14s by the Friday close.

1.39pm.. VIX update from Mr T

Seems a few crazies are buying VIX July 50, 60s...urghh

12pm update - market just quietly waiting

Mr Market seems more than content to trade within an exceptionally narrow trading range. A few pts up..a few pts down. Everyone is getting the opportunity to exit ahead what might possibly be some rather turbulent afternoon price action.

sp'60min

Summary

With price action relatively stable, indeed, there can be NO excuses today.

Everyone has had the chance to exit or (boldly) take new long/short positions. Personally, I think the latter is just overly risky..for both sides.

--

*I remain more than content to be a mere spectator today.

--

Time for lunch...and get refuelled for the busy afternoon.

--

Gold update from Dr J.

stay tuned

--

GLD, daily

There is clear upside of 35/40 by the close of today, with downside snap level, $25 away.

If I had to guess which way it'll go, then I think...UP.. along with the main market, but I sure won't risk trading it today!

12.03pm.. R2K is very weak right now, -0.6% It did have a very strong run though, so maybe its just cooling off a bit.

sp'60min

Summary

With price action relatively stable, indeed, there can be NO excuses today.

Everyone has had the chance to exit or (boldly) take new long/short positions. Personally, I think the latter is just overly risky..for both sides.

--

*I remain more than content to be a mere spectator today.

--

Time for lunch...and get refuelled for the busy afternoon.

--

Gold update from Dr J.

stay tuned

--

GLD, daily

There is clear upside of 35/40 by the close of today, with downside snap level, $25 away.

If I had to guess which way it'll go, then I think...UP.. along with the main market, but I sure won't risk trading it today!

12.03pm.. R2K is very weak right now, -0.6% It did have a very strong run though, so maybe its just cooling off a bit.

11am update - minor chop

Market is just churning ahead of the Fed. Precious metals are slightly higher, with Gold +$7. If the fed re-inspires the market that QE will indeed never end, Gold could easily see very strong gains by the close. Oil remains flat.

sp'60min

Summary

Not much to say, its going to be kinda quiet until the Fed at 2pm.

Even after the announcement, it will be interesting to see how the market reacts to the Bernanke press conference. Often we see a stronger reaction to what is said in the press conf. rather than the 2pm press release/statement.

stay tuned!

sp'60min

Summary

Not much to say, its going to be kinda quiet until the Fed at 2pm.

Even after the announcement, it will be interesting to see how the market reacts to the Bernanke press conference. Often we see a stronger reaction to what is said in the press conf. rather than the 2pm press release/statement.

stay tuned!

10am update - minor weakness

The market is trading a little lower, but its all noise, especially ahead of the FOMC announcement. Hourly index charts are rolling over, and it should be noted the 'best bear case by the close is sp'1620, however that seems near impossible.

sp'60min

sp'daily5

Summary

You can clearly see the rollover on the hourly MACD cycle, but then, we have had the same situation in the past 3 days, only for the market to quickly rally back.

--

To go short..is fighting the primary trend.

To go long...is risking a major snap lower.

-

*I'm sitting today out. It'll be easier on my stomach, urghh.

Thursday will be a lot easier to trade, and it should be noted, will see a mid-size QE of $3bn

--

stay tuned!

sp'60min

sp'daily5

Summary

You can clearly see the rollover on the hourly MACD cycle, but then, we have had the same situation in the past 3 days, only for the market to quickly rally back.

--

To go short..is fighting the primary trend.

To go long...is risking a major snap lower.

-

*I'm sitting today out. It'll be easier on my stomach, urghh.

Thursday will be a lot easier to trade, and it should be noted, will see a mid-size QE of $3bn

--

stay tuned!

Pre-Market Brief

Good morning. Futures are unchanged, we're set to open at sp'1651. Metals are a touch higher, whilst Oil is fractionally higher. The market awaits the FOMC announcement at 2pm, with a Bernanke press conference shortly after. An interesting day awaits!

sp'60min

sp'daily5

Summary

Well, here we go again. Its a fed day, and in this QE supported market, arguably, today is the most important day of the year so far.

What will the fed do ?

I'm guessing...nothing, other than issue a statement of no policy change.

The fed appears to be playing little games with the US markets, and why would they stop now? Release hints of tapering..but never actually do it.

--

This afternoons price action could be real choppy, but underlying pressure - especially seen on the daily charts is STRONGLY inclined to the upside.

inv. H/S target zone is sp'1670/75, and that is easily viable by the close of today.

--

*I remain on the sidelines, and am trying to resist getting involved on what could be very turbulent afternoon trading.

9.32am... Captain America opens the NYSE. Hmm.

sp'60min

sp'daily5

Summary

Well, here we go again. Its a fed day, and in this QE supported market, arguably, today is the most important day of the year so far.

What will the fed do ?

I'm guessing...nothing, other than issue a statement of no policy change.

The fed appears to be playing little games with the US markets, and why would they stop now? Release hints of tapering..but never actually do it.

--

This afternoons price action could be real choppy, but underlying pressure - especially seen on the daily charts is STRONGLY inclined to the upside.

inv. H/S target zone is sp'1670/75, and that is easily viable by the close of today.

--

*I remain on the sidelines, and am trying to resist getting involved on what could be very turbulent afternoon trading.

9.32am... Captain America opens the NYSE. Hmm.

Awaiting another Fed day

The market appears rather confident ahead of the next FOMC announcement. The daily charts have seen price momentum swing almost fully back to the bulls. Baring a 'spooky' fed statement/policy change, this market looks set for sp'1700s within the next few weeks.

sp'weekly8 - near term count'2

sp'weekly9 - mid-term count, bullish outlook

Summary

I don't expect anything from the Fed tomorrow that will spook the market. Interest rates aren't going to change, nor is the much touted 'tapering' going to begin. No, it will be surely just be an FOMC statement of nothing.

That certainly doesn't mean the market won't briefly sell lower, but that in itself is again the proverbial 'dip buying opportunity'.

--

The two weekly charts above, remain my 'best guess'. The bigger macro-picture is holding together, despite the underlying western-economic weakness out there. The central banks are still managing to paper over the problems, and with bonds largely unattractive, where else is the money going to go?

I do still expect a mid-size wave lower in Aug/September, but that will probably be all the bears get this year...ironically back to the levels of last week.

All things considered, this market looks set to be testing sp'2000 in spring 2014.

Looking ahead

The FOMC announcement is at 2pm, and the Bernanke will be doing a press conference around 2.15/30pm.

We could see some pretty wild price swings, so..for those with trading stops...it could be a very annoying afternoon.

--

*I'm sitting the current Fed-affected market out until Thursday morning. Of course, if I'm right, the sp' will be in the 1670s by then, at which point a new long position will be...too late. Besides, opex is this Friday.

Arguably, it is a case of 'come back next week', and just buy on the next minor down cycle.

Goodnight from London

--

I noticed this on ZH, it certainly deserves being highlighted here also...

Kyle Bass, a broad overview of what is coming.

--

sp'weekly8 - near term count'2

sp'weekly9 - mid-term count, bullish outlook

Summary

I don't expect anything from the Fed tomorrow that will spook the market. Interest rates aren't going to change, nor is the much touted 'tapering' going to begin. No, it will be surely just be an FOMC statement of nothing.

That certainly doesn't mean the market won't briefly sell lower, but that in itself is again the proverbial 'dip buying opportunity'.

--

The two weekly charts above, remain my 'best guess'. The bigger macro-picture is holding together, despite the underlying western-economic weakness out there. The central banks are still managing to paper over the problems, and with bonds largely unattractive, where else is the money going to go?

I do still expect a mid-size wave lower in Aug/September, but that will probably be all the bears get this year...ironically back to the levels of last week.

All things considered, this market looks set to be testing sp'2000 in spring 2014.

Looking ahead

The FOMC announcement is at 2pm, and the Bernanke will be doing a press conference around 2.15/30pm.

We could see some pretty wild price swings, so..for those with trading stops...it could be a very annoying afternoon.

--

*I'm sitting the current Fed-affected market out until Thursday morning. Of course, if I'm right, the sp' will be in the 1670s by then, at which point a new long position will be...too late. Besides, opex is this Friday.

Arguably, it is a case of 'come back next week', and just buy on the next minor down cycle.

Goodnight from London

--

I noticed this on ZH, it certainly deserves being highlighted here also...

Kyle Bass, a broad overview of what is coming.

--

Daily Index Cycle update

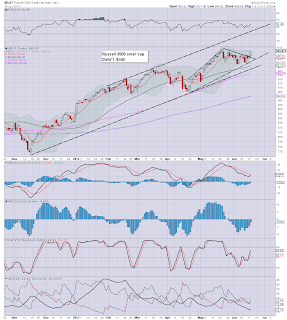

The US equity market closed higher for the second consecutive day, with most indexes climbing almost 1%. Trans and the R2K both support the notion that the market has completed a wave'4, with a fifth to take the market into the sp'1700s this July.

sp'daily5

R2K

Trans

Summary

Another day that the bears will want to forget, although its not like the primary trend is down, so it really shouldn't come as a surprise.

--

One thing that comes to mind. How many were shorting into the swift down move yesterday afternoon, and are still holding on the short side?

--

If the market gains some relief/confidence from the FOMC tomorrow, then the sp'1670s look a given, the only issue then would be..how soon until we break the Bernanke 'reversal day' high of 1687?

Right now, the 1700s look viable almost within the next week or two, but appear much more likely by mid July.

What is clear..the notion of a near term break <1608....err, no. That just seems so unlikely now. Bears had their chance...and failed.

---

a little more later...

sp'daily5

R2K

Trans

Summary

Another day that the bears will want to forget, although its not like the primary trend is down, so it really shouldn't come as a surprise.

--

One thing that comes to mind. How many were shorting into the swift down move yesterday afternoon, and are still holding on the short side?

--

If the market gains some relief/confidence from the FOMC tomorrow, then the sp'1670s look a given, the only issue then would be..how soon until we break the Bernanke 'reversal day' high of 1687?

Right now, the 1700s look viable almost within the next week or two, but appear much more likely by mid July.

What is clear..the notion of a near term break <1608....err, no. That just seems so unlikely now. Bears had their chance...and failed.

---

a little more later...

Subscribe to:

Comments (Atom)