With the 'great news' that Merkel cancels a press conference, the indexes snapped higher, and the VIX got whacked lower.

This kind of last hour nonsense is arguably one of the most annoying things about this nasty market. To think, that the cheerleaders on clown channel still ask the question 'why is the retail investor not returning?'.

VIX, 60min

VIX, daily, rainbow

VIX, weekly

Summary

Despite todays last hour nonsense, VIX is still in a broad uptrend.

From a weekly cycle perspective, the bears would really prefer a close tomorrow of 21+.

July targets remain unchanged, VIX 30s..and probably 40s - equating to sp' in the lower 1100s.

Thursday, 28 June 2012

Closing Brief - hyper last hour ramp

Urghh..a nasty and twisted closing hour. It would appear that Merkel 'cancelling press conference' is now the best news ever! Clearly, we've seen a hyper reverse cascade UP, as the bears cover..and even some panic buying by the bull lunatics.

This nonsense changes nothing, although it IS a problem for the monthly cycle, where I would still want to see <1305 by the Friday close.

The closing hourly cycles....

IWM

Dow

Sp, 60min, H/S chart

Summary

Nothing has changed. This latest closing hour madness is just a symptom of the idiocy..and sickness inherent in the mindset of the bulls. The cancellation of a press conference, and thats now touted as 'good news'.

Idiots.

Those buying into this rally will get nuked in the days ahead.

--

Ohh..and Germany is now probably less likely to want to bail out Italy.

This nonsense changes nothing, although it IS a problem for the monthly cycle, where I would still want to see <1305 by the Friday close.

The closing hourly cycles....

IWM

Dow

Sp, 60min, H/S chart

Summary

Nothing has changed. This latest closing hour madness is just a symptom of the idiocy..and sickness inherent in the mindset of the bulls. The cancellation of a press conference, and thats now touted as 'good news'.

Idiots.

Those buying into this rally will get nuked in the days ahead.

--

Ohh..and Germany is now probably less likely to want to bail out Italy.

3pm update - a close below the H/S neckline?

Bears are having a good day. Looks like micro-wave'2 was confirmed earlier with the break into the 1313s...so..we're soon going to get our first challenge of the 1310/09 area. Its really not necessary today, it would be a real bonus though if we can close 1308..or lower.

Bears have a superb July to look forward to, a likely move down to at least sp'1150.

Sp' daily 4mth

sp'60min, count

Summary

Bearish. ;)

--

...more after the close (and the game)

Bears have a superb July to look forward to, a likely move down to at least sp'1150.

Sp' daily 4mth

sp'60min, count

Summary

Bearish. ;)

--

...more after the close (and the game)

2pm update - Germany verses one of the PIIGS

Once again its that time of day again, its time for another Euro 2012 match. Tonights battle is between the mighty Germany and the insolvent Italians.

I will again recommend...(within SEC regulations I believe)...long... Germany!

-

Meanwhile...back at the casino...

sp'60min, count

*micro-wave'2 (black count) might already be done, a baby bear flag...if you see 1313s before the close, then we're probably in micro-wave'3.

Summary

A close under 1320 would certainly be preferred right now, anything in the low 1310s would be more than good enough, and open the door to a nice gap lower tomorrow morning in the 1300/1290 area.

The VIX remains somewhat quiet, I'd like a close at least in the low 21s.

---

*a few other notable issues today..

-FB breaks $31.....initiating a sell signal in my view

-Silver breaks a new low (back to November 2010 levels), with probably at least another $4 to go..maybe a lot more if sp can break 1100 later this year.

More later..but I do have a match to focus on too ;)

I will again recommend...(within SEC regulations I believe)...long... Germany!

-

Meanwhile...back at the casino...

sp'60min, count

*micro-wave'2 (black count) might already be done, a baby bear flag...if you see 1313s before the close, then we're probably in micro-wave'3.

Summary

A close under 1320 would certainly be preferred right now, anything in the low 1310s would be more than good enough, and open the door to a nice gap lower tomorrow morning in the 1300/1290 area.

The VIX remains somewhat quiet, I'd like a close at least in the low 21s.

---

*a few other notable issues today..

-FB breaks $31.....initiating a sell signal in my view

-Silver breaks a new low (back to November 2010 levels), with probably at least another $4 to go..maybe a lot more if sp can break 1100 later this year.

More later..but I do have a match to focus on too ;)

1pm update - Friday target remains 1300/1290

The trend continues to look mighty fine for the bears. Those bears who somewhat boldly went short in the sp'1330s yesterday should be very pleased with themselves today, and should feel confident of further declines to come tomorrow.

The bigger cycles are currently almost fully back on track, I still would prefer a June monthly close of sp<1305.

sp'60min H/S

vix'60min

Summary

Quietly confident. I'm in no rush to exit at these levels.

A Friday exit at 1290 would make for an especially nice third post-FOMC short trade.Thanks for no QE3 Benny, you sure made things easier!

The bigger cycles are currently almost fully back on track, I still would prefer a June monthly close of sp<1305.

sp'60min H/S

vix'60min

Summary

Quietly confident. I'm in no rush to exit at these levels.

A Friday exit at 1290 would make for an especially nice third post-FOMC short trade.Thanks for no QE3 Benny, you sure made things easier!

12pm update - don't get lost in the noise

The earlier break to sp'1314 was a good opening move lower for the bears. Right now we are clearly seeing a little bounce, I don't expect it to last. Anyone going long right now with the outlook that the market is going to break yesterdays 1334 peak..is plain bull-crazy.

The daily chart is clear, the two day 'minute wave'2 rally..is over. Now its time for minute wave'3, which by definition should take out the minute wave'1 low of 1309.

sp' daily, 4mth

sp'60min - count

Summary

An exit late Friday in the 1300/1290 area would be ideal right now, and that remains my plan.

--

As for next week...probably lower, at least for Mon/Tuesday.

At some point we're going to need to take out the 1266 low, and it should be within the next week or so. If we're not in the low 1200s by mid July..then my overall 1150/00 target would be looking a little difficult to reach. First things first though....a break of the 1309 low.

Anyway...time for lunch!

The daily chart is clear, the two day 'minute wave'2 rally..is over. Now its time for minute wave'3, which by definition should take out the minute wave'1 low of 1309.

sp' daily, 4mth

sp'60min - count

Summary

An exit late Friday in the 1300/1290 area would be ideal right now, and that remains my plan.

--

As for next week...probably lower, at least for Mon/Tuesday.

At some point we're going to need to take out the 1266 low, and it should be within the next week or so. If we're not in the low 1200s by mid July..then my overall 1150/00 target would be looking a little difficult to reach. First things first though....a break of the 1309 low.

Anyway...time for lunch!

11am update - better than expected

The morning is going VERY well for the bears. It looks like minute wave'3 of minor'3 is now underway - this wave can be expected to last at least 3 days, possibly 5-7.

First target is a break of the 1310 H/S neckline. A break of that today now looks very likely, with the MACD cycle still due to go negative cycle in the next 30-90mins.

sp'60min HS formation

vix'60min

Summary

Yesterdays little move looks like a cruel tease to the bulls. There could be a lot of burnt traders in the next few days.

VIX is confirming the move lower, a close in the 22s would be a real bonus, and would suggest 24 very viable by Friday.

--

I will hold short at least until 1300/1290..which remains viable as early as late this afternoon.

More later....

First target is a break of the 1310 H/S neckline. A break of that today now looks very likely, with the MACD cycle still due to go negative cycle in the next 30-90mins.

sp'60min HS formation

vix'60min

Summary

Yesterdays little move looks like a cruel tease to the bulls. There could be a lot of burnt traders in the next few days.

VIX is confirming the move lower, a close in the 22s would be a real bonus, and would suggest 24 very viable by Friday.

--

I will hold short at least until 1300/1290..which remains viable as early as late this afternoon.

More later....

10am update - bears ready to rampage

A good start to the day for those short, yet the bears do have some significant walls to break through. sp'1310 is the neckline of the H/S formation. I want to see 1305 to be sure of a break..which would suggest that minute wave'3 of minor wave'3 is underway.

Most important of all, we MUST close at least moderately red today. My broader outlook requires the SP' to close June <1305. If we somehow magically close green today, I'd be VERY concerned.

sp'60min H/S formation

VIX'60min

sp, daily, 4mth

Summary

A very long..and critical 2 trading days for those bears looking for much lower levels in July. Bears should be seeking a close under the hourly 10MA. A close under 1310 would be a bonus today.

Look to the VIX today, I want to see a close in the 21s at least. That will open up 22/24 by the Friday close.

I remain short, my first target exit is 1300/1290..by the Friday close.

More across the day !

Most important of all, we MUST close at least moderately red today. My broader outlook requires the SP' to close June <1305. If we somehow magically close green today, I'd be VERY concerned.

sp'60min H/S formation

VIX'60min

sp, daily, 4mth

Summary

A very long..and critical 2 trading days for those bears looking for much lower levels in July. Bears should be seeking a close under the hourly 10MA. A close under 1310 would be a bonus today.

Look to the VIX today, I want to see a close in the 21s at least. That will open up 22/24 by the Friday close.

I remain short, my first target exit is 1300/1290..by the Friday close.

More across the day !

Pre-Market Brief

Good morning. Futures are sp-8, suggesting an open of 1324. Its hot in London city today, hopefully that is now an omen for the bulls to once again get scorched.

I'm again seeing talk across the web of sp'1365/80 in the coming days. It will be important for the bears to stop this latest micro-rally today. Bears should look for the VIX to close in the 21s, for a clue as to tomorrows action.

GDP: Q1 (second revision): 1.9%

Jobless claims: 386k

--

sp'60min, H/S formation

Summary

Bears will most certainly want to see the current 2 day rally come to a firm halt today. A close above the resistance zone sp'1335/40 would in my view seriously wreck the overall bearish outlook.

As I've noted throughout June, how we close the month is very important. A Friday close of sp<1305 would be VERY much preferred.

Good wishes for Thursday trading

I'm again seeing talk across the web of sp'1365/80 in the coming days. It will be important for the bears to stop this latest micro-rally today. Bears should look for the VIX to close in the 21s, for a clue as to tomorrows action.

GDP: Q1 (second revision): 1.9%

Jobless claims: 386k

--

sp'60min, H/S formation

Summary

Bears will most certainly want to see the current 2 day rally come to a firm halt today. A close above the resistance zone sp'1335/40 would in my view seriously wreck the overall bearish outlook.

As I've noted throughout June, how we close the month is very important. A Friday close of sp<1305 would be VERY much preferred.

Good wishes for Thursday trading

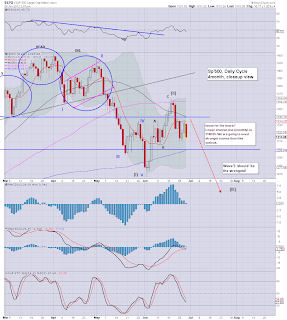

Mid-term targets - remain on track

It remains bemusing how after two days of minor rally, there are again bulls out there touting new highs. The rise from 1310 to the Wednedsay close of 1332 is irrevelent noise.

To close today, here are two charts, both of which are very clear on the bigger picture, and clarify the targets I continue to be looking for this summer.

Sp, daily9c, bearish outlook

If this is indeed minor wave 3 (blue count) of what can be thought of as 'intermediate 1', then we should NOT break a new high >1363. Indeed, we should fail to close over 1335/40 in the days ahead (see hourly cycles).

A close for the month of June sp<1305 would be VERY much preferred, to instill further confidence in the overall outlook.

VEU, (world indexes, ex-USA) monthly

A rare look at the VEU monthly chart. Note how in the 2008 collapse wave we could never get back above the monthly 10MA. This month, we hit the 10MA...and failed. Interesting huh?

Key levels remain 35.0..and 30 - which equates to probably sp'1100.

Summary

There is nothing in either the daily or monthly charts that is yet suggestive of some kind of bullish up trend in the months ahead.

With the FOMC now out of the way until at least August, bears have free reign in July, its time for them to start whacking this market lower...much lower. A break to 1225/00 is much needed by mid July.

I remain holding short overnight, next exit target is 1300/1290, that could still come by the Friday close.

Goodnight from London

To close today, here are two charts, both of which are very clear on the bigger picture, and clarify the targets I continue to be looking for this summer.

Sp, daily9c, bearish outlook

If this is indeed minor wave 3 (blue count) of what can be thought of as 'intermediate 1', then we should NOT break a new high >1363. Indeed, we should fail to close over 1335/40 in the days ahead (see hourly cycles).

A close for the month of June sp<1305 would be VERY much preferred, to instill further confidence in the overall outlook.

VEU, (world indexes, ex-USA) monthly

A rare look at the VEU monthly chart. Note how in the 2008 collapse wave we could never get back above the monthly 10MA. This month, we hit the 10MA...and failed. Interesting huh?

Key levels remain 35.0..and 30 - which equates to probably sp'1100.

Summary

There is nothing in either the daily or monthly charts that is yet suggestive of some kind of bullish up trend in the months ahead.

With the FOMC now out of the way until at least August, bears have free reign in July, its time for them to start whacking this market lower...much lower. A break to 1225/00 is much needed by mid July.

I remain holding short overnight, next exit target is 1300/1290, that could still come by the Friday close.

Goodnight from London

Daily Index Cycle update - short term bounce

The main indexes all increased today, but it was nothing for the bulls to get hyper about, and neither should the bears be put on suicide watch. The market- as seen better from the daily cycles, is merely having a few days retracement back upward.

Only with a close over 1340..and more decisively 1363, can the bulls start claiming the trend is back with them.

IWM, bearish outlook

Dow

Sp, 4mth view

Transports

Summary

From a MACD cycle point of view, we are still in a broadly negative situation for the indexes. There is nothing yet that would greatly concern me about any further upside. Only a close above 1340 would have me reassess my downside targets for July.

The red line..still under the green line!

Despite the minor wave'2 up from sp'1266 to 1363, the 10 day MA is still under the 50day MA - this is bearish! If the market can close Friday at least in the 1310s, that should prevent the 10MA from crossing the 50, and getting what would be a very bullish cross.

Hold the Line

Bears certainly need to hold the line at the 1335/40 zone, with no closes above it! We have more econ-data both tomorrow and Friday, so Mr Market will have some fundamental things to consider - even if the EU rumour machine starts up again.

A little more later...

Only with a close over 1340..and more decisively 1363, can the bulls start claiming the trend is back with them.

IWM, bearish outlook

Dow

Sp, 4mth view

Transports

Summary

From a MACD cycle point of view, we are still in a broadly negative situation for the indexes. There is nothing yet that would greatly concern me about any further upside. Only a close above 1340 would have me reassess my downside targets for July.

The red line..still under the green line!

Despite the minor wave'2 up from sp'1266 to 1363, the 10 day MA is still under the 50day MA - this is bearish! If the market can close Friday at least in the 1310s, that should prevent the 10MA from crossing the 50, and getting what would be a very bullish cross.

Hold the Line

Bears certainly need to hold the line at the 1335/40 zone, with no closes above it! We have more econ-data both tomorrow and Friday, so Mr Market will have some fundamental things to consider - even if the EU rumour machine starts up again.

A little more later...

Subscribe to:

Comments (Atom)