With equities opening lower on Ukraine concerns, the VIX managed to jump into the 16s. However, with a rather typical latter day equity recovery, the VIX closed below the opening level, settling +14.3% @ 16.00. Near term market outlook though, is obviously somewhat shaky.

VIX'60min

VIX'daily3

Summary

Let me be clear... market is highly susceptible to any sporadic 'bad news' from the Ukraine. That sort of thing is of course entirely unpredictable, and can ruin any wave count/pattern, no matter how good the analysis/theory.

Black-fail for the bears

The daily candle on the VIX should concern the bears. A black-fail candle is never a good sign of continued upside. Indeed, with a black candle sitting in the gap zone, I'm highly inclined to believe that is a short term top.

The most bearish aspect though, underlying MACD (blue bar histogram) cycle ticked higher for the fourth consecutive day, and looks set to go positive cycle at the Tuesday open. I guess you could say...bulls..beware!

As ever, there is key resistance at the big 20 threshold, but unless things go 'hot' in the Ukraine, I don't think we can see VIX 20s until April.

--

more later..on the indexes

Monday, 3 March 2014

Closing Brief

Equities closed somewhat above the lows, with the sp'500 settling -13pts @ 1845. The two leaders - Trans/R2K, both settled -0.6%. Near term outlook is uncertain, with a market vulnerable to further adverse developments in the Ukraine.

sp'60min

Summary

*A somewhat understandable choppy closing hour, as some were bailing into the close, but with the bulls managing a daily close in the 1840s.

--

No doubt, there will be a lot of doom talk across many sites tonight. Yet really...anyone just needs to go stare at a weekly/monthly chart. The primary trend remains...UP.

Certainly, if Ukraine starts shooting down planes..things get way more wild..and VIX 20s would be a given.

--

the usual bits and pieces across the evening...

sp'60min

Summary

*A somewhat understandable choppy closing hour, as some were bailing into the close, but with the bulls managing a daily close in the 1840s.

--

No doubt, there will be a lot of doom talk across many sites tonight. Yet really...anyone just needs to go stare at a weekly/monthly chart. The primary trend remains...UP.

Certainly, if Ukraine starts shooting down planes..things get way more wild..and VIX 20s would be a given.

--

the usual bits and pieces across the evening...

3pm update - tricky close to call

Despite the ongoing little ramp from sp'1834 to 1848, the closing hour is a tricky one to call. Clearly, some minor chop is likely, and some will bail into the close - concerned with possible overnight bad news from Russia/Urkraine. Metals look set to close with strong gains, Gold +$25

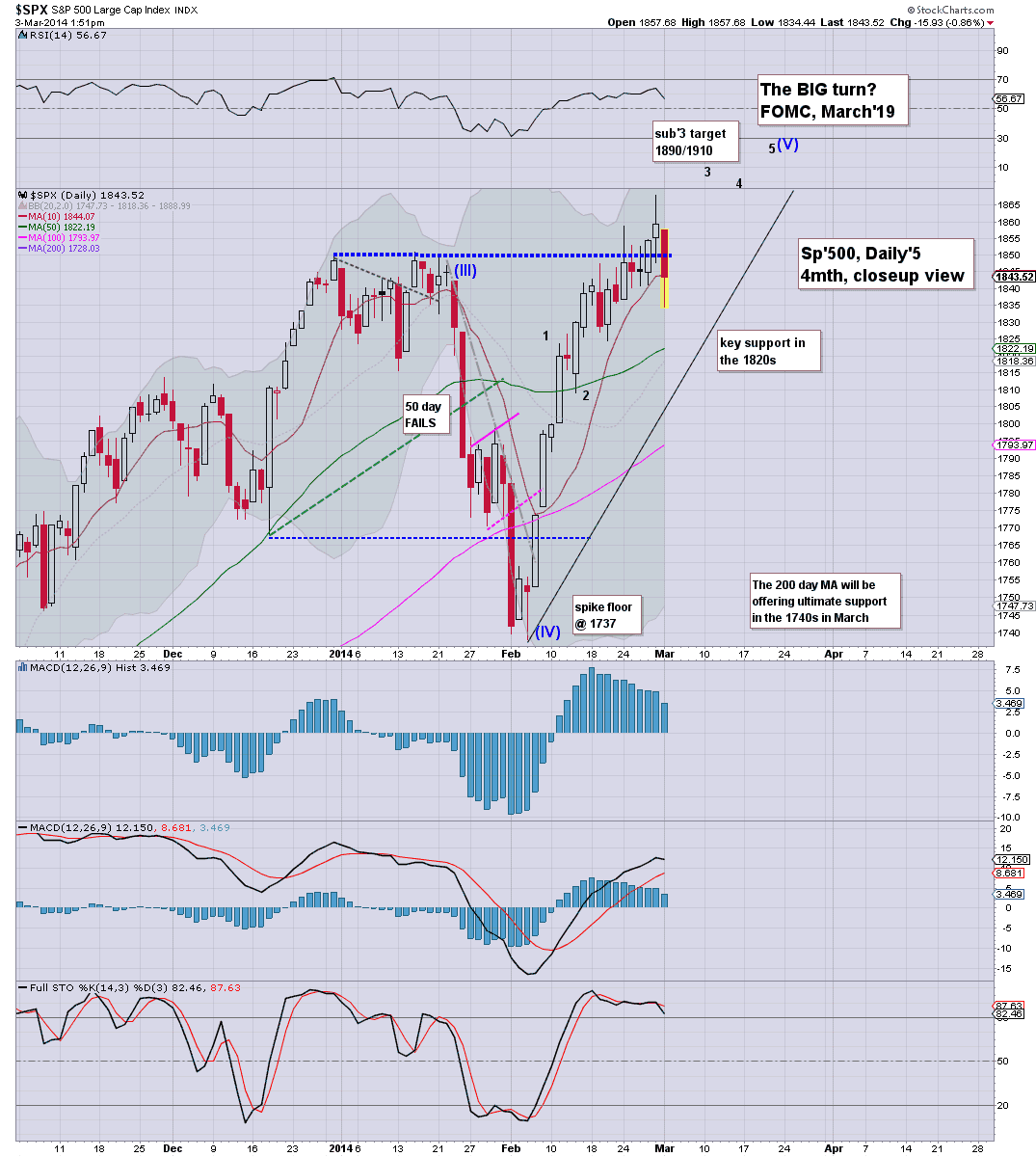

sp'daily5

Summary

Equity bulls should be content with any close in the 1840s..never mind the 1850s!

-

Price action remains in favour of the bulls..and you can imagine if market likes the jobs data this Friday, then a weekly close in the 1870/80s is just about viable - again, assuming Ukraine doesn't start shooting down Russian jets.

-

updates into the close..if I can stay awake.

--

3.08pm... chop chop...with the VIX trying to hold the low 16s into the close.

Overall though...equity bulls held the bears pretty well.

Notable weakness : UGAZ -8%......a real surprise there.

3.35pm...the minor chop continues... as noted..equity bulls should be content with ANY close >1840.

Anyway, at least the week started..not boring!

sp'daily5

Summary

Equity bulls should be content with any close in the 1840s..never mind the 1850s!

-

Price action remains in favour of the bulls..and you can imagine if market likes the jobs data this Friday, then a weekly close in the 1870/80s is just about viable - again, assuming Ukraine doesn't start shooting down Russian jets.

-

updates into the close..if I can stay awake.

--

3.08pm... chop chop...with the VIX trying to hold the low 16s into the close.

Overall though...equity bulls held the bears pretty well.

Notable weakness : UGAZ -8%......a real surprise there.

3.35pm...the minor chop continues... as noted..equity bulls should be content with ANY close >1840.

Anyway, at least the week started..not boring!

2pm update - battling into the late afternoon

US indexes are still lower on the day, but the equity bears are losing control. There is now opportunity for a daily close in the sp'1845/50 zone, along with VIX in the 15s. Metals are holding gains, with Gold +$25. Notable (surprising) weakness, Nat' Gas -1.7%.

sp'daily5

vix'daily3

Summary

I realise many will be touting major declines across the rest of this week, but price action still doesn't support the bears.

We're just not seeing the consistent..and significant downside.

--

Notable weakness, TWTR, UAL, both -3%

*it has been a pretty busy day, so no opportunity to cover the weekly/monthy cycles...will look at those later in the evening. Suffice to say.the sp'1900s are STILL a viable upside target later this month - assuming the Ukraine doesn't start shooting down Russian jets.

sp'daily5

vix'daily3

Summary

I realise many will be touting major declines across the rest of this week, but price action still doesn't support the bears.

We're just not seeing the consistent..and significant downside.

--

Notable weakness, TWTR, UAL, both -3%

*it has been a pretty busy day, so no opportunity to cover the weekly/monthy cycles...will look at those later in the evening. Suffice to say.the sp'1900s are STILL a viable upside target later this month - assuming the Ukraine doesn't start shooting down Russian jets.

1pm update - rainbows, but no unicorns

US equities remain at high risk of a typical latter day ramp..back into the sp'1850s. The VIX has remained stuck in the gap zone in the 16s, and frankly, isn't showing a market that is particularly concerned. Metals are holding strong gains, Gold +$26

sp'60min

Summary

*yes, I'm adjusting the broad channel on the hourly chart. In the bigger picture, we're still broadly heading higher.

I'd only change my outlook on any break <1800, and that sure doesn't look likely.

--

VIX update...

That should remain a concern to the equity bears...gap zone..a black candle...and threat of slipping back into the 15/14s

1.02pm... 15min cycle turning bullish....bulls are starting to take control again... sp'1843.

VIX about to lose the 16s.

*Russia said 'no ultimatum'...thats gotta be good for 10/15pts...yes?

1.20pm.. looks like bulls have free ride to 1850/52 by 3pm. How we close though..tricky....since sporadic Russia/Ukraine headlines still appearing on the news wires.

|

| A ray of hope..for the bull maniacs. |

sp'60min

Summary

*yes, I'm adjusting the broad channel on the hourly chart. In the bigger picture, we're still broadly heading higher.

I'd only change my outlook on any break <1800, and that sure doesn't look likely.

--

VIX update...

That should remain a concern to the equity bears...gap zone..a black candle...and threat of slipping back into the 15/14s

1.02pm... 15min cycle turning bullish....bulls are starting to take control again... sp'1843.

VIX about to lose the 16s.

*Russia said 'no ultimatum'...thats gotta be good for 10/15pts...yes?

1.20pm.. looks like bulls have free ride to 1850/52 by 3pm. How we close though..tricky....since sporadic Russia/Ukraine headlines still appearing on the news wires.

12pm update - latter day ramp?

US indexes are still holding borderline significant declines, but there is now fair likelihood we have seen (at least for today), a floor in the upper sp'1830s. Metals are building strong gains, with Gold +$28, and Silver +2.0%. Oil is holding 2% gains, but Nat'gas has (surprisingly) turned red.

sp'60min

GLD, daily

Summary

So much to cover...hard to keep up today.

Suffice to say, the equity bears are STILL not showing any significant downside power. We didn't open -2%...and we have a VIX which is struggling to hold the mid teens, and that is after Russia invaded another country!

When I really think about it..it is truly incredible that we aren't in the VIX 30s...or 40s right now. If Ukraine fights back, we're looking at something that could seriously get ugly.

--

VIX update from Mr T.

-

time for tea :)

-

12.12pm... finally, the VIX breaks the opening high, and the indexes are seeing another wave lower.

Still...this is nothing 'major'...yet.

Next support is clearly the 1830/26 zone...which would equate to VIX 17/18.

12.16pm...really whipsawing now....1834...to 1840...and it sure is a bit wild-west today.

sp'60min

GLD, daily

Summary

So much to cover...hard to keep up today.

Suffice to say, the equity bears are STILL not showing any significant downside power. We didn't open -2%...and we have a VIX which is struggling to hold the mid teens, and that is after Russia invaded another country!

When I really think about it..it is truly incredible that we aren't in the VIX 30s...or 40s right now. If Ukraine fights back, we're looking at something that could seriously get ugly.

--

VIX update from Mr T.

-

time for tea :)

-

12.12pm... finally, the VIX breaks the opening high, and the indexes are seeing another wave lower.

Still...this is nothing 'major'...yet.

Next support is clearly the 1830/26 zone...which would equate to VIX 17/18.

12.16pm...really whipsawing now....1834...to 1840...and it sure is a bit wild-west today.

11am update - typical turn time

US equities are holding moderate declines of around 0.8%, with a VIX +14% in the low 16s. However, we're now approaching the typical time when the downside pressure (what little there is) is usually exhausted. The question now is...how well can the bulls fight back into the late afternoon?

sp'60min

vix'60min

Summary

For me, the VIX remains the underlying problem for the equity bears. Yes, it is significantly higher, but overall..this just isn't a market that is particularly upset.

-

I think the opening black-fail candle on the hourly VIX is the key aspect of today.

Holding to original outlook..continued broad upside into the next FOMC.

With sig' QE today..and Wednesday...bears still face the old problem.

-

Metals are building gains.. Gold +$27...back to the level from last October. More on that ...later.

11.14am.. marginal new lows on the indexes...

but VIX has still not broken above the gap high.

--

Bears just don't have the downside power kick.

Metals build gains... Gold +$29...one of the strongest gains in some weeks..maybe months?

11.21am.. Again... market trying to floor..just around 1840...and this is the typical turn time!

Bears....beware!

11.43am.. triple spike floor on the 15min cycle. Nothing conclusive yet..but it makes for a pretty good initial floor.

Bears probably getting the last opportunity to exit before the ramp.

sp'60min

vix'60min

Summary

For me, the VIX remains the underlying problem for the equity bears. Yes, it is significantly higher, but overall..this just isn't a market that is particularly upset.

-

I think the opening black-fail candle on the hourly VIX is the key aspect of today.

Holding to original outlook..continued broad upside into the next FOMC.

With sig' QE today..and Wednesday...bears still face the old problem.

-

Metals are building gains.. Gold +$27...back to the level from last October. More on that ...later.

11.14am.. marginal new lows on the indexes...

but VIX has still not broken above the gap high.

--

Bears just don't have the downside power kick.

Metals build gains... Gold +$29...one of the strongest gains in some weeks..maybe months?

11.21am.. Again... market trying to floor..just around 1840...and this is the typical turn time!

Bears....beware!

11.43am.. triple spike floor on the 15min cycle. Nothing conclusive yet..but it makes for a pretty good initial floor.

Bears probably getting the last opportunity to exit before the ramp.

10am update - VIX is warning the equity bears

Despite equities opening somewhat lower (but not significantly)...the VIX is likely telling the story here. We have a black-fail candle - in a gap zone...and again, it seems there just isn't much power on the downside. With sig' QE this morning..bears face the usual problems

VIX'60min

sp'daily5

Summary

Lots to cover today....bear with me.

Those black candles usually don't bode well for the equity bears.

-

I have a LOT to say on the weekly/monthly cycles..but I'll leave that for later today, after things settle down a bit.

Suffice to say...I'm holding to original outlook..broad upside into the FOMC of March'19.

10.15am... divergence between indexes and VIX.

Indexes new low..but VIX still below the opening gap.

-

I can't take these declines seriously...at all.

Typical turn time..is of course..around 11am....

10.30am..possible reversal here...from sp'1841.... smaller 5/15min cycles are offering a pretty strong turn.

VIX did NOT break the opening high...and again..that is a key problem for the equity bears.

VIX'60min

sp'daily5

Summary

Lots to cover today....bear with me.

Those black candles usually don't bode well for the equity bears.

-

I have a LOT to say on the weekly/monthly cycles..but I'll leave that for later today, after things settle down a bit.

Suffice to say...I'm holding to original outlook..broad upside into the FOMC of March'19.

10.15am... divergence between indexes and VIX.

Indexes new low..but VIX still below the opening gap.

-

I can't take these declines seriously...at all.

Typical turn time..is of course..around 11am....

10.30am..possible reversal here...from sp'1841.... smaller 5/15min cycles are offering a pretty strong turn.

VIX did NOT break the opening high...and again..that is a key problem for the equity bears.

Pre-Market Brief

Good morning. Futures are lower (although not significantly), sp -14pts, we're set to open at 1845. Precious metals are sharply higher, Gold is +$22, with Silver +1.5%. Miners are benefiting, GDX +2.6%. Oil and Gas are both higher on the Crimea concerns, both by around 2.5%

sp'60min

Summary

Welcome to March!

So, we're going to open lower..but the real question is...is this the start of something major...or just another reversal coming?

Best guess...a reversal..whether this morning, later today..or as the week progresses.

-

Those bears holding (bravely) short across the weekend are getting a prime opportunity to tighten trading stops. If market does reverse..at least they'll likely guarantee some degree of profit. It would be pretty damn stupid to see some good profits turn into sig' losses by this Friday..yes?

--

Update from Mr Carboni

--

Good wishes for today..and the month! Spring is coming :)

-

Ohh, and I've even mentioned we have sig QE-pomo today, along with some econ-data..but you read my weekend report anyway...right?

-

8.35am.. ooh lookie...CNBC rolls out Buffett this morning...and naturally..Ms. Quick is there with him.

sp -17pts.. 1842.... still.. that is barely significant.

8.40am... I was thinking about the VIX....best guess...we open +15%...to the low 16s.

However, again, I have to note..equity bears need to be VERY careful here about a reversal, especially around the typical turn time of 11am.

Beware of black-fail candles on the daily/hourly VIX chart this morning!

Best guess... sp' floors in the 1840/35 zone...with VIX 16s.

-

9.20am.. so.....we're set to open sp -14pts...to the low 1840s..and VIX +12/15%.

I remain VERY concerned at a likely reversal this morning.

There just isn't much downside power (still)...and with QE of $2-3bn...bears......beware!

-

9.32am...okay people.... VIX +17% in the low 16s...

Watching for a reversal here!

--

*I'm looking at the bollinger bands..weekly/monthly charts...more on that later though.

The trading range for the spring is starting to be come a little clearer.

VIX, black-fail candle in the GAP zone...low 16s.

I think that is probably it.

-

9.38am.... black candle on the VIX....indexes are lower, but holding broad support, including the daily 10MA.

9.40am.. we're only 10mins in..and the VIX is -5% from the opening gap.

sp'60min

Summary

Welcome to March!

So, we're going to open lower..but the real question is...is this the start of something major...or just another reversal coming?

Best guess...a reversal..whether this morning, later today..or as the week progresses.

-

Those bears holding (bravely) short across the weekend are getting a prime opportunity to tighten trading stops. If market does reverse..at least they'll likely guarantee some degree of profit. It would be pretty damn stupid to see some good profits turn into sig' losses by this Friday..yes?

--

Update from Mr Carboni

--

Good wishes for today..and the month! Spring is coming :)

-

Ohh, and I've even mentioned we have sig QE-pomo today, along with some econ-data..but you read my weekend report anyway...right?

-

8.35am.. ooh lookie...CNBC rolls out Buffett this morning...and naturally..Ms. Quick is there with him.

sp -17pts.. 1842.... still.. that is barely significant.

8.40am... I was thinking about the VIX....best guess...we open +15%...to the low 16s.

However, again, I have to note..equity bears need to be VERY careful here about a reversal, especially around the typical turn time of 11am.

Beware of black-fail candles on the daily/hourly VIX chart this morning!

Best guess... sp' floors in the 1840/35 zone...with VIX 16s.

-

9.20am.. so.....we're set to open sp -14pts...to the low 1840s..and VIX +12/15%.

I remain VERY concerned at a likely reversal this morning.

There just isn't much downside power (still)...and with QE of $2-3bn...bears......beware!

-

9.32am...okay people.... VIX +17% in the low 16s...

Watching for a reversal here!

--

*I'm looking at the bollinger bands..weekly/monthly charts...more on that later though.

The trading range for the spring is starting to be come a little clearer.

VIX, black-fail candle in the GAP zone...low 16s.

I think that is probably it.

-

9.38am.... black candle on the VIX....indexes are lower, but holding broad support, including the daily 10MA.

9.40am.. we're only 10mins in..and the VIX is -5% from the opening gap.

Subscribe to:

Comments (Atom)