With equities seeing minor weak chop across the day, the VIX finally managed a fractionally higher close, +0.6% @ 13.27. Near term outlook is for the VIX to remain in the 14/12 zone until next Wednesday afternoon - when we will likely see QE-taper'4 announced.

VIX'daily3

Summary

Little to add,

VIX remains crushed, and ongoing price action suggest the equity bulls will remain in control into the middle of next week.

-

more later..on the indexes

Wednesday, 23 April 2014

Closing Brief

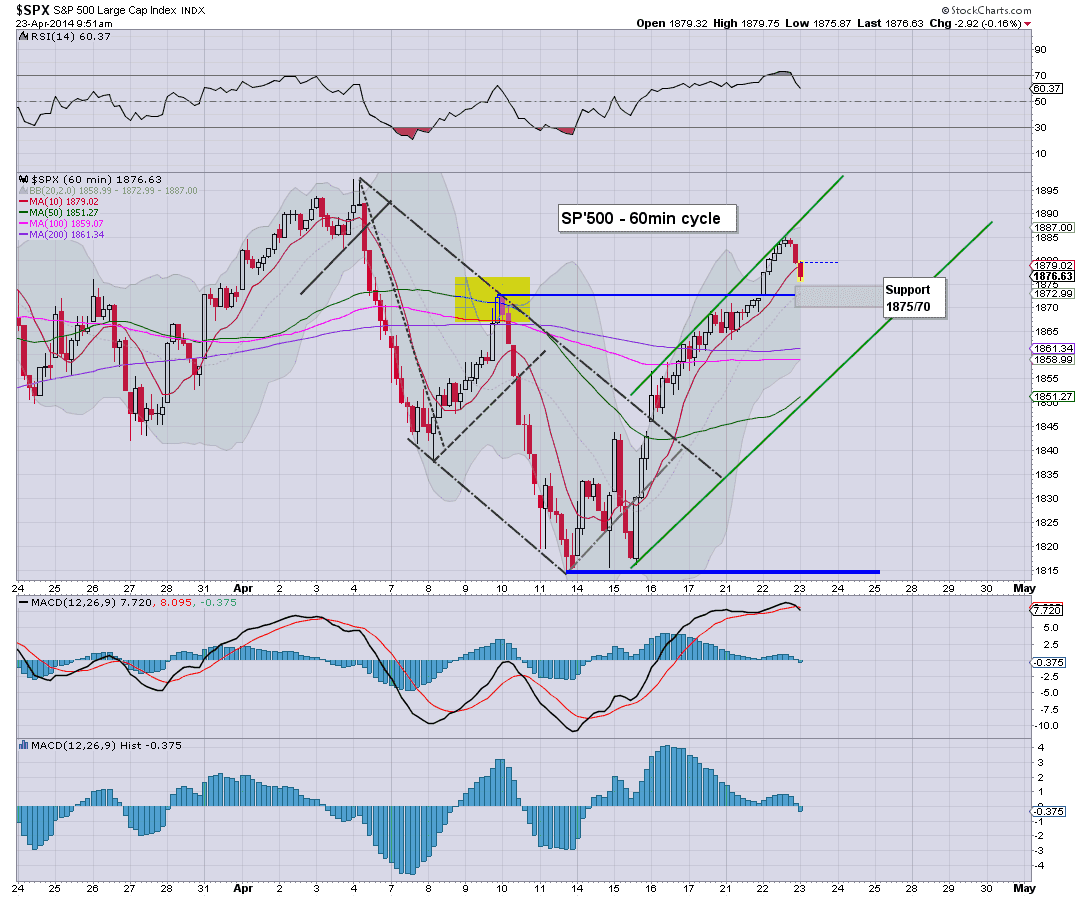

US indexes saw a day of price consolidation, sp -4pts @ 1875. The two leaders - Trans/R2K, settled +0.1% and -0.7% respectively. Near term outlook is for the broader upward trend to continue, at least into the FOMC announcement of next Wednesday.

sp'60min

Summary

*FB earnings were good, but market selling it lower, -5% @ $60

---

A very quiet day, and surely a day of classic consolidation, after a climb (yes, based on low volume), from sp'1814 to 1884.

Bulls just need to clear 1885..and that opens the door to a new index high in the low 1900s...very viable next week.

Other than that...nothing to add...except...

AAPL earnings..due.. 4.30pm.

--

4.13pm... FB turns green in AH, back to the $63s, but its a bit choppy. Overall though, the numbers were pretty good..at least on 'first look'.

4.32pm.. Great headline numbers from AAPL, $11.62 EPS for Q1.

How the market deals with that...remains to be seen.

-

4.35pm.. BIG news... AAPL stock split... 7 for 1 .... lol...there will be a LOT more retail piling into this hugely undervalued stock now.

Waiting for the stock to re-list..at 4.45pm.

4.46pm... AAPL to the 560s...and headed to the monthly upside target of $600 in May.

Equity bears...facing a world of hurt tomorrow, urghh.

4.51pm.. AAPL +8% @ 566...

Sp' looks set to open in the mid 1880s tomorrow, a weekly close in the 1900s..is now viable.

4.48pm.. The AAPL gains are holding, and that should set up the rest of the week.

AAPL, monthly...

Upside to $600 looks an easy target, now that key resistance of 550 is broken.

---

more later...on the VIX

sp'60min

Summary

*FB earnings were good, but market selling it lower, -5% @ $60

---

A very quiet day, and surely a day of classic consolidation, after a climb (yes, based on low volume), from sp'1814 to 1884.

Bulls just need to clear 1885..and that opens the door to a new index high in the low 1900s...very viable next week.

Other than that...nothing to add...except...

AAPL earnings..due.. 4.30pm.

--

4.13pm... FB turns green in AH, back to the $63s, but its a bit choppy. Overall though, the numbers were pretty good..at least on 'first look'.

4.32pm.. Great headline numbers from AAPL, $11.62 EPS for Q1.

How the market deals with that...remains to be seen.

-

4.35pm.. BIG news... AAPL stock split... 7 for 1 .... lol...there will be a LOT more retail piling into this hugely undervalued stock now.

Waiting for the stock to re-list..at 4.45pm.

4.46pm... AAPL to the 560s...and headed to the monthly upside target of $600 in May.

Equity bears...facing a world of hurt tomorrow, urghh.

4.51pm.. AAPL +8% @ 566...

Sp' looks set to open in the mid 1880s tomorrow, a weekly close in the 1900s..is now viable.

4.48pm.. The AAPL gains are holding, and that should set up the rest of the week.

AAPL, monthly...

Upside to $600 looks an easy target, now that key resistance of 550 is broken.

---

more later...on the VIX

3pm update - minor chop into the close

US equities look set to conclude the day..much as they began, with some minor weak chop. Hourly index charts are suggestive that bears will not be able to break much below 1870, before the next up wave. Metals remain a touch weak, with Oil having now turned red.

sp'60min

Summary

Notable weakness in the momo stocks, with NFLX and TSLA both lower by a rather significant -5% or so.

-

I will hold overnight, the 3 positions I picked up this morning...

LONG FCX, RIG, and SHORT, SLV

-

updates into the close....but the real action is around 4.30pm..when AAPL earnings are due.

-

3.10pm. Hourly MACD cycle on the indexes is arguably floored. There is nothing definitive yet, but I'd not be on the short side of the main indexes for tomorrow..and indeed, into the Friday close.

More than anything right now, there is a shear absence of downside power. That sure won't last forever of course, but there appears little to stop the market from melting upward into the FOMC of next Wednesday.

3.14pm.. Looking ahead to AAPL.

The key thresholds are 550 and 510/08. Until we break above/below there, it remains relatively minor chop.

Indeed, equity bulls should be battling for 5/6% gain, which should help 'inspire' the rest of the Nasdaq tomorrow. The bigger monthly charts will still be offering the $600 threshold across May/June.

-

3.48pm.. minor weak chop....and that..appears to be the best the bears can manage.

I wish otherwise....I'll still look for a major wave lower, sometime late May/early June.

back at the close.....with AAPL.

sp'60min

Summary

Notable weakness in the momo stocks, with NFLX and TSLA both lower by a rather significant -5% or so.

-

I will hold overnight, the 3 positions I picked up this morning...

LONG FCX, RIG, and SHORT, SLV

-

updates into the close....but the real action is around 4.30pm..when AAPL earnings are due.

-

3.10pm. Hourly MACD cycle on the indexes is arguably floored. There is nothing definitive yet, but I'd not be on the short side of the main indexes for tomorrow..and indeed, into the Friday close.

More than anything right now, there is a shear absence of downside power. That sure won't last forever of course, but there appears little to stop the market from melting upward into the FOMC of next Wednesday.

3.14pm.. Looking ahead to AAPL.

The key thresholds are 550 and 510/08. Until we break above/below there, it remains relatively minor chop.

Indeed, equity bulls should be battling for 5/6% gain, which should help 'inspire' the rest of the Nasdaq tomorrow. The bigger monthly charts will still be offering the $600 threshold across May/June.

-

3.48pm.. minor weak chop....and that..appears to be the best the bears can manage.

I wish otherwise....I'll still look for a major wave lower, sometime late May/early June.

back at the close.....with AAPL.

2pm update - continued minor chop

US indexes continue to see very minor price chop - ahead of AAPL earnings after the close. Metals remain fractionally lower, whilst Oil is holding slight gains of 0.1%. The momo stocks are seeing some rather significant weakness.

sp'60min

Summary

A daily close in the 1860s still looks unlikely. There just isn't much downside power, well, except in the momo stocks.

-

Notable weakness...

OPEN, daily

Major problems, with the floor just taken out. How about a table for two, with Puts for desert?

As it is, I've little in getting involved, not least after already picking up 3 positions this morning.

2.24pm. minor weak chop, hourly lower bollinger band..offering first support around 1865. Certainly, the 1850s look out of reach for the bears.

The VIX might close fractionally positive, but still, the 13s are the 'crushed' 13s.

sp'60min

Summary

A daily close in the 1860s still looks unlikely. There just isn't much downside power, well, except in the momo stocks.

-

Notable weakness...

OPEN, daily

Major problems, with the floor just taken out. How about a table for two, with Puts for desert?

As it is, I've little in getting involved, not least after already picking up 3 positions this morning.

2.24pm. minor weak chop, hourly lower bollinger band..offering first support around 1865. Certainly, the 1850s look out of reach for the bears.

The VIX might close fractionally positive, but still, the 13s are the 'crushed' 13s.

1pm update - afternoon nap?

US equities are set for a quiet afternoon, with a daily close somewhere in the 1885/75 zone. Metals are a touch weak. Notable weakness in NFLX, -4% in the $350s, after AMZN secured the TV rights to the Khalessi and Tony Soprano.

sp'60min

Summary

So, a few hours of quiet. However, we do have Q1 earnings from AAPL, due around 4.30pm. That will merit some attention.

--

Price action entirely favours the bulls in the broader market, at least until next Wednesday.

If Mr Market decides that 'taper'4 is a sign of 'confidence in the Fed', then the sp'1900s will likely be broken into - opening up the next target zone of 1925/50.

-

sp'60min

Summary

So, a few hours of quiet. However, we do have Q1 earnings from AAPL, due around 4.30pm. That will merit some attention.

--

Price action entirely favours the bulls in the broader market, at least until next Wednesday.

If Mr Market decides that 'taper'4 is a sign of 'confidence in the Fed', then the sp'1900s will likely be broken into - opening up the next target zone of 1925/50.

-

12pm update - afternoon melt

US indexes look prone to melting somewhat to the upside this afternoon, not least helped by a few billion dollars of QE fuel. Equity bears look shut out until at least next Wednesday - FOMC, taper'4 day. Until then, bulls have a fair chance of pushing into the low 1900s.

sp'60min

Summary

Suffice to say, I'm content with how today is going. Ford remains an interesting one to watch, and it did briefly break above the 200 dma this morning. Earnings are Friday morning I believe.

--

VIX update from Mr T

--

time for lunch

sp'60min

Summary

Suffice to say, I'm content with how today is going. Ford remains an interesting one to watch, and it did briefly break above the 200 dma this morning. Earnings are Friday morning I believe.

--

VIX update from Mr T

--

time for lunch

11am update - underlying strength

US equities have seen a little morning weakness, but we have an hourly spike-floor candle in the support zone of sp'1875/70. There is next to zero downside pressure, and weekly charts continue to warn of much higher levels into May.

sp'60min

Summary

I've been shopping this morning...

LONG, RIG, FCX

SHORT, SLV.

I would also consider long Ford (F), but not with the 5/15min cycles as they are.

-

Notable weakness.. NFLX

I guess the Khalessi is long AMZN ?

--

time to cook...

11.16am.. minor chop..and maybe we're looking at a nano ABC wave. Regardless, bigger cycles are all bullish.

notable weakness: TSLA, -3.7%, whilst Ford is +0.8%, hmm

sp'60min

Summary

I've been shopping this morning...

LONG, RIG, FCX

SHORT, SLV.

I would also consider long Ford (F), but not with the 5/15min cycles as they are.

-

Notable weakness.. NFLX

I guess the Khalessi is long AMZN ?

--

time to cook...

11.16am.. minor chop..and maybe we're looking at a nano ABC wave. Regardless, bigger cycles are all bullish.

notable weakness: TSLA, -3.7%, whilst Ford is +0.8%, hmm

10am update - opening minor weakness

US indexes open a little lower, with likely support in the sp'1875/70 zone. Metals open a touch higher, but look vulnerable...as ever. VIX is +2%, but even the mid teens look difficult to reach.

sp'60min

Summary

*picked up a few positions, (I am in the mood)...

LONG, RIG

SHORT, SLV.

I will probably post something on RIG later this evening.

--

As for the broader market, it remains a case that the equity bears have little downside power. I realise some are still seeking a retrace to the 1850s, but really, that looks difficult.

There is a sig' QE today, and with another two next Mon/Tuesday, bears face the usual problems.

-

notable weakness: NFLX -2.5%, on news that AMZN has a deal with HBO.

10.03am.. minor weakness...I'd be surprised to see the 1860s.

10.09am.. LONG... FCX. , from $33.20s

..and that will suffice for me today. Now its the waiting game.

-

10.36am... Notable strength in Ford (F), +1.1%. A break >16.50 would be bullish for May/June.

sp'60min

Summary

*picked up a few positions, (I am in the mood)...

LONG, RIG

SHORT, SLV.

I will probably post something on RIG later this evening.

--

As for the broader market, it remains a case that the equity bears have little downside power. I realise some are still seeking a retrace to the 1850s, but really, that looks difficult.

There is a sig' QE today, and with another two next Mon/Tuesday, bears face the usual problems.

-

notable weakness: NFLX -2.5%, on news that AMZN has a deal with HBO.

10.03am.. minor weakness...I'd be surprised to see the 1860s.

10.09am.. LONG... FCX. , from $33.20s

..and that will suffice for me today. Now its the waiting game.

-

10.36am... Notable strength in Ford (F), +1.1%. A break >16.50 would be bullish for May/June.

Pre-Market Brief

Good morning. Futures are a touch lower, sp -3pts, we're set to open at 1876. A retrace to the 1875/70 zone seems likely this morning, before the algo-bot upward melt resumes. Metals are set to open moderately higher, Gold +$3.

sp'60min

Summary

I will note again that the original retrace target zone of 1850/40s now seems out of range. I suppose its still viable, but weekly charts argue against it.

Regardless of the minor noise, the sp'1900s look a relatively easy target before month end, even with QE taper'4 due next Wednesday.

--

Video from Hunter, with some doomer chatter on bank bail-ins

-

Have a good Wednesday!

9.08am.. NFLX, is having issues..-3% @ $362. WIll be one to watch today.

UPDATE.. watching clown finance TV... it would seem AMZN has linked up with an exclusive deal with HBO.

I can certainly now understand why NFLX is getting knocked lower.

9.37am.. choppy open..

LONG ... RIG. Weekly charts are offering sig' upside next week. I'm in from the low $41s.

sp'60min

Summary

I will note again that the original retrace target zone of 1850/40s now seems out of range. I suppose its still viable, but weekly charts argue against it.

Regardless of the minor noise, the sp'1900s look a relatively easy target before month end, even with QE taper'4 due next Wednesday.

--

Video from Hunter, with some doomer chatter on bank bail-ins

-

Have a good Wednesday!

9.08am.. NFLX, is having issues..-3% @ $362. WIll be one to watch today.

UPDATE.. watching clown finance TV... it would seem AMZN has linked up with an exclusive deal with HBO.

I can certainly now understand why NFLX is getting knocked lower.

9.37am.. choppy open..

LONG ... RIG. Weekly charts are offering sig' upside next week. I'm in from the low $41s.

Transports new high, others to follow

The Transports is not called the 'old leader' for no good reason. With a new historic high today of 7764, the other US indexes look set to similarly break new highs. Weekly MACD cycles are highly suggestive of further upside into early May..perhaps all the way into mid June.

Trans, weekly

SP' weekly

Summary

A sixth day for the bull maniacs, and despite some commentators correctly pointing out that the rally is based on low volume, it really doesn't matter, does it?

The trend is UP on all the bigger cycles, daily, weekly, and monthly. Indeed, the monthly charts are now offering as high as the 1960s - although I don't think that is really viable in this latest multi-week up wave.

Looking ahead

We have the PMI manu', and some housing data. There is also the EIA oil report, which might help to keep Oil on the current down trend.

*there is sig' QE of $2-2.5bn.

--

Another great video from Gordon T Long

This update focuses especially on China. Interestingly, the guest has an outlook that I broadly share. Perhaps some sig' economic/market weakness in Q3/4, but from there, things could get really wild, with a subsequent hyper-wave.

I'm still broadly resigned to 'general upside' into late 2015/early 2016, not least if the Fed - and other central banks, go nuclear with the QE button later this year.

--

At least I'm not getting burnt

I remain content to sit on the sidelines. I have ZERO inclination to attempt any index-shorts, but neither do I have much interest in going long right now. So, I'm missing out on yet another rally, but hey..at least I ain't losing anything.

Right now, my best guess is that we'll see broad upside into late May/early June. The FOMC of June'18 would be a particularly attractive time (at least to me) to launch another major short.

Goodnight from London

Trans, weekly

SP' weekly

Summary

A sixth day for the bull maniacs, and despite some commentators correctly pointing out that the rally is based on low volume, it really doesn't matter, does it?

The trend is UP on all the bigger cycles, daily, weekly, and monthly. Indeed, the monthly charts are now offering as high as the 1960s - although I don't think that is really viable in this latest multi-week up wave.

Looking ahead

We have the PMI manu', and some housing data. There is also the EIA oil report, which might help to keep Oil on the current down trend.

*there is sig' QE of $2-2.5bn.

--

Another great video from Gordon T Long

This update focuses especially on China. Interestingly, the guest has an outlook that I broadly share. Perhaps some sig' economic/market weakness in Q3/4, but from there, things could get really wild, with a subsequent hyper-wave.

I'm still broadly resigned to 'general upside' into late 2015/early 2016, not least if the Fed - and other central banks, go nuclear with the QE button later this year.

--

At least I'm not getting burnt

I remain content to sit on the sidelines. I have ZERO inclination to attempt any index-shorts, but neither do I have much interest in going long right now. So, I'm missing out on yet another rally, but hey..at least I ain't losing anything.

Right now, my best guess is that we'll see broad upside into late May/early June. The FOMC of June'18 would be a particularly attractive time (at least to me) to launch another major short.

Goodnight from London

Daily Index Cycle update

US indexes closed higher for a sixth day, sp +7pts @ 1879. The two leaders - Trans/R2K, settled higher by 0.6% and 1.1% respectively, with the former breaking a new historic high of 7764. Near term outlook offers a break >sp'1897 before end month.

sp'daily5

R2K

Trans

Summary

There is little to add. There is no power on the downside, and with the Trans' breaking a new historic high, the rest of the other indexes will surely follow in the near term.

The next thing for the bulls to be concerned about is GDP Q1, and the FOMC of next Wednesday. Until then, the current up wave will likely continue.

--

a little more later...

sp'daily5

R2K

Trans

Summary

There is little to add. There is no power on the downside, and with the Trans' breaking a new historic high, the rest of the other indexes will surely follow in the near term.

The next thing for the bulls to be concerned about is GDP Q1, and the FOMC of next Wednesday. Until then, the current up wave will likely continue.

--

a little more later...

Subscribe to:

Comments (Atom)