Despite a few geo-political concerns this week, the US equity indexes continued their broad climb, with net weekly changes ranging from +1.6% (Transports) to -0.7% (Rus'2000). Near term outlook is for the sp'1990/2000s before end July.

Lets take our regular look at six of the main US indexes

sp'500

Despite the big Thursday fall of -23pts, the sp'500 still managed a net weekly gain of 10pts, and on Friday, came within just 0.3% of breaking a new historic high (>1985). Near term outlook is bullish, and the 1990/2000s are viable next week. By mid August, the sp'2040/50 zone will be viable.

Equity bears have nothing to tout, until we see a weekly closing under the 10MA, which will jump to the 1950s next week. Underlying MACD (blue bar histogram) ticked lower for a second week, but price momentum remains very much in favour to the bulls.

Nasdaq Comp'

The tech' gained 0.4% this week, and put in a rather bullish spike floor candle, having held the price cluster zone of the mid 4300s. There looks to be very valid upside all the way into September, probably to the 4700s.

Dow

The mighty Dow gained 0.9% this week, having broken a new historic high of 17151. There is absolutely nothing bearish for this index. Price action remains very gradual, but consistently to the upside. The 18000s look viable in late Sept/early Oct.

NYSE Comp'

The master index gained around 0.5%, and importantly, held the weekly 10MA. There looks to be easy upside to the 11200s by mid August.

R2K

The second market leader had some real problems this week, swinging from 1169 to 1131. Having managed Friday gains of 1.6%, the R2K saw net weekly declines of a moderate -0.7%. The 1130/20s are now key support.. and rising each week.

It will be important for the broader market to see the R2K make a series of net weekly gains into August. Most important...a new high >1213. That seems viable by mid August.

Equity bears have nothing to tout unless they can break under the key floor of 1080. Those who believe the sp'2100s are viable, should be open to the R2K in the 1300s, but that will likely be a good 6-9 months away.

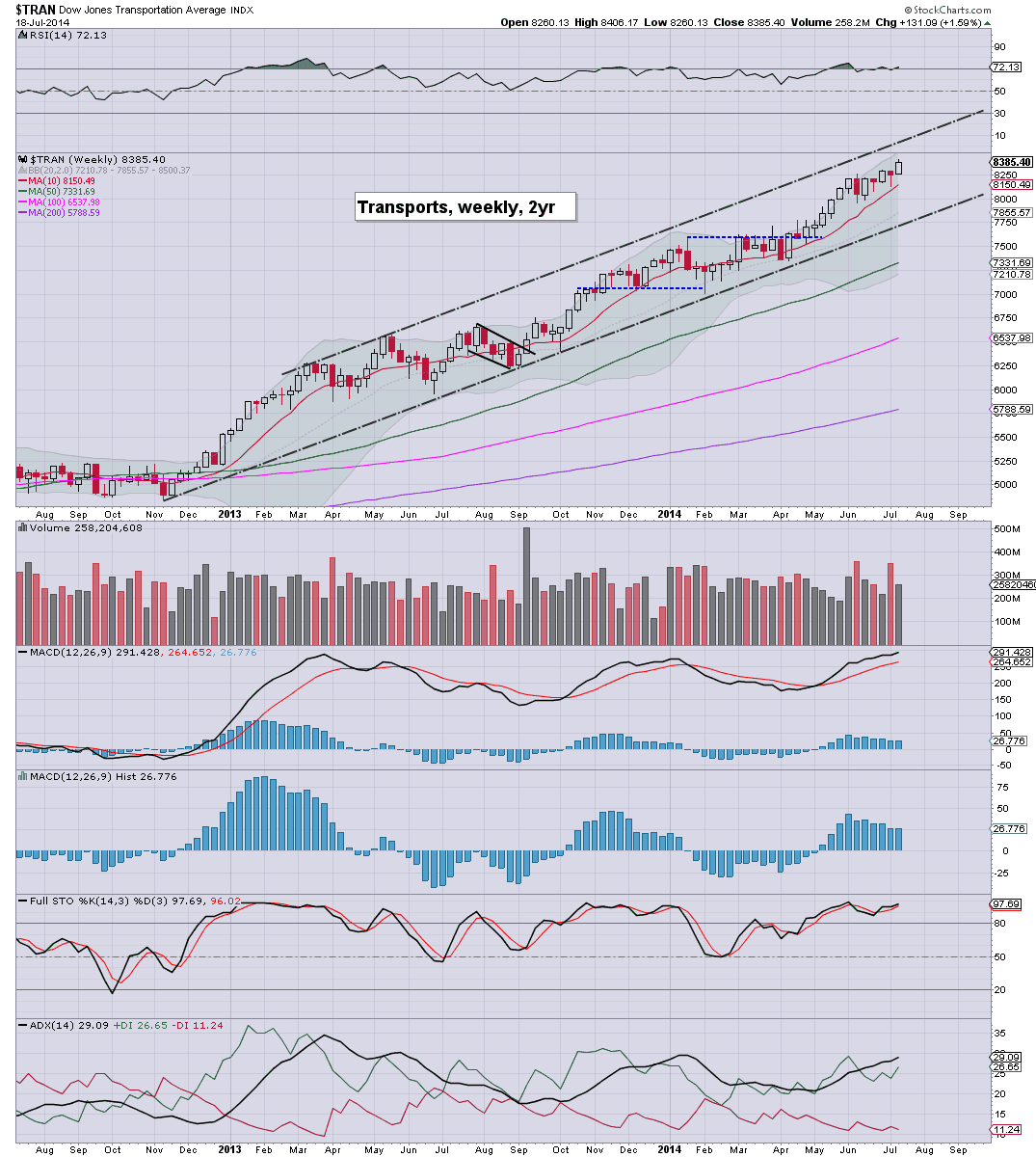

Trans

The old leader was the strongest index this week, climbing a significant 1.6%. The 8500s look viable next week, and that is another 2% higher. The current rate of increase is 250pts a month, and thus the 9000s will be viable late Sept/early Oct.

Summary

Most notable this week, new historic highs in the Dow and Transports. On the flip side, the R2K was very weak for a second consecutive week, but did recover much of the losses with the Friday gains.

We have some interesting spike floor weekly candles, and price action remains much the same. With the VIX having been knocked back to the 12s - and seemingly headed for single digit levels eventually, equity bulls have little to be concerned about for the rest of the summer.

Looking ahead

Next week will be largely about earnings as another truck load of companies report for Q2.

In terms of econ-data, there is CPI and existing home sales data on Tuesday. Thursday will see jobless claims and new home sales. The week will conclude with Durable goods orders.

*there is sig' QE - Wed' $2bn, Thur' $3bn... bears... beware!

--

back on Monday :)

--

Video from Gordon T Long, with Rubino on the issue of financial repression.

As ever, for those interested in the macro picture.. this is good viewing.

Saturday, 19 July 2014

Net weekly gains

Whilst many were calling for continued downside, US equities ended the week on a pretty positive note. It is highly notable that the Sp'500 ended the week with net weekly gains of 10pts (0.5%) @ 1978. The sp'1990/2000s look very likely before end month.

sp'weekly8

Summary

Regardless of how you might want to count this nonsense, the primary trend remains to the upside. Yes, we closed the week with a blue candle on the 'rainbow' chart, but price action remains pretty strong, and is reflected in a VIX that is unable to hold the mid teens for more than a few trading hours.

The fact that most US indexes managed net weekly gains is again testament to the underlying upside power in this market. Unquestionably...the broader trend remains to the upside...and we look set for the 1990/2000s within the next week or two.

-

...and that concludes another week in the worlds most twisted casino.

Goodnight from London

-

*the weekend update will be on the US weekly indexes

sp'weekly8

Summary

Regardless of how you might want to count this nonsense, the primary trend remains to the upside. Yes, we closed the week with a blue candle on the 'rainbow' chart, but price action remains pretty strong, and is reflected in a VIX that is unable to hold the mid teens for more than a few trading hours.

The fact that most US indexes managed net weekly gains is again testament to the underlying upside power in this market. Unquestionably...the broader trend remains to the upside...and we look set for the 1990/2000s within the next week or two.

-

...and that concludes another week in the worlds most twisted casino.

Goodnight from London

-

*the weekend update will be on the US weekly indexes

Daily Index Cycle update

US indexes closed with rather significant gains, sp +20pts @ 1978. The two leaders - Trans/R2K, settled higher by 1.3% and 1.6% respectively. Near term outlook is for the broader upward trend to resume, with sp'2000s viable before end month.

sp'daily5

R2K

Trans

Summary

So..the week ended on a pretty positive note, and the doomy gloomy mood from Thursday was completely reversed.

Indeed, most notable was seeing the sp'500 come within 0.3% of breaking a new historic high. The 1990/2000s look very viable in the near term.

--

Closing update from Riley

--

--

a little more later...

sp'daily5

R2K

Trans

Summary

So..the week ended on a pretty positive note, and the doomy gloomy mood from Thursday was completely reversed.

Indeed, most notable was seeing the sp'500 come within 0.3% of breaking a new historic high. The 1990/2000s look very viable in the near term.

--

Closing update from Riley

--

--

a little more later...

Subscribe to:

Comments (Atom)