The VIX closed very marginally lower in the brief AH trading today. Considering the index gains, VIX held up very well indeed.

The blue candle on the rainbow chart (elder impulse system), along with a still recovering MACD cycle, is highly suggestive of much higher VIX in the coming 3-5 days.

VIX'60min

VIX, daily, rainbow

VIX, weekly

Summary

VIX is arguably still in a general uptrend on the hourly cycle. First target would be 22/24 in the coming few days.

The bigger cycles warn of 30s and 40s in July.

Right now..those VIX August calls sure look cheap.

Wednesday, 27 June 2012

Closing Brief - a minor victory for the bulls

A somewhat stressful day for those bears who are not keeping the bigger picture in mind (low sp'1100s, late July). Clearly, a fair few will have bailed today, and some may even have gone long. The action in the VIX is not confirming the rally in the indexes. Bears have that going for them at least today.

Lets take a look at those closing hourly indexes...

IWM

Dow

Sp

Summary

The closing hour did see a little reaction off the 1335 resistance line.

I remain confidently short, looking for the next exit (my third post-FOMC short trade) around sp'1300/1290, which can still occur by the Friday close. The bigger targets remain 1225/00..and then 1150/00 - in the latter part of July.

More later...

Lets take a look at those closing hourly indexes...

IWM

Dow

Sp

Summary

The closing hour did see a little reaction off the 1335 resistance line.

I remain confidently short, looking for the next exit (my third post-FOMC short trade) around sp'1300/1290, which can still occur by the Friday close. The bigger targets remain 1225/00..and then 1150/00 - in the latter part of July.

More later...

3pm update - minute wave'2 complete?

Whilst the PIIGS battle it out on the green grass, the market looks like its quite possibly maxed out for this 'minute wave'2 of minor 3..of main wave'1 (if that makes sense!)

sp'60min, chart'1

sp'60min, H/S formation

VIX, 60min

Summary

Most bears should arguably not have been stopped out yet, only a close over 1335 would be a threat to the overall outlook, and 1340 would be for those with greater loss-tolerance.

The VIX is especially looking good from the bearish perspective.

The bears would much prefer a close under the hourly 10MA of sp'1326.

More after the close

sp'60min, chart'1

sp'60min, H/S formation

VIX, 60min

Summary

Most bears should arguably not have been stopped out yet, only a close over 1335 would be a threat to the overall outlook, and 1340 would be for those with greater loss-tolerance.

The VIX is especially looking good from the bearish perspective.

The bears would much prefer a close under the hourly 10MA of sp'1326.

More after the close

2pm update - Battle of the PIIGS

Whilst the casino wheel continues to slowly spin this afternoon, there are other more important matters due to begin...

The Euro' 2012 football match - Portugal vs Spain ;) I think I can say (without the SEC sending a SWAT team through my window), I would be 'bullish Spain!'

-

sp'60min H/S formation

Summary

Bears would very much prefer a close under the hourly 10MA of 1324. That would certainly take the edge off today, and would still easily allow a move to 1300/1290 by Friday.

As noted MANY times this month, it will be important to see the month of June close sp<1305. A close this Friday of 1330s or higher would seriously wreck the monthly bearish outlook.

More later...but there is an important game to focus on!

ps. The big unknown about today's big game...who will ask the referee for a bailout first?

The Euro' 2012 football match - Portugal vs Spain ;) I think I can say (without the SEC sending a SWAT team through my window), I would be 'bullish Spain!'

-

sp'60min H/S formation

Summary

Bears would very much prefer a close under the hourly 10MA of 1324. That would certainly take the edge off today, and would still easily allow a move to 1300/1290 by Friday.

As noted MANY times this month, it will be important to see the month of June close sp<1305. A close this Friday of 1330s or higher would seriously wreck the monthly bearish outlook.

More later...but there is an important game to focus on!

ps. The big unknown about today's big game...who will ask the referee for a bailout first?

1pm update - waiting for a turn

Market still crawling higher this hour. We're now close to the border of what is probably a large H/S formation. Bulls should be seeking a breakout >1340. Bears will need to get back into the low 1310s..and break 1300 to confirm much lower levels in July.

Its not a bad place for new positions to be taken, whether bullish or bearish. The stop levels are indeed pretty clear.

sp'60min H/S formation

sp, daily, 4mth

Summary

The daily index chart does look a little scary right now, but the daily 10MA at 1335 is pretty strong resistance, a close above that won't be easy for the bulls.

VIX continuing to hold up well. The option writers clearly aren't so bullish about the near term as the indexes might suggest.

I remain short...and will hold overnight.

--

Recommended afternoon reading...

'no risk of (Australian) housing bust'

Mish again highlighting a key issue...Australia (and Canada in my view too) both have crazy housing problems right now. Both look set for major down cycles.

Its not a bad place for new positions to be taken, whether bullish or bearish. The stop levels are indeed pretty clear.

sp'60min H/S formation

sp, daily, 4mth

Summary

The daily index chart does look a little scary right now, but the daily 10MA at 1335 is pretty strong resistance, a close above that won't be easy for the bulls.

VIX continuing to hold up well. The option writers clearly aren't so bullish about the near term as the indexes might suggest.

I remain short...and will hold overnight.

--

Recommended afternoon reading...

'no risk of (Australian) housing bust'

Mish again highlighting a key issue...Australia (and Canada in my view too) both have crazy housing problems right now. Both look set for major down cycles.

12pm update - H/S formation.. bearish!

With the VIX still holding up well (it was even green earlier - a real warning to those bulls going long this morning), the sp' index appears to have a new H/S formation. I should have perhaps identified it a bit earlier, so I am somewhat annoyed with myself again, urghh!

If the formation is correct, it would imply there will not be a daily close over sp'1335/40, and then bears should seek a break below 1310/00 within days.

Sp'60min H/S formation

Vix'60min

Summary

I remain short (from sp'1319), riding out this annoying minor rally, first exit target 1300/1290. That could still be hit by this Friday close, but if things get choppy, I might have to hold into next week before my next exit.

I still plan to short every bounce/spike all the way down to sp'1150/00 across all of July. I will NOT get rattled by this kind of nonsense that we've seen this morning.

So, those bears holding on right now should merely button up their flak jackets, sit back..and wait.

More across the afternoon.

If the formation is correct, it would imply there will not be a daily close over sp'1335/40, and then bears should seek a break below 1310/00 within days.

Sp'60min H/S formation

Vix'60min

Summary

I remain short (from sp'1319), riding out this annoying minor rally, first exit target 1300/1290. That could still be hit by this Friday close, but if things get choppy, I might have to hold into next week before my next exit.

I still plan to short every bounce/spike all the way down to sp'1150/00 across all of July. I will NOT get rattled by this kind of nonsense that we've seen this morning.

So, those bears holding on right now should merely button up their flak jackets, sit back..and wait.

More across the afternoon.

11am update - VIX holding up for the bears

Considering the gains across the indexes this morning, the VIX is holding up very well. This could easily be a clear sign for the bears that this move higher is an intra-day fake.

VIX'60min

sp'60min

Summary

Next soft resistance for the bulls is sp'1335. I would be very surprised if we can close over that.

I remain holding short...until 1300. I'm certainly not bailing at these levels.

--

One thing I am keeping in mind though, it is arguably very important for the June month to close at least marginally red. Bears need to see the SP' fall back 20pts or so by Friday. As I noted a few days ago, I'd really like to see Friday close sp'1305 or lower.

sp'monthly

More later!

VIX'60min

sp'60min

Summary

Next soft resistance for the bulls is sp'1335. I would be very surprised if we can close over that.

I remain holding short...until 1300. I'm certainly not bailing at these levels.

--

One thing I am keeping in mind though, it is arguably very important for the June month to close at least marginally red. Bears need to see the SP' fall back 20pts or so by Friday. As I noted a few days ago, I'd really like to see Friday close sp'1305 or lower.

sp'monthly

More later!

Pre-Market Brief

Good morning! Today should be one for the bears. Now, remember, last Thursday the market opened marginally up..but still closed down around dow -250pts. So, we have a long day ahead. Bears should not get rattled by minor up moves. The main trend remains down.

Key econ-data just out..

Durable Goods Orders: 1.1% vs 0.4 expected... so.. that will was certainly above the outlook.

*pending home sales at 10am.

--

sp'60min

vix'60min

We could easily see a spike up to VIX'22 later today or tomorrow.

Summary

Bears need to see a break of yesterdays low of 1310. That should open up 1300, and if that fails to hold, then the low 1290s. The 200 day MA at 1297 will certainly be one key level to keep in mind for those looking to exit today/tomorrow.

With Durable Goods Orders somewhat better than expected, futures are flat/marginally higher.

Good wishes for Wednesday trading!

Key econ-data just out..

Durable Goods Orders: 1.1% vs 0.4 expected... so.. that will was certainly above the outlook.

*pending home sales at 10am.

--

sp'60min

vix'60min

Summary

Bears need to see a break of yesterdays low of 1310. That should open up 1300, and if that fails to hold, then the low 1290s. The 200 day MA at 1297 will certainly be one key level to keep in mind for those looking to exit today/tomorrow.

With Durable Goods Orders somewhat better than expected, futures are flat/marginally higher.

Good wishes for Wednesday trading!

Primary target remains sp'1100

The short term daily action remains choppy - as is often the case, but the multi-month trend remains absolutely clear.

We remain in a downtrend since the rollover in April.

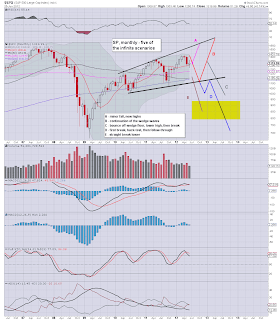

sp'monthly, scenario outlook

Summary

A significant decline is anticipated in July, and we could swiftly decline all the way the target zone of 1150/00, although it may take as long as August to reach the target. In the scheme of things, I don't much care how many weeks it takes. As I increasingly like to say..'the good bear..is a patient bear'.

---

My 'best guess' scenario target remains B.

B for Bernanke...you might say. If Benny does not at least overtly hint at QE3 in August though..we'll soon break the 1100 level, at which point there will be two key levels/zones to look for.

1. Sp'1060s would clearly take out last years low

2. Sp'999, would break the ultimate psychological level. The market has not been <1000, since Sept'2009..

Looking ahead to Wednesday

Some key econ-data pre-market...so be sure not to oversleep! I'd be content to exit my latest short around sp'1300, but its viable we could even go a little lower than that. As ever..good short-stops..will make things simpler.

Goodnight from London

We remain in a downtrend since the rollover in April.

sp'monthly, scenario outlook

Summary

A significant decline is anticipated in July, and we could swiftly decline all the way the target zone of 1150/00, although it may take as long as August to reach the target. In the scheme of things, I don't much care how many weeks it takes. As I increasingly like to say..'the good bear..is a patient bear'.

---

My 'best guess' scenario target remains B.

B for Bernanke...you might say. If Benny does not at least overtly hint at QE3 in August though..we'll soon break the 1100 level, at which point there will be two key levels/zones to look for.

1. Sp'1060s would clearly take out last years low

2. Sp'999, would break the ultimate psychological level. The market has not been <1000, since Sept'2009..

Looking ahead to Wednesday

Some key econ-data pre-market...so be sure not to oversleep! I'd be content to exit my latest short around sp'1300, but its viable we could even go a little lower than that. As ever..good short-stops..will make things simpler.

Goodnight from London

Daily Index Cycles - Bearish Wednesday ahead

The daily cycles all look set for a bearish Wednesday..and indeed, possibly the rest of this week. First downside target will be sp'1300/1290..which is feasible by the end of tomorrow.

IWM, bearish

Dow

Sp, daily, 4mth

Transports

Summary

The MACD cycle (blue bar histogram) is indeed set to go negative cycle tomorrow. The algo-bots will doubtless be programmed to sell into that type of signal. At some point we are going to take out the recent sp'1266 low..and then move to 1225/00. The early part of July..starting next week no less, will be one VERY busy time for those shorting their way to sp'1150/00.

I remain holding short overnight..and indeed, seeking my next exit (my third post-FOMC short-trade) somewhere around sp'1300/1290...late Wednesday..or Thursday. I really don't mind ;)

A little more later...

IWM, bearish

Dow

Sp, daily, 4mth

Transports

Summary

The MACD cycle (blue bar histogram) is indeed set to go negative cycle tomorrow. The algo-bots will doubtless be programmed to sell into that type of signal. At some point we are going to take out the recent sp'1266 low..and then move to 1225/00. The early part of July..starting next week no less, will be one VERY busy time for those shorting their way to sp'1150/00.

I remain holding short overnight..and indeed, seeking my next exit (my third post-FOMC short-trade) somewhere around sp'1300/1290...late Wednesday..or Thursday. I really don't mind ;)

A little more later...

Subscribe to:

Comments (Atom)