With US equity indexes closing broadly weak, the VIX battled higher from an early low of 15.22, settling -0.9% @ 15.91. Near term outlook offers the sp'2020s which should equate to VIX 18/19s. If sp'2000/1990s, VIX will briefly test the 20/21 zone... before rapidly cooling into mid month.

VIX'60min

VIX'daily3

Summary

A day of relative minor swings for equities and the VIX.

What should be clear, sustained action above the key 20 threshold looks out of range until at least late May.

--

more later... on the indexes

Thursday, 5 May 2016

Closing Brief

US equities closed on broadly weak, sp -0.5pts @ 2050. The two leaders - Trans/R2K, settled lower by -1.1% and -0.5% respectively. Near term outlook offers a break of the sp'2040 threshold. The big unknown is whether the two soft lows of 2039/33 will hold. A weekly close in the 2020s would lead to 2000/1990s, before next bounce.

sp'60min

Summary

*closing hour action: not surprisingly... just more minor chop

--

Frankly, not much to say about today.

After two days of decline.. a day chop.. as market was content to enter a holding pattern ahead of the next key econ-data.

From a pure cyclical perspective, the setup arguably favours the equity bears, not least as the daily/weekly cycles are swinging increasingly toward the bears each day.

Have a good evening.

--

*earnings due: GPRO, WYNN, and SQ.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: not surprisingly... just more minor chop

--

Frankly, not much to say about today.

After two days of decline.. a day chop.. as market was content to enter a holding pattern ahead of the next key econ-data.

From a pure cyclical perspective, the setup arguably favours the equity bears, not least as the daily/weekly cycles are swinging increasingly toward the bears each day.

Have a good evening.

--

*earnings due: GPRO, WYNN, and SQ.

--

more later... on the VIX

3pm update - chop into the close

US equities remain in minor chop mode, with a likely close in the sp'2055/50 zone. Oil has significantly cooled from morning highs... currently +1% in the $44s. USD is set for a third day of gains, +0.6% in the DXY 93.70s.

sp'60min

USO, daily2

Summary

*that is a rather stinky black-fail candle for Oil.. and notably, the third one in recent days. Its a pretty rare thing to see.. showing repeated failures to hold gains.

At the very least, oil bulls should be somewhat concerned.

--

Not much to add.

Market is set for more chop into the close... ahead of the Friday monthly jobs data.

-

notable weakness... FCX, daily

Having broken rising trend, next key support is around $10.. and that is around 10% lower.

--

back at the close

-

3.01pm.. ohoh, clown finance TV doing a live interview with fed official Lockhart in the closing hour.

Mr Market IS watching.....................

.. and here he is...

Touting Q2-4 will be better than Q1.

sp'60min

USO, daily2

Summary

*that is a rather stinky black-fail candle for Oil.. and notably, the third one in recent days. Its a pretty rare thing to see.. showing repeated failures to hold gains.

At the very least, oil bulls should be somewhat concerned.

--

Not much to add.

Market is set for more chop into the close... ahead of the Friday monthly jobs data.

-

notable weakness... FCX, daily

Having broken rising trend, next key support is around $10.. and that is around 10% lower.

--

back at the close

-

3.01pm.. ohoh, clown finance TV doing a live interview with fed official Lockhart in the closing hour.

Mr Market IS watching.....................

.. and here he is...

Touting Q2-4 will be better than Q1.

2pm update - more bearish sunshine

US equities remain in minor chop mode.. with underlying price pressure still clearly leaning to the downside. A break into the sp'2030s remains very viable tomorrow. A more dynamic move into the 2020s would start to give initial clarity/confidence that 2111 was indeed an important mid term high.

sp'60min

VIX'60min

Summary

*no doubt, part of the current afternoon equity cooling is due to Oil, which has lost most of the earlier 3% gains.

--

So.. we're a little lower.

Considering current price action remains broadly subdued, a break under the sp'2040 threshold looks more viable tomorrow than by today's close.

If the market can break under the soft two lows of 2039/33.. with a weekly close in the 2020s, we'll likely see another wave lower next Mon/Tuesday to 2000/1990s.. and then another bounce of around 3%.

-

Here in London city....

Pretty hazy, but I'm fine with that :)

sp'60min

VIX'60min

Summary

*no doubt, part of the current afternoon equity cooling is due to Oil, which has lost most of the earlier 3% gains.

--

So.. we're a little lower.

Considering current price action remains broadly subdued, a break under the sp'2040 threshold looks more viable tomorrow than by today's close.

If the market can break under the soft two lows of 2039/33.. with a weekly close in the 2020s, we'll likely see another wave lower next Mon/Tuesday to 2000/1990s.. and then another bounce of around 3%.

-

Here in London city....

Pretty hazy, but I'm fine with that :)

1pm update - oil is starting to cool

US equities remain in minor chop mode, sp +3pts @ 2054. Most notable right now is the price action in oil, which has started to cool. The current black-fail daily candle should be at least somewhat concerning to the equity/oil bull maniacs.

USO'daily2

sp'60min

Summary

Little to add.

Market is seeing a day of minor chop.. ahead of the jobs data.

Cyclically, the setup will favour the equity bears tomorrow, not least as the bigger daily/weekly cycles are leaning bearish.

--

time for some sun....

USO'daily2

sp'60min

Summary

Little to add.

Market is seeing a day of minor chop.. ahead of the jobs data.

Cyclically, the setup will favour the equity bears tomorrow, not least as the bigger daily/weekly cycles are leaning bearish.

--

time for some sun....

12pm update - minor swings

US equities remain in minor chop mode, seeing a morning low of sp'2051, but seemingly headed for another brief foray to the 2060/65 zone. Sustained action >2080 looks out of range before the 2030/20s. Market is clearly content for a day of minor chop before the Friday monthly jobs data.

sp'60min

VIX'60min

Summary

So... a touch of weakness to 2051.. and a clear spike back upward. As things are, we'll be cyclically on the high side by the close of today. For the equity bears.. that at least offers a reasonable setup for tomorrow.

--

notable weakness: the EU financial of doom: DB, daily

Another rather nasty day, currently -3% or so in the $16s. The $10 threshold looks a valid target this summer... and if that's the case, its hard to envision sp' now having broken under the 1810 low.

--

time to see what the cheerleaders are saying on clown finance TV.......

sp'60min

VIX'60min

Summary

So... a touch of weakness to 2051.. and a clear spike back upward. As things are, we'll be cyclically on the high side by the close of today. For the equity bears.. that at least offers a reasonable setup for tomorrow.

--

notable weakness: the EU financial of doom: DB, daily

Another rather nasty day, currently -3% or so in the $16s. The $10 threshold looks a valid target this summer... and if that's the case, its hard to envision sp' now having broken under the 1810 low.

--

time to see what the cheerleaders are saying on clown finance TV.......

11am update - the reality sets in for TSLA

Whilst the main market is seeing moderate chop (increasingly leaning weak)... there is notable weakness in Tesla (TLSA) currently -4% in the $213s. Next support is around 200/195, and its somewhat amusing to see one analyst on clown finance TV already touting a return to the $140s.

TSLA, daily

sp'60min

Summary

re: TSLA. I actually like the company.. great product line, but the reality remains.. it doesn't make a profit.

Despite a planned massive ramp in production to 500,000 vehicles by 2017/18.. that remains a plan.. and for the moment, Mr Market is not content.

A further capital injection is going to be necessary to fund this loss making company. Whether that is via new shares.. or just adding to existing debt.... difficult to say.

In any case.. TSLA looks headed for 200/195 in the near term. A return to the Feb' low in the 140s looks a pretty easy target... and that doesn't even assume sp'1600s.

--

As for the main market.... choppy... a minor daily gain looks probable.... with a move to the 2030s tomorrow.. which should equate to VIX 18s.

It remains the case that bears should pushing for a daily close in the 2020s, to give some initial confidence that 2111 is a key mid term high.

--

other notable weakness... AAPL, daily

Sub $90s look due this summer... next target is around $70.

--

stay tuned

TSLA, daily

sp'60min

Summary

re: TSLA. I actually like the company.. great product line, but the reality remains.. it doesn't make a profit.

Despite a planned massive ramp in production to 500,000 vehicles by 2017/18.. that remains a plan.. and for the moment, Mr Market is not content.

A further capital injection is going to be necessary to fund this loss making company. Whether that is via new shares.. or just adding to existing debt.... difficult to say.

In any case.. TSLA looks headed for 200/195 in the near term. A return to the Feb' low in the 140s looks a pretty easy target... and that doesn't even assume sp'1600s.

--

As for the main market.... choppy... a minor daily gain looks probable.... with a move to the 2030s tomorrow.. which should equate to VIX 18s.

It remains the case that bears should pushing for a daily close in the 2020s, to give some initial confidence that 2111 is a key mid term high.

--

other notable weakness... AAPL, daily

Sub $90s look due this summer... next target is around $70.

--

stay tuned

10am update - opening shaky gains

US equities open a little higher, but the gains are a little shaky, as underlying price pressure is still leaning to the downside. VIX remains broadly subdued, fractionally lower in the 15.90s. USD is notably higher, +0.5% in the DXY 93.60s. Oil +3.4% in the $45s.

sp'60min

VIX'60min

Summary

*Fed official Bullard -the bane of the equity bears, is talking around lunch time, and Mr Market will be listening.

--

The opening minor gains have already almost faded... but price action remains pretty subdued. A break of yesterday's low of sp'2045 looks unlikely today.

Best guess... a fractionally higher/flat close... with another break lower - into the sp'2030s - with VIX 17/18s tomorrow.

--

Meanwhile... Cramer is a little twitchy that the BDI has fallen for the past four days.

Ironically, this is the same guy who has been interpreting the recent rally in the BDI as a super bullish sign for the world economy. Maybe someone needs to show him a 10yr chart for some perspective.

--

notable weakness... FIT, daily

Earnings were lousy, an ugly stock, almost one year old, FIT looks set to break the Feb' low of $11.91.. and eventually sub $10.

yours.. not wearing an electronic step counter.

sp'60min

VIX'60min

Summary

*Fed official Bullard -the bane of the equity bears, is talking around lunch time, and Mr Market will be listening.

--

The opening minor gains have already almost faded... but price action remains pretty subdued. A break of yesterday's low of sp'2045 looks unlikely today.

Best guess... a fractionally higher/flat close... with another break lower - into the sp'2030s - with VIX 17/18s tomorrow.

--

Meanwhile... Cramer is a little twitchy that the BDI has fallen for the past four days.

Ironically, this is the same guy who has been interpreting the recent rally in the BDI as a super bullish sign for the world economy. Maybe someone needs to show him a 10yr chart for some perspective.

--

notable weakness... FIT, daily

Earnings were lousy, an ugly stock, almost one year old, FIT looks set to break the Feb' low of $11.91.. and eventually sub $10.

yours.. not wearing an electronic step counter.

Pre-Market Brief

Good morning. US equity futures are moderately higher, sp +9pts, we're set to open at 2060. USD continues to claw higher, +0.3% in the DXY 93.40s. Metals are rebounding, Gold +$2, with Silver +1.0%. Oil is powerfully higher, +3.8% in the $45s.

sp'60min

Summary

So, we're set to open in yesterday's gap zone of 2063/60. Further upside much beyond 2070 looks unlikely.

Equity bears should be aiming for a flat close, with a break lower tomorrow, at least into the 2030s.

--

early movers....

TSLA +4% @ $231, post earnings

CHK +7.... junk rebounding

FCX +3% .. as above

SDRL +5% ""

--

Overnight action

Japan: CLOSED

China: +0.2% @ 2997

Germany: currently +0.1% @ 9838.

-

Have a good Thursday

-

8.44am jobless claims, 274k.... a little higher... but still.... remaining very low. Those calling for an outright recession are going to need to see 350/400k.

re: Friday monthly jobs. Market is seeking net gains of 200k.. with a headline rate a touch lower @ 4.9%. That does not seem overly optimistic... and will likely be attained.

--

notable weakness: DB, -2.0%... as financials continue to remain under pressure as threat of Draghi lowering rates again.

Its somewhat ironic that at least the market seems to accept that low/negative rates are bad for the financials.. the very sector that almost took down the system in 2008.

sp'60min

Summary

So, we're set to open in yesterday's gap zone of 2063/60. Further upside much beyond 2070 looks unlikely.

Equity bears should be aiming for a flat close, with a break lower tomorrow, at least into the 2030s.

--

early movers....

TSLA +4% @ $231, post earnings

CHK +7.... junk rebounding

FCX +3% .. as above

SDRL +5% ""

--

Overnight action

Japan: CLOSED

China: +0.2% @ 2997

Germany: currently +0.1% @ 9838.

-

Have a good Thursday

-

8.44am jobless claims, 274k.... a little higher... but still.... remaining very low. Those calling for an outright recession are going to need to see 350/400k.

re: Friday monthly jobs. Market is seeking net gains of 200k.. with a headline rate a touch lower @ 4.9%. That does not seem overly optimistic... and will likely be attained.

--

notable weakness: DB, -2.0%... as financials continue to remain under pressure as threat of Draghi lowering rates again.

Its somewhat ironic that at least the market seems to accept that low/negative rates are bad for the financials.. the very sector that almost took down the system in 2008.

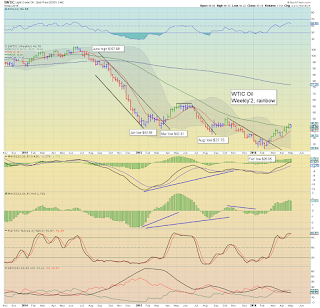

WTIC oil remains vulnerable

WTIC Oil has rallied from the Feb' low of $26.05 to last week's high of $46.78. A large part of the recent rally since Feb' has been the weakening USD. If the USD can at least hold the DXY 91s, considering the over supply issue remaining completely unresolved, Oil remains vulnerable to renewed downside into the summer.

WTIC, daily

WTIC, weekly

Summary

The current blue candle on the weekly chart is marginally interesting, but we're still holding above the rising trend/support from the February low.

Oil bears need to see a weekly/monthly close under the $40 threshold to have any initial confidence that the low 30s or even a return to test the $26 low is possible this summer.

Considering the over-supply issue, I'm still of the view that WTIC oil in the teens would make for a far more natural capitulation for the energy industry.

--

Market/Gold chatter from Schiff

--

Looking ahead

Thursday will see the usual weekly jobless claims.

*Fed official Bullard - the bane of the equity bears (remember Oct'2014?), is due to speak in late morning.

In AH, a quartet of fed presidents are at a conf' in Stanford.

--

Goodnight from London

WTIC, daily

WTIC, weekly

Summary

The current blue candle on the weekly chart is marginally interesting, but we're still holding above the rising trend/support from the February low.

Oil bears need to see a weekly/monthly close under the $40 threshold to have any initial confidence that the low 30s or even a return to test the $26 low is possible this summer.

Considering the over-supply issue, I'm still of the view that WTIC oil in the teens would make for a far more natural capitulation for the energy industry.

--

Market/Gold chatter from Schiff

--

Looking ahead

Thursday will see the usual weekly jobless claims.

*Fed official Bullard - the bane of the equity bears (remember Oct'2014?), is due to speak in late morning.

In AH, a quartet of fed presidents are at a conf' in Stanford.

--

Goodnight from London

Daily Index Cycle update

US equities closed broadly lower for a second consecutive day, sp -12pts

@ 2051 (intra low 2045). The two leaders - Trans/R2K, settled lower by

-0.9% and -0.8% respectively. Near term outlook offers a break under the

important 2040 threshold.. with a fair opportunity of a weekly close in

the 2020s.

sp'daily

Dow

Summary

Suffice to add... equities continue to weaken from the sp'2111 high. Overall price action is yet to get especially bearish.. with a great many aspects of support from the 2040 threshold to the 1990s.

Sustained action under the giant psy' level of 2K looks unlikely until late May.

--

a little more later...

sp'daily

Dow

Summary

Suffice to add... equities continue to weaken from the sp'2111 high. Overall price action is yet to get especially bearish.. with a great many aspects of support from the 2040 threshold to the 1990s.

Sustained action under the giant psy' level of 2K looks unlikely until late May.

--

a little more later...

Subscribe to:

Comments (Atom)