With US equities closing broadly lower, the VIX was back on the rise (intra high 16.42), settling +6.3% @ 15.60. Near term outlook offers the sp'2040/38 zone... which should equate to VIX 18s. Sustained action above the key 20 threshold still looks out of range in the current cycle.

VIX'60min

VIX'daily3

Summary

Without question.. in the scheme of things, the VIX remains at relatively low levels. Even a move to the 18/19s later this week would still make for a VIX that is massively below the levels since in Jan/Feb'.

At best.. VIX might see 19-21 zone in the near term. Sustained action above the key 20 threshold looks out of range.

--

more later... on the indexes

Tuesday, 3 May 2016

Closing Brief

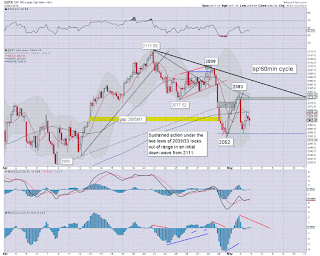

US equity indexes closed broadly weak, sp -18pts @ 2063 (intra low 2054). The two leaders - Trans/R2K, settled lower by -1.2% and -1.7% respectively. Near term outlook offers sp'2040/38 - where the 50dma is lurking. A daily close under the two soft lows of 2039/33, in the 2020s will not be easy.

sp'60min

Summary

*closing hour action: weakness into the close, but nothing significant.

--

.. and thus concludes another day in the world's most twisted casino.

Certainly, the intraday bounce from 2054 to 2069 gave most equity bears a scare (yours truly included).. as there was threat of another push to the 2080s again.

The bigger daily/weekly cycles continue to increasingly swing in favour to the equity bears.

Even a basic 38% fib retrace would give the sp'1990s... which is a 6% cooling from the 2111 high.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: weakness into the close, but nothing significant.

--

.. and thus concludes another day in the world's most twisted casino.

Certainly, the intraday bounce from 2054 to 2069 gave most equity bears a scare (yours truly included).. as there was threat of another push to the 2080s again.

The bigger daily/weekly cycles continue to increasingly swing in favour to the equity bears.

Even a basic 38% fib retrace would give the sp'1990s... which is a 6% cooling from the 2111 high.

--

more later... on the VIX

3pm update - Tuesday negates Monday

Despite a notable rally from the earlier low of sp'2054, US equities are still set to close broadly lower, with most indexes set to negate most/all of yesterday's nonsense. VIX is still lacking any sustained upside power. Near term target remains sp'2040 with VIX 18s.

sp'60min

VIX'60min

Summary

So... yesterday.. the setup was leaning bearish.

Today.. - from the 5/15/60min cyclical perspective.. its less bearish.. although the daily/weekly cycles are more bearish.

.. if that makes sense?

What does seem clear... until we take out the two soft lows of 2039/33... with a daily close in the sp'2020s... equity bears can't yet get any initial confidence that 2111 is a key mid term high.

I'm guessing 2111 is a key high, but I sure as hell ain't remotely confident yet... and the current price action remains frequently annoying.

-

notable strength: AAPL, daily

yes.. AAPL is net higher... but then it has been due a bounce.. if only for a day or two. AAPL will have serious problems if the sp' loses the 2030s later this week.

sp'60min

VIX'60min

Summary

So... yesterday.. the setup was leaning bearish.

Today.. - from the 5/15/60min cyclical perspective.. its less bearish.. although the daily/weekly cycles are more bearish.

.. if that makes sense?

What does seem clear... until we take out the two soft lows of 2039/33... with a daily close in the sp'2020s... equity bears can't yet get any initial confidence that 2111 is a key mid term high.

I'm guessing 2111 is a key high, but I sure as hell ain't remotely confident yet... and the current price action remains frequently annoying.

-

notable strength: AAPL, daily

yes.. AAPL is net higher... but then it has been due a bounce.. if only for a day or two. AAPL will have serious problems if the sp' loses the 2030s later this week.

2pm update - its getting annoying again

US equities have recovered from a low of sp'2054 to 2068, with VIX cooling back to the low 15s. It remains the case that the bull maniacs are still not remotely concerned that 2111 might be a key marginally lower high. Oil remains broadly weak, -2.9% in the $43s.

sp'60min

VIX'60min

Summary

So yes.... I'm getting somewhat annoyed, not least as the VIX has lost almost two thirds of the earlier gains.

Equity bears need to turn this around into the close.. otherwise the gap zone of 2079/77 will be a threat tomorrow.. with descending trend around 2090 at the Wed' open.

-

Here in London city....

The forecast is for the 70s with sunshine later this week. Is that bearish for UK equities?

-

notable strength, AAPL +2.2% in the $95s... but more on that one later.

sp'60min

VIX'60min

Summary

So yes.... I'm getting somewhat annoyed, not least as the VIX has lost almost two thirds of the earlier gains.

Equity bears need to turn this around into the close.. otherwise the gap zone of 2079/77 will be a threat tomorrow.. with descending trend around 2090 at the Wed' open.

-

Here in London city....

The forecast is for the 70s with sunshine later this week. Is that bearish for UK equities?

-

notable strength, AAPL +2.2% in the $95s... but more on that one later.

1pm update - where are the dip buyers?

US equities remain broadly weak, and are still well within range of breaking the Friday low of sp'2052 before today's close. A test of the 50dma - around 2040/38, looks highly probable in the near term. VIX is +7%.. and is still relatively low in the 15s.

sp'daily5

VIX'daily3

Summary

Little to add.

Now its merely a case of whether we close weak... or see another dumb closing hour ramp like Friday. Considering the bigger daily/weekly cycles.. we should lean weak.

--

notable weakness.... STX, daily

Ugly as hell... now under the psy' level of $20... the $10/7s look due.. if sp'1600s.

-

time for some sun.... back at 2pm

sp'daily5

VIX'daily3

Summary

Little to add.

Now its merely a case of whether we close weak... or see another dumb closing hour ramp like Friday. Considering the bigger daily/weekly cycles.. we should lean weak.

--

notable weakness.... STX, daily

Ugly as hell... now under the psy' level of $20... the $10/7s look due.. if sp'1600s.

-

time for some sun.... back at 2pm

12pm update - broadly weak

US equities remain broadly weak, having broken a new intra low of sp'2054 - with VIX 16.42. Oil remains under sig' pressure, -2.6% in the $44s, the 42/41s look due later this week. USD has seen a sig' swing from the DXY 91.90s to the 92.80s.

sp'daily5

USO, daily2

Summary

re: Oil/USO.. next support will be around $10.00 this Friday... and that is another 5% lower.. equiv' to WTIC around $42/41s

--

So.. we've already come pretty close to breaking the Friday low of sp'2052.

The mainstream cheerleaders are clearly a little twitchy.. as they are starting to wonder just how low we might trade by the end of the week.

A break <2052 looks highly probable.. and that will lead to another push to 2040.. where the 50dma is lurking.

--

notable weakness.. miners.. FCX, daily

A second day lower.. but still holding within the upward trend. The Jan' low of $3.52 looks a bizarrely long ways lower

--

time for lunch :)

sp'daily5

USO, daily2

Summary

re: Oil/USO.. next support will be around $10.00 this Friday... and that is another 5% lower.. equiv' to WTIC around $42/41s

--

So.. we've already come pretty close to breaking the Friday low of sp'2052.

The mainstream cheerleaders are clearly a little twitchy.. as they are starting to wonder just how low we might trade by the end of the week.

A break <2052 looks highly probable.. and that will lead to another push to 2040.. where the 50dma is lurking.

--

notable weakness.. miners.. FCX, daily

A second day lower.. but still holding within the upward trend. The Jan' low of $3.52 looks a bizarrely long ways lower

--

time for lunch :)

11am update - significantly lower

US equities continue to slip, with all the main indexes now significantly lower. It is notable that the 'old leader' - Transports, has taken out the 50/200 day MAs. VIX is holding gains of around 8%, but still in the relatively low upper 15s.

Trans, daily

VIX'daily3

Summary

Well, its kinda interesting... but really... even a daily close in the 2040s won't get me particularly excited. For that... I need the 2020s, and that is clearly out of range today.. if not until Friday.

VIX has plenty of upside spike territory to the 19/21 zone. The bigger weekly cycle offers 25/28s.. but that looks out of range in the current cycle.

For now.. a realistic outcome is 2040.. with VIX 18s.

Best case... 1990s.. with VIX 20/21s... briefly.

In either case.. another bounce... at least to 2050/60s.

--

notable weakness... DB, daily

... with the Australian central bank cutting rates.. its a reminder that low rates.. or worse - NIRP, are a disastrous monetary policy for the financials. When DB loses the $15s, it'll be a clear signal the broader world markets are about to snap powerfully lower.

--

time to cook

Trans, daily

VIX'daily3

Summary

Well, its kinda interesting... but really... even a daily close in the 2040s won't get me particularly excited. For that... I need the 2020s, and that is clearly out of range today.. if not until Friday.

VIX has plenty of upside spike territory to the 19/21 zone. The bigger weekly cycle offers 25/28s.. but that looks out of range in the current cycle.

For now.. a realistic outcome is 2040.. with VIX 18s.

Best case... 1990s.. with VIX 20/21s... briefly.

In either case.. another bounce... at least to 2050/60s.

--

notable weakness... DB, daily

... with the Australian central bank cutting rates.. its a reminder that low rates.. or worse - NIRP, are a disastrous monetary policy for the financials. When DB loses the $15s, it'll be a clear signal the broader world markets are about to snap powerfully lower.

--

time to cook

10am update - opening weakness

US equities open broadly lower, with the sp'500 back in the 2060s - with VIX 16s. First soft target is around 2040.. which should equate to VIX 18/19s. Oil is not helping underlying market mood, -1.6% in the $44s.

sp'daily5

VIX'daily3

Summary

After yesterday's rebound, this morning's open really helps increase the probability that we'll at least hit the 50dma around 2040 within the next few days.

Things only get interesting on a daily close in the 2020s, and that remains a very difficult level to hit in the current down cycle from 2111.

Again, if we do see a break <2033.. that will open up a 38% fib retrace to the 1990s.. before next sig' bounce.

-

notable weakness, TWTR, daily

Continuing to degrade... seemingly headed lower until a 'bargain bidder' appears from the shadows.

--

time to shop... back soon

sp'daily5

VIX'daily3

Summary

After yesterday's rebound, this morning's open really helps increase the probability that we'll at least hit the 50dma around 2040 within the next few days.

Things only get interesting on a daily close in the 2020s, and that remains a very difficult level to hit in the current down cycle from 2111.

Again, if we do see a break <2033.. that will open up a 38% fib retrace to the 1990s.. before next sig' bounce.

-

notable weakness, TWTR, daily

Continuing to degrade... seemingly headed lower until a 'bargain bidder' appears from the shadows.

--

time to shop... back soon

Pre-Market Brief

Good morning. US equity futures are broadly lower, sp -15pts, we're set to open at 2066. USD continues to weaken, -0.2% in the DXY 92.40s. Metals are little stronger, Gold +$6, with Silver +0.1%. Oil is sig' lower, -1.2% in the $44s.

sp'60min

Summary

So.... almost all of yesterday's gains are set to be negated at the open... for the bears.. this is a rather good start to the day.

What will be important is breaking under the Friday low of 2052... but that is 29pts (1.4%) lower... and considering the power of the rebounds... it won't be easy.

The bigger daily/weekly cycles continue to lean in favour of the bears.. and 2040 remains a realistic initial target this week.

Things only get interesting on a daily close in the 2020s, and that looks out of range this week.

*if we do break under 2033 though... a 38% fib retrace (of 1810-2111) to the 1990s will become a target.. before next opex.

--

early movers...

BAC -1.3%.. as Mr Market is struggling whether to price in a rate hike.. or otherwise.

FCX -2.5% in the $13s.. which is a somewhat bizarre level considering the global economic weakness

SDRL -6.4%... as oil/energy sector back under pressure

VIX +8% in the 15.80s.. breaking the Friday high of 17.09 will be tough.... and will be more viable tomorrow.

--

Update from Mr C.

Mostly commodity chatter.. but it merits some consideration.

--

Overnight action

Japan: CLOSED

China: +1.8% @ 2992... are the PBOC meddling again?

Germany: -1.8% @ 9938... indeed, the loss of the 10K threshold will have some of the bull maniacs a little twitchy now.

--

Have a good Tuesday

-

9.27am.. In far more important news.. Capt' will ring the opening bell.

Bullish team Capt'

sp'60min

Summary

So.... almost all of yesterday's gains are set to be negated at the open... for the bears.. this is a rather good start to the day.

What will be important is breaking under the Friday low of 2052... but that is 29pts (1.4%) lower... and considering the power of the rebounds... it won't be easy.

The bigger daily/weekly cycles continue to lean in favour of the bears.. and 2040 remains a realistic initial target this week.

Things only get interesting on a daily close in the 2020s, and that looks out of range this week.

*if we do break under 2033 though... a 38% fib retrace (of 1810-2111) to the 1990s will become a target.. before next opex.

--

early movers...

BAC -1.3%.. as Mr Market is struggling whether to price in a rate hike.. or otherwise.

FCX -2.5% in the $13s.. which is a somewhat bizarre level considering the global economic weakness

SDRL -6.4%... as oil/energy sector back under pressure

VIX +8% in the 15.80s.. breaking the Friday high of 17.09 will be tough.... and will be more viable tomorrow.

--

Update from Mr C.

Mostly commodity chatter.. but it merits some consideration.

--

Overnight action

Japan: CLOSED

China: +1.8% @ 2992... are the PBOC meddling again?

Germany: -1.8% @ 9938... indeed, the loss of the 10K threshold will have some of the bull maniacs a little twitchy now.

--

Have a good Tuesday

-

9.27am.. In far more important news.. Capt' will ring the opening bell.

Bullish team Capt'

Japan continues to struggle

Whilst the US equity market started the month on a broadly positive note, there remained underlying weakness in Japan, with the Nikkei -3.1% @ 16147. Despite continued meddling by the BoJ, the Nikkei continues to struggle since the June 2015 high of 20952.

Japan, monthly

sp'monthly

Summary

sp'monthly: it is notable that the important 10MA is currently @ 2017. Equity bears seeking broad downside this summer/autumn should be seeking a May close well under that.. preferably <1950, which is some 6.5% lower.

The May 20th 2015 high of 2134.72 will indeed be almost a full year old in just 3 weeks time.

re: Japan: despite the BoJ printers spinning... its still not been enough to stop the Nikkei from broadly declining across the year. Target downside is the 13/12k zone.

--

Market chatter from Schiff

--

Looking ahead

Tuesday has nothing of significance scheduled.

*Fed official Mester will be speaking in the morning, with Lockhart in the evening.

--

Goodnight from London

Japan, monthly

sp'monthly

Summary

sp'monthly: it is notable that the important 10MA is currently @ 2017. Equity bears seeking broad downside this summer/autumn should be seeking a May close well under that.. preferably <1950, which is some 6.5% lower.

The May 20th 2015 high of 2134.72 will indeed be almost a full year old in just 3 weeks time.

re: Japan: despite the BoJ printers spinning... its still not been enough to stop the Nikkei from broadly declining across the year. Target downside is the 13/12k zone.

--

Market chatter from Schiff

--

Looking ahead

Tuesday has nothing of significance scheduled.

*Fed official Mester will be speaking in the morning, with Lockhart in the evening.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed broadly higher, sp +16pts @ 2081. The two

leaders - Trans/R2K, settled higher by 0.7% and 0.9% respectively. Near

term outlook offers renewed downside to the 2040s. A daily close in the

2030/20s will be really difficult, along with a VIX above the key 20

threshold.

sp'daily5

Nasdaq comp'

Summary

sp'500: retracing much of the Thurs/Friday decline, but remaining under the key 10MA (2088). The lower daily bollinger and the 50dma are offering a realistic downside target of 2040 later this week.

Nasdaq comp': a daily gain of 0.9%, but still under the 200dma. The 50dma looks unlikely to cross back over the 200 in the near term. First downside target is the 4600/4500s.

--

a little more later...

sp'daily5

Nasdaq comp'

Summary

sp'500: retracing much of the Thurs/Friday decline, but remaining under the key 10MA (2088). The lower daily bollinger and the 50dma are offering a realistic downside target of 2040 later this week.

Nasdaq comp': a daily gain of 0.9%, but still under the 200dma. The 50dma looks unlikely to cross back over the 200 in the near term. First downside target is the 4600/4500s.

--

a little more later...

Subscribe to:

Comments (Atom)