It was a mixed week for US equity indexes,

with net weekly changes ranging from +0.41%

(Dow), +0.14% ( NYSE comp'), +0.02% (sp'500), -0.30% (R2K), -0.48% (Trans), to

-0.64% (Nasdaq comp').

Lets take our regular look at six of the main US indexes

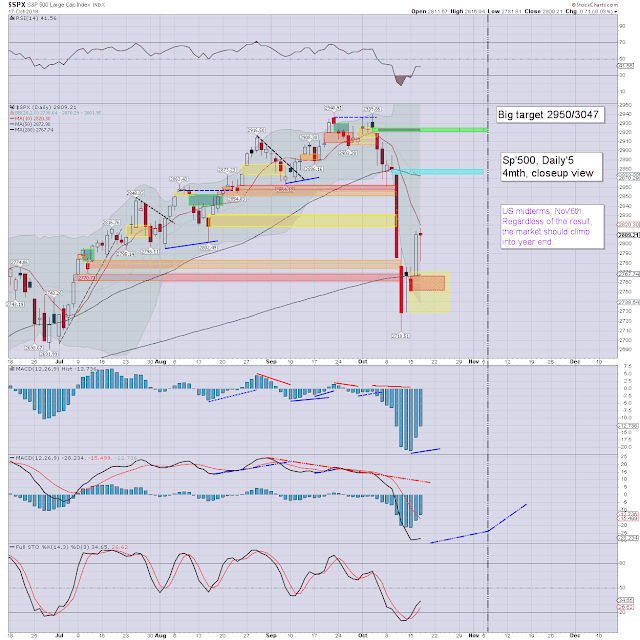

sp'500

The spx settled effectively flat for the week, having seen a rally to 2816, and swinging to a low of 2749. Underlying macd (blue bar histogram) ticked lower for a 4th week. There is plenty of potential for further sig' weakness before end month.

Best guess: a marginally lower low within 2709/2690s, before whipsawing back upward into end month. The market will have a far better chance of sustained upside once the US midterms are out of the way.

Most bearish case is the 2675/50 zone, but even if that is seen, I'd still look for an October settlement back above the monthly 10MA, which will be in the 2770s. Time is an issue though, with just eight trading days left of the month. The situation is somewhat similar to Oct'2014.

--

Nasdaq comp'

Tech closed lower for a third consecutive week, with the Nasdaq comp' settling -0.64% to 7449. Price momentum is back to levels last seen in Feb'2016. On any basis, cyclically extremely low, and due to find a floor.

Dow

The mighty Dow was very resilient this week, settling +0.41% to 25444. Despite the gain in price, actual momentum has turned outright negative, and threatens renewed sig' cooling. Note the lower bollinger, offering big support around the 24200s, and that is a clear 4% lower. If seen, it would equate to sp'2675/50.

NYSE comp'

The master index settled +0.14% at 12457. Technically, there is little sign of a floor, with the February low just 3.3% to the downside.

R2K

The second market leader - R2K, fell for a fifth consecutive week, -0.3% to 1542, the lowest close since April. Indeed, the April low of 1482 isn't far down.

Trans

The 'old leader' Transports, fell for a fifth consecutive week, settling -0.48% to 10438. Giant support within 10000/9700s.Whilst higher WTIC/fuel is an issue, it is being negated by the broadly strong US economy. Recent earnings in Delta (DAL) and United (UAL) are entirely supportive of this view.

–

Summary

Three indexes settled net higher, with three net lower.

The Dow was most resilient this week, with the Nasdaq lagging, but the net weekly changes were only moderate.

YTD performance:

The Nasdaq comp' is +7.9%, but that is some 10% lower since August. The spx is currently +3.5%, the Dow +2.9%, with the R2K +0.4%. The Trans is -1.6%, with the NYSE comp' -2.7%.

--

Looking ahead

There is a veritable truck load of earnings this week, notably: HAL (Mon'), CAT, MMM (Tues'), FCX, BA, F, MSFT, V, AMD (Wed'), INTC, MRK, TWTR, AMZN, GOOGL, SNAP (Thurs').

-

M -

T - Richmond Fed' manu'

W - FHFA house price index, new home sales, EIA Pet', Fed Beige book

T - Weekly jobs, durable goods order, intl' trade, pending home sales

F - Q3 GDP (first print*), consumer sent'

*market is expecting 3.3%, vs prev' 4.2%. I can't fathom why the market would expect such significant cooling. I would expect at least 3.5%, if not >4.0%. As ever, first print is often significantly revised.

If the GDP data does come in hotter than consensus, there will be threat of 'good news is bad news'. The market would raise expectations for more rate hikes next year, and we've seen how the market reacts to that outlook lately.

--

If you value my work, subscribe to me.

For details:

https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Have a good weekend

--

*the next post on this page will likely appear.................

Saturday, 20 October 2018

Friday, 19 October 2018

Opex swings

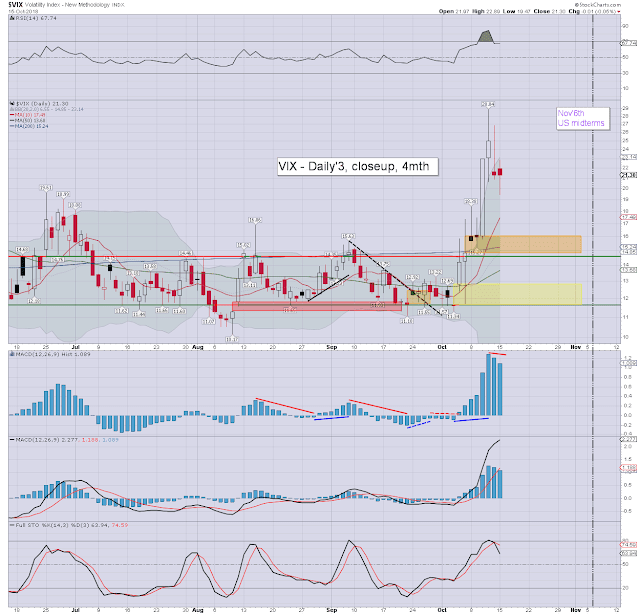

US equity indexes closed very mixed, sp -1pt at 2767. Nasdaq comp' -0.5%. The two leaders -

Trans/R2K, settled +0.3% and -1.2% respectively. VIX settled -0.8% to 19.89. Near term outlook

offers a marginally lower low (<sp'2710) next week, before whipsawing

back upward into end month.

sp'daily5

VIX'daily3

Summary

It was a day of swings in equity land, but then it was opex, which inherently leans to chop. The spx saw a morning high of 2797, but then swung lower to an afternoon low of 2760, and settling at 2767.

Volatility briefly broke above the key 20 threshold, but then resumed back into cooling mode, settling in the upper 19s. Regardless of how Monday might open, a marginally lower low (<sp'2710) looks rather probable next week. Whilst that will spook some, it would make for a more natural and solid floor, ahead of the US midterms (Nov'6th).

--

Bonus chart: Germany, monthly

With eight trading days left of October, the DAX is currently -5.66% at 11553. There is zero sign of a floor/turn, and this remains a real problem for the equity bulls.

--

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

sp'daily5

VIX'daily3

Summary

It was a day of swings in equity land, but then it was opex, which inherently leans to chop. The spx saw a morning high of 2797, but then swung lower to an afternoon low of 2760, and settling at 2767.

Volatility briefly broke above the key 20 threshold, but then resumed back into cooling mode, settling in the upper 19s. Regardless of how Monday might open, a marginally lower low (<sp'2710) looks rather probable next week. Whilst that will spook some, it would make for a more natural and solid floor, ahead of the US midterms (Nov'6th).

--

Bonus chart: Germany, monthly

With eight trading days left of October, the DAX is currently -5.66% at 11553. There is zero sign of a floor/turn, and this remains a real problem for the equity bulls.

--

|

| Night falls in the London metropolis |

|

| SpaceX to the moon... and beyond! |

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Thursday, 18 October 2018

Just another Thursday

US equity indexes closed very significantly lower, sp -40pts (1.6%) at

2768. Nasdaq comp' -2.1% at 7485. The two leaders - Trans/R2K, settled

-2.6% and -1.9% respectively. VIX settled +15.3% at 20.06. Near term outlook offers chop into opex,

but a marginally lower low (<2710) still appears probable early next

week.

sp'daily5

VIX'daily3

Summary

Thursdays do tend to favour the equity bears (for various reasons), and today's weakness was not exactly a surprise. US equities opened moderately lower, saw an early low of 2788, with an initial rally to 2806. Then comments from Draghi and Mnuchin gave the market the excuse, sending prices spiraling lower into the afternoon.

Volatility was naturally higher, with the VIX settling above the key 20 threshold. S/t outlook offers a marginally lower low (<sp'2710), although considering tomorrow is opex - which leans to chop, that is far more viable next Mon/Tuesday.

-

Bonus chart: China, monthly

With a Thursday decline of -2.9%, the Shanghai comp' is net lower for October by a rather severe -11.9%, having broken a new multi-year low of 2485. With soft psy'2500 lost, its mostly a case of 'empty air' to the giant 2K threshold. If that occurs.... implications for most China related stocks, not least BABA, JD, TCEHY, and BIDU.

--

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

sp'daily5

VIX'daily3

Summary

Thursdays do tend to favour the equity bears (for various reasons), and today's weakness was not exactly a surprise. US equities opened moderately lower, saw an early low of 2788, with an initial rally to 2806. Then comments from Draghi and Mnuchin gave the market the excuse, sending prices spiraling lower into the afternoon.

Volatility was naturally higher, with the VIX settling above the key 20 threshold. S/t outlook offers a marginally lower low (<sp'2710), although considering tomorrow is opex - which leans to chop, that is far more viable next Mon/Tuesday.

-

Bonus chart: China, monthly

With a Thursday decline of -2.9%, the Shanghai comp' is net lower for October by a rather severe -11.9%, having broken a new multi-year low of 2485. With soft psy'2500 lost, its mostly a case of 'empty air' to the giant 2K threshold. If that occurs.... implications for most China related stocks, not least BABA, JD, TCEHY, and BIDU.

--

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Wednesday, 17 October 2018

Midweek swings

US equity indexes closed a little mixed, sp -0.7pts at 2809. The two

leaders - Trans/R2K, settled -0.6% and -0.4% respectively. VIX settled -1.2% at 17.40. Near term

outlook offers sig' weakness to the sp'2750s, which would likely equate

to VIX 22/23s.

sp'daily5

VIX'daily3

Summary

US equities opened a little weak, and quickly spiraled down to 2781, before a powerful rebound to 2816. The late afternoon saw a lot of chop, leaning on the weaker side, with the spx settling effectively flat.

Volatility was naturally mixed, opening in the 17s, but then swinging to a high of 19.55, before cooling back, settling fractionally lower in the 17s. The daily candle is a hollow red reversal, which leans s/t bullish.

Thursday will (in theory) lean to sig' equity downside to the sp'2750s, which would likely equate to VIX 22/23s.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

sp'daily5

VIX'daily3

Summary

US equities opened a little weak, and quickly spiraled down to 2781, before a powerful rebound to 2816. The late afternoon saw a lot of chop, leaning on the weaker side, with the spx settling effectively flat.

Volatility was naturally mixed, opening in the 17s, but then swinging to a high of 19.55, before cooling back, settling fractionally lower in the 17s. The daily candle is a hollow red reversal, which leans s/t bullish.

Thursday will (in theory) lean to sig' equity downside to the sp'2750s, which would likely equate to VIX 22/23s.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Tuesday, 16 October 2018

Bears getting cooked

US equity indexes closed powerfully higher, sp +59pts (2.1%) at 2809.

Nasdaq comp' +2.9% to 7645. The two leaders - Trans/R2K, settled +1.8%

and +2.8% respectively. VIX settled -17.3% at 17.62. Near term outlook offers a cooling wave, some

sporadic 'spooky news' would help, especially on Thursday.

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and relentlessly built gains all the way into the late afternoon. The sp' saw a closing hour high of 2813, which is 113pts (4.2%) above the Thursday low.

With equities powerfully higher, volatility was ground lower for a third day, with the VIX settling in the mid 17s. S/t outlook still offers an equity cooling wave, but its going to take some sporadic spooky news to get anywhere near last weeks low.

--

Bonus chart: Germany, monthly

With 11 trading days left of the month, the DAX is currently -3.8% at 11776. This remains a concern.

-

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and relentlessly built gains all the way into the late afternoon. The sp' saw a closing hour high of 2813, which is 113pts (4.2%) above the Thursday low.

With equities powerfully higher, volatility was ground lower for a third day, with the VIX settling in the mid 17s. S/t outlook still offers an equity cooling wave, but its going to take some sporadic spooky news to get anywhere near last weeks low.

--

Bonus chart: Germany, monthly

With 11 trading days left of the month, the DAX is currently -3.8% at 11776. This remains a concern.

-

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Monday, 15 October 2018

Still leaning weak

US equity indexes closed rather mixed, sp -16pts (0.6%) at 2750. Nasdaq

comp' -0.9% to 7430. The two leaders - Trans/R2K, settled +0.6% and

+0.4% respectively. VIX settled -0.05% at 21.30. Near term outlook offers a marginally lower low to

around sp'2700.

sp'daily5

VIX'daily3

Summary

US equities opened little weak, seeing a low of 2749, and then clawing upward to 2775.99 in the 2pm hour.. fractionally breaking above the Friday high. The closing hour saw a distinct reversal, settling moderately lower at 2750.

Volatility saw a mixed day, settling effectively u/c in the 21s. S/t outlook offers equity cooling of around 2% to 2700, and that will likely equate to VIX 24/27s.

-

Bonus chart: China, monthly

The Shanghai comp' saw a Monday decline of -1.5%, and with 12 trading days left of the month, that makes for a current net monthly decline of -9.0%. Ugly... real ugly. Again, I have to wonder that the communist leadership are actually happy to see the capitalistic speculators hurt by lower prices.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

sp'daily5

VIX'daily3

Summary

US equities opened little weak, seeing a low of 2749, and then clawing upward to 2775.99 in the 2pm hour.. fractionally breaking above the Friday high. The closing hour saw a distinct reversal, settling moderately lower at 2750.

Volatility saw a mixed day, settling effectively u/c in the 21s. S/t outlook offers equity cooling of around 2% to 2700, and that will likely equate to VIX 24/27s.

-

Bonus chart: China, monthly

The Shanghai comp' saw a Monday decline of -1.5%, and with 12 trading days left of the month, that makes for a current net monthly decline of -9.0%. Ugly... real ugly. Again, I have to wonder that the communist leadership are actually happy to see the capitalistic speculators hurt by lower prices.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Saturday, 13 October 2018

Weekend update - US equity indexes

It was a powerfully bearish week for US equity indexes,

with net weekly declines ranging from -6.4%

(Trans), -5.2% (R2K), -4.2% (Dow, NYSE comp'), -4.1% (sp'500), to -3.7% (Nasdaq comp').

Lets take our regular look at six of the main US indexes (weekly candle charts)

sp'500

The spx fell for a third consecutive week, settling -118pts (4.1%) to 2767, with an intra low of 2710. Weekly price momentum has turned outright negative, with a bearish macd cross. Note the lower bollinger at 2701.

Best guess: next week might well open higher, but another s/t rollover will offer a marginally lower low to around 2700. That would make for a more natural key low, with renewed upside into Friday opex. I'd imagine the market makers might seek to pin the spx to around 2800.

Nasdaq comp'

Tech cooled for a second week, settling -3.7% at 7496. Note the pierce of the 50wma, which hasn't been traded under since July 2016. Another rollover early next week would offer the 7200/7000 zone.

Dow

The mighty Dow fell for a third week, settling -1107pts (4.2%) to 25399. Underlying macd (blue bar histogram) will see a bearish cross at next Monday's open, and that does lean to further s/t weakness. Note the lower bollinger, offering next support in the 24100/200s... a clear 1000pts (4%) lower.

NYSE comp'

A third consecutive week lower, settling -4.2% to 12439. The Feb' low of 12048 is just 3.1% lower.

R2K

The R2K fell for the 5th week of 6, settling -85pts (5.2%) at 1546. Underlying macd cycle is at -17.69, the lowest since Sept'2011, when price was around 675.

Trans

The 'old leader' - Trans, was the weakest index/sector this week, with a net weekly decline of a rather severe -717pts (6.4%) to 10489. There are multiple aspects of support all the way to the 9700s. WTIC/fuel prices remain a valid concern, but as seen with Delta Airlines (DAL), so long as the broader economy is growing, higher costs are tolerable, and can be (at least partly) passed onto the consumer.

–

Summary

All six of the main US indexes were powerfully lower.

The Transports lead the way lower, whilst the Nasdaq was most resilient.

YTD performance:

The Nasdaq comp' remains the leader, +8.6%, with the spx +3.5%, and the Dow +2.5%. The R2K is +0.7%, the Transports -1.2%, and the NYSE comp' -2.9%

--

Looking ahead

key earnings: BAC (Mon'), GS, MS, NFLX, UAL, IBM (Tues'), PYPL (Thurs')

--

M - Retail sales, Empire State, Busin' invent

T - Indust' prod', housing market index,

W - Housing starts, EIA Pet' report, FOMC mins (2pm)

T - Weekly jobs, phil' fed, leading indicators

F - Existing home sales, *OPEX*

--

Final note

Since the Wednesday drop, the usual suspects have crawled out of their holes once again. They are the same people who were calling for financial and economic Armageddon this spring. With the market eventually breaking new historic highs, they scurried away, back into their holes.

If you ask any of them why the market was whacked this week, some might start throwing out the same nonsense... an over-valued market, higher rates are bad for the economy, or that the bull market is simply exhausted after almost a decade.

They sure won't quote to you any econ-data or corporate earnings. No, they won't do that, because the econ-data and corporate earnings continue to come in broadly fine. Neither will they raise the issue of capital flows into the US, or that the USD is still king of FIAT land. Instead, they might start touting an imminent USD collapse, or that Gold will soon hit 2k, 5K, or even higher. I could highlight a fair number of these people, but you should know the names by now.

Could the market see another wave lower next week? Of course, and weekly support on the Dow is another 4% lower, which would equate to sp'2675/50. Were the market to settle the month below current levels, that would merit alarm bells. However, we've 13 trading days left of October, and a lot can happen between now and then.

To me, the ultimate sell signal will be when the Fed suspend QT and/or cut rates.

Fed rates, with the sp'500, monthly, 20yr.

-

As things are, another hike is due in December, regardless of whatever the US President might wish. Powell should be very inclined to resist such wishes, and ignore the criticisms that the fed is 'crazy' or 'out of control'.

In the most recent cycle, the Fed cut rates in Sept'2007. The market maxed out one month later. Every cycle is unique, but I would look to the fed as the (ironic) ultimate sell signal.

Just so there is no misunderstanding, were the fed to suspend QT and/or cut rates, yours truly would call for a grand decline. The most natural target would be a back test of the 2000/2007 double top of the sp'1500s.

As things are, my outlook is that we'll see the Fed raise rates in December, and at least twice more in 2019. If I'm right, those calling for an equity collapse will have to remain in their holes until at least mid 2020.

Yours... trying to stay balanced, whilst most (not least the Cramer) have once again lost their minds

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.

Lets take our regular look at six of the main US indexes (weekly candle charts)

sp'500

The spx fell for a third consecutive week, settling -118pts (4.1%) to 2767, with an intra low of 2710. Weekly price momentum has turned outright negative, with a bearish macd cross. Note the lower bollinger at 2701.

Best guess: next week might well open higher, but another s/t rollover will offer a marginally lower low to around 2700. That would make for a more natural key low, with renewed upside into Friday opex. I'd imagine the market makers might seek to pin the spx to around 2800.

Nasdaq comp'

Tech cooled for a second week, settling -3.7% at 7496. Note the pierce of the 50wma, which hasn't been traded under since July 2016. Another rollover early next week would offer the 7200/7000 zone.

Dow

The mighty Dow fell for a third week, settling -1107pts (4.2%) to 25399. Underlying macd (blue bar histogram) will see a bearish cross at next Monday's open, and that does lean to further s/t weakness. Note the lower bollinger, offering next support in the 24100/200s... a clear 1000pts (4%) lower.

NYSE comp'

A third consecutive week lower, settling -4.2% to 12439. The Feb' low of 12048 is just 3.1% lower.

R2K

The R2K fell for the 5th week of 6, settling -85pts (5.2%) at 1546. Underlying macd cycle is at -17.69, the lowest since Sept'2011, when price was around 675.

Trans

The 'old leader' - Trans, was the weakest index/sector this week, with a net weekly decline of a rather severe -717pts (6.4%) to 10489. There are multiple aspects of support all the way to the 9700s. WTIC/fuel prices remain a valid concern, but as seen with Delta Airlines (DAL), so long as the broader economy is growing, higher costs are tolerable, and can be (at least partly) passed onto the consumer.

–

Summary

All six of the main US indexes were powerfully lower.

The Transports lead the way lower, whilst the Nasdaq was most resilient.

YTD performance:

The Nasdaq comp' remains the leader, +8.6%, with the spx +3.5%, and the Dow +2.5%. The R2K is +0.7%, the Transports -1.2%, and the NYSE comp' -2.9%

--

Looking ahead

key earnings: BAC (Mon'), GS, MS, NFLX, UAL, IBM (Tues'), PYPL (Thurs')

--

M - Retail sales, Empire State, Busin' invent

T - Indust' prod', housing market index,

W - Housing starts, EIA Pet' report, FOMC mins (2pm)

T - Weekly jobs, phil' fed, leading indicators

F - Existing home sales, *OPEX*

--

Final note

Since the Wednesday drop, the usual suspects have crawled out of their holes once again. They are the same people who were calling for financial and economic Armageddon this spring. With the market eventually breaking new historic highs, they scurried away, back into their holes.

If you ask any of them why the market was whacked this week, some might start throwing out the same nonsense... an over-valued market, higher rates are bad for the economy, or that the bull market is simply exhausted after almost a decade.

They sure won't quote to you any econ-data or corporate earnings. No, they won't do that, because the econ-data and corporate earnings continue to come in broadly fine. Neither will they raise the issue of capital flows into the US, or that the USD is still king of FIAT land. Instead, they might start touting an imminent USD collapse, or that Gold will soon hit 2k, 5K, or even higher. I could highlight a fair number of these people, but you should know the names by now.

Could the market see another wave lower next week? Of course, and weekly support on the Dow is another 4% lower, which would equate to sp'2675/50. Were the market to settle the month below current levels, that would merit alarm bells. However, we've 13 trading days left of October, and a lot can happen between now and then.

To me, the ultimate sell signal will be when the Fed suspend QT and/or cut rates.

Fed rates, with the sp'500, monthly, 20yr.

-

As things are, another hike is due in December, regardless of whatever the US President might wish. Powell should be very inclined to resist such wishes, and ignore the criticisms that the fed is 'crazy' or 'out of control'.

In the most recent cycle, the Fed cut rates in Sept'2007. The market maxed out one month later. Every cycle is unique, but I would look to the fed as the (ironic) ultimate sell signal.

Just so there is no misunderstanding, were the fed to suspend QT and/or cut rates, yours truly would call for a grand decline. The most natural target would be a back test of the 2000/2007 double top of the sp'1500s.

As things are, my outlook is that we'll see the Fed raise rates in December, and at least twice more in 2019. If I'm right, those calling for an equity collapse will have to remain in their holes until at least mid 2020.

Yours... trying to stay balanced, whilst most (not least the Cramer) have once again lost their minds

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.

Friday, 12 October 2018

Choppy gains into the weekend

US equity indexes closed broadly higher, sp +38pts (1.4%) at 2767.

Nasdaq comp' +2.3% at 7496. The two leaders - Trans/R2K, settled +0.8%

and +0.1% respectively. VIX settled -14.7% at 21.31. Near term outlook offers early Monday upside,

but then another rollover.

sp'daily5

VIX'daily3

Summary

US equities opened rather powerfully higher, with the sp' hitting 2775, but that was the high of the day, with the market then swinging lower into the 12pm hour, printing 2729, just 1pt from fully filling the opening gap. The afternoon leaned back upward, with a distinct short squeeze. Whilst the spx settled above the 200dma, the daily candle was a black-fail, which leans s/t bearish.

Volatility melted lower into the weekend, with the VIX swinging from an early afternoon intra high of 26.80, and settling sig' lower in the 21s.

Whilst Monday might open higher, the next s/t rollover could easily result in a marginally lower low, around weekly support of sp'2700/2690.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

sp'daily5

VIX'daily3

Summary

US equities opened rather powerfully higher, with the sp' hitting 2775, but that was the high of the day, with the market then swinging lower into the 12pm hour, printing 2729, just 1pt from fully filling the opening gap. The afternoon leaned back upward, with a distinct short squeeze. Whilst the spx settled above the 200dma, the daily candle was a black-fail, which leans s/t bearish.

Volatility melted lower into the weekend, with the VIX swinging from an early afternoon intra high of 26.80, and settling sig' lower in the 21s.

Whilst Monday might open higher, the next s/t rollover could easily result in a marginally lower low, around weekly support of sp'2700/2690.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Thursday, 11 October 2018

Grander concerns

US equity indexes closed very significantly lower, sp -57pts (2.1%) at

2728. Nasdaq comp' -1.2% at 7329. The two leaders - Trans/R2K, settled

-1.4% and -1.9% respectively. Near term outlook offers a bounce, but

probably starting from around weekly support of the 2690s. There are

grander concerns, not least for the German and Chinese markets.

sp'daily5

VIX'daily3

Summary

It was a day of significant swings in equity land. The spx opened moderately lower to 2767 (2pts above the 200dma), but then whipsawed upward to 2795, only to see swing lower to a 2pm 'horror hour' low of 2710, and settling at 2728.

Volatility opened mixed (pre-market print 24.52), seeing an intra high of 28.84, and settling +8.8% at 24.98. S/t outlook offers (weekly cycle) support of the 2690s, before threat of a very sig' multi-day rally, starting either Friday or next Monday.

Meanwhile....

This sort of talk from the US President isn't going to help inspire broader capital market confidence.

Clown finance TV rightly pointed out the following...

Its notable that Trump has also noted that whilst he doesn't like higher rates, he acknowledges that the savers have been hard hit since 2008. I will merely add that whilst yours truly is no fan of those at Print Central, I will hope that Powell and the other governors just ignore such Presidential complaints... and keep on raising rates into/across 2019.

-

Bigger concerns

Whilst I understand most of you will be entirely focused on the US market, I'm trying to also keep in mind the grander picture.. via other world markets.

Germany, monthly

The DAX is currently -5.8% at 11539. This is seriously ugly, and right now, its my biggest concern for world equities. The break of l/t trend from 2009 is not to be dismissed lightly.

China, monthly

The Shanghai comp' is currently -8.4% at 2583, having decisively broken core support of the Sept' low, and also the Jan'/Feb'2016 low of 2638.

How both of these markets settle the month is arguably very important indeed. Its difficult to see the US market able to see renewed and sustained upside into 2019, if the DAX is imploding toward 8k. Something to consider... for the rest of the month.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

sp'daily5

VIX'daily3

Summary

It was a day of significant swings in equity land. The spx opened moderately lower to 2767 (2pts above the 200dma), but then whipsawed upward to 2795, only to see swing lower to a 2pm 'horror hour' low of 2710, and settling at 2728.

Volatility opened mixed (pre-market print 24.52), seeing an intra high of 28.84, and settling +8.8% at 24.98. S/t outlook offers (weekly cycle) support of the 2690s, before threat of a very sig' multi-day rally, starting either Friday or next Monday.

Meanwhile....

This sort of talk from the US President isn't going to help inspire broader capital market confidence.

Clown finance TV rightly pointed out the following...

Its notable that Trump has also noted that whilst he doesn't like higher rates, he acknowledges that the savers have been hard hit since 2008. I will merely add that whilst yours truly is no fan of those at Print Central, I will hope that Powell and the other governors just ignore such Presidential complaints... and keep on raising rates into/across 2019.

-

Bigger concerns

Whilst I understand most of you will be entirely focused on the US market, I'm trying to also keep in mind the grander picture.. via other world markets.

Germany, monthly

The DAX is currently -5.8% at 11539. This is seriously ugly, and right now, its my biggest concern for world equities. The break of l/t trend from 2009 is not to be dismissed lightly.

China, monthly

The Shanghai comp' is currently -8.4% at 2583, having decisively broken core support of the Sept' low, and also the Jan'/Feb'2016 low of 2638.

How both of these markets settle the month is arguably very important indeed. Its difficult to see the US market able to see renewed and sustained upside into 2019, if the DAX is imploding toward 8k. Something to consider... for the rest of the month.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Subscribe to:

Posts (Atom)