Whilst equity indexes closed moderately mixed, the VIX swung from an early low of 13.66 to an intra high of 14.43, settling -0.8% @ 13.96. Near term outlook offers the sp'2065/61 gap zone, which should equate to VIX 15/16s. An April close in the 2050/40s would likely equate to 17/19s.

VIX'60min

VIX'daily3

Summary

Suffice to add, the VIX remains broadly subdued, as equities are still holding at/very close to recent highs.

Even if the market cools to the 2040s within the next 3-5 trading days, sustained action above the key VIX 20 threshold looks out of range for some weeks.

--

more later... on the indexes

Tuesday, 26 April 2016

Closing Brief

US equity indexes closed fairly mixed, sp +3pts @ 2091 (intra high 2096). The two leaders - Trans/R2K, both settled higher by around 1.0%. Near term outlook offers a post-FOMC break to the 2065/61 gap zone. There is a viable April close in the 2050/40s.. with VIX in the 17-19 zone.

sp'60min

Summary

closing hour action: micro chop.. leaning to the upside

--

**awaiting AAPL earnings**

--

So.. a pre-FOMC announcement day of moderate chop.. a mere 11pt (0.5%) trading range.. not exactly exciting... but to be expected.

Aside from AAPL earnings and the next pair of oil inventory reports, there is little reason the market will see any dynamic moves until tomorrow afternoon.

--

4.52pm.. rather amusing reaction in both TWTR and AAPL... the latter of which is now trading in the $97s... the price cluster zone of 98/96.

*if the main market does not break new highs in the near term.. we'll see another giant rollover.. with sp'1600/1500s.. and that'd equate to AAPL $70.

Interesting times.

--

more later.. on the VIX

sp'60min

Summary

closing hour action: micro chop.. leaning to the upside

--

**awaiting AAPL earnings**

--

So.. a pre-FOMC announcement day of moderate chop.. a mere 11pt (0.5%) trading range.. not exactly exciting... but to be expected.

Aside from AAPL earnings and the next pair of oil inventory reports, there is little reason the market will see any dynamic moves until tomorrow afternoon.

--

4.52pm.. rather amusing reaction in both TWTR and AAPL... the latter of which is now trading in the $97s... the price cluster zone of 98/96.

*if the main market does not break new highs in the near term.. we'll see another giant rollover.. with sp'1600/1500s.. and that'd equate to AAPL $70.

Interesting times.

--

more later.. on the VIX

3pm update - more of the same

US equities are set to close around current levels, if leaning a touch on the downside. It remains notable that the two leaders - Trans/R2K, are both higher by around 1.0%. Metals are holding gains, Gold +$4, with Silver +0.5%. Oil is helping to prop up the main market, +2.5% in the $43s.

sp'60min

VIX'60min

Summary

Little to add.

Price action is broadly subdued.. as most traders are naturally just waiting for AAPL earnings and more so.. the FOMC/Yellen.

--

notable weakness, AAPL -0.6% in the $104s.

--

back at the close

sp'60min

VIX'60min

Summary

Little to add.

Price action is broadly subdued.. as most traders are naturally just waiting for AAPL earnings and more so.. the FOMC/Yellen.

--

notable weakness, AAPL -0.6% in the $104s.

--

back at the close

2pm update - awaiting an AAPL lightning bolt

Whilst the main market remains in minor chop mode, attention is naturally shifting to AAPL, which has earnings due at 5pm EST. As some believe, will this be the first time iPhone sales actually decline... and will the market still be able to just ignore a lousy earnings/outlook, and ramp AAPL to the gap zone of $109/108 ?

AAPL, daily

sp'60min

Summary

From a pure cyclical (daily) perspective, AAPL is more vulnerable to upside than downside.

However, price momentum itself is outright bearish.

Best guess: a break under the lower gap zone of 103/102, there is a lot of price cluster support in the 98/96 zone.

-

*To be clear.. I have no position in AAPL, and will merely watch it in AH for sheer entertainment reasons.

--

Meanwhile.... here in London city...

Naturally, yours truly has a penchant for open spaces whenever lightning bolts start to rain down. Bullish ionised air.

--

back at 3pm

AAPL, daily

sp'60min

Summary

From a pure cyclical (daily) perspective, AAPL is more vulnerable to upside than downside.

However, price momentum itself is outright bearish.

Best guess: a break under the lower gap zone of 103/102, there is a lot of price cluster support in the 98/96 zone.

-

*To be clear.. I have no position in AAPL, and will merely watch it in AH for sheer entertainment reasons.

--

Meanwhile.... here in London city...

Naturally, yours truly has a penchant for open spaces whenever lightning bolts start to rain down. Bullish ionised air.

--

back at 3pm

1pm update - the two leaders

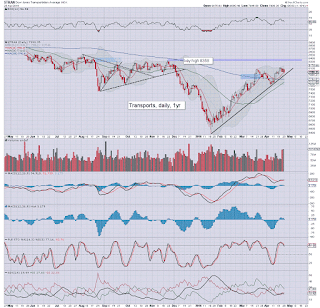

Whilst the headline indexes - sp/dow/nasdaq remain in micro chop mode, there is notable strength in the two leaders - Trans/R2K, both currently higher by around 1.0%. R2K has made a new cycle high of 1149, whilst price structure for the tranny is a clear bull flag.

R2K, daily

Trans, daily

Summary

Were it not for AAPL earnings or the next pair of oil inventory reports, I could understand if any normal person switches off their screen until 2pm tomorrow.

As for the two leaders - in terms of near term/post FOMC downside potential, it is a concern.

-

notable strength, miners, GDX, daily

A clear spike off rising trend/support. Its still pretty bullish. By default, bullish metals/miners are arguably still an indirect bearish equity signal, as has been the case since last December.

--

time for some sun amongst the showers.... back at 2'

R2K, daily

Trans, daily

Summary

Were it not for AAPL earnings or the next pair of oil inventory reports, I could understand if any normal person switches off their screen until 2pm tomorrow.

As for the two leaders - in terms of near term/post FOMC downside potential, it is a concern.

-

notable strength, miners, GDX, daily

A clear spike off rising trend/support. Its still pretty bullish. By default, bullish metals/miners are arguably still an indirect bearish equity signal, as has been the case since last December.

--

time for some sun amongst the showers.... back at 2'

12pm update - chop chop

US equities remain choppy, with most indexes broadly flat. VIX is subdued, but holding well above the early low of 13.66. A move into the upper teens - and sp'2050/40s, looks due... by the weekend.

sp'daily5

VIX'daily3

Summary

Well, frankly, there is little to add.

Clearly, next event is AAPL earnings (due 5pm EST)... along with an API report.

Aside from that... market is likely to remain in minor chop mode.

--

notable weakness... FB, daily

Yet another momo stock.... somewhat struggling. It could be argued we've seen a key double top in the 117/116s. Next support is the 200dma, which in early May will be in the $102s... and that is 7% lower.

--

time for lunch, back at 1pm

sp'daily5

VIX'daily3

Summary

Well, frankly, there is little to add.

Clearly, next event is AAPL earnings (due 5pm EST)... along with an API report.

Aside from that... market is likely to remain in minor chop mode.

--

notable weakness... FB, daily

Yet another momo stock.... somewhat struggling. It could be argued we've seen a key double top in the 117/116s. Next support is the 200dma, which in early May will be in the $102s... and that is 7% lower.

--

time for lunch, back at 1pm

11am update - morning turn

US equities push to sp'2096, but are seeing a somewhat discernible turn. USD is continuing to weaken, -0.4% in the DXY 94.40s. Metals have turned higher, Gold +$4, with Silver +0.3%. Oil is holding sig' gains of 1.4% in the $43s.

sp'60min

VIX'60min

Summary

*lack of sleep... hence I missed the open..

--

So.. a little higher... but now.. back to flat....

None of the econ data was great, least of all Durable Goods orders, which gave a y/y decline of -2.5%. That sure ain't something for the macro bulls to be pleased about it.

It remains the case that price action is likely to be increasingly subdued into tomorrow afternoon.

AAPL will no doubt liven things up though in AH.

-

notable weakness... NFLX, daily

The former much beloved momo stock continues to get ground lower. Next support is the $90 threshold.. and then $80.

sp'60min

VIX'60min

Summary

*lack of sleep... hence I missed the open..

--

So.. a little higher... but now.. back to flat....

None of the econ data was great, least of all Durable Goods orders, which gave a y/y decline of -2.5%. That sure ain't something for the macro bulls to be pleased about it.

It remains the case that price action is likely to be increasingly subdued into tomorrow afternoon.

AAPL will no doubt liven things up though in AH.

-

notable weakness... NFLX, daily

The former much beloved momo stock continues to get ground lower. Next support is the $90 threshold.. and then $80.

Pre-Market Brief

Good morning. US equity futures are a little higher, sp +6pts, we're set to open at 2093 - a mere 0.9% from the recent high. USD is -0.2% in the DXY 94.60s. Metals are weak, Gold -$5, with Silver -0.5%. Oil is +0.4% in the $43s.

sp'60min

Summary

*awaiting a quartet of econ data..

--

Not much to add from the overnight post.

Price action remains pretty subdued.

At things are.. cyclically, the hourly equity/VIX cycles are currently on track to be on the high end into tomorrow afternoon.

--

Overnight action

Japan: -0.5% @ 17353

China: +0.6% @ 2964

Germany: currently back to u/c @ 10298.

-

Have a good Tuesday

sp'60min

Summary

*awaiting a quartet of econ data..

--

Not much to add from the overnight post.

Price action remains pretty subdued.

At things are.. cyclically, the hourly equity/VIX cycles are currently on track to be on the high end into tomorrow afternoon.

--

Overnight action

Japan: -0.5% @ 17353

China: +0.6% @ 2964

Germany: currently back to u/c @ 10298.

-

Have a good Tuesday

Looking ahead into end month

It was a broadly weak start to the last week of April, with the sp'500 settling -3pts @ 2087. Price action is likely to get much more dynamic into the monthly close, as even the most bullish of bull maniacs will have to accept a basic retrace of the 301pt ramp from 1810 to 2111 is seemingly underway.

sp'weekly6

sp'monthly1b

Summary

re: weekly6: a notable blue candle, although yes, that didn't work out so great at the start of the month.

Re: monthly1b: as ever, a close under the 10MA will be rather important, currently @ 2021. As things are, equity bears will likely have to be content with the 2050/40s.

Sustained action <2040 looks unlikely in the near term. Sub 2K looks viable no earlier than mid May.

--

China market still struggling

The Shanghai comp' is currently lower by -1.9% for April...

With just 4 trading days left of the month, a close >3K looks unlikely, and that should concern the communists. There is viable downside to the 2300/2200s this June/July. The 'end of the world' doomers will need sub 2K, but right now that looks unlikely.

*I will cover the world markets in depth this coming weekend.

--

Econ/Market chatter - Mr Long and the infamous Mr Dent

As ever... make of that... what you will. I think its worth watching, but I sure don't agree with all of it.

--

Looking ahead

Tuesday will see a quartet of key data: Durable Goods Orders, Case-Shiller HPI, consumer con', and Richmond Fed'.

AAPL have earnings at 5pm EST... and it'll be one to watch in the early evening.

--

Goodnight from London

sp'weekly6

sp'monthly1b

Summary

re: weekly6: a notable blue candle, although yes, that didn't work out so great at the start of the month.

Re: monthly1b: as ever, a close under the 10MA will be rather important, currently @ 2021. As things are, equity bears will likely have to be content with the 2050/40s.

Sustained action <2040 looks unlikely in the near term. Sub 2K looks viable no earlier than mid May.

--

China market still struggling

The Shanghai comp' is currently lower by -1.9% for April...

With just 4 trading days left of the month, a close >3K looks unlikely, and that should concern the communists. There is viable downside to the 2300/2200s this June/July. The 'end of the world' doomers will need sub 2K, but right now that looks unlikely.

*I will cover the world markets in depth this coming weekend.

--

Econ/Market chatter - Mr Long and the infamous Mr Dent

As ever... make of that... what you will. I think its worth watching, but I sure don't agree with all of it.

--

Looking ahead

Tuesday will see a quartet of key data: Durable Goods Orders, Case-Shiller HPI, consumer con', and Richmond Fed'.

AAPL have earnings at 5pm EST... and it'll be one to watch in the early evening.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed broadly weak, sp -3pts @ 2087. The two leaders -

Trans/R2K, settled lower by -1.2% and -0.7% respectively. Near term

outlook offers increasingly dynamic price action, with a very realistic

decline to the sp'2040s - along with VIX spiking into the upper teens.

sp'daily5

R2K

Trans

Summary

Suffice to add.. the two leaders are set to follow the headline indexes (sp/dow/nasdaq) and break rising trend/support within the next 1-3 days.

--

a little more later....

sp'daily5

R2K

Trans

Summary

Suffice to add.. the two leaders are set to follow the headline indexes (sp/dow/nasdaq) and break rising trend/support within the next 1-3 days.

--

a little more later....

Subscribe to:

Comments (Atom)