It was a bearish month for world equity

markets, with net monthly declines ranging from -4.9% (Russia), -3.8% (Japan), -3.5% (Greece), -2.9% (Germany, Australia), -1.8% (Spain), -1.7% (USA), -1.6% (China), to -0.7% (Brazil, France). Near term outlook offers broad cooling into the autumn.

Lets take our regular look at ten of the world equity markets

USA - Dow

The mighty Dow cooled by -461pts (1.7%) to 26403. The key 10MA was pierced, but notably settled above. MACD (green bar histogram) cycle, ticked lower, as price momentum has remained negative since Oct'2018.

Note the monstrous technical/cyclical divergences that stretch back to Jan'2018. The monthly RSI stands at 59.49, a break under the key 50 threshold would merit alarm bells. If the August low of 25339 is broken under, it will offer the June low of 24680. Secondary target would be the lower bollinger, currently at 23451.

The Fed can be expected to cut rates Sept'18th, by -25bps to 1.75/2.00%, with Powell likely to frustrate many (not least the US President) by not acting more drastically. I don't expect any overt threats of renewed QE, until the sp'2600s.

--

Germany – DAX

The economic powerhouse of the EU - Germany, saw the DAX cool for a second month, settling -350pts (2.9%) to 11939. The key 10MA was pierced, but settled above. Price momentum is stalling just under the key zero threshold. Note the monstrous technical divergences that stretch back to spring 2015. A Sept' or Oct' monthly settlement under the key 10MA, would offer the giant threshold of 8000

The ECB can be expected to cut rates Sept'12th, by -10bps to -50bps, and Draghi is likely to threaten spooling up the printers again. Neither measure will help. Even more negative rates will only accelerate the implosion of the German/EU financials, not least Deutsche Bank.

Japan – Nikkei

The Japanese market cooled by -817pts (3.8%) to 20704. This was notably under the 10MA, and key price threshold of 21k. S/t bearish, with next support of psy'20k, and then the Dec'2018 low of 18948.

China – Shanghai comp'

Chinese equities cooled for the 4th month of 5, settling -46pts (1.6%) to 2886. The more bullish could argue that multi-month price structure is a bull flag, offering an eventual challenge of the key 3500s. That scenario would be negated with any monthly settlement <2700 (to be decisive). It is notably the case the HK/China situation hasn't been resolved.

Brazil – Bovespa

The Brazilian market saw a choppy month, settling moderately net lower, -677pts (0.7%) to 101134. On any basis, technically/cyclically very over-stretched, much like 2007/08. I would note the May low of 89408.

Russia - RTSI

The Russian market cooled for a second month, -66pts (4.9%) to 1293. The 10MA was effectively tested and held. Any price action back under the 1200 threshold would merit alarm bells. Lower WTIC/NG prices won't help.

France – CAC

French equities cooled for a second month, -38pts (0.7%) to 5480. We have a clear double top of 5657/5672, and its notable the CAC settled under key price threshold of 5500. Neighbouring Germany is borderline recession, and where Germany goes, other EU states can be expected to follow.

Spain – IBEX

Spanish equities fell for the 3rd month of 4, settling -158pts (1.8%) to 8812. The 10MA was settled under, as the Dec'2018 low of 8286 is easily within range. Any economic weakness will see unresolved issues like Catalonia rise up once again.

Australia – AORD

Australian equities saw the first net monthly decline since Dec'2018, with the AORD -198pts (2.9%) to 6698. Things turn m/t problematic if the 10MA is broken and settled under, and that will be in the 6300/200s in September.

Greece - Athex

Greek equities saw the first net monthly decline since Dec'2018, with the Athex -31pts (3.5%) to 868. It could be argued we have a marginal double top from Feb'2018.

--

Summary

All ten world equity markets settled net lower for August.

Russia and Japan lead the way lower, whilst Brazil and France were most resilient.

Of the ten markets, eight are trading above their key monthly 10MA, the exceptions were Japan and Spain.

--

Looking ahead

It will be a short four day week. We have just a handful of key earnings, but with a fair amount of econ-data.

Earnings: PANW, CLDR (Tues' AH), WORK (Wed' AH), LULU, ZM (Thurs' AH)

Econ-data:

M - CLOSED

T - PMI/ISM manu', construction

W - Intl' trade, Fed Beige book (2pm)

T - Weekly jobs, ADP jobs, product'/costs, PMI/ISM serv', factory orders, EIA Pet'/NG

F - Monthly jobs

--

Final note

September should see further rate cuts, not least from the US Fed and the ECB. Such monetary easing is a sign that even the monetary masters see problems ahead. Whilst Europe is borderline recession, the US economy continues to tick along.

We've a great many geo-political issues to keep in mind, not least the China/HK situation, Iran/US, and BREXIT - due Oct'31st, which might mark a key equity floor, before a recovery into year end/early 2020.

Equity bears will have prime opportunity across September and October. A retrace to the June low of Dow 24680 and SPX 2728 isn't a bold target, and I would keep in mind that the Transports and R2K have already broken their June lows. The other indexes can be expected to follow.

There is also the issue of trade/tariffs, and that continued uncertainty won't help global equity markets. It is the case that Trump will be far more inclined to reach a deal with China, if his beloved equity market gets whacked. September should be.... entertaining.

--

If you value my work, subscribe to my intraday service.

For

details, and the latest offers: http://permabeardoomster.com/

Enjoy the three day holiday weekend

--

*the next post on this page will likely appear 5pm EDT on Tuesday Sept'3rd.

Saturday 31 August 2019

Friday 30 August 2019

August settles

US equity indexes closed a little mixed, sp +1.9pts (0.1%) at 2926. Nasdaq comp' -0.1%. Dow +0.1%. The two leaders - Trans/R2K, settled +0.2% and -0.1% respectively.

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher to sp'2940, but then went into cooling mode, seeing a late morning low of 2913, before clawing back upward.The afternoon saw further chop, leaning on the weaker side.

Meanwhile, the US president issued another triple tweet swipe at the Fed..

-

Volatility was notable resilient into the holiday weekend, with the VIX settling +6.1% to 18.98. Today's settling black equity candle at key resistance merits some reflection.

SPX, monthly

August settled net lower by -53pts (1.8%) to 2926. The SPX settled a considerable 113pts above the key 10MA of 2813. The m/t bullish trend that began from the Dec'2018 low, remains intact. Things only turn interesting with a break >2960 (to be decisive), or <2822.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher to sp'2940, but then went into cooling mode, seeing a late morning low of 2913, before clawing back upward.The afternoon saw further chop, leaning on the weaker side.

Meanwhile, the US president issued another triple tweet swipe at the Fed..

-

Volatility was notable resilient into the holiday weekend, with the VIX settling +6.1% to 18.98. Today's settling black equity candle at key resistance merits some reflection.

SPX, monthly

August settled net lower by -53pts (1.8%) to 2926. The SPX settled a considerable 113pts above the key 10MA of 2813. The m/t bullish trend that began from the Dec'2018 low, remains intact. Things only turn interesting with a break >2960 (to be decisive), or <2822.

--

| The London Parakeets |

| The sun sets on August trading |

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Thursday 29 August 2019

Pre-holiday gains

US equity indexes closed significantly higher, sp +36pts (1.3%) at 2924. Nasdaq comp' +1.5%. The two leaders - Trans/R2K, settled +2.0% and +1.6% respectively. Near term outlook offers chop into the long holiday weekend.

sp'daily5

VIX'daily3

Summary

US equities opened significantly higher, as the mainstream were back to 'everything is fine again' mode.

Meanwhile...

... and we know that 'what they should', means negative rates with renewed QE.

-

Volatility was naturally in melt mode, with the VIX settling -7.6% at 17.88. The s/t outlook favours equity chop into the weekend.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened significantly higher, as the mainstream were back to 'everything is fine again' mode.

Meanwhile...

... and we know that 'what they should', means negative rates with renewed QE.

-

Volatility was naturally in melt mode, with the VIX settling -7.6% at 17.88. The s/t outlook favours equity chop into the weekend.

--

|

| Descending into the land of BREXIT chaos |

| Another day closer to autumn |

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Wednesday 28 August 2019

The swings continue

US equity indexes closed broadly higher, sp +18pts (0.7%) at 2887. Nasdaq comp' +0.4%. Dow +1.0%. The two leaders - Trans/R2K, settled +1.8% and +1.1% respectively.

sp'daily5

VIX'daily3

Summary

US equities opened on a weak note, but sp'2853 was all the bears could manage, and we saw an opening reversal. Equities battled upward to moderate gains into the afternoon, printing 2890, and settling +18pts at 2887.

Meanwhile...

... it just wouldn't be a normal trading day without at least one tweet from the US President about Print Central.

Volatility saw an early spike to 21.64, but then cooled back, settling -4.7% at 19.35. S/t outlook offers a little further upside in equities, but a break <2822 still appears far more probable than a decisive bullish break >2960.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened on a weak note, but sp'2853 was all the bears could manage, and we saw an opening reversal. Equities battled upward to moderate gains into the afternoon, printing 2890, and settling +18pts at 2887.

Meanwhile...

... it just wouldn't be a normal trading day without at least one tweet from the US President about Print Central.

Volatility saw an early spike to 21.64, but then cooled back, settling -4.7% at 19.35. S/t outlook offers a little further upside in equities, but a break <2822 still appears far more probable than a decisive bullish break >2960.

--

| A glimpse of late summer sunshine |

| .. as Autumn isn't far off. |

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Tuesday 27 August 2019

Trump vs Print Central

US equity indexes closed on a weak note, sp -9pts (0.3%) at 2869. Nasdaq comp' -0.3%. Dow -0.5%. The two leaders - Trans/R2K, settled -1.0% and -1.4% respectively.

sp'daily5

VIX'daily3

Summary

US equities opened on a positive note, but the SPX got stuck at 2898, notably 2pts shy of the key 2900 threshold. There was cooling into early afternoon, with a low of 2860, with late day chop to settle at 2869.

Meanwhile...

After his weekend break at the G7 in France, it sure didn't take long for Trump to resume the attacks on the Fed. The US President has his designated scapegoat for any degree of equity downside, never mind a possible recession.

-

Volatility saw an early low of VIX 18.49, but then swung to 21.04, and settling +5.1% at 20.31. S/t outlook offers an equity brick wall around sp'2900. Another challenge to break the recent low of sp'2822 is on the menu.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened on a positive note, but the SPX got stuck at 2898, notably 2pts shy of the key 2900 threshold. There was cooling into early afternoon, with a low of 2860, with late day chop to settle at 2869.

Meanwhile...

After his weekend break at the G7 in France, it sure didn't take long for Trump to resume the attacks on the Fed. The US President has his designated scapegoat for any degree of equity downside, never mind a possible recession.

-

Volatility saw an early low of VIX 18.49, but then swung to 21.04, and settling +5.1% at 20.31. S/t outlook offers an equity brick wall around sp'2900. Another challenge to break the recent low of sp'2822 is on the menu.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Monday 26 August 2019

Starting positive

US equity indexes closed significantly higher, sp +31pts (1.1%) at 2878. Nasdaq comp' +1.3%. The two leaders - Trans/R2K, settled +1.0% and +1.1% respectively.

sp'daily5

VIX'daily3

Summary

US equities started the week on a positive note, although the gains were pretty shaky, with the SPX cooling to 2856, before swinging back upward into the afternoon.

Meanwhile...

... it was just another day in the twilight zone, as Pisani of CNBC highlighted the recent phases of 'Trump mood'. Its not a stretch to eventually seeing a little box in one of the corners highlighting what mood phase we're in.

Volatility remained elevated, with the VIX settling -2.8% at 19.32. S/t outlook favours the equity bulls for early Tuesday. More broadly though, price structure is a big bear flag, offering an eventual break lower.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities started the week on a positive note, although the gains were pretty shaky, with the SPX cooling to 2856, before swinging back upward into the afternoon.

Meanwhile...

... it was just another day in the twilight zone, as Pisani of CNBC highlighted the recent phases of 'Trump mood'. Its not a stretch to eventually seeing a little box in one of the corners highlighting what mood phase we're in.

Volatility remained elevated, with the VIX settling -2.8% at 19.32. S/t outlook favours the equity bulls for early Tuesday. More broadly though, price structure is a big bear flag, offering an eventual break lower.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Saturday 24 August 2019

Weekend update - US equity indexes

It was a bearish week for US equity indexes,

with net weekly declines ranging from -2.3%

(Trans, R2K), -1.8% (Nasdaq comp'), -1.4% (SPX), -1.3% (NYSE comp'), to

-1.0% (Dow). Near term outlook offers further downside.

Lets take our regular look at six of the main US indexes

sp'500

The SPX fell for a fourth consecutive week, net lower by -41pts (1.4%) to 2847. Weekly price momentum ticked lower for a fourth week. The recent break of m/t rising trend offers a push to at least the June low of 2728.

More broadly, the SPX is currently net lower for August by -133pts (4.5%). If August settles under the monthly 10MA (currently at 2805), it would threaten the most bearish s/t scenario of the lower monthly bollinger, currently at 2548.

-

Nasdaq comp'

The Nasdaq comp' fell for a fourth week, settling -144pts (1.8%) to 7751. Note the June low of 7292.

Dow

The mighty Dow cooled for the fifth week of six, settling -247pts (1.0%) to 25628. Note the June low of 24680, a clear 1000pts lower.

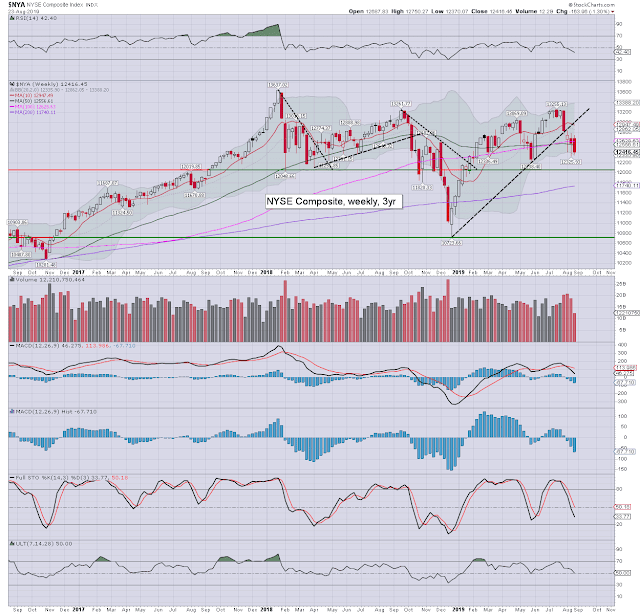

NYSE comp'

The master index cooled for the fifth week of six, settling -163pts (1.3%) to 12416. Note the June low of 12238.

R2K

The second market leader cooled for a fourth consecutive week, settling -34pts (2.3%) to 1459. Note that we've already broken below the June low. Next support is key price threshold of the 1430s, and then the 1400 threshold.

Trans

The 'old leader' - Transports, fell for a fourth week, settling -227pts (2.3%) to 9739. Note that we've already broken the June low. Next major support is the Dec' low of 8636.

–

Summary

All six of the US equity indexes fell for a fourth consecutive week, settling with significant net weekly declines.

The Trans and R2K are leading the way lower, with the Dow most resilient.

Its notable that the Trans and R2K have already broken below their June lows, and its highly supportive of the notion that the SPX will see further cooling to its June low of 2728.

--

Looking ahead

After the rough Friday close, the Monday open should be 'real interesting'. We have a light sprinkling of earnings, with a fair amount of econ-data. I would especially look to the Chicago PMI, which will likely remain under the recessionary threshold of 50.0.

Earnings:

M -

T - MOMO, HPE,

W - TIFF, PVH, BOX

T - BBY, DG, DLTR, ANF, AMTD, ULTA, DELL, MRVL

F - CPB, BIG

--

Econ-data:

M - Durable goods orders

T - Case-Shiller HPI, FHFA HPI, consumer con', Richmond Fed

W - EIA Pet' report

T - Q2 GDP (print'2), weekly jobs, intl' trade, wholesale invent', pending home sales

F - Pers' income/outlays, Chicago PMI, consumer sent'.

*Friday will be end month, so expect some chop on higher volume. Further, as Monday Sept'2nd is CLOSED, trading could be expected to be lighter, but still with threat of 'rats selling into the weekend'.

--

Final note

It sure wasn't a great week in equity land, and the bulls can place the blame on none other than the US President. After all, until 10.57am on Friday, most indexes were set for sig' net weekly gains.

Instead, all the main indexes were lower for a fourth week, with a couple already under their June lows. The following comes to mind...

Fed rates with SPX, monthly, 20yr

*note that the July rate cut still hasn't been accounted for in this EOM chart.

-

I will merely add, the recently added red vertical line isn't something to be dismissed lightly. If the headline indexes (SPX, Dow, Nas') also make it to their June lows within 1-2 weeks, it will make new historic highs even more difficult.

Seriously, does anyone still think rate cut'2 (Sept'18th: -25bps to 1.75/2.00%), is going to help?

Arguably, the ultimate question right now, would even QE4 being announced, be enough to generate net gains in the US market, whilst the econ-data and earnings continue to weaken?

--

If you value my work on Blogger and Twitter, subscribe to me.

For details/latest offers, see: Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EDT on Monday.

Lets take our regular look at six of the main US indexes

sp'500

The SPX fell for a fourth consecutive week, net lower by -41pts (1.4%) to 2847. Weekly price momentum ticked lower for a fourth week. The recent break of m/t rising trend offers a push to at least the June low of 2728.

More broadly, the SPX is currently net lower for August by -133pts (4.5%). If August settles under the monthly 10MA (currently at 2805), it would threaten the most bearish s/t scenario of the lower monthly bollinger, currently at 2548.

-

Nasdaq comp'

The Nasdaq comp' fell for a fourth week, settling -144pts (1.8%) to 7751. Note the June low of 7292.

Dow

The mighty Dow cooled for the fifth week of six, settling -247pts (1.0%) to 25628. Note the June low of 24680, a clear 1000pts lower.

NYSE comp'

The master index cooled for the fifth week of six, settling -163pts (1.3%) to 12416. Note the June low of 12238.

R2K

The second market leader cooled for a fourth consecutive week, settling -34pts (2.3%) to 1459. Note that we've already broken below the June low. Next support is key price threshold of the 1430s, and then the 1400 threshold.

Trans

The 'old leader' - Transports, fell for a fourth week, settling -227pts (2.3%) to 9739. Note that we've already broken the June low. Next major support is the Dec' low of 8636.

–

Summary

All six of the US equity indexes fell for a fourth consecutive week, settling with significant net weekly declines.

The Trans and R2K are leading the way lower, with the Dow most resilient.

Its notable that the Trans and R2K have already broken below their June lows, and its highly supportive of the notion that the SPX will see further cooling to its June low of 2728.

--

Looking ahead

After the rough Friday close, the Monday open should be 'real interesting'. We have a light sprinkling of earnings, with a fair amount of econ-data. I would especially look to the Chicago PMI, which will likely remain under the recessionary threshold of 50.0.

Earnings:

M -

T - MOMO, HPE,

W - TIFF, PVH, BOX

T - BBY, DG, DLTR, ANF, AMTD, ULTA, DELL, MRVL

F - CPB, BIG

--

Econ-data:

M - Durable goods orders

T - Case-Shiller HPI, FHFA HPI, consumer con', Richmond Fed

W - EIA Pet' report

T - Q2 GDP (print'2), weekly jobs, intl' trade, wholesale invent', pending home sales

F - Pers' income/outlays, Chicago PMI, consumer sent'.

*Friday will be end month, so expect some chop on higher volume. Further, as Monday Sept'2nd is CLOSED, trading could be expected to be lighter, but still with threat of 'rats selling into the weekend'.

--

Final note

It sure wasn't a great week in equity land, and the bulls can place the blame on none other than the US President. After all, until 10.57am on Friday, most indexes were set for sig' net weekly gains.

Instead, all the main indexes were lower for a fourth week, with a couple already under their June lows. The following comes to mind...

Fed rates with SPX, monthly, 20yr

*note that the July rate cut still hasn't been accounted for in this EOM chart.

-

I will merely add, the recently added red vertical line isn't something to be dismissed lightly. If the headline indexes (SPX, Dow, Nas') also make it to their June lows within 1-2 weeks, it will make new historic highs even more difficult.

Seriously, does anyone still think rate cut'2 (Sept'18th: -25bps to 1.75/2.00%), is going to help?

Arguably, the ultimate question right now, would even QE4 being announced, be enough to generate net gains in the US market, whilst the econ-data and earnings continue to weaken?

--

If you value my work on Blogger and Twitter, subscribe to me.

For details/latest offers, see: Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EDT on Monday.

Friday 23 August 2019

Enemy of the State?

US equity indexes closed powerfully lower, sp -75pts (2.6%) at 2847. Nasdaq comp' -3.0%. Dow -2.4%. The two leaders - Trans/R2K, settled -3.3% and -3.1% respectively. Near term outlook threatens a sig' gap lower at the Monday open.

sp'daily5

VIX'daily3

Summary

US equities were somewhat wild even before the market opened, with the SPX swinging from around +8pts to -20pts. The market opened moderately weak, but then battled upward to fractionally positive with the Powell press release/statement.

At 10.57am EDT, the US President decided to get involved...

Its a rather incredible tweet, but also somewhat disturbing.

Q. If you were Powell, what the hell would you make of it? You're effectively being equated to the leader for what is (arguably) an enemy state.

A serious question, might Powell just quietly walk away before year end?

Trump continued...

The FOREX market took this as alluding to an announcement that the US Treasury will actively try to weaken the dollar.

The afternoon saw continued weakness, with few (understandably) wanting to 'buy the dip' ahead of the weekend. The closing hour printed 2834, and settling at 2847.

Volatility swung from 16.04, to spike above the key 20 threshold, settling +19.1% at 19.87. S/t outlook threatens a Monday gap open <sp'2822, which would offer a test of the June low of 2728.

--

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities were somewhat wild even before the market opened, with the SPX swinging from around +8pts to -20pts. The market opened moderately weak, but then battled upward to fractionally positive with the Powell press release/statement.

At 10.57am EDT, the US President decided to get involved...

Its a rather incredible tweet, but also somewhat disturbing.

Q. If you were Powell, what the hell would you make of it? You're effectively being equated to the leader for what is (arguably) an enemy state.

A serious question, might Powell just quietly walk away before year end?

Trump continued...

The FOREX market took this as alluding to an announcement that the US Treasury will actively try to weaken the dollar.

The afternoon saw continued weakness, with few (understandably) wanting to 'buy the dip' ahead of the weekend. The closing hour printed 2834, and settling at 2847.

Volatility swung from 16.04, to spike above the key 20 threshold, settling +19.1% at 19.87. S/t outlook threatens a Monday gap open <sp'2822, which would offer a test of the June low of 2728.

--

| Gold, Silver, and the miners ascending into the weekend |

| No sunset for the equity bulls |

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Subscribe to:

Posts (Atom)