A somewhat weak end to the day, but certainly a strong week overall for the bull maniacs. I'm sure glad its over.

The closing hourly index charts...

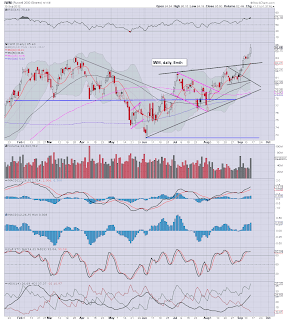

IWM

SP

Transports

Summary

Suffice to say, we're probably due a down cycle, but just like two weeks ago, it might be barely 20/30pts to the downside.

More later in the evening, and across the weekend.

Regardless...have a good weekend!

Friday, 14 September 2012

3pm update - another week soon to close

Well, it was the week of a 1.2 trillion QE package, a week where the Germans said Yes, and we've just one trading hour left to endure.

Thank the gods. I'm really tired !

sp'60min

Summary

First support is a very obvious 1450. I still think 1420 is the next viable target low for the daily cycle, but that could easily take 5-7 trading days to achieve.

For the moment, the bulls can justifiably laugh. The Bernanke has delivered, and despite it probably being a 'panic move', it will certainly help to prop prices up in the months to come, or should that be 'years'?

Urghh.

More after the close

Thank the gods. I'm really tired !

sp'60min

Summary

First support is a very obvious 1450. I still think 1420 is the next viable target low for the daily cycle, but that could easily take 5-7 trading days to achieve.

For the moment, the bulls can justifiably laugh. The Bernanke has delivered, and despite it probably being a 'panic move', it will certainly help to prop prices up in the months to come, or should that be 'years'?

Urghh.

More after the close

2pm update - sp'1450 is first support

We have a clear accelerated up trend, as apparent on both the daily and hourly index charts. Yes, a pullback is likely, but even a multi-day minor drop to 1420 looks the very best bear case right now.

With the Fed buying 40bn MBS, and then 45bn of treasury bonds per month (the latter starting from January), its going to be near impossible for the bears to sustain any down trend. Baring a black swan of course.

sp'60min

sp'daily5

Summary

First target is sp'1450 some time this Monday, but as you can see, even that doesn't wreck the current accelerated up trend that we are currently in. It is entirely possible the smaller 15/60min cycles will be fully rest by the end of Monday, and Tuesday will see a renewed push higher.

It all remains rather sickening to view this madness.

With the Fed buying 40bn MBS, and then 45bn of treasury bonds per month (the latter starting from January), its going to be near impossible for the bears to sustain any down trend. Baring a black swan of course.

sp'60min

sp'daily5

Summary

First target is sp'1450 some time this Monday, but as you can see, even that doesn't wreck the current accelerated up trend that we are currently in. It is entirely possible the smaller 15/60min cycles will be fully rest by the end of Monday, and Tuesday will see a renewed push higher.

It all remains rather sickening to view this madness.

12pm update - The Fed will destroy the world

The Fed have without question brought forward the end game. Many of the doomers are no doubt outraged at the latest equity ramp - in the face of a weakening global economy, and here we are, with a new 1.02 trn (annual rate) QE..with no end.

Mr Faber, aka, Dr Doom summarises it all better than I possibly could...

meanwhile....back at the Casino

sp'daily5

VIX, daily

Summary

We are surely going to max out 'soon', but as I keep noting, the issue then becomes, what level of pullback are we going to see next week? It could merely be a case of trading sideways - much like 2/3 weeks ago, where we then exploded higher yet again.

VIX is suggestive of a floor, but it has to be said, that is highly unreliable at such low levels.

There is a HUGE amount to consider this weekend, and I have a great deal to say on the latest QE, but I'll save that for later.

Time for lunch

Mr Faber, aka, Dr Doom summarises it all better than I possibly could...

meanwhile....back at the Casino

sp'daily5

VIX, daily

Summary

We are surely going to max out 'soon', but as I keep noting, the issue then becomes, what level of pullback are we going to see next week? It could merely be a case of trading sideways - much like 2/3 weeks ago, where we then exploded higher yet again.

VIX is suggestive of a floor, but it has to be said, that is highly unreliable at such low levels.

There is a HUGE amount to consider this weekend, and I have a great deal to say on the latest QE, but I'll save that for later.

Time for lunch

10am update - Even sp'1420 looks a struggle

With QE3 of 1.2 trillion now underway, the market is turning into a freight train.

Baring any 'upset', the current trend is for sp'1600 by year end, with Oil probably $115/125 Great huh?

sp'60min

sp'daily5

Summary

Anyone short from yesterday is now seriously underwater. The underlying momentum is just so strong to the upside, its going to be VERY difficult just to break into the 1440s again.

My original first exit target of 1420 is still viable by the end of the month, but then what? Considering the monthly index charts, sp'1500s in October, frankly looks a given.

What is clear is that the Fed WILL print to oblivion, in which case...prices will just keep on rising, even if the US slipped into recession in Q4/Q1 2013. It just won't matter to the market, with the Fed further increasing purchases next Spring I'd guess.

Back at 12pm.

Baring any 'upset', the current trend is for sp'1600 by year end, with Oil probably $115/125 Great huh?

sp'60min

sp'daily5

Summary

Anyone short from yesterday is now seriously underwater. The underlying momentum is just so strong to the upside, its going to be VERY difficult just to break into the 1440s again.

My original first exit target of 1420 is still viable by the end of the month, but then what? Considering the monthly index charts, sp'1500s in October, frankly looks a given.

What is clear is that the Fed WILL print to oblivion, in which case...prices will just keep on rising, even if the US slipped into recession in Q4/Q1 2013. It just won't matter to the market, with the Fed further increasing purchases next Spring I'd guess.

Back at 12pm.

Pre-Market Brief

Good morning. Futures are sp+4pts, we're set to open near yesterdays high of 1463

Retail Sales: 0.9% for August, a touch higher than expected

sp'60min

sp'daily5

Summary

Bears sorely need a reversal today or early next week. I'm sure we'll get one soon, but the down move most likely won't be too much. Even a move to 1420 looks like the best bears will get.

In retrospect, what was announced by Bernanke yesterday was pretty staggering.. a 1.2 trillion QE3 package, spread across 15months..with no end date as such. All things considered, its surprising the market didn't rally 5%.

Its clear that most people just simply don't comprehend the scale of what the Fed are going to implement.

--

We have much more data to come this morning, so stay tuned!

Retail Sales: 0.9% for August, a touch higher than expected

sp'60min

sp'daily5

Summary

Bears sorely need a reversal today or early next week. I'm sure we'll get one soon, but the down move most likely won't be too much. Even a move to 1420 looks like the best bears will get.

In retrospect, what was announced by Bernanke yesterday was pretty staggering.. a 1.2 trillion QE3 package, spread across 15months..with no end date as such. All things considered, its surprising the market didn't rally 5%.

Its clear that most people just simply don't comprehend the scale of what the Fed are going to implement.

--

We have much more data to come this morning, so stay tuned!

Primary trend remains UP

With the Bernanke announcing new QE today, the market is again showing a new wave of strength. The possible scenario outlook of a major down wave in the autumn are once again fading away into oblivion.

Lets consider the big monthly chart for the sp'500

sp'monthly, rainbow, 6yr

Summary

We've now got 3 strong green candles, and baring any 'upset', October will also be green, and a hit of the huge 1500 level is now within range.

First target is the upper bollinger - currently 1473 (and rising). At the current rate of uptrend, the market will close the year around 1550/1600.

That outlook assumes 'no surprises' - no middle east Israeli attack on Iran, with the econ-data coming in at least 'reasonable'. That arguably translates to US Q3 (to be released late October) growth of at least 1%

It also assumes continued low volume/algo-bot melt up, with the 'Santa rally' period helping inspire the market to close on a high.

I am short, seeking a minor pullback - at least to 1420, but the bears need to recognise, the current trend does indeed remain UP. Until we put in a monthly close with a blue/red candle, those bears holding short for more than a few days at a time, are going to get burnt.

Goodnight from London

Lets consider the big monthly chart for the sp'500

sp'monthly, rainbow, 6yr

Summary

We've now got 3 strong green candles, and baring any 'upset', October will also be green, and a hit of the huge 1500 level is now within range.

First target is the upper bollinger - currently 1473 (and rising). At the current rate of uptrend, the market will close the year around 1550/1600.

That outlook assumes 'no surprises' - no middle east Israeli attack on Iran, with the econ-data coming in at least 'reasonable'. That arguably translates to US Q3 (to be released late October) growth of at least 1%

It also assumes continued low volume/algo-bot melt up, with the 'Santa rally' period helping inspire the market to close on a high.

I am short, seeking a minor pullback - at least to 1420, but the bears need to recognise, the current trend does indeed remain UP. Until we put in a monthly close with a blue/red candle, those bears holding short for more than a few days at a time, are going to get burnt.

Goodnight from London

Daily Index Cycle update

The main indexes certainly had a strong day, and are now brushing up against what is the upper channel, from the June low of 1266. Yeah, we're almost 200pts above the June low, after just 3.5 months, incredible.

IWM, daily

Sp'daily5

Transports

Summary

We're very high on the smaller cycles, so it will very difficult for the market to keep pushing higher tomorrow. When you consider the sp' daily chart, this is especially obvious, with the market now looking very over-extended - closing some 12pts outside the upper bollinger band - a pretty rare thing.

Both IWM and the Transports are sporting a tiny spike on today's candle, but its nothing to be taken seriously yet. Bears will need to see at least a flat close tomorrow, and preferably a decline back into the sp'1440s. That's a 'reasonable' hope for tomorrow.

Friday - LOTS of econ-data

We have retail sales, CPI, industrial production, consumer sentiment, and business inventories. That will really give the market something to think about.

With the 'QE threat' now done with, what are the bull maniacs going to do if the econ-data continues to warn of recession? Maybe Mr Draghi will start talking up things again?

So, even though today was very much a victory for the bulls, it could be back to reality tomorrow, if some of the data comes in worse than the algo-bots are expecting.

A little more later.

IWM, daily

Sp'daily5

Transports

Summary

We're very high on the smaller cycles, so it will very difficult for the market to keep pushing higher tomorrow. When you consider the sp' daily chart, this is especially obvious, with the market now looking very over-extended - closing some 12pts outside the upper bollinger band - a pretty rare thing.

Both IWM and the Transports are sporting a tiny spike on today's candle, but its nothing to be taken seriously yet. Bears will need to see at least a flat close tomorrow, and preferably a decline back into the sp'1440s. That's a 'reasonable' hope for tomorrow.

Friday - LOTS of econ-data

We have retail sales, CPI, industrial production, consumer sentiment, and business inventories. That will really give the market something to think about.

With the 'QE threat' now done with, what are the bull maniacs going to do if the econ-data continues to warn of recession? Maybe Mr Draghi will start talking up things again?

So, even though today was very much a victory for the bulls, it could be back to reality tomorrow, if some of the data comes in worse than the algo-bots are expecting.

A little more later.

Subscribe to:

Comments (Atom)