Equity bulls manage a bounce right after the opening gap lower, from sp'1809 to 1819. Underlying weakness should resume later today, with target downside to 1800/1790s by late Friday. Metals continue the strength of recent days, Gold +$6

sp'daily5

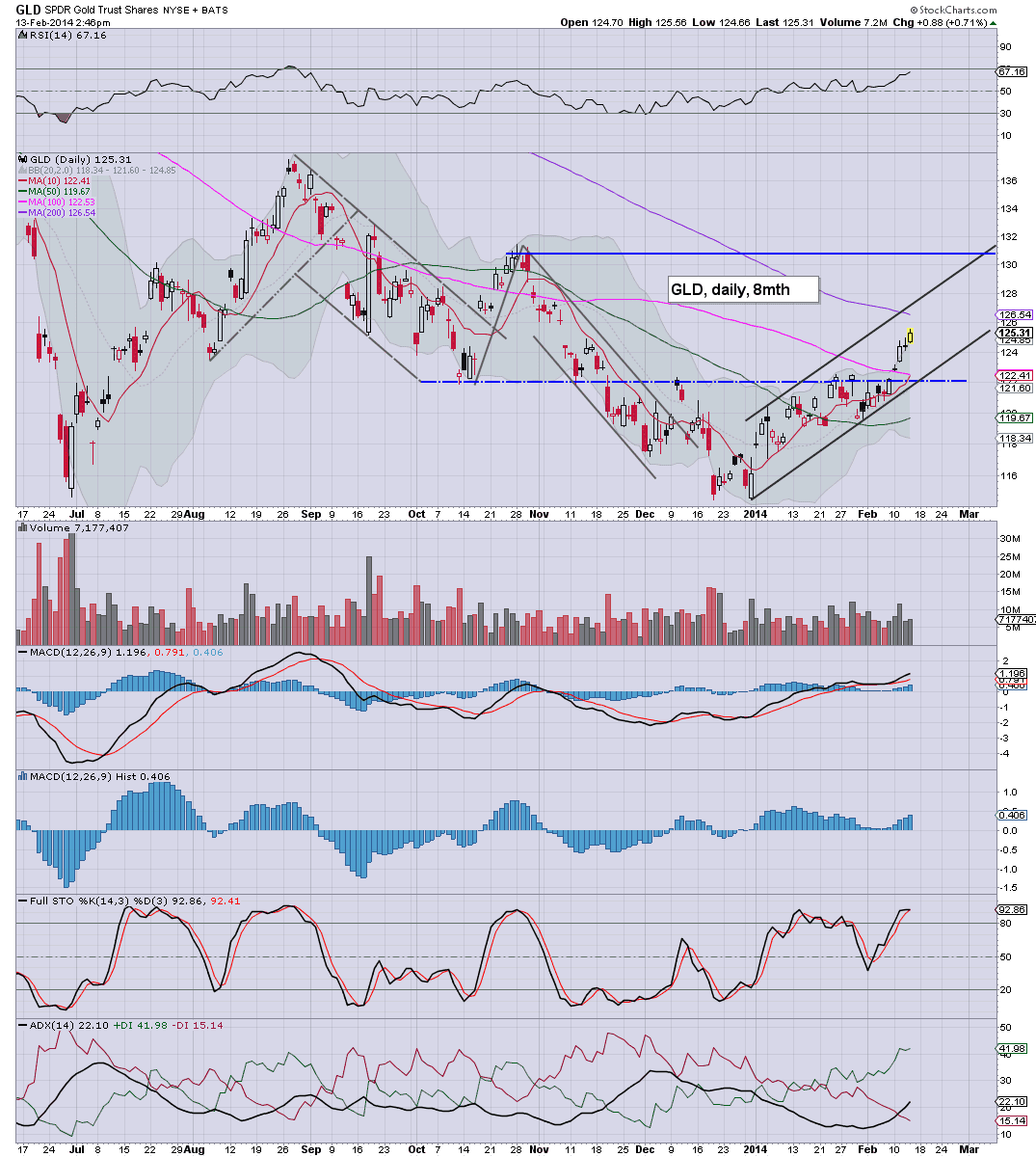

GLD, daily

Summary

*no doubt, the opening bounce annoyed those bears who weren't tightening short-stops at the very open.

--

A reversal candle on the daily index chart, but I'd still look for another wave lower later today.

-

All things considered, I can't see 1809 being the low of this retracement. It is notable we did break under the 50 day MA..now @ 1810. So.. a little tech-damage has been achieved by the bears this morning.

--

Notable strength: UGAZ +6.3%.. it sure is cold out there today.

--

Based on smaller 5/15min cycles..this latest nonsense should level out within an hour. Obviously...the last line of short-stops will be in the 1825/30 zone.

11.07am...provisional exhaustion on the smaller 5/15min cycles at 1822..a mere 4pts shy of the Wednesday high.

Day-trading bears have opportunity to re-short here..from the bounce of 1809. Pretty good risk/reward into Friday.

VIX is notably red, -0.5% in the 14.20s..but so far..holding the recent low of 14.02.

11.23am...bears on the edge.... 1826.55 is the level the bulls need to break...or its a micro double top..and we'll drop from here.

Easy place to re-short...with a nano scale tight stop!

If Mr Market wants to annoy everyone...briefly break 1827/28...then reverse.

UGAZ building gains...+8.3%.....

11.30am... bull maniacs gotta push here to new highs..or they gonna get whipsawed back lower this afternoon.

Even Zerohedge noting the morning ramp..despite no QE-pomo.

Seeking a reversal from here....just 2.5pts of buffer zone left for the bears.

11.45am.. perhaps most notable.. gold, building gains..+$8..not a dramatic move, but still...its been climbing for some days now. The only issue is that Silver is really lagging, still stuck under old broken support.