The VIX again closed a touch lower, but its a clear wedge, and at least a mini snap higher is due in the coming few days. Of course, even a 10% jump would only get VIX to the high 16s. Great huh ?

As I regularly note, a VIX under 20, means any index declines are to treated with great caution. Remember that Monday a few weeks ago, where we opened with VIX +26% to 20, and dow -239, it sure didn't close that way.

VIX'60min

VIX, daily

Summary

There a few out there touting 'VIX to hit 10...or even <10' in the coming months, I'm not one of them. Even if the main indexes break >1422, I can't see VIX that low.

It remains a remarkably cheap time to buy VIX calls, as ever..timing is everything, and besides, whilst the main index trends are UP, its still kinda risky.

More to come!

Thursday, 9 August 2012

Closing Brief

Another quiet day, at what remains the worlds most rigged and twisted legal casino.

We appear to be setting up tomorrow with some bullish pennants, a move to a new high of 1410/15 seems viable.

The closing hourly charts

IWM

Dow

SP

Summary

Another relatively flat day. I suppose it could be said we're forming a nice flat top - or even the head of a H/S formation (see daily charts earlier), and that we'll rollover in the next few days - at least to the low 1370s.

Regardless, no declines can be taken seriously until we break into the 1340s. Until then....it remains a series of higher highs..and higher lows.

A little more later.

We appear to be setting up tomorrow with some bullish pennants, a move to a new high of 1410/15 seems viable.

The closing hourly charts

IWM

Dow

SP

Summary

Another relatively flat day. I suppose it could be said we're forming a nice flat top - or even the head of a H/S formation (see daily charts earlier), and that we'll rollover in the next few days - at least to the low 1370s.

Regardless, no declines can be taken seriously until we break into the 1340s. Until then....it remains a series of higher highs..and higher lows.

A little more later.

3pm update - Closing hour tedium

There would appear no reason why this final hour will be any different than any of the others. The VIX shows a complete lack of volatility in the immediate term.

sp'60min, rainbow

sp,daily5b

Summary

What else needs to be said, other than..we remains trading in a micro-range.

The daily MACD cycle is showing signs of levelling out. Not a bad level to short at, with simple stops around 1405/10/23.

A little more after the close...

sp'60min, rainbow

sp,daily5b

Summary

What else needs to be said, other than..we remains trading in a micro-range.

The daily MACD cycle is showing signs of levelling out. Not a bad level to short at, with simple stops around 1405/10/23.

A little more after the close...

2pm update - latter day weakness?

More nothing. Smaller cycles offer opportunity to close lower, but really, there is ZERO momentum to the downside still.

sp'60min, rainbow

Summary

So dull again today.

--

sp'60min, rainbow

Summary

So dull again today.

--

1pm update - still sleepy

The earlier collapse wave...5 points...is indeed shameful..and mere noise.

Its too quiet to stay awake...

sp'60min

Summary

It looks like we briefly broke the small wedge, within the bigger one. Yet, we're back to flat again.

Dull, dull..dull

Its too quiet to stay awake...

sp'60min

Summary

It looks like we briefly broke the small wedge, within the bigger one. Yet, we're back to flat again.

Dull, dull..dull

12pm update - bears need to feed

The market remains in utterly mindless semi-conscious boredom mode, although in the last 10 minutes, something seems to have upset those nasty algo-bots.

Meanwhile....in Colorado, USA

--

Sp'daily5b - H/S formation idea

Summary

Market is ticking lower as I type.

*new chart above, its just an idea. I only have low confidence in this formation right now.

Most important of all, as noted, bears must see 1340s...to suggest 'anything interesting', otherwise, its just another higher low..and then up we go into September.

Time for lunch...maybe...something sweet.

Meanwhile....in Colorado, USA

--

Sp'daily5b - H/S formation idea

Summary

Market is ticking lower as I type.

*new chart above, its just an idea. I only have low confidence in this formation right now.

Most important of all, as noted, bears must see 1340s...to suggest 'anything interesting', otherwise, its just another higher low..and then up we go into September.

Time for lunch...maybe...something sweet.

11am update - zero volume slow motion melt

Another dead trading day.

sp'60min

Summary

I'd be utterly bemused if we can break over the top of the wedge/channel line at 1409/10.

First downside target 1402..which is embarrassing to say, since its only 3pts lower.

sp'60min

Summary

I'd be utterly bemused if we can break over the top of the wedge/channel line at 1409/10.

First downside target 1402..which is embarrassing to say, since its only 3pts lower.

10am update - morning chop

Very little happening, VIX is flat, remaining in the lowly 15s.

A market of no volume..and no fear, with the occasionally algo-bot going insane. Great huh ?

sp'60min

Summary

Only a break into the 1340s - some 4% lower, would start to reverse the bigger up trends.

Its really starting to look like there is no point trading this nonsense until after we get past the labour day holiday.

Come back September 4'th?

A market of no volume..and no fear, with the occasionally algo-bot going insane. Great huh ?

sp'60min

Summary

Only a break into the 1340s - some 4% lower, would start to reverse the bigger up trends.

Its really starting to look like there is no point trading this nonsense until after we get past the labour day holiday.

Come back September 4'th?

Pre-market Brief

Good morning. Futures are marginally lower, sp-2pts, we're set to open around the big 1400 level. Futures overnight were as high as sp+6pts. All minor moves though, it has to be said.

Weekly jobs data: 361k vs 367k consensus.

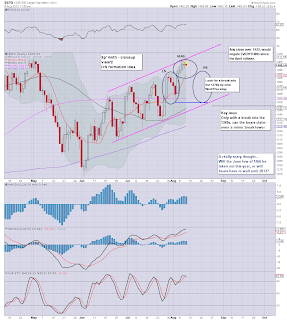

sp'60min

sp'daily5

Summary

The broader daily trend remains very clearly up..and is now supported by rising weekly and monthly cycles. The hourly is a clear wedge within a wedge...a break to the downside seems likely within the next day or so.

First target would be 1380 by next Monday.

As noted on the hourly chart though, bears have to see a break below the recent low of 1354 to put in a lower low - something we've not done since the June low of 1266.

Good wishes for Thursday.

Weekly jobs data: 361k vs 367k consensus.

sp'60min

sp'daily5

Summary

The broader daily trend remains very clearly up..and is now supported by rising weekly and monthly cycles. The hourly is a clear wedge within a wedge...a break to the downside seems likely within the next day or so.

First target would be 1380 by next Monday.

As noted on the hourly chart though, bears have to see a break below the recent low of 1354 to put in a lower low - something we've not done since the June low of 1266.

Good wishes for Thursday.

Daily Index Cycle update

Very minor moves in the main indexes. Both the transports and Rus'2000 index again showed slight weakness again.

IWM (representing Rus'2000 small cap)

Dow

Transports

Summary

Very minor moves today, essentially low volume algo-bot chop.

There are wedges within wedges, so I can understand that some are getting very bearish into the tail end of this week, but there just doesn't seem to be any underlying sellside action/momentum. We couldn't hold a 5pt drop at the open for more than an hour.

From a MACD (blue bar histogram) cycle perspective, there is NO sign of a turn, or even levelling out yet. At the current rate, there is no chance of a clear rollover in progress until next week.

As I keep noting..the bears need a catalyst to get any major down cycle underway. So far as I can see, there is nothing apparent in the view field. Where do those black swans live anyway?

Goodnight from London

IWM (representing Rus'2000 small cap)

Dow

Transports

Summary

Very minor moves today, essentially low volume algo-bot chop.

There are wedges within wedges, so I can understand that some are getting very bearish into the tail end of this week, but there just doesn't seem to be any underlying sellside action/momentum. We couldn't hold a 5pt drop at the open for more than an hour.

From a MACD (blue bar histogram) cycle perspective, there is NO sign of a turn, or even levelling out yet. At the current rate, there is no chance of a clear rollover in progress until next week.

As I keep noting..the bears need a catalyst to get any major down cycle underway. So far as I can see, there is nothing apparent in the view field. Where do those black swans live anyway?

Goodnight from London

Subscribe to:

Comments (Atom)