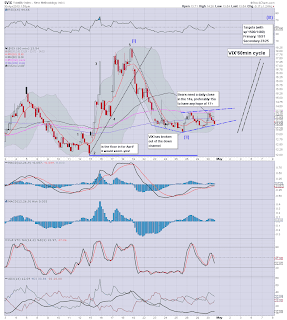

With the indexes seeing latter day melt into the close, the VIX naturally slipped lower, closing -1.4% @ 13.52. The VIX has been effectively in sideways chop for the last 5 trading days, which is actually somewhat impressive, with the main indexes continuing to rally.

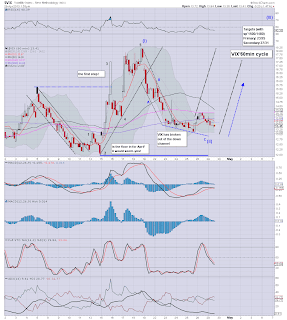

VIX'60min

VIX'daily3

Summary

Suffice to say, the VIX is largely powerless right now.

Equity bears need a daily VIX close >14.50..preferably in the 15s, with sp <1570. Right now, the latter especially looks difficult.

--

I'm still seeking a VIX jump...but until those initial levels are hit, hopes of 20s, have to be put back on hold...yet again.

more later..on the indexes

Tuesday, 30 April 2013

Closing Brief

The main indexes all closed moderately higher. The Nasdaq was especially strong, lead by AAPL which managed to close around 3% higher. VIX failed to hold the earlier 14s, and it remains an entirely complacent market. The Oil/Gas market was the only weak aspect.

sp'60min

Summary

...and April comes to an end.

The sixth consecutive monthly gain for the SP, although the two leading indexes - Trans/R2K both saw moderate declines.

*SP' fractioanlly takes out the April' high of 1597.35, and technically speaking, that merely confirms the action in the Nasdaq of the past few days.

-

more later...on the VIX

sp'60min

Summary

...and April comes to an end.

The sixth consecutive monthly gain for the SP, although the two leading indexes - Trans/R2K both saw moderate declines.

*SP' fractioanlly takes out the April' high of 1597.35, and technically speaking, that merely confirms the action in the Nasdaq of the past few days.

-

more later...on the VIX

3pm update - another lousy month for the bears

April is coming to a close, with just one trading hour left. The SP' has broken new historic highs this month, and the VIX remains in the low teens. QE-POMO continues each and every day, and despite genuine recessionary data, the market won't significantly fall. For the bears..April was just another month of failure.

sp'60min

sp'monthly

Summary

April with be the sixth consecutive monthly gain for the SP'500, and the 15'th monthly gain - of 19, since the market began a major wave higher in October'2011.

--

For the bears, even the notion of falling 10% looks 'too far'. Even the decline of two weeks ago was a pitiful 4%.

-

Bad day, bad month..and so far.....bad year.

--

3.18pm..here is something for the remaining doomer bears out there..

Trans, monthly...first down candle since last Sept

Interesting..from the old leader

--

3.40pm... AAPL closing the month....net flat, although its $59 above the recent low.

sp'60min

sp'monthly

Summary

April with be the sixth consecutive monthly gain for the SP'500, and the 15'th monthly gain - of 19, since the market began a major wave higher in October'2011.

--

For the bears, even the notion of falling 10% looks 'too far'. Even the decline of two weeks ago was a pitiful 4%.

-

Bad day, bad month..and so far.....bad year.

--

3.18pm..here is something for the remaining doomer bears out there..

Trans, monthly...first down candle since last Sept

Interesting..from the old leader

--

3.40pm... AAPL closing the month....net flat, although its $59 above the recent low.

2pm update - bots still able to melt this

Market is holding just a fraction below the April'11 high of 1597.35, but then, the Nasdaq is already above that high. The only weakness out there now is in the Oil/Gas market. VIX still failing to show any power, and a close in the 14s now looks out of range.

sp'60min

vix'60min

Summary

Not much to say really. Might close in the 1600s, might not.

All that is clear, is that there is simply no power on the downside. Sure we could drop into the 1580s again, but that counts for nothing.

Perhaps the weakness in the Oil market is a tiny preliminary sign for the main market, but that is stretching things, even for a permabear.

Oil does look 'done' on the daily charts...

USO, daily2

Target would be <32 within 3-5 days

--

2.20pm..those bears seeking a weak close, should be desperate to see a clear VIX break, with a close >14.50.. and sp under the morning low of 1586. The latter looks especially difficult.

sp'60min

vix'60min

Summary

Not much to say really. Might close in the 1600s, might not.

All that is clear, is that there is simply no power on the downside. Sure we could drop into the 1580s again, but that counts for nothing.

Perhaps the weakness in the Oil market is a tiny preliminary sign for the main market, but that is stretching things, even for a permabear.

Oil does look 'done' on the daily charts...

USO, daily2

Target would be <32 within 3-5 days

--

2.20pm..those bears seeking a weak close, should be desperate to see a clear VIX break, with a close >14.50.. and sp under the morning low of 1586. The latter looks especially difficult.

1pm update - its anyones guess, for todays close

Three hours left of the trading month, and frankly, its impossible to even vaguely guess whether we'll close in the sp'1600s...or in the 1580s. The only real weakness still out there is in the metals/oil market. VIX is still unable to hold the 14s.

sp'60min

Summary

Baring some truly bizarre late day sell off, something we've not seen in a few weeks, April will close net higher, making the sixth consecutive monthly gain.

All is well in market land, but then...its probably just the POMO.

--

VIX update..from Mr T

So, someone out there is buying front month VIX calls, hmm.

--

The April'11th high of 1597.35...about to get taken out.

sp'60min

Summary

Baring some truly bizarre late day sell off, something we've not seen in a few weeks, April will close net higher, making the sixth consecutive monthly gain.

All is well in market land, but then...its probably just the POMO.

--

VIX update..from Mr T

So, someone out there is buying front month VIX calls, hmm.

--

The April'11th high of 1597.35...about to get taken out.

12pm update - market switches back to invincible mode

Market seems to have switched on invincible mode this morning. After a recessionary PMI number, the indexes are back to green, and we're breaking higher. Nasdaq is climbing to new post 2009 highs, lead by AAPL +2% in the $440s. Oil/metals remain somewhat weak.

sp'60min

vix'60min

Summary

I think many are getting real tired of this.

-

VIX can't even hold the 14s, and we have a market that could close in the sp'1600s.

..meanwhile..another sign of our healthy US algo-bot market....

Symantec..1min

Great huh, a truck load of stops just got hit..and then..BOOM, right back up.

see ZH for further talk on 'flash crash of the day.

sp'60min

vix'60min

Summary

I think many are getting real tired of this.

-

VIX can't even hold the 14s, and we have a market that could close in the sp'1600s.

..meanwhile..another sign of our healthy US algo-bot market....

Symantec..1min

Great huh, a truck load of stops just got hit..and then..BOOM, right back up.

see ZH for further talk on 'flash crash of the day.

11am update - bears still weak

After some weakness resulting from the recessionary PMI number, market is again back in the 1590s..and those bull maniacs are still in control. VIX is finding it too difficult just to hold the 14s. Precious metals and Oil both moderately weak, and look toppy on the larger time frame.

sp'60min

vix'60min

Summary

A sub'50 PMI number, and the market could yet close higher.

But then..every day is a POMO day, with those algo-bots - low volume permitting, able to melt everything upward.

It remains a very frustrating market.

What is absolutely clear, bears can't be the least bit confident until we're back in those sp'1560s, which is a good 1.5% lower..and that sure doesn't seem likely today..or even tomorrow.

sp'60min

vix'60min

Summary

A sub'50 PMI number, and the market could yet close higher.

But then..every day is a POMO day, with those algo-bots - low volume permitting, able to melt everything upward.

It remains a very frustrating market.

What is absolutely clear, bears can't be the least bit confident until we're back in those sp'1560s, which is a good 1.5% lower..and that sure doesn't seem likely today..or even tomorrow.

10am update - recessionary PMI data

Market is still holding together rather strongly, despite a recessionary Chicago PMI number of 49 - the first sub'50 since 2009. VIX has broken into the 14s, and there is a little weakness in the oil market. Generally though, if the trading volume remains low, algo bots could still melt it back upward later in the day.

sp'60min

vix'60min

Summary

So...bears get a somewhat surprisingly recessionary key PMI number under 50.

But hey, the FOMC are meeting today, so, they are now even less likely to suggest QE will ever end..and that is clearly what the market wants to hear.

Either way, its still not looking good for those in bear land.

Need sp'1560s..to have any sign that the current wave from November is over.

--

VIX daily MACD cycle is starting to tick back up.

Equity bears need VIX in the 15s to really give a clear signal.

*there is no turn on the daily index charts yet, and probably another 2-3 days.

-

10.08am We now have a clear break of the channel on the hourly charts..and VIX is making a run for it. Once again, the last short-stop line is sp'1597 - the April'11 high.

10.30am... Daily MACD turns on VIX, SP, Oil looks weak.

Its NOT conclusive yet..but the signs are out there..how we close the day..and month..will be important.

sp'60min

vix'60min

Summary

So...bears get a somewhat surprisingly recessionary key PMI number under 50.

But hey, the FOMC are meeting today, so, they are now even less likely to suggest QE will ever end..and that is clearly what the market wants to hear.

Either way, its still not looking good for those in bear land.

Need sp'1560s..to have any sign that the current wave from November is over.

--

VIX daily MACD cycle is starting to tick back up.

Equity bears need VIX in the 15s to really give a clear signal.

*there is no turn on the daily index charts yet, and probably another 2-3 days.

-

10.08am We now have a clear break of the channel on the hourly charts..and VIX is making a run for it. Once again, the last short-stop line is sp'1597 - the April'11 high.

10.30am... Daily MACD turns on VIX, SP, Oil looks weak.

Its NOT conclusive yet..but the signs are out there..how we close the day..and month..will be important.

Pre-Market Brief

Good morning. Futures are flat, we're set to open at sp'1593. USD is flat, precious metals are..flat...whilst Oil and Gas are moderately lower. The PMI number will be a key market mover this morning, so lets see if the bulls can manage to hit the next big level of sp'1600s.

sp'60min

vix'60min

Summary

Its the last trading day of April, so there will be some 'end-month' issues today.

--

The VIX is probably all the bears have left to tout. Hourly chart suggest VIX upside viable, and daily chart is certainly looking floored in the mid 13s..but no turn yet.

Given another 2-3 days, VIX should have at least a 'moderate chance' of 16/17.

--

I remain short, and its getting...annoying.

--

*opening the NYSE this morning...Tony Stark...of Stark Industries.

Figures.

-

9.45am.. PMI 49.0 .... RECESSIONARY.

Lets see how the market deals with that.

sp'60min

vix'60min

Summary

Its the last trading day of April, so there will be some 'end-month' issues today.

--

The VIX is probably all the bears have left to tout. Hourly chart suggest VIX upside viable, and daily chart is certainly looking floored in the mid 13s..but no turn yet.

Given another 2-3 days, VIX should have at least a 'moderate chance' of 16/17.

--

I remain short, and its getting...annoying.

--

*opening the NYSE this morning...Tony Stark...of Stark Industries.

Figures.

-

9.45am.. PMI 49.0 .... RECESSIONARY.

Lets see how the market deals with that.

Closing the month on a new high?

With just one trading day left of April, the US markets are set to close another month on another high. The sp' is holding monthly gains of just over 1.5%, and baring a Tuesday daily fall of 25pts, this will mark the 15th month higher out of 19 - since the current grand up wave from Oct'2011.

sp'monthly3, rainbow

sp'weekly2, rainbow

Summary

So..baring a rather substantial Tuesday decline of sp -25pts, we're set to see April close with a green candle on the rainbow chart.

Even more disturbing for the bears is that the weekly charts are now back to green, and we have the upper bollinger band offering the sp'1620s as viable 'at any time'.

If Mr Market wants to obliterate as many bears as possible it'll just keep pushing another 2-3% higher into mid May. Gods help the remaining bears if that the case, which still includes yours truly.

Looking ahead

The big econ-data point for Tuesday is the Chicago PMI number (9.45am), market is seeking 52.4. Bears should be seeking a recessionary number of <50, although that seems rather unlikely.

Frankly, the best the bears can probably hope for Tuesday is a VIX back in the low 15s, with SP 1580s. The following H/S scenario is still arguably viable in the weeks ahead, but even the first target of sp'1485 is now a clear 100pts lower.

sp'daily5a - H/S

--

What is absolutely clear, the bears need to claw back into the 1560s, with VIX showing significant power in the upper teens again. Right now, that looks like an overly wistful and classic 'doomer bear' hope.

Goodnight from London

sp'monthly3, rainbow

sp'weekly2, rainbow

Summary

So..baring a rather substantial Tuesday decline of sp -25pts, we're set to see April close with a green candle on the rainbow chart.

Even more disturbing for the bears is that the weekly charts are now back to green, and we have the upper bollinger band offering the sp'1620s as viable 'at any time'.

If Mr Market wants to obliterate as many bears as possible it'll just keep pushing another 2-3% higher into mid May. Gods help the remaining bears if that the case, which still includes yours truly.

Looking ahead

The big econ-data point for Tuesday is the Chicago PMI number (9.45am), market is seeking 52.4. Bears should be seeking a recessionary number of <50, although that seems rather unlikely.

Frankly, the best the bears can probably hope for Tuesday is a VIX back in the low 15s, with SP 1580s. The following H/S scenario is still arguably viable in the weeks ahead, but even the first target of sp'1485 is now a clear 100pts lower.

sp'daily5a - H/S

--

What is absolutely clear, the bears need to claw back into the 1560s, with VIX showing significant power in the upper teens again. Right now, that looks like an overly wistful and classic 'doomer bear' hope.

Goodnight from London

Daily Index Cycle update

The main indexes continued higher, on what is now day six of a rally from the sp'1536 low. The Nasdaq was the strongest index, with gains of 0.85%, most indexes had closing gains of 0.5% or so. Near term trend is clearly still to the upside, with a bizarrely low VIX in the 13s.

Nasdaq comp

SP'daily5

Trans

Summary

The bears utterly failed today, and it was perhaps one of the worse failures we've seen in some months.

Not only did we see all indexes break the highs from last Wednesday, but we even saw the Nasdaq break the high of April'11.

Clearly, the bulls are still in control, and there is currently no sign of a turn/levelling phase. Indeed, it is entirely possible we'll just gap open higher Tuesday..straight into the sp'1600s.

a little more later

Nasdaq comp

SP'daily5

Trans

Summary

The bears utterly failed today, and it was perhaps one of the worse failures we've seen in some months.

Not only did we see all indexes break the highs from last Wednesday, but we even saw the Nasdaq break the high of April'11.

Clearly, the bulls are still in control, and there is currently no sign of a turn/levelling phase. Indeed, it is entirely possible we'll just gap open higher Tuesday..straight into the sp'1600s.

a little more later

Monday, 29 April 2013

Volatility fractionally higher

With the indexes building upon opening gains across the day, the VIX was lower, but only by 1% at the low. The VIX managed fractional gains by the close, +0.7% @ 13.71. Hourly charts offer VIX upside for Tuesday, with near term initial target on the daily charts remaining in the 16/17s.

VIX'60min

VIX'daily3

Summary

Today was one of those rare days where we have all the indexes closing with distinct gains, but where the VIX was flat..or in today's case..even a touch higher.

Certainly, the hourly charts offer upside across Tuesday, but how high? Daily charts would suggest 16/17s are viable. That is going to probably need sp' back in the 1560s, if not even the 1540s.

As has been the case since late December, first big target is the key threshold of VIX 20. A daily/weekly close >20 would be very significant, and clarify that 'things have changed' since the current index wave from last November.

--

more later..on the indexes

VIX'60min

VIX'daily3

Summary

Today was one of those rare days where we have all the indexes closing with distinct gains, but where the VIX was flat..or in today's case..even a touch higher.

Certainly, the hourly charts offer upside across Tuesday, but how high? Daily charts would suggest 16/17s are viable. That is going to probably need sp' back in the 1560s, if not even the 1540s.

As has been the case since late December, first big target is the key threshold of VIX 20. A daily/weekly close >20 would be very significant, and clarify that 'things have changed' since the current index wave from last November.

--

more later..on the indexes

Closing Brief

The market held minor opening gains, and built upon them across the day. Most indexes saw some clear breaks above last weeks highs, and the Nasdaq even broke the April 11'th high. Hourly charts look prone to weakness on Tuesday, but daily charts show no sign of a broader trend change.

sp'60min

Summary

Despite a touch of weakness in the closing hour, a very disappointing start to the week.

Yet, it is a long week, we have big econ-data/events every day this week, with the FOMC on Wed', the ECB on Thursday, and key jobs data on Friday.

-

Did the sp' just peak at the start of the week @ 1596, or is it just the start of another wave higher?

-

Arguably, the big/serious money bears should have got short stopped out this morning, and most surely can't consider a re-short, until confirmation with a daily close <sp'1570.

more later..on the VIX

sp'60min

Summary

Despite a touch of weakness in the closing hour, a very disappointing start to the week.

Yet, it is a long week, we have big econ-data/events every day this week, with the FOMC on Wed', the ECB on Thursday, and key jobs data on Friday.

-

Did the sp' just peak at the start of the week @ 1596, or is it just the start of another wave higher?

-

Arguably, the big/serious money bears should have got short stopped out this morning, and most surely can't consider a re-short, until confirmation with a daily close <sp'1570.

more later..on the VIX

3pm update - bears fail...again

With the Nasdaq at new highs, and the Dow/Trans taking out the high from last Thursday, the bulls have achieved a significant victory to begin the week. Even if the bears can manage a small down cycle into the 1580s tomorrow, it will count for nothing. Only the 1560s offer any hope of a mid-term trend change.

sp'60min

vix'60min

Summary

VIX might close green, not that it really matters. Most of the indexes have broken key levels, and the only issue now is whether the bulls can get follow through on Tuesday.

Hourly charts are closing to a turn, but as noted...baring a break <sp'1570, its all irrevelent.

--

3.09pm.. hourly charts..rolling over..hence the touch of weakness.

Yet..as I will keep noting though..until we're in the 1560s..bears have 'issues'.

VIX fractionally green.

--

3.41pm...bears just got no power. A close in the 1590s..with VIX 13s. Major failure to start the week.

back at the close.

sp'60min

vix'60min

Summary

VIX might close green, not that it really matters. Most of the indexes have broken key levels, and the only issue now is whether the bulls can get follow through on Tuesday.

Hourly charts are closing to a turn, but as noted...baring a break <sp'1570, its all irrevelent.

--

3.09pm.. hourly charts..rolling over..hence the touch of weakness.

Yet..as I will keep noting though..until we're in the 1560s..bears have 'issues'.

VIX fractionally green.

--

3.41pm...bears just got no power. A close in the 1590s..with VIX 13s. Major failure to start the week.

back at the close.

2pm update - still battling higher

Mr Market is still battling upward, and we now have the Nasdaq above the April'11th highs - equivalent to sp'1597. SP' itself is imminently set to break that high, and a daily close in the 1600s should cause major concern for those seeking downside across May.

sp'60min

vix'60min

Summary

Suffice to say.. a lousy start to the week. There are a few 'small signs' things might be better for the bears tomorrow, but arguably the big/serious money already got short stopped out today, if not last week.

Only the reckless remain.

sp'60min

vix'60min

Summary

Suffice to say.. a lousy start to the week. There are a few 'small signs' things might be better for the bears tomorrow, but arguably the big/serious money already got short stopped out today, if not last week.

Only the reckless remain.

1pm update - bears on the run

The leading indexes are all above the highs of last Thursday. Naturally, the bears are now getting heavily short-stopped out of their positions, and we're no doubt also seeing some bull chasers starting to appear. With a weak USD, and generally 'nothing going on'...algo bot melt into the close seems likely.

sp'60min (updated)

vix'60min

Summary

Hourly index charts have to be redrawn, and with the break >1592, counts need to be thrown out. I suppose some might tout the recent wave lower as a big 4, ..but whatever it is, we're now very much higher.

--

Daily charts offer NO sign of any turn lower.

The one thing the bears still have is a VIX that is only down a few percent, but then...VIX can't get much lower than the 13s anyway.

-

For those not already short stopped out..this is turning out to be something of a Monday mini-massacre.

--

Oil update.. via USO

Oil testing the 200 day MA..so far.. failing to hold over, but obviously the near term trend is still generally to the upside.

I'm still amazed it made it back into the 33s at all.

UPDATE 1.31pm.. VIX trying to go green..whilst indexes still holding gains. Hmm

sp'60min (updated)

vix'60min

Summary

Hourly index charts have to be redrawn, and with the break >1592, counts need to be thrown out. I suppose some might tout the recent wave lower as a big 4, ..but whatever it is, we're now very much higher.

--

Daily charts offer NO sign of any turn lower.

The one thing the bears still have is a VIX that is only down a few percent, but then...VIX can't get much lower than the 13s anyway.

-

For those not already short stopped out..this is turning out to be something of a Monday mini-massacre.

--

Oil update.. via USO

Oil testing the 200 day MA..so far.. failing to hold over, but obviously the near term trend is still generally to the upside.

I'm still amazed it made it back into the 33s at all.

UPDATE 1.31pm.. VIX trying to go green..whilst indexes still holding gains. Hmm

12pm update - still on the border

With the Dow and Transports breaking above last Thursdays 'marginally lower high', the bears have a serious problem. Bears appear weak, and if the algo-bots are left alone, we'll be back to the usual late day afternoon melt, where even the sp' will be >1592.

sp'60min

vix'60min

Summary

First downside target is the soft rising resistance of the hourly 10MA, currently @ sp'1584/85.

With the weak USD, precious metals and Oil are getting an extra kick higher.

--

*I remain heavy short, but underwater. Not drowning (yet)...but might need scuba gear by the close.

VIX update..from Mr T

time for lunch

--

...and there go the 1592 stops.. urghh. Nothing but air until 1597...and then its the big historic 1600s.

Absolutely lousy start to the week, and we're simply right back to low vol' algo bot melt.

12.40pm...bears on the run...stops getting hit..and now its just a matter of whether we close above..or below the April'11 high of sp'1597.

Those touting a cycle high in mid May..now look more likely than not.

sp'60min

vix'60min

Summary

First downside target is the soft rising resistance of the hourly 10MA, currently @ sp'1584/85.

With the weak USD, precious metals and Oil are getting an extra kick higher.

--

*I remain heavy short, but underwater. Not drowning (yet)...but might need scuba gear by the close.

VIX update..from Mr T

time for lunch

--

...and there go the 1592 stops.. urghh. Nothing but air until 1597...and then its the big historic 1600s.

Absolutely lousy start to the week, and we're simply right back to low vol' algo bot melt.

12.40pm...bears on the run...stops getting hit..and now its just a matter of whether we close above..or below the April'11 high of sp'1597.

Those touting a cycle high in mid May..now look more likely than not.

11am update - borderline

The market has built upon earlier gains and we've seen the Dow and Transports break above last Thursdays highs. The SP and R2K are still fractionally under. So far, bears are showing absolutely no downside power, and with a weak USD, everything is melting higher.

sp'daily5

vix'daily3

Summary

The daily charts are still outright bullish - especially for the Dow/Trans, and until we're trading <sp'1570, bears are in serious danger.

After all, its FOMC week, and if Mr Market decides 'QE forever' really does mean 'forever', then sp'1600s will be hit.

-

Its all very disappointing, but its a long week.. could turn yet, but hey, that's merely a vain hope this morning.

For the big/serious money, the short-stops will ALL be around sp'1592/97.

--

UPDATE 11.15am..well, we're pulling a few pts back from the 1592 Thursday high.

Frankly though, can't be even slightly confident until <1570, and that sure doesn't look viable today. Bears just look embaressingly weak.

11.40am hourly charts suggesting bulls have had their fun for the day, perhaps the week.

Remains borderline situation, and the problem I have, is that even sp' doesn't break 1592, the dow...and transports did.

No bearish clarity, unless <1570.

sp'daily5

vix'daily3

Summary

The daily charts are still outright bullish - especially for the Dow/Trans, and until we're trading <sp'1570, bears are in serious danger.

After all, its FOMC week, and if Mr Market decides 'QE forever' really does mean 'forever', then sp'1600s will be hit.

-

Its all very disappointing, but its a long week.. could turn yet, but hey, that's merely a vain hope this morning.

For the big/serious money, the short-stops will ALL be around sp'1592/97.

--

UPDATE 11.15am..well, we're pulling a few pts back from the 1592 Thursday high.

Frankly though, can't be even slightly confident until <1570, and that sure doesn't look viable today. Bears just look embaressingly weak.

11.40am hourly charts suggesting bulls have had their fun for the day, perhaps the week.

Remains borderline situation, and the problem I have, is that even sp' doesn't break 1592, the dow...and transports did.

No bearish clarity, unless <1570.

10am update - waiting for weakness

sp'60min

vix'60min

Summary

Daily charts (not shown) are still to rollover, so lets be clear...bears can't be the least bit confident yet.

Worse, any break >1592, and that would really mess things up for my mid-term outlook.

Bears need a close <1570, with VIX in the 15/16s.

---

*I remain heavy short, via SPY & USO. Seeking a break <1536 within 5-7 trading days. Primary target is sp'1485, with VIX in the low 20s.

-

10.15am. sp'1590.. we're right on the border again. Anything >1592..and we'll spiral much higher.

Urghh, this is starting to get annoying again!

10.30am.. sp'1592.64 was the Thursday high, and we're barely 1pt away.

Dow/Transports..already ABOVE the Thursday high.

The sp'1600 believers will be appearing all over the web within the hour. I can't say I blame them. This ain't looking so good.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +4pts, we're set to open @ 1586, a mere 6pts from the Thursday high. USD is notably weaker by 0.5%, and this is probably helping to kick just about everything higher, inc' the precious metals and Oil. Bears need to reverse this..quickly..

sp'60min

vix'60min

Summary

So, we're set to open a little higher. Bears need to see a morning reversal, or bulls could get a close back into the 1590s, and that would bode badly for the rest of the week.

Yet, there is a truckload of econ-data this week, so....lets see how today goes first, before waving the white flag.

Bear case late today/early Tuesday, sp'1560s, with VIX 16/17s.

Good wishes for the week!

--

9.35am... black candles all over the place. Spike out the weak bears..and then reverse?

I won't be in the least bit pleased unless we get a close in the 1560s..which right now, looks a long way down.

-

Long day ahead.....long week.

sp'60min

vix'60min

Summary

So, we're set to open a little higher. Bears need to see a morning reversal, or bulls could get a close back into the 1590s, and that would bode badly for the rest of the week.

Yet, there is a truckload of econ-data this week, so....lets see how today goes first, before waving the white flag.

Bear case late today/early Tuesday, sp'1560s, with VIX 16/17s.

Good wishes for the week!

--

9.35am... black candles all over the place. Spike out the weak bears..and then reverse?

I won't be in the least bit pleased unless we get a close in the 1560s..which right now, looks a long way down.

-

Long day ahead.....long week.

Saturday, 27 April 2013

Weekend update - US weekly indexes

The US indexes saw net gains of between 1.1-2.5%, with the Rus'2000 small cap leading the way. The Dow was the laggard this week. Despite the gains, none of the indexes made new highs though, and that is indeed the one thing the bears can still be relieved about.

Lets take our regular look at six of the main US indexes..

IWM (repre' Rus'2000 small cap)

The R2K was the leader this week with gains of 2.5%, yet the weekly chart is very clear, we're putting in consistently lower highs. Bulls beware!

Despite the gains, the MACD (blue bar histogram) cycle ticked lower, and is now in its second week in negative territory. First key downside is a break of the 89s..and proceeding to the 85s - the old resistance from last September.

Nasdaq Comp

The tech sector came very close to breaking a new high..but just fell short by less than 1%. MACD cycle ticked higher, but still looks set to go negative cycle within the next week or two. First downside target is a weekly close <3200, and that will open up 3050/3000. Getting a weekly close <3000 is going to be VERY difficult.

Dow

The mighty Dow was the laggard this week with moderate gains of just 1.1%. MACD cycle is still 2-3 weeks away from going negative cycle, and we also await a bearish cross (black line below red).

First downside target are the 14300s, and then 14k. A weekly close <14k, would open up a hit of the lower bollinger - which by mid May will be around 13k. That's a very long way down right now, around 10%.

NYSE Comp

The master index saw gains of around 2%, and also came very close to breaking new highs...but failed. MACD cycle is negative for the second week running, First big downside target are the 8500s, that is 6-7% lower.

SP

The all important SP'500 saw net gains of 27pts, with a weekly close of 1582. The Thursday high of 1592 was a mere 5pts shy of the April'11th high.

It would seem that we have put in a very important marginally lower high, and so long as 1592 is not broken over, bears should have some moderate confidence that a challenge of the 1536 low will be made within the next 3-7 trading days.

A break of 1536 will open up the February 1485 low, and that is just 10pts above the old resistance/highs of last September.

Primary objective should be a hit of the lower bollinger band, currently @ 1407, but by late May it will be around 1450. It looks extremely difficult to envision sub 1400s any time soon.

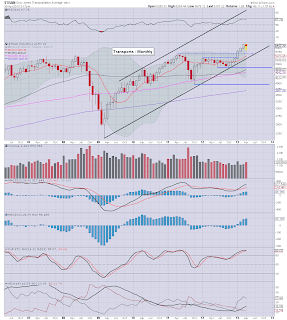

Trans

The old leader climbed 1.3%, but it is still putting in a general series of lower highs. As expected, the MACD cycle is now negative. A very obvious downside target are the 5400s, which is where the rising lower bollinger will be in the latter part of May.

Summary

So, the US market managed an up week, but we have arguably put in what I believe is a rather critical marginally lower high. I had been expecting a rally - to around the low 1570s, and it sure felt uncomfortable with that little foray into the 1590s.

Fortunately though, we've seen a little weakness to close the week, and it is now simply a case of whether the bears can kick this market down hard..or whether the bulls are going to get yet another attempt to take out the recent highs.

All things considered - not least the weekly index charts, I believe the market will break lower into May, and that we'll soon be trading <1500.

Holding to the original outlook - sp'daily5b - best guess

What is now absolutely straight forward is that this scenario gets thrown out if we see any daily closes above the Thursday 'marginally lower high' of 1592.

Arguably, bears need to see a very significant fall either Mon' or Tuesday. As usual, a 3-6hr bounce is then likely, before a sharper fall.

The lower bollinger on the daily is currently 1539. A daily close BELOW this lower band will be important this coming week. But hey, first we need to take out that recent 1536 low.

Q. What about the big fall highlighted in late May ?

- It is just a possible bigger downward scenario/count I am keeping in mind. It will only have a chance of occurring if we are trading in the sp'1490/80s, arguably no later than May'10th.

Looking ahead

Next week is absolutely packed with data/events, there is something significant each day. Highlights include Chicago PMI data on Tuesday, ADP jobs on Wednesday, and also the headline BLS monthly jobs data on Friday. Market is expecting 153k gains with a static rate of 7.6%. Again, anything <100 would be a major disappointment.

However, perhaps even more important than the jobs data will be the FOMC. Yes, it is already time for another announcement from the paper printers at the US Federal Reserve - this Wednesday at 2pm. As ever, it will be all about how the algo-bots interpret the fed speak.

*I am heavy short the indexes (via SPY), and Oil (via USO). I will look to exit at the end of any day where there are significant market declines, and seek a re-short the following day. Key objective are the sp'1490/80s, sometime this May.

back on Monday :)

--

Bonus video - from Ron Walker 'Chart Pattern Trader'

He remains somewhat overly on the 'doomster' train (which yes, coming from me sounds odd), but still, its worth a look, if you have a spare hour, and a lot of coffee/tea.

|

| US markets about to get burnt? |

Lets take our regular look at six of the main US indexes..

IWM (repre' Rus'2000 small cap)

The R2K was the leader this week with gains of 2.5%, yet the weekly chart is very clear, we're putting in consistently lower highs. Bulls beware!

Despite the gains, the MACD (blue bar histogram) cycle ticked lower, and is now in its second week in negative territory. First key downside is a break of the 89s..and proceeding to the 85s - the old resistance from last September.

Nasdaq Comp

The tech sector came very close to breaking a new high..but just fell short by less than 1%. MACD cycle ticked higher, but still looks set to go negative cycle within the next week or two. First downside target is a weekly close <3200, and that will open up 3050/3000. Getting a weekly close <3000 is going to be VERY difficult.

Dow

The mighty Dow was the laggard this week with moderate gains of just 1.1%. MACD cycle is still 2-3 weeks away from going negative cycle, and we also await a bearish cross (black line below red).

First downside target are the 14300s, and then 14k. A weekly close <14k, would open up a hit of the lower bollinger - which by mid May will be around 13k. That's a very long way down right now, around 10%.

NYSE Comp

The master index saw gains of around 2%, and also came very close to breaking new highs...but failed. MACD cycle is negative for the second week running, First big downside target are the 8500s, that is 6-7% lower.

SP

The all important SP'500 saw net gains of 27pts, with a weekly close of 1582. The Thursday high of 1592 was a mere 5pts shy of the April'11th high.

It would seem that we have put in a very important marginally lower high, and so long as 1592 is not broken over, bears should have some moderate confidence that a challenge of the 1536 low will be made within the next 3-7 trading days.

A break of 1536 will open up the February 1485 low, and that is just 10pts above the old resistance/highs of last September.

Primary objective should be a hit of the lower bollinger band, currently @ 1407, but by late May it will be around 1450. It looks extremely difficult to envision sub 1400s any time soon.

Trans

The old leader climbed 1.3%, but it is still putting in a general series of lower highs. As expected, the MACD cycle is now negative. A very obvious downside target are the 5400s, which is where the rising lower bollinger will be in the latter part of May.

Summary

So, the US market managed an up week, but we have arguably put in what I believe is a rather critical marginally lower high. I had been expecting a rally - to around the low 1570s, and it sure felt uncomfortable with that little foray into the 1590s.

Fortunately though, we've seen a little weakness to close the week, and it is now simply a case of whether the bears can kick this market down hard..or whether the bulls are going to get yet another attempt to take out the recent highs.

All things considered - not least the weekly index charts, I believe the market will break lower into May, and that we'll soon be trading <1500.

Holding to the original outlook - sp'daily5b - best guess

What is now absolutely straight forward is that this scenario gets thrown out if we see any daily closes above the Thursday 'marginally lower high' of 1592.

Arguably, bears need to see a very significant fall either Mon' or Tuesday. As usual, a 3-6hr bounce is then likely, before a sharper fall.

The lower bollinger on the daily is currently 1539. A daily close BELOW this lower band will be important this coming week. But hey, first we need to take out that recent 1536 low.

Q. What about the big fall highlighted in late May ?

- It is just a possible bigger downward scenario/count I am keeping in mind. It will only have a chance of occurring if we are trading in the sp'1490/80s, arguably no later than May'10th.

Looking ahead

Next week is absolutely packed with data/events, there is something significant each day. Highlights include Chicago PMI data on Tuesday, ADP jobs on Wednesday, and also the headline BLS monthly jobs data on Friday. Market is expecting 153k gains with a static rate of 7.6%. Again, anything <100 would be a major disappointment.

However, perhaps even more important than the jobs data will be the FOMC. Yes, it is already time for another announcement from the paper printers at the US Federal Reserve - this Wednesday at 2pm. As ever, it will be all about how the algo-bots interpret the fed speak.

*I am heavy short the indexes (via SPY), and Oil (via USO). I will look to exit at the end of any day where there are significant market declines, and seek a re-short the following day. Key objective are the sp'1490/80s, sometime this May.

back on Monday :)

--

Bonus video - from Ron Walker 'Chart Pattern Trader'

He remains somewhat overly on the 'doomster' train (which yes, coming from me sounds odd), but still, its worth a look, if you have a spare hour, and a lot of coffee/tea.

Subscribe to:

Posts (Atom)