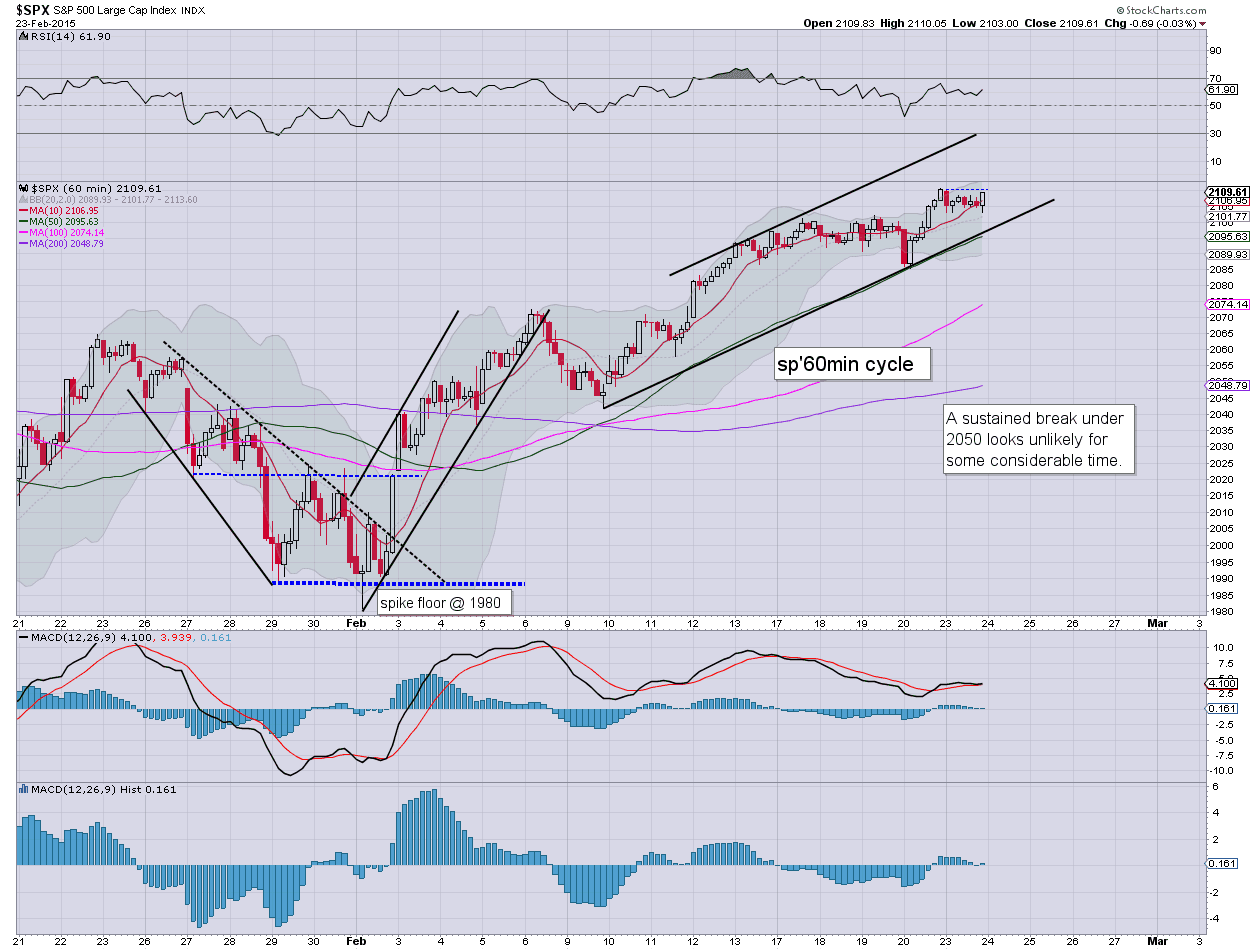

US equities closed moderately mixed, -0.7pts @ 2109. The two leaders - Trans/R2K, settled +0.1% and u/c respectively. Near term outlook offers a cycle high of 2110, with a downside target zone of 2060/40 into next week.

sp'60min

VIX'60min

Summary

*a minor touch of strength into the close, but nothing of significance.

--

So.. equity bulls failed to break a new cycle high, but neither did the bears show any downside power.

Market remains clawing 'broadly higher', even a move to the 50dma in the 2050s next week will do nothing to the broader trend.

--

a daily wrap at 8pm EST

Monday, 23 February 2015

3pm update - weakness into the close

It would seem highly probable that the equity bulls will be unable (for the first time in over a week) to break new highs into the close. It will only take a little closing weakness to take out the morning low of sp'2103, to provide a daily close in the 2090s. Oil has resumed lower after speculation on an OPEC meeting, -2.8%.

sp'60min

USO, daily

Summary

*Oil remains highly volatile intraday... swinging from -3% to -0.7%.. and back to -3%

--

Again, price action remains relatively subdued.. as most are waiting to see what Yellen has to say to the US Senate tomorrow morning.

--

Notable strength: AAPL +2.3% in the $132s.

sp'60min

USO, daily

Summary

*Oil remains highly volatile intraday... swinging from -3% to -0.7%.. and back to -3%

--

Again, price action remains relatively subdued.. as most are waiting to see what Yellen has to say to the US Senate tomorrow morning.

--

Notable strength: AAPL +2.3% in the $132s.

2pm update - the chop continues

US equities remain a touch weak, having seen a minor rally - due to Oil clawing from -3.0% to -0.7%. Metals remain highly vulnerable on rising support, Gold +$1. Equities remain in minor chop mode.. ahead of the Yellen tomorrow morning.

sp'60min

GLD, daily

Summary

*Gold sure looks weak, failed morning rally... highly vulnerable to renewed significant weakness.

--

As for equities, market will typically turn around 2.30pm.. so.. unless the bulls can break sp'2110 within the next 30mins... there is likelihood of weakness into the close...

Seeking a break of the morning low of sp'2103.

sp'60min

GLD, daily

Summary

*Gold sure looks weak, failed morning rally... highly vulnerable to renewed significant weakness.

--

As for equities, market will typically turn around 2.30pm.. so.. unless the bulls can break sp'2110 within the next 30mins... there is likelihood of weakness into the close...

Seeking a break of the morning low of sp'2103.

1pm update - still weak

US equities look increasingly weak, and even the Nasdaq looks vulnerable to closing red, for the first time in nine trading days. Metals also appear increasingly weak, Gold -$1. Oil remains significantly lower, -2. %.

sp'daily5

Summary

Seen on the bigger daily cycle, this market is looking real tired.

Frankly, I'll be surprised if market can break a new high this afternoon... more likely...a break of the morning low of 2103.

A daily close under *2100 now looks viable.

*yes.. the notion of a close under 2100 is pretty bizarre.. if you think about it.

-

Notable weakness, copper miners, FCX and TCK, both lower by around -3%

sp'daily5

Summary

Seen on the bigger daily cycle, this market is looking real tired.

Frankly, I'll be surprised if market can break a new high this afternoon... more likely...a break of the morning low of 2103.

A daily close under *2100 now looks viable.

*yes.. the notion of a close under 2100 is pretty bizarre.. if you think about it.

-

Notable weakness, copper miners, FCX and TCK, both lower by around -3%

12pm update - minor weak chop

US equities remain a touch weak, although as has been the case for the past five trading days... there is typically strength into the mid afternoon. VIX is holding slight gains of 3% in the 14.80s. Metals are a touch higher, Gold +$1. Oil remains weak, -2.5%.

sp'60min

Summary

There is a little divergence on the hourly equity cycle.. and it does bode in favour of the equity bears for tomorrow.

As ever.. its a case of not so much as what Yellen will say.. as how to the market will interpret her random blabberings.

-

Notable strength: AAPL +1.7% in the $131s.. .but clearly...... getting over-stretched

--

VIX update from Mr P.

--

time for lunch, back at 1pm

sp'60min

Summary

There is a little divergence on the hourly equity cycle.. and it does bode in favour of the equity bears for tomorrow.

As ever.. its a case of not so much as what Yellen will say.. as how to the market will interpret her random blabberings.

-

Notable strength: AAPL +1.7% in the $131s.. .but clearly...... getting over-stretched

--

VIX update from Mr P.

--

time for lunch, back at 1pm

11am update - market looking tired

US equities are only moderately lower, but the market sure feels tired, having climbed from sp'1980 to 2110 (6.5%) in just 14 trading days. A retrace to the 2060/40 zone remains very viable into next week. Metals have built gains, Gold +$4. Oil remains weak, -3.2%

sp'daily5

Nasdaq Comp'

Summary

*Nasdaq looks super strong, but it certainly doesn't have to break 5k on this rally. A pull back to the 4800/4700s is very viable.

-

Price action remains relatively muted.. we'll surely see much more dynamic moves tomorrow... once the Yellen starts talking to the Senators.

First soft downside target (for tomorrow).. will be the recent low of 2085.

--

Notable strength: DISCA +8.9% in the $33s... but more on that one later I think.

sp'daily5

Nasdaq Comp'

Summary

*Nasdaq looks super strong, but it certainly doesn't have to break 5k on this rally. A pull back to the 4800/4700s is very viable.

-

Price action remains relatively muted.. we'll surely see much more dynamic moves tomorrow... once the Yellen starts talking to the Senators.

First soft downside target (for tomorrow).. will be the recent low of 2085.

--

Notable strength: DISCA +8.9% in the $33s... but more on that one later I think.

10am update - minor weakness

US equities begin the week on a marginally weak note, sp -6pts @ 2104. VIX is higher, +7%, but still only in the low 15s. Metals are flat. Oil remains sharply lower, -2.8%.... but as ever... vulnerable to extremely strong intraday swings.

sp'daily3

vix'daily3

Summary

*Fib retrace - assuming sp'2110 is a short term top, is highly suggestive of a near term retrace to the 2060/40 zone.. where the 50dma is lurking.

--

So.. a little weakness to start the week, but clearly.. nothing significant. I'm not expecting much from today.... Mr Market is likely to remain in chop mode.. ahead of Yellen at the US Senate tomorrow morning.

--

Notable strength: DISCA (Discovery Comms'), +7% to the $33s on rumour that FOX might be interested. I like the company, a sound balance sheet. A bid around the $50 threshold is very viable, and even without.. the stock is under-valued, relative to main market.

sp'daily3

vix'daily3

Summary

*Fib retrace - assuming sp'2110 is a short term top, is highly suggestive of a near term retrace to the 2060/40 zone.. where the 50dma is lurking.

--

So.. a little weakness to start the week, but clearly.. nothing significant. I'm not expecting much from today.... Mr Market is likely to remain in chop mode.. ahead of Yellen at the US Senate tomorrow morning.

--

Notable strength: DISCA (Discovery Comms'), +7% to the $33s on rumour that FOX might be interested. I like the company, a sound balance sheet. A bid around the $50 threshold is very viable, and even without.. the stock is under-valued, relative to main market.

Pre-Market Brief

Good morning. Futures are a little lower, sp -4pts, we're set to open at 2106. Metals are mixed, Gold -$3, whilst Silver +1.2%. Oil is sharply lower, -3.6% in the $48s, with the $43 cycle low still highly vulnerable to being broken under.

sp'daily5

sp'60min

Summary

*Gold hit $1190 overnight, which is a multi-month low, the Nov' low of $1130 looks set to be exceeded this spring.

--

So.... here we go again. Unlike last week, we should see some much more dynamic price movement... and typically that would favour the bears.

Best case seems to be, a test of the 50dma... which will soon be in the 2050s.. that is only 3% lower. Considering the broader trends, even that will take until next week to achieve.

-

Notable early weakness, oil/gas drillers, RIG -2.7%, SDRL, -4.3%. Both look to be generally weak into the summer, regardless of any continued broader market strength.

-

Econ-chatter from Mr Long, with guest Rubino.

Highly recommended, with some great consideration of the implications of NIRP across the world, and the distortions that might cause.

-

Good wishes for the week ahead!

sp'daily5

sp'60min

Summary

*Gold hit $1190 overnight, which is a multi-month low, the Nov' low of $1130 looks set to be exceeded this spring.

--

So.... here we go again. Unlike last week, we should see some much more dynamic price movement... and typically that would favour the bears.

Best case seems to be, a test of the 50dma... which will soon be in the 2050s.. that is only 3% lower. Considering the broader trends, even that will take until next week to achieve.

-

Notable early weakness, oil/gas drillers, RIG -2.7%, SDRL, -4.3%. Both look to be generally weak into the summer, regardless of any continued broader market strength.

-

Econ-chatter from Mr Long, with guest Rubino.

Highly recommended, with some great consideration of the implications of NIRP across the world, and the distortions that might cause.

-

Good wishes for the week ahead!

Subscribe to:

Comments (Atom)