With US equity indexes breaking new historic highs, the VIX naturally slipped, settling -3.3% @ 11.68. Near term outlook is for the VIX to remain within the 14/11 zone, but if sp'1950/60s, then VIX in the 10s appears viable.

VIX'daily3

Summary

There is little to add.

VIX remains very low, and this (in theory) could remain the case for some weeks.

My best guess is that we'll see a spike (if minor) into the 14/16 zone around the time of the next FOMC - June'18. VIX 20s now look unlikely until at least mid/late July.

--

more later..on the indexes

Thursday, 5 June 2014

Closing Brief

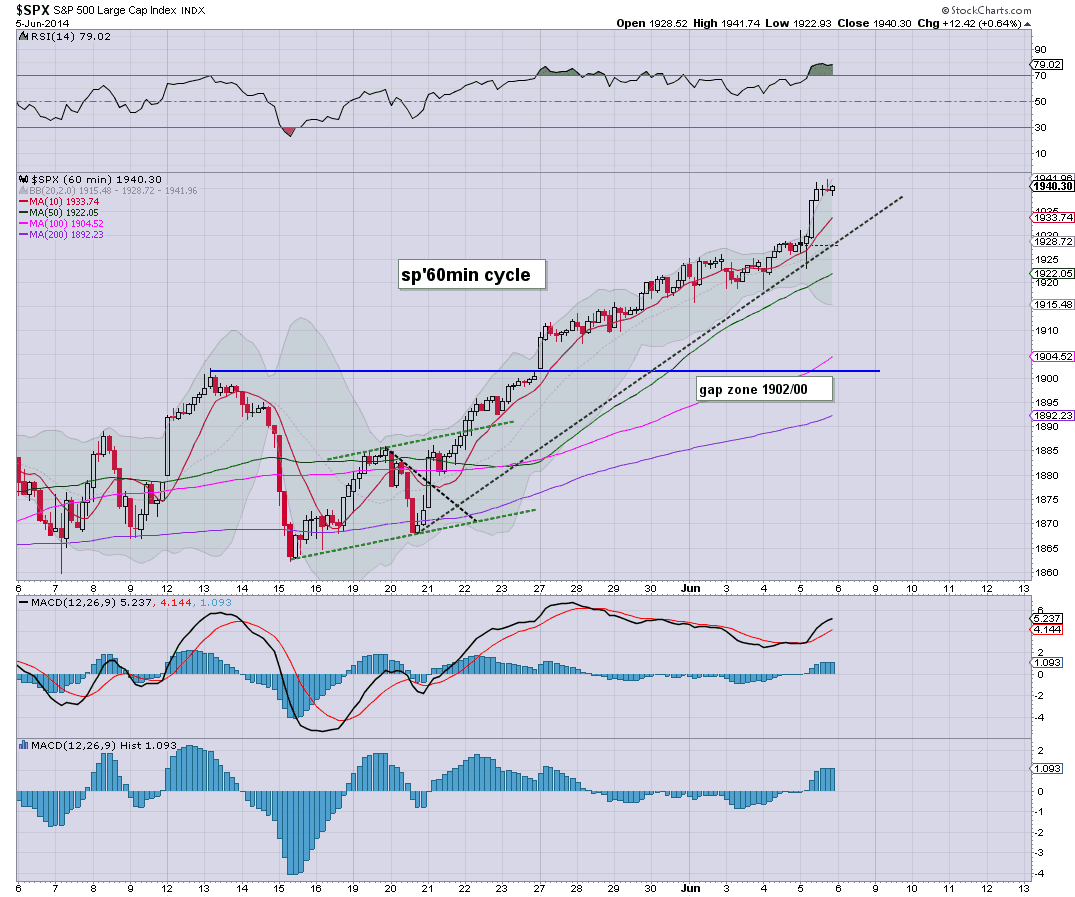

US indexes closed with further gains, sp +12pts @ 1940. The two leaders - Trans/R2K, settled higher by +0.7% and +2.0% respectively. The immediate term remains bullish, but there is threat of a minor retrace from the 1945/50 zone.

sp'60min

Summary

Suffice to say, the lunacy continues, and we didn't even get any QE from the ECB (not that I expected that until later this year).

-

more later...on the VIX

sp'60min

Summary

Suffice to say, the lunacy continues, and we didn't even get any QE from the ECB (not that I expected that until later this year).

-

more later...on the VIX

3pm update - minor melt into the close

US indexes look set for net daily gains across, with the sp' likely to attain a daily close in the 1935/45 zone - impressive on any basis. Metals look set to hold gains, but remain under old broken support. VIX still appears liable to breaking into the 10s...soon.

sp'60min

Summary

Well, with new historic highs, I can understand the dismay that must be out there in equity bear land - although I realise, coming from someone self titled 'permabear', it must sound kinda odd.

Regardless, the trend into early tomorrow is clearly bullish, and market has a fair chance at the 1950s.

-

As ever, I am more interested in the bigger picture, but more on that later...

sp'60min

Summary

Well, with new historic highs, I can understand the dismay that must be out there in equity bear land - although I realise, coming from someone self titled 'permabear', it must sound kinda odd.

Regardless, the trend into early tomorrow is clearly bullish, and market has a fair chance at the 1950s.

-

As ever, I am more interested in the bigger picture, but more on that later...

2pm update - afternoon gains

So far today we've seen new historic highs in the Dow, SP, and the Trans. The R2K/Nasdaq are similarly pushing higher. Metals are holding borderline significant gains, Gold +$9. VIX looks set for another daily close in the 11s.

sp'60min

Summary

I really shouldn't be posting an hour chart - for fear of getting lost in the minor waves, but yes...we are seeing a something of a toppy peak right now..from sp'1941.

Regardless, if the jobs data comes in okay tomorrow, the 1950s will be viable at the open...but from there, remains a sig' chance of a 1.5-2% retrace.

--

I have to wonder what the chartists' Futia and Caldaro are thinking right now..they are getting real close to their original upside targets.

*I remain content on the sidelines..which is usually the case these days..urghh.

sp'60min

Summary

I really shouldn't be posting an hour chart - for fear of getting lost in the minor waves, but yes...we are seeing a something of a toppy peak right now..from sp'1941.

Regardless, if the jobs data comes in okay tomorrow, the 1950s will be viable at the open...but from there, remains a sig' chance of a 1.5-2% retrace.

--

I have to wonder what the chartists' Futia and Caldaro are thinking right now..they are getting real close to their original upside targets.

*I remain content on the sidelines..which is usually the case these days..urghh.

1pm update - powerful gains for the R2K

Equity bears are getting ground into dust, with the sp' already in the 1940s, and the threat of VIX 10s before the weekend. The R2K is powering higher, +1.8% on the day. The big issue is, will the R2K get stuck in the 1170/80s, or keep pushing into the 1200s..and beyond?

R2K, weekly'2

Summary

So...not only did we break the 1930 level, ....but here we are.. 1940s.. a mere 3.2% away from the giant 2000 threshold.

Weekly charts - taken as a whole, offer another week or two higher..which will take us into the FOMC of June'18, when QE'taper 5 will surely be announced.

Actually, bears should hope taper is NOT done, since it would give the market a bit of a scare, at what would be an arguably spooked fed.

--

So..R2K, H/S formation...

I'll keep it in mind, unless we break much above 1190/1200..after that..the scenario would get dropped.

--

R2K, weekly'2

Summary

So...not only did we break the 1930 level, ....but here we are.. 1940s.. a mere 3.2% away from the giant 2000 threshold.

Weekly charts - taken as a whole, offer another week or two higher..which will take us into the FOMC of June'18, when QE'taper 5 will surely be announced.

Actually, bears should hope taper is NOT done, since it would give the market a bit of a scare, at what would be an arguably spooked fed.

--

So..R2K, H/S formation...

I'll keep it in mind, unless we break much above 1190/1200..after that..the scenario would get dropped.

--

12pm update - battling higher

Despite a minor down wave in early morning, the US indexes have battled back - no doubt, helped by $2-3bn of QE-fuel. A daily close in the 1937/42 zone is viable, with 1945/50 early tomorrow, which might equate to VIX in the 10s.

sp'daily5

R2K, daily

Summary

*again, without getting lost in the noise, I'm focusing on the bigger cycles.

--

Suffice to say, the market is pretty content with the ECB policy decisions, and most now recognise that the ECB will likely announce a QE program in the late summer/early autumn.

-

VIX update from Mr T.

--

time for lunch

sp'daily5

R2K, daily

Summary

*again, without getting lost in the noise, I'm focusing on the bigger cycles.

--

Suffice to say, the market is pretty content with the ECB policy decisions, and most now recognise that the ECB will likely announce a QE program in the late summer/early autumn.

-

VIX update from Mr T.

--

time for lunch

11am update - minor chop

US indexes are seeing some minor chop after breaking new historic highs. There remains high probability of a further push to 1940/50....by late Friday morning. From there...a reversal seems likely. Metals are holding gains, Gold +$9

sp'daily5

Summary

*I am resolutely trying not to get lost in the minor noise, as some seem to be.

--

With the QE this morning of $2-3bn, I have to believe we'll battle higher, with a net daily gain.

Where things get interesting is tomorrow, but more on that later...

Time to shop!

-

11.28am.. back from shop... to sp'1933....and the 1940s look an easy target for early tomorrow.

The only issue is can the market spike too far..too fast...to 1945/50..and then see a swift 'Friday jobs reversal'...

right now..I'd give odds of 65% of that....and I will consider an index short early tomorrow.

sp'daily5

Summary

*I am resolutely trying not to get lost in the minor noise, as some seem to be.

--

With the QE this morning of $2-3bn, I have to believe we'll battle higher, with a net daily gain.

Where things get interesting is tomorrow, but more on that later...

Time to shop!

-

11.28am.. back from shop... to sp'1933....and the 1940s look an easy target for early tomorrow.

The only issue is can the market spike too far..too fast...to 1945/50..and then see a swift 'Friday jobs reversal'...

right now..I'd give odds of 65% of that....and I will consider an index short early tomorrow.

10am update - new historic highs

Whilst the German DAX breaks 10k, the US markets have similarly broken new highs in the Dow/SP'500. Daily charts are offering 1940/45 in the immediate term, with 1950/55 on a 'Friday jobs spike'. Metals are holding moderate gains, Gold +$8..but below recently busted support.

sp'daily5

Summary

*sig' QE-pomo this morning...bears...beware!

---

So..we have NIRP in the EU, but no QE program, with just another large LTRO.

Overall, the path is clear in the EU.

Eventually, the ECB will resort to buying bonds from the various EU states as a last ditch effort to stimulate growth/avoid recession....but not until the autumn, at which time we might have seen a multi-month down wave.

--

*I remain content on the sidelines, and will see if we're 1945/50 tomorrow morning - which would be a far better level to launch an index short.

-

10.19am.. I hold to earlier outlook....

QE will be kicking in soon....

I can NOT take these declines seriously.

sp'daily5

Summary

*sig' QE-pomo this morning...bears...beware!

---

So..we have NIRP in the EU, but no QE program, with just another large LTRO.

Overall, the path is clear in the EU.

Eventually, the ECB will resort to buying bonds from the various EU states as a last ditch effort to stimulate growth/avoid recession....but not until the autumn, at which time we might have seen a multi-month down wave.

--

*I remain content on the sidelines, and will see if we're 1945/50 tomorrow morning - which would be a far better level to launch an index short.

-

10.19am.. I hold to earlier outlook....

QE will be kicking in soon....

I can NOT take these declines seriously.

Pre-market Brief

Good morning...and for those in the EU...welcome to NIRP (negative interest rate policy). Futures are a little higher, sp +3pts, we're set to open at 1930. Metals are flat. Market is awaiting an ECB press conf. at 8.30 EST.

sp'daily5

Summary

*so far today..

Draghi has announced...

Deposit rate: lowerered from 0.00 to -0.1%

From what I gather, that is the rate the ECB will charge banks for holding money.

Benchmark rate: lowerered from 0.25% to 0.15% - the headline interest rate.

-

There are rumours of a QE program...but...I await the press conference at 8.30am EST.

--

Update from the Permabull

Naturally, Oscar will be delighted that savers in the EU are going to get smacked even further. After all, a rising equity market is all that matters right?

-

8.34am... sp +6pts..... market starting to break...with new policies announcement....

8.37am... German DAX hits 10000...first time.

sp +8pts....and climbing....

..all sorts of weird policy measures being announced....

sp' set to open around 1935... upper bollinger on daily AND weekly cycle...

At best..bulls could maybe hit 1945/50 on a Friday spike.

8.51am.. It would seem...

NO QE program, but market is pleased with another LTRO of $400bn or so

Metals are starting to move... gold +$13

9.04am... Equity bears need to keep in mind, there is sig' QE-pomo today....

I do NOT expect a reversal today....but perhaps tomorrow..from 1945/50.

9,18am.. sp +3pts..we've cooled a little, but still.. 1930s are due.

sp'daily5

Summary

*so far today..

Draghi has announced...

Deposit rate: lowerered from 0.00 to -0.1%

From what I gather, that is the rate the ECB will charge banks for holding money.

Benchmark rate: lowerered from 0.25% to 0.15% - the headline interest rate.

-

There are rumours of a QE program...but...I await the press conference at 8.30am EST.

--

Update from the Permabull

Naturally, Oscar will be delighted that savers in the EU are going to get smacked even further. After all, a rising equity market is all that matters right?

-

8.34am... sp +6pts..... market starting to break...with new policies announcement....

8.37am... German DAX hits 10000...first time.

sp +8pts....and climbing....

..all sorts of weird policy measures being announced....

sp' set to open around 1935... upper bollinger on daily AND weekly cycle...

At best..bulls could maybe hit 1945/50 on a Friday spike.

8.51am.. It would seem...

NO QE program, but market is pleased with another LTRO of $400bn or so

Metals are starting to move... gold +$13

9.04am... Equity bears need to keep in mind, there is sig' QE-pomo today....

I do NOT expect a reversal today....but perhaps tomorrow..from 1945/50.

9,18am.. sp +3pts..we've cooled a little, but still.. 1930s are due.

Awaiting the ECB

US, and most world equity markets are awaiting the next scheduled policy announcement from the ECB. It would seem highly probable that interest rates will be fractionally reduced, but that there will not be a QE program. How the market reacts to no ECB QE-fuel, will likely be the big issue for Thursday.

sp'weekly8

R2K weekly2

Summary

I would draw attention to what remains a valid H/S scenario for the R2K. Such a bearish outlook would get dropped on any daily close back in the 1200s, but that is a further 6% higher.

-

The R2K/Nasdaq looked pretty strong today, and certainly, are highly suggestive of another 1-2% higher in the immediate term. The bigger issue is whether the R2K is setting up a giant H/S formation. As ever, it is just one scenario, but from a bearish perspective, it is a particularly attractive one for this summer.

Schiff on smaller product sizes

I think most should be well aware of the growing issue of everyday products being reduced in size. In fact, its often worse, with a higher price for a smaller product.

..but hey...the Fed and ECB are telling us deflation is a problem. I guess the Schiff, myself, and many others are just perceiving things incorrectly.

The issue of lower quality products (or services) is something few bring up, and I have to commend Schiff on highlighting it. BBC news did a similar report on electrical items recently. They noted how old washing machines would typically last 10yrs, but now consumers are lucky if their machine last 5-7yrs.

Such issues are a strong sign of the underlying degradation of the western economies.

--

Looking ahead

Tomorrow will of course be all about the ECB decision.

My best guess, lower rates, but no QE. The tricky part is whether the market will still believe 'ohh, but the QE will come later in the year'. I'm guessing that will indeed be the outcome, with the broader capital markets somewhat... 'content'.

*there will be sig' QE-pomo of $2-3bn

--

Goodnight from London

sp'weekly8

R2K weekly2

Summary

I would draw attention to what remains a valid H/S scenario for the R2K. Such a bearish outlook would get dropped on any daily close back in the 1200s, but that is a further 6% higher.

-

The R2K/Nasdaq looked pretty strong today, and certainly, are highly suggestive of another 1-2% higher in the immediate term. The bigger issue is whether the R2K is setting up a giant H/S formation. As ever, it is just one scenario, but from a bearish perspective, it is a particularly attractive one for this summer.

Schiff on smaller product sizes

I think most should be well aware of the growing issue of everyday products being reduced in size. In fact, its often worse, with a higher price for a smaller product.

..but hey...the Fed and ECB are telling us deflation is a problem. I guess the Schiff, myself, and many others are just perceiving things incorrectly.

The issue of lower quality products (or services) is something few bring up, and I have to commend Schiff on highlighting it. BBC news did a similar report on electrical items recently. They noted how old washing machines would typically last 10yrs, but now consumers are lucky if their machine last 5-7yrs.

Such issues are a strong sign of the underlying degradation of the western economies.

--

Looking ahead

Tomorrow will of course be all about the ECB decision.

My best guess, lower rates, but no QE. The tricky part is whether the market will still believe 'ohh, but the QE will come later in the year'. I'm guessing that will indeed be the outcome, with the broader capital markets somewhat... 'content'.

*there will be sig' QE-pomo of $2-3bn

--

Goodnight from London

Daily Index Cycle update

US indexes saw minor chop across the day, sp +3pts @ 1927 (new historic high of 1928). The two leaders - Trans/R2K, settled u/c and +0.4% respectively. Near term outlook is for sp'1935/50 zone, but a minor retrace seems likely.. perhaps beginning this Friday.

sp'daily5

R2K, daily

Trans

Summary

*I would especially wish to highlight the R2K, which appears floored in the 1120s..and set for the 1170/80 zone by the next FOMC of June'18.

--

So..most notable aspect of the day, a new historic high for the sp'500, and the sp'1930s seem highly likely tomorrow. Considering the bigger weekly/monthly charts, there looks to be a fair chance of 1945/50 in the near term, before a minor retrace.

I still think the equity bull maniacs are NOT going to hit sp'2000 this year, before a major (if brief) multi-month down wave.

*I am content on the sidelines..will consider an index short this Friday, is sp'1945/50 on a 'good monthly jobs data' spike.

--

a little more later...

sp'daily5

R2K, daily

Trans

Summary

*I would especially wish to highlight the R2K, which appears floored in the 1120s..and set for the 1170/80 zone by the next FOMC of June'18.

--

So..most notable aspect of the day, a new historic high for the sp'500, and the sp'1930s seem highly likely tomorrow. Considering the bigger weekly/monthly charts, there looks to be a fair chance of 1945/50 in the near term, before a minor retrace.

I still think the equity bull maniacs are NOT going to hit sp'2000 this year, before a major (if brief) multi-month down wave.

*I am content on the sidelines..will consider an index short this Friday, is sp'1945/50 on a 'good monthly jobs data' spike.

--

a little more later...

Subscribe to:

Comments (Atom)