With equities seeing a second day of broad declines, the VIX continued to climb, settling +3.1% @ 15.70. Across the week, the VIX gained a rather significant 18.8%. Near term outlook offers the sp'2040/30s.. which should equate to VIX 18s.

VIX'60min

VIX'daily3

VIX'weekly

Summary

So, we've seen the VIX swing from a Thursday low of 13.30 to a Friday afternoon high of 17.09 (with sp'2052). The closing action was one of rapid cooling in the VIX - as equities jumped around 0.7%.

Broadly though, the VIX is on the rise. It would seem the 18s are due next week... the 19-21 zone looks 'briefly' possible if sp'2030/20s.

Sustained action above the key 20 threshold looks out of range in the current cycle, until the latter half of May.

--

more later.. on the indexes

Friday, 29 April 2016

Closing Brief

US equity indexes ended the week/month on a broadly weak note, sp -10pts @ 2065 (intra low 2052). The two leaders - Trans/R2K, settled lower by -1.2% and -0.8% respectively. Near term outlook offers the sp'2030/20s, which will likely equate to VIX in the 18/19s.

sp'60min

Summary

*closing hour action: a rather strong ramp from 2054 to 2069, with some pretty choppy action into the monthly close.

--

... and another week in the world's most twisted casino comes to a close.

Certainly... the bulls tried damn hard to break/hold the sp'2100 threshold.. but failed. With that failure saw increasing weakness.

The weekly/monthly close in the 2060s is interesting, but those equity bears are going to need to see some daily closes in the 2020s and lower to offer initial hope that 2111 is a key mid term high.

One thing is for sure... May won't be dull.

--

*the usual bits and pieces across the evening.. to wrap up the week

sp'60min

Summary

*closing hour action: a rather strong ramp from 2054 to 2069, with some pretty choppy action into the monthly close.

--

... and another week in the world's most twisted casino comes to a close.

Certainly... the bulls tried damn hard to break/hold the sp'2100 threshold.. but failed. With that failure saw increasing weakness.

The weekly/monthly close in the 2060s is interesting, but those equity bears are going to need to see some daily closes in the 2020s and lower to offer initial hope that 2111 is a key mid term high.

One thing is for sure... May won't be dull.

--

*the usual bits and pieces across the evening.. to wrap up the week

3pm update - the sun sets on April

Regardless of the exact close, all US equity indexes are set for significant net weekly declines. Despite some trend/support breaks, what will be critical for the equity bears, is for the market to put in a marginally lower high (<sp'2111) in the subsequent multi-day bounce - as looks set to begin at some point next week.

sp'weekly1b

Nasdaq comp' weekly

Summary

*keep in mind, for a net monthly decline, we need sp <2059.74

--

Suffice to add... an interesting week, but really... the moves are still relatively minor, and we remain very close to recent multi-month highs.

I will only have renewed confidence that we've seen a mid term high @ sp'2111, if we see a daily close in the 2020s next week. That will not be easy, as there are a great many aspects of support in the 2040/30s.

--

More April showers... so I guess I should expect rainbows (and unicorns?) into the close.

yours... ending the month on a positive note :)

-

RE: TVIX.. for those curious... I'm seeking 4.75/5.25 next week...

Will hold across the weekend

-

3.03pm.. for those in the mood for something different...

The communists protestors are out in force, as Trump is due to speak.

sp'weekly1b

Nasdaq comp' weekly

Summary

*keep in mind, for a net monthly decline, we need sp <2059.74

--

Suffice to add... an interesting week, but really... the moves are still relatively minor, and we remain very close to recent multi-month highs.

I will only have renewed confidence that we've seen a mid term high @ sp'2111, if we see a daily close in the 2020s next week. That will not be easy, as there are a great many aspects of support in the 2040/30s.

--

More April showers... so I guess I should expect rainbows (and unicorns?) into the close.

yours... ending the month on a positive note :)

-

RE: TVIX.. for those curious... I'm seeking 4.75/5.25 next week...

Will hold across the weekend

-

3.03pm.. for those in the mood for something different...

The communists protestors are out in force, as Trump is due to speak.

2pm update - how low next week?

US equity indexes look set for a second day of broad declines, having achieved more trend/support breaks. Next week offers at least the sp'2040s - which will equate to VIX 17/18s. There are a great many aspects of support in the 2030/20s. A break <2K looks unlikely in first half of May.

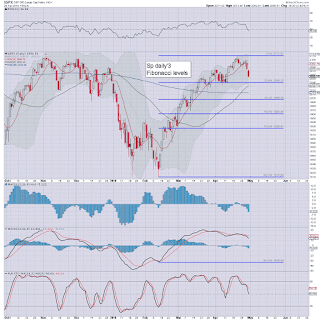

sp'daily3 - fib retraces.

sp'weekly1c - time fibs

Summary

re: daily3, the lower daily bol' is around 2035... close to the 50dma.

If sp'2020s.... if will break the two soft lows of 2039/33.. and that would give initial confidence that 2111 is a key mid term high.-

--

re: weekly1c: Yes, time fibs are pretty kooky, but still.. a snap lower late May would make sense.

-

Best guess? 2040/35 zone... then bouncing for at least 3-5 days to 2070/80

--

notable strength: miners, GDX 4.7%.... having doubled since the Jan' low. Incredible strength.

--

back at 3pm

sp'daily3 - fib retraces.

sp'weekly1c - time fibs

Summary

re: daily3, the lower daily bol' is around 2035... close to the 50dma.

If sp'2020s.... if will break the two soft lows of 2039/33.. and that would give initial confidence that 2111 is a key mid term high.-

--

re: weekly1c: Yes, time fibs are pretty kooky, but still.. a snap lower late May would make sense.

-

Best guess? 2040/35 zone... then bouncing for at least 3-5 days to 2070/80

--

notable strength: miners, GDX 4.7%.... having doubled since the Jan' low. Incredible strength.

--

back at 3pm

1pm update - remaining broadly weak

Despite a secondary bounce, US equities remain broadly weak. A weekly/monthly close in the sp'2050/40s looks probable, and that will make for a net monthly decline. VIX is seeing some interesting upside, but still relatively low in the 16s. Next downside target is sp'2040 with VIX 18s.

sp'weekly1b

VIX'daily3

Summary

*at best.. VIX 19-21 'briefly' next week with sp'2030/20s... but that is a stretch.

--

Little to add.

Some renewed selling into the weekend looks due, as some of the bull maniacs should be at least marginally concerned about next Monday's open.

--

notable weakness... QCOM, daily

Ugly... and if the broader market implodes.. QCOM will be a $30 stock. I realise that target sounds like 'crazy talk' right now.

--

back at 2pm

sp'weekly1b

VIX'daily3

Summary

*at best.. VIX 19-21 'briefly' next week with sp'2030/20s... but that is a stretch.

--

Little to add.

Some renewed selling into the weekend looks due, as some of the bull maniacs should be at least marginally concerned about next Monday's open.

--

notable weakness... QCOM, daily

Ugly... and if the broader market implodes.. QCOM will be a $30 stock. I realise that target sounds like 'crazy talk' right now.

--

back at 2pm

12pm update - sunshine for the equity bears

US equities saw a natural bounce from the sp'2065/61 gap zone, but there has already been a break into the 2050s.. with VIX pushing toward the 17s. USD remains weak, -0.8%.. set to lose the DXY 93s. Metals are powerful, Gold +$22, with Silver +1.5%.

sp'monthly

VIX'weekly

Summary

*as ever, I am trying not to get overly lost in the minor noise... so this hour.. focusing on the bigger monthly/weekly charts.

As things are.. we're set for marginal net monthly declines in a number of indexes.

Despite a sig' net weekly VIX gain.. we're still at very low levels.

Hyper VIX upside to the 30s, 40s.. or even higher, looks viable in the latter half of May. No doubt the mainstream will be seriously twitchy about the June BREXIT vote.. amongst other things.

--

notable reversal.... RIG, daily

ugly candle.. ugly company... capitulation is STILL due in the energy/mining/shipping sectors... and RIG remains on my disappear list.

--

Here in London city...

Another very mixed spring day... sharp showers.. but then glorious sunshine. A great day for equity downside.

--

time to cook

sp'monthly

VIX'weekly

Summary

*as ever, I am trying not to get overly lost in the minor noise... so this hour.. focusing on the bigger monthly/weekly charts.

As things are.. we're set for marginal net monthly declines in a number of indexes.

Despite a sig' net weekly VIX gain.. we're still at very low levels.

Hyper VIX upside to the 30s, 40s.. or even higher, looks viable in the latter half of May. No doubt the mainstream will be seriously twitchy about the June BREXIT vote.. amongst other things.

--

notable reversal.... RIG, daily

ugly candle.. ugly company... capitulation is STILL due in the energy/mining/shipping sectors... and RIG remains on my disappear list.

--

Here in London city...

|

| Bullish Horse Chestnut |

|

| Bullish April sunshine and showers. |

Another very mixed spring day... sharp showers.. but then glorious sunshine. A great day for equity downside.

--

time to cook

11am update - 2050s later today?

US equity indexes remain moderately weak, but are seeing a natural bounce from the gap zone of sp'2061/65. VIX has cooled from an early high of 16.45 back into the 15s. Broadly, the market still looks headed to at least the 2040s - which will likely equate to VIX 18s.

sp'60min

VIX'60min

Summary

Not much to add.

A natural bounce.... now its a case of whether renewed weakness into the important monthly close.

The 2050s would be 'useful'.... and open up the 2040s next Mon/Tuesday.

--

notable weakness... AAPL, monthly

Seen on the giant monthly cycle, AAPL is sporting a truly horrific April candle. Bearish engulfing, unable to clear the 10MA. Target remains $70.

*related stock... QCOM.... similarly ugly.. target is $30.

-

time for some sun.. or rain.... back 12pm

sp'60min

VIX'60min

Summary

Not much to add.

A natural bounce.... now its a case of whether renewed weakness into the important monthly close.

The 2050s would be 'useful'.... and open up the 2040s next Mon/Tuesday.

--

notable weakness... AAPL, monthly

Seen on the giant monthly cycle, AAPL is sporting a truly horrific April candle. Bearish engulfing, unable to clear the 10MA. Target remains $70.

*related stock... QCOM.... similarly ugly.. target is $30.

-

time for some sun.. or rain.... back 12pm

10am update - so many charts, not enough time

US equities open moderately weak, with the sp' breaking under rising trend/support into the 2060s. Meanwhile, there are marginal breaks of trend in the two leaders - Trans/R2K. With the USD -0.6% in the DXY 93s, the metals are making a play to break above Gold $1300 and Silver $18s.

Trans, daily

R2K, daily

Summary

*Chicago PMI: 50.4... borderline recessionary, and it should at least concern the bull maniacs that the US economy is flat lining.

--

There are an absolute truck load of interesting individual movers out there right now.... I will try to highlight as many as I can.... lets start with...

DIS, daily

A poke above key resistance.. but its clearly rolling over.

-

STX, daily

Earnings were lousy... the statement was blaming lacking of demand. Yeah.. global economic weakness.

.. but hey.. Buffett said earnings are [broadly] fine... so I guess STX should really be up.

--

stay tuned.

--

10.01am Consumer sentiment: 89.0.... not great....

A break into the sp'2050s before the typical 11am turn would be useful... as at least it'd break another soft support zone.

-

10.08am.. browsing some of the monthly charts for AAPL, DIS, NFLX, .... its a long long list.... its looks borderline horrific.

The May/June candles could be scary bearish!

Trans, daily

R2K, daily

Summary

*Chicago PMI: 50.4... borderline recessionary, and it should at least concern the bull maniacs that the US economy is flat lining.

--

There are an absolute truck load of interesting individual movers out there right now.... I will try to highlight as many as I can.... lets start with...

DIS, daily

A poke above key resistance.. but its clearly rolling over.

-

STX, daily

Earnings were lousy... the statement was blaming lacking of demand. Yeah.. global economic weakness.

.. but hey.. Buffett said earnings are [broadly] fine... so I guess STX should really be up.

--

stay tuned.

--

10.01am Consumer sentiment: 89.0.... not great....

A break into the sp'2050s before the typical 11am turn would be useful... as at least it'd break another soft support zone.

-

10.08am.. browsing some of the monthly charts for AAPL, DIS, NFLX, .... its a long long list.... its looks borderline horrific.

The May/June candles could be scary bearish!

Pre-Market Brief

Good morning. US equity futures are fractionally lower, sp' -1pt, we're set to open at 2074. With the USD -0.3% in the DXY 93.40s, the metals continue to climb, Gold +$6 in the $1270s, with Silver +0.5% in the upper $17s. Oil is similarly strong, +1.6% in the $46s.

sp'60min

Summary

*awaiting a quartet of data, notably Chicago PMI (9.45am)

--

So.... world markets are leaning weak into month end, and most of them are still broadly bearish from spring/summer 2015.... but more on that in this weekend's post.

--

As for today, regardless of the exact open, price momentum is leaning on the bearish side.. a hit of the sp'2065/61 gap zone looks due today.

All things considered, a monthly close in the sp'2050s would be a bonus, and offer the 2040s next Monday.

As noted yesterday, until I see a daily close in the sp'2020s, I will not have any confidence that the market has made a mid term high of 2111.

--

early movers...

AMZN +12%, EPS, $1.07... call it $4 a year.... a PE of roughly 160/170. What a bargain huh?

EXPE +11%, moderate net profit... far more than Mr Market expected

SDRL +17%... but still only in the $5s.

GDX +1.0%... as the metals continue to climb.

--

Update from Mr C.

The 'failed head test' scenario, if it plays out, offers downside to at least the sp'1600/1500s.. which would no doubt freak out the mainstream.

--

Overnight action..

Japan: CLOSED, settling April @ 16666

China: -0.2% @ 2938... so much for the 3K threshold.

Germany: currently -1.3% @ 10188

-

Good wishes for Friday!

--

8.53am.. a minor.. but important break lower in pre-market.. sp -6pts @ 2069.

earnings (or rather, lack of) from CVX not helping... CVX -1.5%

-

Buffett 'earnings have never been better'. Is he referring to any country on this planet.. or some other part of the galaxy?

-

9.21am.. With GDX +2.1% @ $24.81.. the miner ETF has now officially doubled up since the Jan'19'th low of $12.40.

Pretty incredible.. considering Gold has not even broken into the $1300s yet.

-

9.23am.. notable weakness. Seagate (STX). -5% in the $25s as earnings missed.

-

9.45am.. Chicago PMI: 50.4... WEAK WEAK WEAK... and borderline recession.

sp'60min

Summary

*awaiting a quartet of data, notably Chicago PMI (9.45am)

--

So.... world markets are leaning weak into month end, and most of them are still broadly bearish from spring/summer 2015.... but more on that in this weekend's post.

--

As for today, regardless of the exact open, price momentum is leaning on the bearish side.. a hit of the sp'2065/61 gap zone looks due today.

All things considered, a monthly close in the sp'2050s would be a bonus, and offer the 2040s next Monday.

As noted yesterday, until I see a daily close in the sp'2020s, I will not have any confidence that the market has made a mid term high of 2111.

--

early movers...

AMZN +12%, EPS, $1.07... call it $4 a year.... a PE of roughly 160/170. What a bargain huh?

EXPE +11%, moderate net profit... far more than Mr Market expected

SDRL +17%... but still only in the $5s.

GDX +1.0%... as the metals continue to climb.

--

Update from Mr C.

The 'failed head test' scenario, if it plays out, offers downside to at least the sp'1600/1500s.. which would no doubt freak out the mainstream.

--

Overnight action..

Japan: CLOSED, settling April @ 16666

China: -0.2% @ 2938... so much for the 3K threshold.

Germany: currently -1.3% @ 10188

-

Good wishes for Friday!

--

8.53am.. a minor.. but important break lower in pre-market.. sp -6pts @ 2069.

earnings (or rather, lack of) from CVX not helping... CVX -1.5%

-

Buffett 'earnings have never been better'. Is he referring to any country on this planet.. or some other part of the galaxy?

-

9.21am.. With GDX +2.1% @ $24.81.. the miner ETF has now officially doubled up since the Jan'19'th low of $12.40.

Pretty incredible.. considering Gold has not even broken into the $1300s yet.

-

9.23am.. notable weakness. Seagate (STX). -5% in the $25s as earnings missed.

-

9.45am.. Chicago PMI: 50.4... WEAK WEAK WEAK... and borderline recession.

It remains a nasty market

Despite the BoJ upsetting Japan - and indeed, most EU markets, the US market only opened moderately lower. The fact the market then saw a classic opening reversal was a fierce reminder to just how nasty this market remains. Even the latter day weakness was small solace to those still resolutely holding short.

sp'weekly1b

sp'monthly1b

Summary

A net weekly decline now looks probable, not least as last week's low of sp'2077 was decisively broken under in today's closing hour.

Now its merely a case of whether the equity bears can attain a monthly close in the 2070s.. the very viable 2060s... or even the 2050s.

For a net monthly decline, equity bears need <2059.

--

Special mention for Japan - Nikkei, monthly

With the Thursday decline of -3.6%, the Nikkei is now moderately net lower for April, and remains broadly weak since last summer.

--

Looking ahead

Friday will see a rather important quartet of econ-data - pers' income/outlays, employment costs, consumer sent', and most important of all.. the latest Chicago PMI.

The market is seeking a non recessionary 53.4, which does seem somewhat overly optimistic. I'd not be surprised to see a number under the key 50 threshold.

*Fed official Kaplan will be talking about monetary policy in London city in the early morning.

yours truly will not be attending.

Goodnight from London

sp'weekly1b

sp'monthly1b

Summary

A net weekly decline now looks probable, not least as last week's low of sp'2077 was decisively broken under in today's closing hour.

Now its merely a case of whether the equity bears can attain a monthly close in the 2070s.. the very viable 2060s... or even the 2050s.

For a net monthly decline, equity bears need <2059.

--

Special mention for Japan - Nikkei, monthly

With the Thursday decline of -3.6%, the Nikkei is now moderately net lower for April, and remains broadly weak since last summer.

--

Looking ahead

Friday will see a rather important quartet of econ-data - pers' income/outlays, employment costs, consumer sent', and most important of all.. the latest Chicago PMI.

The market is seeking a non recessionary 53.4, which does seem somewhat overly optimistic. I'd not be surprised to see a number under the key 50 threshold.

*Fed official Kaplan will be talking about monetary policy in London city in the early morning.

yours truly will not be attending.

Goodnight from London

Daily Index Cycle update

US equities closed on a particularly negative note, sp -19pts @ 2075

(intra high 2099). The two leaders - Trans/R2K, settled lower by -1.5%

and -1.2% respectively. Near term outlook offers the 2060s, a break

under the two soft lows of 2039/33 will very difficult.

sp'daily5

Nasdaq comp'

Summary

sp'500: a day with two rather strong reversals.. from an early low of 2082 to 2099, but then rapid cooling into the close.. with an intra low of 2071

Nasdaq: a notable close below the 200dma.

--

a little more later...

sp'daily5

Nasdaq comp'

Summary

sp'500: a day with two rather strong reversals.. from an early low of 2082 to 2099, but then rapid cooling into the close.. with an intra low of 2071

Nasdaq: a notable close below the 200dma.

--

a little more later...

Subscribe to:

Comments (Atom)