With the indexes seeing their first 'moderate' intra-day weakness in over a week, the VIX spiked higher from the mid 11s, and was 11% higher by early afternoon. Yet...with the indexes recovering, the VIX slipped back, closing +6% @ 12.27

VIX'60min

VIX'daily3

Summary

Not much to note, other than today's spike is to be largely dismissed as 'static'.

The main indexes look set to hold together until at least early next week, in which case the VIX certainly won't be able to sustain a multi-day move higher.

--

more later..on the indexes

Tuesday, 12 March 2013

Closing Brief

Most of the main indexes closed slightly lower, but the declines were arguably borderline noise. With the VIX cooling off into the close, the bears should be very concerned about a renewed cycle higher...all the way into the weekend.

sp'60min

Summary

So, with most indexes closed a little lower, thats the high of this multi-month cycle,..yes?

Err, probably not..quite yet.

I'm still guessing we battle higher into next week. Sp'1560/70s are viable later this week..even the 1600s are possible..and the latter would make for a far better re-short level.

--

*Today was good, am holding nothing overnight, might go long SLV/USO early Wednesday.

--

The usual bits and pieces across the evening.

sp'60min

Summary

So, with most indexes closed a little lower, thats the high of this multi-month cycle,..yes?

Err, probably not..quite yet.

I'm still guessing we battle higher into next week. Sp'1560/70s are viable later this week..even the 1600s are possible..and the latter would make for a far better re-short level.

--

*Today was good, am holding nothing overnight, might go long SLV/USO early Wednesday.

--

The usual bits and pieces across the evening.

3pm update - melt into the close?

The sp is -6pts @ 1549. The bears are merely being teased. There is no reason to believe this is the start of anything significant. VIX is holding gains of 11%, but we're still only talking about VIX 12s. Dollar is flat, Oil and Silver remain higher, but lacking any real power.

sp'60min

Summary

There is - as always, going to be some upward pressure into the close.

---

*I'm content to sit it out overnight. No positions, will consider re-long SLV and USO in the morning.

back after the close

sp'60min

Summary

There is - as always, going to be some upward pressure into the close.

---

*I'm content to sit it out overnight. No positions, will consider re-long SLV and USO in the morning.

back after the close

2pm update - 3s, 4s, 5s...urghh

Underlying pressure remains upward. With opex this Friday, and two major POMO days, bears face massive issues. If we're still in a minute wave'3 higher...we're still going to battle higher into next week. The sp'1570s are very viable by this Friday.

sp'60min - micro count

Summary

I've made a vain attempt to update the near term micro-count on the hourly index chart.

*this chartist seems to have it figured out.. see: Waveaholic

---

Basically..I'm assuming...

1. we're still yet to complete the tiny (black) wave'3 - perhaps today is sub'4 ?

2. we then see a small (blue) 4 down

3. a final wave Blue'5 of the 3 up.

urghh..its all too annoying, and frankly, I'm more than happy to just leave the indexes to churn higher into next week.

The higher we go, the safer it will be to launch a re-short.

--

back at 3pm

sp'60min - micro count

Summary

I've made a vain attempt to update the near term micro-count on the hourly index chart.

*this chartist seems to have it figured out.. see: Waveaholic

---

Basically..I'm assuming...

1. we're still yet to complete the tiny (black) wave'3 - perhaps today is sub'4 ?

2. we then see a small (blue) 4 down

3. a final wave Blue'5 of the 3 up.

urghh..its all too annoying, and frankly, I'm more than happy to just leave the indexes to churn higher into next week.

The higher we go, the safer it will be to launch a re-short.

--

back at 3pm

12pm update - minor declines

The morning declines are indeed minor, and to be dismissed as irrelevant noise. Yes, the VIX is 8% higher, but 8% of a small number...still makes for a low VIX. Dollar has flipped to green, and this is putting a little downward pressure back on the metals and Oil

sp'daily'5

vix'daily'3

Summary

I find the micro-counts hard to work out, but it looks like this might be a '4 of the final fifth. Regardless, I sure won't be doing any index shorts/long VIX until next week..at the earliest.

Bears could get smacked up into opex...not least with big pomo on Thursday AND Friday.

--

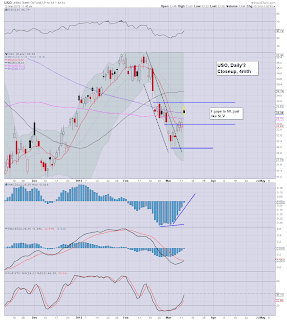

What I remain meddling with - USO and SLV

SLV, daily2

USO, daily2

I bailed on both at the open, and look to re-long late today..or early Wednesday.

--

VIX update..from Mr T

back at 2pm

sp'daily'5

vix'daily'3

Summary

I find the micro-counts hard to work out, but it looks like this might be a '4 of the final fifth. Regardless, I sure won't be doing any index shorts/long VIX until next week..at the earliest.

Bears could get smacked up into opex...not least with big pomo on Thursday AND Friday.

--

What I remain meddling with - USO and SLV

SLV, daily2

USO, daily2

I bailed on both at the open, and look to re-long late today..or early Wednesday.

--

VIX update..from Mr T

back at 2pm

10am update - same as yesterday

Good morning. Perhaps I should just link to yesterdays 10am post. After all, it'll be almost exactly the same. Opening minor declines...with an expected latter day recovery/melt up. USD is slightly lower, and a new down cycle could continue for 1-2 weeks.

sp'daily5

vix'daily3

Summary

Nothing much going on, although the dollar weakness is kinda notable.

-

*I bailed on SLV at the open...and also just stopped out of USO. Both..very significant gains.

Expecting a minor down cycle in both..until at least 1-2pm. I might jump back aboard one/both later today.

sp'daily5

vix'daily3

Summary

Nothing much going on, although the dollar weakness is kinda notable.

-

*I bailed on SLV at the open...and also just stopped out of USO. Both..very significant gains.

Expecting a minor down cycle in both..until at least 1-2pm. I might jump back aboard one/both later today.

Another week to wait

The main US equity indexes continue to melt higher. There is simply no sign of the near term bullish trend ending. However, from a cycle perspective, we're arguably 'likely' to see a turn to the downside beginning next week. The only issue is how low do we go?

sp'daily7 - fib levels

sp'weekly2, rainbow

Summary

It does look like we have another quiet trading week ahead. There is no 'major' econ-data due,

I have to believe bears are going to have to wait at least until next week, after this Fridays opex. Bears should also - as ever, keep in mind the next big POMO days, which are this Thursday and Friday.

So, I won't be meddling in any index shorts - or VIX long, until at least next week. There just doesn't seem to be any point.

How low in the next cycle?

I think bears will at least see the sp'1470s - that's a good 80/90pts lower. However, I just can't see anything <1425/00 under any scenario.

Indeed, after any correction, I'm concerned that we'll see a renewed melt higher across the summer, into the sp'1700s..even 1800s.

--

*In the meantime, I hold long overnight, via SLV and USO, both look okay for further upside for at least 3-5 days.

Goodnight from London

sp'daily7 - fib levels

sp'weekly2, rainbow

Summary

It does look like we have another quiet trading week ahead. There is no 'major' econ-data due,

I have to believe bears are going to have to wait at least until next week, after this Fridays opex. Bears should also - as ever, keep in mind the next big POMO days, which are this Thursday and Friday.

So, I won't be meddling in any index shorts - or VIX long, until at least next week. There just doesn't seem to be any point.

How low in the next cycle?

I think bears will at least see the sp'1470s - that's a good 80/90pts lower. However, I just can't see anything <1425/00 under any scenario.

Indeed, after any correction, I'm concerned that we'll see a renewed melt higher across the summer, into the sp'1700s..even 1800s.

--

*In the meantime, I hold long overnight, via SLV and USO, both look okay for further upside for at least 3-5 days.

Goodnight from London

Daily Index Cycle update

The main market closed moderately higher. Only the Rus'2000 small cap failed to close higher, with the transports similarly stuck under recent highs. Near term trend remains bullish, but we're getting close to being overbought. Next down cycle likely to start after this coming opex.

IWM, daily

SP'daily5

Trans

Summary

A pretty dull day to start the week. I don't expect Tuesday to be any different.

Underlying MACD (blue bar histogram) cycle is still ticking higher, and there is no sign of this current up cycle having maxed out.

Considering its opex week, and with two rather large POMOs on Thur/Friday, I can't see the bears have any window of opportunity until next week at least.

--

*I holding long overnight via SLV and USO.

A little more later.

IWM, daily

SP'daily5

Trans

Summary

A pretty dull day to start the week. I don't expect Tuesday to be any different.

Underlying MACD (blue bar histogram) cycle is still ticking higher, and there is no sign of this current up cycle having maxed out.

Considering its opex week, and with two rather large POMOs on Thur/Friday, I can't see the bears have any window of opportunity until next week at least.

--

*I holding long overnight via SLV and USO.

A little more later.

Subscribe to:

Comments (Atom)