US equity indexes closed moderately higher, sp +6pts at 2368. The two

leaders - Trans/R2K, both settled higher by 0.8%. VIX settled +1.0% at 11.54. Near term outlook

offers moderate chop into the monthly/Q1 close. Broader upside to the

2425/50 zone looks a given by late April/early May.

sp'daily5

VIX'daily3

Summary

It was another day for the equity bulls, as despite opening much like Wednesday (minor chop mode), the market managed to break above soft resistance of sp'2363, and successfully held moderate gains across the afternoon.

Market volatility remains naturally very subdued, as the VIX is set to settle the month sub-teens. It is notable that unlike February, we did see VIX in the teens this month.. if only briefly.

For some extra charts in AH, see https://twitter.com/permabear_uk

Goodnight from London

--

Friday, 31 March 2017

Thursday, 30 March 2017

Naturally choppy

US equity indexes closed moderately mixed, sp +2pts at 2361. The two

leaders - Trans/R2K, settled -0.2% and +0.3% respectively. VIX settled -0.9% at 11.42. Near term

outlook offers threat of Thursday moderate weakness, before a swing

upward into the monthly/Q1 close.

sp'daily5

VIX'daily3

Summary

It was a day of minor chop for US equities. This was natural, as the smaller 60/15min cycles were on the high side, whilst at the same time, the bigger daily cycle, is seeing price momentum swing back to the equity bulls. The remainder of the week/month can be expected to be mostly 'more of the same'.

Market volatility remains very subdued, with the VIX settling net lower for a third consecutive day. It was particularly notable in early morning that with sp' -5pts, the VIX had already turned fractionally red! The key 20 threshold looks out of range until at least late April.

--

Here in London city...

Moody skies as the sun sets on the UK being part of the EU. In many ways though, I don't expect that much to change, as the political/societal elite never wanted to leave anyway. For some though, the removal of the right to live and work in other parts of Europe will be a truly great loss.

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

It was a day of minor chop for US equities. This was natural, as the smaller 60/15min cycles were on the high side, whilst at the same time, the bigger daily cycle, is seeing price momentum swing back to the equity bulls. The remainder of the week/month can be expected to be mostly 'more of the same'.

Market volatility remains very subdued, with the VIX settling net lower for a third consecutive day. It was particularly notable in early morning that with sp' -5pts, the VIX had already turned fractionally red! The key 20 threshold looks out of range until at least late April.

--

Here in London city...

Moody skies as the sun sets on the UK being part of the EU. In many ways though, I don't expect that much to change, as the political/societal elite never wanted to leave anyway. For some though, the removal of the right to live and work in other parts of Europe will be a truly great loss.

Goodnight from London

--

Wednesday, 29 March 2017

Broad equity gains

US equity indexes closed broadly higher, sp +16pts at 2358. The two

leaders - Trans/R2K, settled higher by 1.8% and 0.7% respectively. VIX settled -7.8% at 11.53. Near

term outlook offers a fair amount of chop into end month. More broadly,

the 2425/50 zone is on the menu for late April/early May.

sp'daily5

VIX'daily3

Summary

The market opened in minor chop mode, but with no downside power, it was just a matter of time before equities built rather broad gains. The net daily gains give high confidence that sp'2322 is a key short term low. In theory, the market should battle upward to the 2425/50 zone by late April/early May.

Volatility was naturally continuing to cool, with the VIX already cooling back into the 11s. The 10s are clearly due, with the 9s viable if the bulls have a case of mild hysteria within 3-5 weeks.

--

Here in the metropolis...

It was another reasonable spring day. More importantly - for those in the northern hemisphere, we're another day closer to summer warmth, which I really am bullish about.

Don't forget, extra charts in the late evening via https://twitter.com/permabear_uk Any retweets guarantee citizenship*

Goodnight from London

--

--

*Would you like to know more? see: http://www.imdb.com/title/tt0120201

sp'daily5

VIX'daily3

Summary

The market opened in minor chop mode, but with no downside power, it was just a matter of time before equities built rather broad gains. The net daily gains give high confidence that sp'2322 is a key short term low. In theory, the market should battle upward to the 2425/50 zone by late April/early May.

Volatility was naturally continuing to cool, with the VIX already cooling back into the 11s. The 10s are clearly due, with the 9s viable if the bulls have a case of mild hysteria within 3-5 weeks.

--

Here in the metropolis...

|

| Sundown.. 2.20pm EST. |

It was another reasonable spring day. More importantly - for those in the northern hemisphere, we're another day closer to summer warmth, which I really am bullish about.

Don't forget, extra charts in the late evening via https://twitter.com/permabear_uk Any retweets guarantee citizenship*

Goodnight from London

--

--

*Would you like to know more? see: http://www.imdb.com/title/tt0120201

Tuesday, 28 March 2017

Reversing upward

US equity indexes closed on a slightly mixed note, sp -2pts at 2341

(intra low 2322). The two leaders - Trans/R2K, settled higher by 0.1%

and 0.2% respectively. VIX settled -3.5% at 12.50. Near term outlook offers upside to 2360/70 into

end month. Broader upside to 2425/50 seems a given by late April/early

May.

sp'daily5

VIX'daily3

Summary

US equities opened broadly lower, but there was a rather clear reversal underway within minutes. There just aren't many willing sellers at these levels. The sp' daily candle was a classic hollow red reversal.. managing to close above the key 50dma. Its a rather bullish sign.

VIX saw a pre-market print of 15.11, but only managed 14.82 in early trading, and was then ground lower across the day. For much of the day, the daily candle was of the black-fail type, but even managed to turn outright red. The volatility bulls really should be concerned!

On balance.. the market looks prone to battling upward into late April/early May.

--

This evening's movie...

--

For some AH bonus charts... https://twitter.com/permabear_uk

If you retweet any of my posts, a trader gets their wings.

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

US equities opened broadly lower, but there was a rather clear reversal underway within minutes. There just aren't many willing sellers at these levels. The sp' daily candle was a classic hollow red reversal.. managing to close above the key 50dma. Its a rather bullish sign.

VIX saw a pre-market print of 15.11, but only managed 14.82 in early trading, and was then ground lower across the day. For much of the day, the daily candle was of the black-fail type, but even managed to turn outright red. The volatility bulls really should be concerned!

On balance.. the market looks prone to battling upward into late April/early May.

--

This evening's movie...

|

| Mr Fuzzy Bear is always watching - The Wolf of Wall Street (2013). |

For some AH bonus charts... https://twitter.com/permabear_uk

If you retweet any of my posts, a trader gets their wings.

Goodnight from London

--

Saturday, 25 March 2017

Weekend update - US weekly indexes

It was a bearish week for US equities, with net weekly declines ranging from -2.6% (R2K), -1.5% (Dow, NYSE comp'), to -1.2% (Nasdaq comp'). Near term outlook offers renewed upside into April earnings, at least to the sp'2425/50 zone. The French election will be a clear threat to the US and other world markets, but should be brief like the BREXIT event.

Lets take our regular look at six of the main US indexes

sp'500

The sp' saw a net weekly decline of -34pts (1.4%) to 2343 (intra week low 2335). Its notable we still saw a weekly close above the key 10MA, which has broadly held since early Nov'. Underlying MACD (blue bar histogram) ticked lower for a third consecutive week. There is a threat of a bearish cross into month end.

Best guess: the 50dma - in the low 2330s, should hold across next week. Renewed upside into end month and across at least the first half of April. By mid April, the market should be pushing for new historic highs >2400, with 2425/50 by late April/early May.

Equity bears have nothing to tout unless we break mid term rising trend, which at end April, will be around 2260.

--

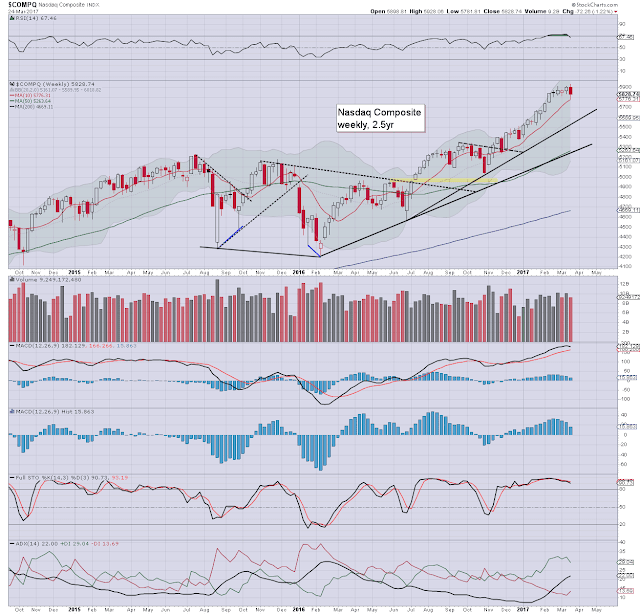

Nasdaq comp;

The tech - which has been leading the way higher, was the most resilient index this week, settling -1.2% at 5828. However, it was VERY notable that the equity bulls managed a new historic high on Tuesday of 5928. The bulls can tolerate another 3-4% lower before any problems.

Dow

The mighty Dow declined -317pts (1.5%) to 20596. Indeed, most should recognise how the giant psy' level of 20k is now first soft support. That looks set to hold in the near term, before another wave higher to the 21300/500 zone.

NYSE comp'

The master index settled -1.5% at 11418, the first close under the weekly 10MA since late Oct'. However, things only turn bearish if rising trend from the Feb'2016 low is broken. By late April, that will be around 11200. First big target is the 12k threshold which seems viable as early as June.

R2K

The second market leader saw the biggest decline this week, -36pts (2.6%) to 1354. There are multiple aspects of support within the 1320/00 zone. It seems extremely unlikely that the R2K will see any price action <1300 in the near term. Instead, renewed upside to new historic highs within the 1425/50 zone. The 1500s look a stretch though, before a broader market retrace.

Trans

The 'old leader' - Trans, declined for a third consecutive week, settling -2.4% at 8928, back to levels from mid November. Indeed, the tranny is struggling, at levels equivalent to sp'2100. Lower bollinger will be offering strong support in the 8800s next week, and that should hold. Its notable that underlying MACD cycle has now been outright bearish for a third week. Cyclically, we're on the low end. Trans to 10k seems a valid target this summer.

--

Summary

The most bearish week for most US equities since late Oct'2016

All indexes remain relatively close to recent historic highs. It is notable that the Nasdaq comp' broke a new historic high on Tuesday.

There remains around 5% of downside buffer before the mid term trends - from the early 2016 lows, are at risk of being broken.

--

Looking ahead

It will be the run into end month, and for the chartists out there, the monthly closes are especially important.

M -

T - intl' trade, Case-Shiller HPI, consumer con', Richmond fed

W - pending home sales, EIA Pet' report

T - weekly jobs, Q1 GDP (3rd estimate), corp' profits, EIA Nat' gas

F - pers' income/outlays, Chicago PMI, consumer sent'

*there are a truckload of fed officials on the loose, notably Bullard on Friday.

**UK/EU clocks jump ahead 1hr in the early hours of Sunday, bringing back the standard 5hr difference to EST. Yours truly will be especially pleased about that.

--

Special note - the French election

With the healthcare bill out of the way (at least for a while!) the next big event is the French presidential election. Round one is due Sunday April 23rd. If no clear winner, then it will drag out to round two - Sunday May 7th.

For the curious: https://en.wikipedia.org/wiki/French_presidential_election,_2017

Its fascinating that the French equity market is now at key multi-decade declining trend/resistance.

CAC, monthly, 20yr

A major failure or breakout is due. Those hyper-bulls seeking broad upside across 2017, are going to need to see the French market break up and away.

--

Follow me on twitter: https://twitter.com/permabear_uk, where I am trying to provide some extra charts of interest each evening. If you retweet any of my tweets, a trader gets their wings.

--

Have a good weekend

--

*the next post on this page will likely appear Monday at 7pm EST

Lets take our regular look at six of the main US indexes

sp'500

The sp' saw a net weekly decline of -34pts (1.4%) to 2343 (intra week low 2335). Its notable we still saw a weekly close above the key 10MA, which has broadly held since early Nov'. Underlying MACD (blue bar histogram) ticked lower for a third consecutive week. There is a threat of a bearish cross into month end.

Best guess: the 50dma - in the low 2330s, should hold across next week. Renewed upside into end month and across at least the first half of April. By mid April, the market should be pushing for new historic highs >2400, with 2425/50 by late April/early May.

Equity bears have nothing to tout unless we break mid term rising trend, which at end April, will be around 2260.

--

Nasdaq comp;

The tech - which has been leading the way higher, was the most resilient index this week, settling -1.2% at 5828. However, it was VERY notable that the equity bulls managed a new historic high on Tuesday of 5928. The bulls can tolerate another 3-4% lower before any problems.

Dow

The mighty Dow declined -317pts (1.5%) to 20596. Indeed, most should recognise how the giant psy' level of 20k is now first soft support. That looks set to hold in the near term, before another wave higher to the 21300/500 zone.

NYSE comp'

The master index settled -1.5% at 11418, the first close under the weekly 10MA since late Oct'. However, things only turn bearish if rising trend from the Feb'2016 low is broken. By late April, that will be around 11200. First big target is the 12k threshold which seems viable as early as June.

R2K

The second market leader saw the biggest decline this week, -36pts (2.6%) to 1354. There are multiple aspects of support within the 1320/00 zone. It seems extremely unlikely that the R2K will see any price action <1300 in the near term. Instead, renewed upside to new historic highs within the 1425/50 zone. The 1500s look a stretch though, before a broader market retrace.

Trans

The 'old leader' - Trans, declined for a third consecutive week, settling -2.4% at 8928, back to levels from mid November. Indeed, the tranny is struggling, at levels equivalent to sp'2100. Lower bollinger will be offering strong support in the 8800s next week, and that should hold. Its notable that underlying MACD cycle has now been outright bearish for a third week. Cyclically, we're on the low end. Trans to 10k seems a valid target this summer.

--

Summary

The most bearish week for most US equities since late Oct'2016

All indexes remain relatively close to recent historic highs. It is notable that the Nasdaq comp' broke a new historic high on Tuesday.

There remains around 5% of downside buffer before the mid term trends - from the early 2016 lows, are at risk of being broken.

--

Looking ahead

It will be the run into end month, and for the chartists out there, the monthly closes are especially important.

M -

T - intl' trade, Case-Shiller HPI, consumer con', Richmond fed

W - pending home sales, EIA Pet' report

T - weekly jobs, Q1 GDP (3rd estimate), corp' profits, EIA Nat' gas

F - pers' income/outlays, Chicago PMI, consumer sent'

*there are a truckload of fed officials on the loose, notably Bullard on Friday.

**UK/EU clocks jump ahead 1hr in the early hours of Sunday, bringing back the standard 5hr difference to EST. Yours truly will be especially pleased about that.

--

Special note - the French election

With the healthcare bill out of the way (at least for a while!) the next big event is the French presidential election. Round one is due Sunday April 23rd. If no clear winner, then it will drag out to round two - Sunday May 7th.

For the curious: https://en.wikipedia.org/wiki/French_presidential_election,_2017

Its fascinating that the French equity market is now at key multi-decade declining trend/resistance.

CAC, monthly, 20yr

A major failure or breakout is due. Those hyper-bulls seeking broad upside across 2017, are going to need to see the French market break up and away.

--

Follow me on twitter: https://twitter.com/permabear_uk, where I am trying to provide some extra charts of interest each evening. If you retweet any of my tweets, a trader gets their wings.

--

Have a good weekend

--

*the next post on this page will likely appear Monday at 7pm EST

Friday, 24 March 2017

Bearish end to the week

US equity indexes closed moderately mixed, sp -2pts at 2343. The two

leaders - Trans/R2K, settled -0.1% and +0.1% respectively. VIX settled -1.2% at 12.96. Near term

outlook still offers threat of a test of the rising 50dma in the low

sp'2330s.

sp'daily5

VIX'daily3

Summary

It was a day of swings, with morning strength to 2356, but then latter day weakness to 2335 - fractionally breaking the Wed' low.

With equities turning moderately lower in the afternoon, the VIX briefly saw the 14s, before cooling due to a closing hour equity ramp.

--

As for Trump pulling the healthcare bill, it was never going to be easy, but its clearly a sign of weakness as even some republicans won't support their President. It doesn't bode well for subsequent tax or infrastructure bills, which the market has used as a (valid) excuse for powerful gains since last November.

I would hope we could all agree though, some drama to end the week, is usually a good thing, right?

Goodnight from London

--

*the weekend post will appear Sat' 12pm, and will detail the US weekly indexes

sp'daily5

VIX'daily3

Summary

It was a day of swings, with morning strength to 2356, but then latter day weakness to 2335 - fractionally breaking the Wed' low.

With equities turning moderately lower in the afternoon, the VIX briefly saw the 14s, before cooling due to a closing hour equity ramp.

--

As for Trump pulling the healthcare bill, it was never going to be easy, but its clearly a sign of weakness as even some republicans won't support their President. It doesn't bode well for subsequent tax or infrastructure bills, which the market has used as a (valid) excuse for powerful gains since last November.

I would hope we could all agree though, some drama to end the week, is usually a good thing, right?

Goodnight from London

--

*the weekend post will appear Sat' 12pm, and will detail the US weekly indexes

Thursday, 23 March 2017

Twitchy market

US equities closed moderately mixed, sp -2pts at 2345. The two leaders -

Trans/R2K, settled -0.6% and +0.6% respectively. VIX settled +2.4% at 13.12. Near term outlook

offers high threat of a test of the 50dma, which will be around 2330

early Friday morning. Broadly though, another push into the 2400s looks a

given into April earnings.

sp'daily5

VIX'daily3

Summary

It was a pretty choppy day in equity land, as the market was naturally twitchy due to the looming healthcare bill. There was some distinct weakness into the close, with the spiky daily candle suggestive of further weakness on Friday. On balance, no sustained price action under the 50dma.

VIX saw an intra high 13.17, as today was the first time we've seen the 13s in 'normal trading' since Jan'19th. Clearly, if the main market opens sharply lower tomorrow morning, 14s will be due... 15s on a stretch.

--

As for the healthcare bill

I'm pretty much a cheerleader for Trump... and was one of those few people who foresaw his presidency a long... long time ago. Yet even Trump is entirely failing to address the core problem within American healthcare.

Denniger of 'Market Ticker' has droned on about this issue for many years, and I shall merely refer you to any of his recent articles on the matter. See http://market-ticker.org

I'm refraining from making any comments on yesterday's madness in the city. Suffice to add... this afternoon's sunshine was something of a relief.

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

It was a pretty choppy day in equity land, as the market was naturally twitchy due to the looming healthcare bill. There was some distinct weakness into the close, with the spiky daily candle suggestive of further weakness on Friday. On balance, no sustained price action under the 50dma.

VIX saw an intra high 13.17, as today was the first time we've seen the 13s in 'normal trading' since Jan'19th. Clearly, if the main market opens sharply lower tomorrow morning, 14s will be due... 15s on a stretch.

--

As for the healthcare bill

I'm pretty much a cheerleader for Trump... and was one of those few people who foresaw his presidency a long... long time ago. Yet even Trump is entirely failing to address the core problem within American healthcare.

Denniger of 'Market Ticker' has droned on about this issue for many years, and I shall merely refer you to any of his recent articles on the matter. See http://market-ticker.org

|

| Spring sunset.. 2.20pm EST |

Goodnight from London

--

Wednesday, 22 March 2017

Battling to bounce

US equity indexes closed moderately mixed, sp +4pts at 2348 (intra low

2336). The two leaders - Trans/R2K, settled +0.6% and -0.1%

respectively. VIX settled +2.7% at 12.81. Near term outlook offers high threat of a test of the

50dma.. which will soon be around 2330.

sp'daily5

VIX'daily3

Summary

Equities: an intra low of 2336, but then a rather typical latter day recovery, with a minor gain. There is huge overhead resistance within the 2380/90 zone. It seems very viable that the market could see another wave lower to test the rising 50dma, before a realistic opportunity to break/clear >2390.

VIX: The print of 13.16 was actually seen in pre-market. Stockcharts (and I guess most other charting software) now generally include pre-market, and the 15mins of AH price action, as part of each daily candle. In any case... the VIX is still reflective of a broadly confident capital market.

*for some extra charts/chatter later this evening, see https://twitter.com/permabear_uk

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

Equities: an intra low of 2336, but then a rather typical latter day recovery, with a minor gain. There is huge overhead resistance within the 2380/90 zone. It seems very viable that the market could see another wave lower to test the rising 50dma, before a realistic opportunity to break/clear >2390.

VIX: The print of 13.16 was actually seen in pre-market. Stockcharts (and I guess most other charting software) now generally include pre-market, and the 15mins of AH price action, as part of each daily candle. In any case... the VIX is still reflective of a broadly confident capital market.

*for some extra charts/chatter later this evening, see https://twitter.com/permabear_uk

Goodnight from London

--

Tuesday, 21 March 2017

Go take a Valium

US equity indexes closed significantly lower, sp -29pts at 2344. The two

leaders - Trans/R2K, settled lower by a very significant -1.9% and

-2.7% respectively. VIX settled +10.0% to 12.47. With the break <2350, near term outlook offers a

test of the key 50dma, which will soon be in the 2330s.

sp'daily5

VIX'daily3

Summary

Today was admittedly something of a surprise, seeing the most dynamic downward action (for most indexes) since Sept'9th 2016. It was a fourth consecutive net daily decline for the sp'500, the most bearish run since late January, back when the sp' was battling against the 2300 threshold.

Cyclically, we're on the low end, and the equity bears are going to struggle to achieve any daily closes under the 50dma.. which is still rising, and will soon be in the sp'2330s.

Market volatility certainly picked up today, with the VIX seeing an opening classic hollow red reversal candle (hourly cycle, not shown).. and then quickly climbing. Despite sig' equity weakness, the VIX still couldn't see the low teens today, and it remains reflective of underlying capital market confidence.

Need a Valium?

Browsing around twitter and various blogs today, I am already starting to see borderline bearish hysteria. The top calling maniacs are at it again.

Lets be clear, the mid term bullish trends from the key lows in early 2016 remain FULLY intact. Nothing changes unless we're trading under the monthly 10MA - currently at sp'2216, although that number will naturally increase each month. For the moment, if you're feeling excited that the grand rally from 2009 is complete, I would suggest go take a Valium, or something.

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

Today was admittedly something of a surprise, seeing the most dynamic downward action (for most indexes) since Sept'9th 2016. It was a fourth consecutive net daily decline for the sp'500, the most bearish run since late January, back when the sp' was battling against the 2300 threshold.

Cyclically, we're on the low end, and the equity bears are going to struggle to achieve any daily closes under the 50dma.. which is still rising, and will soon be in the sp'2330s.

Market volatility certainly picked up today, with the VIX seeing an opening classic hollow red reversal candle (hourly cycle, not shown).. and then quickly climbing. Despite sig' equity weakness, the VIX still couldn't see the low teens today, and it remains reflective of underlying capital market confidence.

Need a Valium?

Browsing around twitter and various blogs today, I am already starting to see borderline bearish hysteria. The top calling maniacs are at it again.

Lets be clear, the mid term bullish trends from the key lows in early 2016 remain FULLY intact. Nothing changes unless we're trading under the monthly 10MA - currently at sp'2216, although that number will naturally increase each month. For the moment, if you're feeling excited that the grand rally from 2009 is complete, I would suggest go take a Valium, or something.

Goodnight from London

--

Monday, 20 March 2017

Subdued price action

US equity indexes closed moderately weak, sp -4pts at 2373. The two

leaders - Trans/R2K, both settled -0.5%. VIX settled +0.5% at 11.34. Near term outlook offers

another lurch upward... as the 2425/50 zone seems a given into April

earnings.

sp'daily5

VIX'daily3

Summary

The week began on a pretty subdued note (don't I say that every week?), with the market seeing an afternoon swing from sp'2369 to 2376. The drama!

VIX remains naturally subdued.. still entirely unable to reach the 13s - last seen Jan'19th. Its notable we sure are seeing a great many black-fail daily candles, as any equity downside is usually reversed later in the day.

--

Yours truly wants your support.

I'm trying something new, and want to see if I can capture some added attention via Twitter. I'm aiming to post 3-5 charts each day in the late evening.

First target is 250,000 hits within a month. That is not exactly bold, I know a few who catch millions.

--

You can follow me on Twitter @ https://twitter.com/permabear_uk

If you want to help.. retweet! No... 'likes' don't count, and do nothing to build my audience, which is the primary aim of this endeavour.

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

The week began on a pretty subdued note (don't I say that every week?), with the market seeing an afternoon swing from sp'2369 to 2376. The drama!

VIX remains naturally subdued.. still entirely unable to reach the 13s - last seen Jan'19th. Its notable we sure are seeing a great many black-fail daily candles, as any equity downside is usually reversed later in the day.

--

Yours truly wants your support.

I'm trying something new, and want to see if I can capture some added attention via Twitter. I'm aiming to post 3-5 charts each day in the late evening.

First target is 250,000 hits within a month. That is not exactly bold, I know a few who catch millions.

--

You can follow me on Twitter @ https://twitter.com/permabear_uk

If you want to help.. retweet! No... 'likes' don't count, and do nothing to build my audience, which is the primary aim of this endeavour.

Goodnight from London

--

Saturday, 18 March 2017

Weekend update - US weekly indexes

It was a somewhat mixed week for US equity indexes, with net weekly changes ranging from 1.9% (R2K), +0.7% (Nasdaq comp'), +0.2% (sp'500), to -1.5% (Transports). Near term outlook offers further upside into April earnings. The year end target of sp'2683 remains on track.

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 traded within a narrow range of just 32pts, with a net weekly gain of 5pts (0.2%) to 2378. Underlying MACD (blue bar histogram) cycle ticked lower for a second week, but remains strongly positive. The key 10MA is currently at 2330, and will be around the 2400 threshold by mid/late April.

Best guess: Another push into the low/mid 2400s seems due into April earnings. The 2500s seem a given, the only issue is whether that is briefly delayed by a 'spooked mainstream' - via the French elections. The 2600/700s remain a valid target by year end.

Equity bears have absolutely nothing to tout unless the mid term rising trend - from the Feb'2016 low (1810) is broken, and in early May that will be around 2260.

--

Nasdaq comp'

The tech continues to lead the way higher, and its notable that Friday saw a new (if fractional) historic high of 5912, with the Nasdaq settling net higher by 0.7% at 5901. The broader trend remains powerfully bullish, as the 6000s are clearly within range into April. Core support at the 5k level is now 901pts (15%) lower, and looks very secure for the long term.

Dow

The mighty Dow saw a fractional net weekly gain of 0.1%, settling at 20914. First big support is the 20k threshold, and its ironic that the equity bears will be lucky to see that tested, if the Dow first pushes to around 21500 in April. A yearly close in the 23000s seems very viable, so long as the econ-data and earnings continue to come in 'reasonable', with the fed raising rates at least twice more.

NYSE comp'

The master index saw a net weekly gain of 0.8%, settling at 11589. Upper bollinger is offering the 11800s in the near term, with 12k seemingly probable in April. A year end close in the 13000s seems viable.

R2K

The second market leader - R2K, saw a rather significant net weekly gain of 1.9%, settling at 1391. Its notable that whilst prices remain close to recent historic highs, underlying MACD continues to cool from grossly overbought levels, and is now moderately negative for a third consecutive week. There are a fair few aspects of support within the 1320/00 zone, and that looks set to hold in any market retrace this spring/summer. A year end close in the 1600/700s appears highly probable.

Trans

The old leader - Trans, is still a bit of a lagged, falling for a second consecutive week, with a net decline of -1.5% to 9145. The 9k threshold does look secure in the near/mid term, as another push upward toward the giant psy' level of 10k is due - certainly by mid summer. A year end close in the 11/12k zone seems viable.

--

Summary

Recent price action has been somewhat choppy, but all US equity indexes are holding within the upward trends that stretch back to the key lows in early 2016.

All indexes remain close to historic highs, even the somewhat laggy Transports.

The Nov'2016 lows are a very long way down.

The year end target of sp'2683 remains on track.

Equity bears have nothing to tout, even if the market retraces around 5%, which currently looks off the menu until at least late April/May.

--

Looking ahead

A pretty light week is ahead.

*notable earnings: Lennar, Fedex, and Nike - all on Tuesday.

M -

T -

W - FHFA house price indx, exist' home sales, EIA Pet'

T - weekly jobs, new home sales

F - durable goods orders

*there are a fair number of fed officials on the loose. Yellen appears early Thursday at some community dev' conference, and I'd imagine it might capture some mainstream media attention. Kashkari is due at 12pm the same day, and the issue of his dissent against the March rate hike will likely be raised. Friday will see a trio, including the bane of the equity bears - Bullard.

--

If you value my postings, you can subscribe to me, which give you access to my continuing intraday commentary. I post around 220-240 times a month, focusing on US equities, but also a broad array of market related issues.

The cost is $20pcm - roughly $1 per trading day. Or... you could buy one share of SNAP per month (or two shares by late summer).

--

Another way you can support my work is by simply re-tweeting anything from https://twitter.com/permabear_uk It would make a difference!

Have a good weekend

--

*the next post on this page will likely appear at 7pm EST on Monday.

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 traded within a narrow range of just 32pts, with a net weekly gain of 5pts (0.2%) to 2378. Underlying MACD (blue bar histogram) cycle ticked lower for a second week, but remains strongly positive. The key 10MA is currently at 2330, and will be around the 2400 threshold by mid/late April.

Best guess: Another push into the low/mid 2400s seems due into April earnings. The 2500s seem a given, the only issue is whether that is briefly delayed by a 'spooked mainstream' - via the French elections. The 2600/700s remain a valid target by year end.

Equity bears have absolutely nothing to tout unless the mid term rising trend - from the Feb'2016 low (1810) is broken, and in early May that will be around 2260.

--

Nasdaq comp'

The tech continues to lead the way higher, and its notable that Friday saw a new (if fractional) historic high of 5912, with the Nasdaq settling net higher by 0.7% at 5901. The broader trend remains powerfully bullish, as the 6000s are clearly within range into April. Core support at the 5k level is now 901pts (15%) lower, and looks very secure for the long term.

Dow

The mighty Dow saw a fractional net weekly gain of 0.1%, settling at 20914. First big support is the 20k threshold, and its ironic that the equity bears will be lucky to see that tested, if the Dow first pushes to around 21500 in April. A yearly close in the 23000s seems very viable, so long as the econ-data and earnings continue to come in 'reasonable', with the fed raising rates at least twice more.

NYSE comp'

The master index saw a net weekly gain of 0.8%, settling at 11589. Upper bollinger is offering the 11800s in the near term, with 12k seemingly probable in April. A year end close in the 13000s seems viable.

R2K

The second market leader - R2K, saw a rather significant net weekly gain of 1.9%, settling at 1391. Its notable that whilst prices remain close to recent historic highs, underlying MACD continues to cool from grossly overbought levels, and is now moderately negative for a third consecutive week. There are a fair few aspects of support within the 1320/00 zone, and that looks set to hold in any market retrace this spring/summer. A year end close in the 1600/700s appears highly probable.

Trans

The old leader - Trans, is still a bit of a lagged, falling for a second consecutive week, with a net decline of -1.5% to 9145. The 9k threshold does look secure in the near/mid term, as another push upward toward the giant psy' level of 10k is due - certainly by mid summer. A year end close in the 11/12k zone seems viable.

--

Summary

Recent price action has been somewhat choppy, but all US equity indexes are holding within the upward trends that stretch back to the key lows in early 2016.

All indexes remain close to historic highs, even the somewhat laggy Transports.

The Nov'2016 lows are a very long way down.

The year end target of sp'2683 remains on track.

Equity bears have nothing to tout, even if the market retraces around 5%, which currently looks off the menu until at least late April/May.

--

Looking ahead

A pretty light week is ahead.

*notable earnings: Lennar, Fedex, and Nike - all on Tuesday.

M -

T -

W - FHFA house price indx, exist' home sales, EIA Pet'

T - weekly jobs, new home sales

F - durable goods orders

*there are a fair number of fed officials on the loose. Yellen appears early Thursday at some community dev' conference, and I'd imagine it might capture some mainstream media attention. Kashkari is due at 12pm the same day, and the issue of his dissent against the March rate hike will likely be raised. Friday will see a trio, including the bane of the equity bears - Bullard.

--

If you value my postings, you can subscribe to me, which give you access to my continuing intraday commentary. I post around 220-240 times a month, focusing on US equities, but also a broad array of market related issues.

The cost is $20pcm - roughly $1 per trading day. Or... you could buy one share of SNAP per month (or two shares by late summer).

--

Another way you can support my work is by simply re-tweeting anything from https://twitter.com/permabear_uk It would make a difference!

Have a good weekend

--

*the next post on this page will likely appear at 7pm EST on Monday.

Friday, 17 March 2017

Subdued end to the week

US equity indexes closed moderately mixed, sp -3pts at 2378. The two

leaders - Trans/R2K, settled -0.4% and +0.4% respectively. VIX settled +0.6% at 11.28. Near term

outlook offers another push into the sp'2400s, with the 2500s a viable

target if the Market can cope with the French elections in April/May.

sp'daily5

VIX'daily3

Summary

It was quad-opex, and price action was naturally rather tight, with a trading range for the sp'500 of just 8pts. VIX was itself subdued, swinging from an intra low of 10.78 to settle fractionally higher in the low 11s.

Goodnight from London

--

*the weekend post will appear Sat' 12pm EST, and will detail the US weekly indexes

sp'daily5

VIX'daily3

Summary

It was quad-opex, and price action was naturally rather tight, with a trading range for the sp'500 of just 8pts. VIX was itself subdued, swinging from an intra low of 10.78 to settle fractionally higher in the low 11s.

Goodnight from London

--

*the weekend post will appear Sat' 12pm EST, and will detail the US weekly indexes

Thursday, 16 March 2017

Broadly strong

US equity indexes closed moderately weak, sp -3pts at 2381. The two

leaders - Trans/R2K, settled -0.5% and +0.2% respectively. VIX settled -3.6% at 11.21. Near term

outlook offers chop into the quad-opex/weekly close. Another push upward

into the sp'2400s is due, as broader price action is strong.

sp'daily5

VIX'daily3

Summary

It was a pretty subdued in equity land, with most indexes leaning moderately weak. It was notable that the Nasdaq comp' came within a single point of breaking a new historic high.

The VIX continues to reflect powerful underlying equity strength, and melted moderately lower to the low 11s. A weekly settlement in the 10s is easily within range.

--

Something to stare at... at least for a few minutes..

UK, monthly

We're halfway through March, and the UK FTSE is net higher by a rather significant 2.1%, having broken a new historic high of 7444. Anyone doubt 9/10k as a minimum target before it all ends badly?

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

It was a pretty subdued in equity land, with most indexes leaning moderately weak. It was notable that the Nasdaq comp' came within a single point of breaking a new historic high.

The VIX continues to reflect powerful underlying equity strength, and melted moderately lower to the low 11s. A weekly settlement in the 10s is easily within range.

--

Something to stare at... at least for a few minutes..

UK, monthly

We're halfway through March, and the UK FTSE is net higher by a rather significant 2.1%, having broken a new historic high of 7444. Anyone doubt 9/10k as a minimum target before it all ends badly?

Goodnight from London

--

Subscribe to:

Posts (Atom)