Another quiet day in market land.

The closing hourly charts

IWM

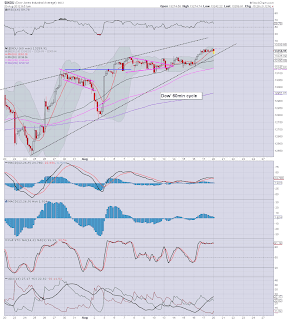

Dow

Sp

Summary

The Rus'2000 and Transports remain a real mess, but the dow/sp'500 are pretty clearly in ascending wedges that will surely break to the downside. Yet downside might be only 2%, dow 13k, and sp'1390, before 'benny @ jackson hole' next Friday.

There really just isn't much to say right now. The daily index moves are so tiny, with the VIX seemingly content to remain well under the usual periodic lows of 16/15.

For any 'normal person', it really is a case of 'come back in mid September'. I don't expect QE at the next FOMC, so, lets see where we are at that time.

A little more later.

Monday, 20 August 2012

12.30pm update - poor bears

Another lousy start to the week for the bears. With the primary weekly and monthly trends still bullish, the algo-bots remain in firm control.

There is simply ZERO sell-side volume, and the bots are able to 'work their magic'.

dow'60min

VIX'60min

Summary

I have to say, its pathetically laughable how the bears still can't break the indexes below the lower wedge line.

Clearly, the meltup can't last forever, yet a weak pullback to dow 13k looks the best the bears can get.

Mr VIX saw almost a 10% rise early this morning, but as I keep saying, 10% of not very much is..not very much. Until VIX is back over 18 or so...any rise in the VIX is to be dismissed as mere noise.

More after the close*

---

*really, there just isn't much to say intra-day at the moment, so updates are going to be somewhat sporadic.

There is simply ZERO sell-side volume, and the bots are able to 'work their magic'.

dow'60min

VIX'60min

Summary

I have to say, its pathetically laughable how the bears still can't break the indexes below the lower wedge line.

Clearly, the meltup can't last forever, yet a weak pullback to dow 13k looks the best the bears can get.

Mr VIX saw almost a 10% rise early this morning, but as I keep saying, 10% of not very much is..not very much. Until VIX is back over 18 or so...any rise in the VIX is to be dismissed as mere noise.

More after the close*

---

*really, there just isn't much to say intra-day at the moment, so updates are going to be somewhat sporadic.

10am update - due a break lower

We are due some sort of 2-3% move lower, yet even that's arguably a 'moderate chance'. The bears have a real problem. Underlying momentum on the big weekly and monthly cycles remains UP. It will take a major decline to the sp'1340s, just to level out the bigger cycles, and I honestly can't see that happening any time soon.

dow'60min

dow, daily

Summary

The dow seems to be the index first likely to break below the wedge.

On the daily, you can see we have a pretty good chance at a pullback, but it will probably be no lower than the recent low of 12800, and maybe not even 13000. So, again, bears might only get 2% lower between now and early next week.

Until the infamous 'Jackson hole' is out of the way, and the FOMC of Sept'13, it sure doesn't look good trading weather for the bears.

VIX is up 6%, but at such low levels, its all noise. Only with a move into the 18s, can the VIX be taken seriously.

*Next update 12pm.

dow'60min

dow, daily

Summary

The dow seems to be the index first likely to break below the wedge.

On the daily, you can see we have a pretty good chance at a pullback, but it will probably be no lower than the recent low of 12800, and maybe not even 13000. So, again, bears might only get 2% lower between now and early next week.

Until the infamous 'Jackson hole' is out of the way, and the FOMC of Sept'13, it sure doesn't look good trading weather for the bears.

VIX is up 6%, but at such low levels, its all noise. Only with a move into the 18s, can the VIX be taken seriously.

*Next update 12pm.

Pre-Market Brief

Good morning. It was a quiet weekend, there really doesn't seem to be anything going on at the moment. Europe is seemingly fast asleep/on holiday. lets see how this week goes!

As the following chart clearly shows..for the near term at least, the trend remains UP.

sp'daily3

Summary

It'll probably be relatively quiet this week, there isn't really anything lined up that would make for major moves. That's not to say we can't see see some downside, we sure are due some Yet, on any outlook, even a move to 1380 looks a stretch right now.

As noted many times lately, bears must see sp'1340s to have ANY confidence the short term trend -which started early June, is over.

Good wishes for the trading week

More across the day.

As the following chart clearly shows..for the near term at least, the trend remains UP.

sp'daily3

Summary

It'll probably be relatively quiet this week, there isn't really anything lined up that would make for major moves. That's not to say we can't see see some downside, we sure are due some Yet, on any outlook, even a move to 1380 looks a stretch right now.

As noted many times lately, bears must see sp'1340s to have ANY confidence the short term trend -which started early June, is over.

Good wishes for the trading week

More across the day.

Subscribe to:

Comments (Atom)