US equities closed moderately lower for the second consecutive day, sp -13pts @ 1963 (intra low 1959). The two leaders - Trans/R2K, settled lower by -0.1% and -1.1% respectively. Near term outlook offers minor chance of a further small wave lower, but the sp'2000s look due... soon.

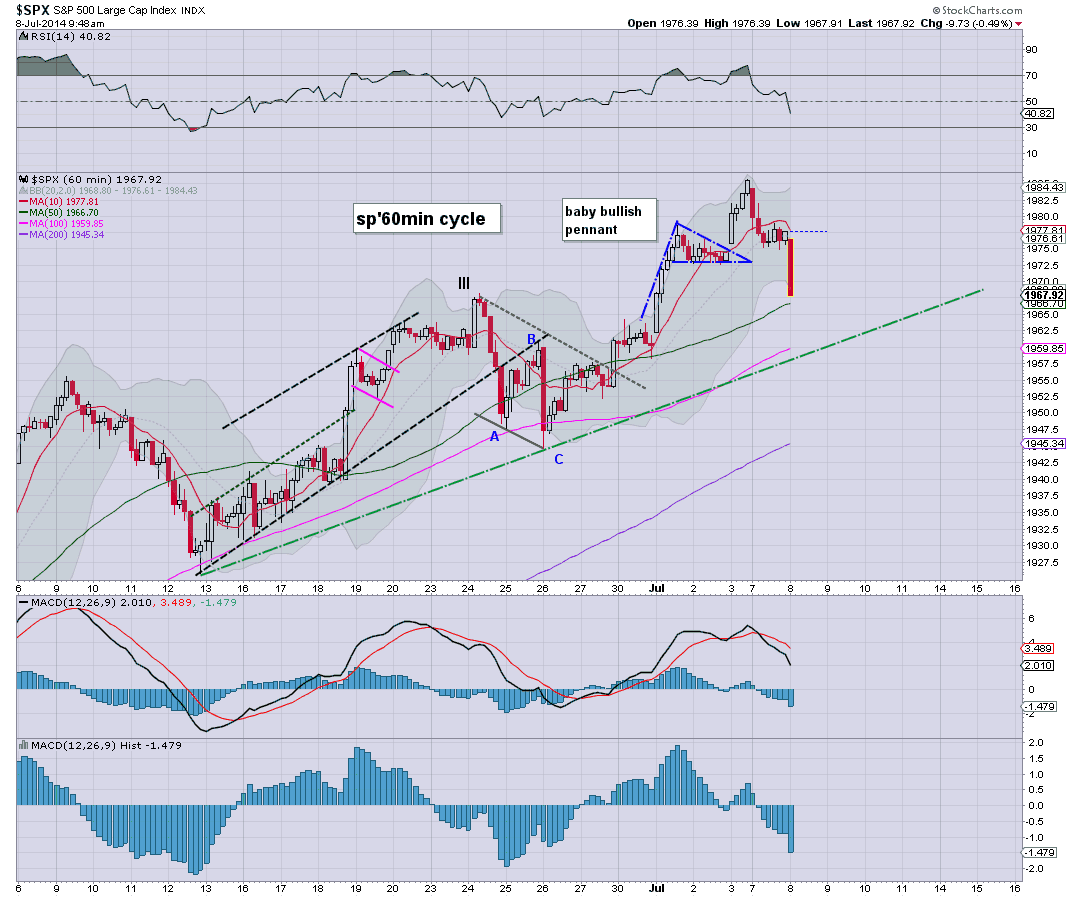

sp'60min

Summary

*far more importantly....we have Brazil vs Germany.

--

I will post a daily wrap at 8pm EST.

Tuesday, 8 July 2014

3pm update - chop into the close

US equities look set for some mild chop into the close, and it would look highly probable that the equity bulls will manage a daily close in the 1960s... which keeps the short term upward trend intact.

sp'60min

Summary

Little to add...

Hourly cycles look floored at sp'1959, and we are already see the MACD cycle starting to tick higher.

--

back at the close.

sp'60min

Summary

Little to add...

Hourly cycles look floored at sp'1959, and we are already see the MACD cycle starting to tick higher.

--

back at the close.

2pm update - reversals all over the place

US indexes are clawing back upward, from the earlier low of sp'1959. There are strong reversals in a great many individual stocks, notably in the airlines - UAL, DAL, and AA. VIX looks to have maxed out at 12.51.

sp'60min

Summary

It looks like 1959 was a short term floor, and we're headed higher. There remains moderate chance of a further down wave later this week, but really, odds are against it. Certainly, it would make for an overly risky short-side trade.

We're seeing some buying interest with the hourly cycle now floored...

Just one of the huge reversals of today...

UAL, daily

It doesn't get much clearer than that. UAL looks set for the big $50 later this year, although Delta (DAL) is in far better shape, and less volatile than United.

sp'60min

Summary

It looks like 1959 was a short term floor, and we're headed higher. There remains moderate chance of a further down wave later this week, but really, odds are against it. Certainly, it would make for an overly risky short-side trade.

We're seeing some buying interest with the hourly cycle now floored...

Just one of the huge reversals of today...

UAL, daily

It doesn't get much clearer than that. UAL looks set for the big $50 later this year, although Delta (DAL) is in far better shape, and less volatile than United.

1pm update - battling for a floor

US indexes remain weak, with sig' declines in the R2K -1.4%. The sp'500 failed to hold the 1960 level, but still... a daily close in the 1950s seems unlikely. Equity bears are highly vulnerable to a whipsaw higher across the rest of the week.

sp'60min

Summary

*hourly candle is closing positive, bodes well for a floor of sp'1959

--

Call it whatever you want, but the market looks floored to me. Whether we drop a little further seems of little consequence.

This is the same situation we've seen so many times already this year, and we know how it ends.. right?

-

A move from the 1960s. into the 2000s looks viable next week.

-

There are a great deal of notable decliners, not least the airline stocks, but we now have an apparent reversal in UAL...

--

stay tuned

1.16pm... sp'1964... and we're seeing early confirmation of a floor.

Equity bears should arguably have bailed some hours ago.

Notable reversals ... to the upside in a fair few stocks..notably UAL, DAL

FCX - which I highlighted yesterday already green, +0.2%

sp'60min

Summary

*hourly candle is closing positive, bodes well for a floor of sp'1959

--

Call it whatever you want, but the market looks floored to me. Whether we drop a little further seems of little consequence.

This is the same situation we've seen so many times already this year, and we know how it ends.. right?

-

A move from the 1960s. into the 2000s looks viable next week.

-

There are a great deal of notable decliners, not least the airline stocks, but we now have an apparent reversal in UAL...

--

stay tuned

1.16pm... sp'1964... and we're seeing early confirmation of a floor.

Equity bears should arguably have bailed some hours ago.

Notable reversals ... to the upside in a fair few stocks..notably UAL, DAL

FCX - which I highlighted yesterday already green, +0.2%

12pm update - floored at 1960.... probably

US indexes remain weak, with notable declines in the R2K, lower by another -1.7%. However, there are multiple aspects of support in the low sp'1960s, and a break into the 1950s seems somewhat unlikely.

sp'60min

Summary

Well, all things considered, we probably have a key floor here in the low 1960s.

No one can whine about this...

Bears are getting a chance to exit...

Bulls are getting the opportunity to buy somewhat cheaper.. especially in the airlines and some of the momo stocks.

-

Video update from Riley

--

VIX update from Mr T.

-

time for some ice water.

12.19pm.. so much for 1960..... next support 1958/57..

Regardless, equity bears are getting a real opportunity to exit here.

VIX +10% in the 12.50s.... 13s still look tough to hit.

12.30pm.. back to 1961.... hmmm Bears are very vulnerable here... esp' those short the R2K.

sp'60min

Summary

Well, all things considered, we probably have a key floor here in the low 1960s.

No one can whine about this...

Bears are getting a chance to exit...

Bulls are getting the opportunity to buy somewhat cheaper.. especially in the airlines and some of the momo stocks.

-

Video update from Riley

--

VIX update from Mr T.

-

time for some ice water.

12.19pm.. so much for 1960..... next support 1958/57..

Regardless, equity bears are getting a real opportunity to exit here.

VIX +10% in the 12.50s.... 13s still look tough to hit.

12.30pm.. back to 1961.... hmmm Bears are very vulnerable here... esp' those short the R2K.

11am update - gap fill at 1962

US indexes remain moderately weak, with the sp' having a high potential of having completed a gap fill at sp'1962. Equity bears will find it very difficult to push much lower today. VIX has probably maxed out at 12.45.

sp'60min

Summary

...and I'm back from the shops... bullish retail, I guess you could say.

--

We don't have a clear turn yet.. but considering the past few weeks.. and months of price action, we probably have a floor in for today.

For those who think the sp'2000s are due... now would be prime buying time.

-

Notable weakness: TWTR, -7%

Unless you think sp is going <1900, the momo stocks - inc' Twitter, will no doubt recover.

-

11.20am... market battling to hold the earlier low of 1962.

Short term momentum remains with the bears..but its going to be damn hard to break into the 1950s today. VIX looks similarly maxed out on the hourly....

but no confirmed turn yet.

-

FOMC minutes are tomorrow, that'd make for a valid excuse to begin a new up wave.

11.30am.. Mr Market just gently washing away the weak bull hands... 1961/60.

R2K -1.7%.... that makes for around -3.5% across 9 trading hours. Pretty strong retrace.

11.33am.. provisional sign of a turn at sp'1960... bears...beware!

11.37am... increasing probability with each minute that 1960 was the floor of what was a rather swift 2 day decline, roughly -1.2% for the headline indexes.

..time for a somewhat early lunch, back at 12pm

sp'60min

Summary

...and I'm back from the shops... bullish retail, I guess you could say.

--

We don't have a clear turn yet.. but considering the past few weeks.. and months of price action, we probably have a floor in for today.

For those who think the sp'2000s are due... now would be prime buying time.

-

Notable weakness: TWTR, -7%

Unless you think sp is going <1900, the momo stocks - inc' Twitter, will no doubt recover.

-

11.20am... market battling to hold the earlier low of 1962.

Short term momentum remains with the bears..but its going to be damn hard to break into the 1950s today. VIX looks similarly maxed out on the hourly....

but no confirmed turn yet.

-

FOMC minutes are tomorrow, that'd make for a valid excuse to begin a new up wave.

11.30am.. Mr Market just gently washing away the weak bull hands... 1961/60.

R2K -1.7%.... that makes for around -3.5% across 9 trading hours. Pretty strong retrace.

11.33am.. provisional sign of a turn at sp'1960... bears...beware!

11.37am... increasing probability with each minute that 1960 was the floor of what was a rather swift 2 day decline, roughly -1.2% for the headline indexes.

..time for a somewhat early lunch, back at 12pm

10am update - strong support in the 1960s

US indexes open moderately weak, but there are multiple aspects of support (across different cycles) in the low sp'1960s. It would seem highly unlikely that the bears can push below 1960 this week.. or indeed, any time soon.

sp'60min

Summary

*VIX is 6% higher, back in the low 12s, but the teens look somewhat unlikely. I suppose 13s are viable if sp'1962/60 today.

--

So... a second morning of declines, but the declines are not significant, and we'll surely hold the 1960s.. before resuming higher.

--

Notable weakness in the airlines.. UAL, DAL, AA

UAL, daily

UAL is close to key support, I'd not be surprised if this floors here.. syncing up with the sp'1960s.

-

I think I should shop... I want some extra things for tonight's big game!

10-.09am.. sp'1965... probably no more than 3-5pts to go.. and then level out.

Equity bears should arguably be tightening stops now.. but I realise some will be seeking much lower levels. Price action does not support such a view though.

Notable weakness: TWTR, -4.5%, back below the $40 threshold, but I still think that nonsense is headed for $50... but more probably on earnings.

sp'60min

Summary

*VIX is 6% higher, back in the low 12s, but the teens look somewhat unlikely. I suppose 13s are viable if sp'1962/60 today.

--

So... a second morning of declines, but the declines are not significant, and we'll surely hold the 1960s.. before resuming higher.

--

Notable weakness in the airlines.. UAL, DAL, AA

UAL, daily

UAL is close to key support, I'd not be surprised if this floors here.. syncing up with the sp'1960s.

-

I think I should shop... I want some extra things for tonight's big game!

10-.09am.. sp'1965... probably no more than 3-5pts to go.. and then level out.

Equity bears should arguably be tightening stops now.. but I realise some will be seeking much lower levels. Price action does not support such a view though.

Notable weakness: TWTR, -4.5%, back below the $40 threshold, but I still think that nonsense is headed for $50... but more probably on earnings.

Pre-Market Brief

Good morning. Futures are a touch lower, sp -2pts, we're set to open at 1975. Precious metals are a little higher, Gold +$3. Equity bears have 'best case' downside to the low 1960s, before the market breaks into the 2000s.

sp'60min

Summary

So, minor weakness to start another day, and there is certainly opportunity for the bears to knock the market another 0.5% or so lower in the headline indexes.

notable early decliner: SDRL, -3.8%.

--

Video update from an especially bouncy Carboni

--

The one good thing about today... we have a game, A semi final @ 4pm EST Brazil vs Germany. I will be cheering on the Brazilians.

Have a good Tuesday

sp'60min

Summary

So, minor weakness to start another day, and there is certainly opportunity for the bears to knock the market another 0.5% or so lower in the headline indexes.

notable early decliner: SDRL, -3.8%.

--

Video update from an especially bouncy Carboni

--

The one good thing about today... we have a game, A semi final @ 4pm EST Brazil vs Germany. I will be cheering on the Brazilians.

Have a good Tuesday

Daily Wrap

A somewhat quiet start to the week, with moderate declines for most indexes. Only the R2K showed any significant downside action, but then, that index has soared 12% from the recent lows. Regardless of the minor weakness, the sp'2000s are coming.

sp'weekly8b

VIX'daily3

Summary

*first, I should note, don't get overly fixated on the timing of sub'3-5 - even if you agree with that particular count. The point should be.... we're still headed broadly higher.

-

So.. another week underway... and we have a blue candle to start, but that could easily turn to green if we're breaking the 1990s this Friday. It is notable that the upper bollinger band on the weekly cycle is now in the 1990s, and it will be in the 2000s next week.

Most certainly, the giant psy' level of sp'2000 looks viable next week.

--

Volatility remains very low

VIX closed significantly higher, +10%, but we're still only in the 11.40s, and it remains bizarre how the VIX can't even re-take the low teens. If we do hit the sp'2100s later this year... VIX will surely have melted into the 9s.. or even the 8s.

Looking ahead

The only data of significance tomorrow is consumer credit (3pm). There are also two fed officials on the loose, and Mr Market will no doubt be listening.

*next sig' QE-pomo is not until next Thursday.. July'17.

--

Goodnight from London

sp'weekly8b

VIX'daily3

Summary

*first, I should note, don't get overly fixated on the timing of sub'3-5 - even if you agree with that particular count. The point should be.... we're still headed broadly higher.

-

So.. another week underway... and we have a blue candle to start, but that could easily turn to green if we're breaking the 1990s this Friday. It is notable that the upper bollinger band on the weekly cycle is now in the 1990s, and it will be in the 2000s next week.

Most certainly, the giant psy' level of sp'2000 looks viable next week.

--

Volatility remains very low

VIX closed significantly higher, +10%, but we're still only in the 11.40s, and it remains bizarre how the VIX can't even re-take the low teens. If we do hit the sp'2100s later this year... VIX will surely have melted into the 9s.. or even the 8s.

Looking ahead

The only data of significance tomorrow is consumer credit (3pm). There are also two fed officials on the loose, and Mr Market will no doubt be listening.

*next sig' QE-pomo is not until next Thursday.. July'17.

--

Goodnight from London

Subscribe to:

Comments (Atom)