With the indexes ramping into the close, the VIX collapsed, closing -8.1% @ 14.89. Across the week, the VIX declined by 11.7%. Volatility looks set to melt lower for the rest of July, perhaps down to VIX 12/11s.

VIX'60min

VIX'daily

VIX'weekly

Summary

For the bears, the VIX tells the story, it is an utterly fearless market.

No fear of Europe, no fear of bond yields, no fear of Oil >$100, no fear of...anything.

--

Absolutely incredible, but then...the market is propped up by $85bn of QE each..and every month. Until that ends..the broad up trend..will no doubt continue.

more later..on the indexes.

Friday, 5 July 2013

Closing Brief - bulls win again

The main indexes closed broadly higher, with the sp +16pts @ 1631. Near term trend is bullish, and even the weekly charts are turning back to the upside. High risk of further upside early next week, and if Bernanke doesn't upset the market, sp'1700s by early August.

sp'60min

Summary

So, the bulls end the week on a positive note, and generally, it was indeed an important week where they held the big sp'1600 level.

With this latest bear failure, the 1650/60s look an easy target for next week, and the only issue in my view is whether things simply melt higher across July.

So long as earnings come in reasonable, we'll just keep on climbing, not least with the ongoing QE-pomo program.

--

*I am back on the sidelines, after bailing this afternoon (from deeply underwater short-positions).

--

*bits and pieces to wrap up what has been a short..but bloody week for those on the bearish side.

Have a good weekend.

--

**next main post, late Saturday, probably on the US monthly indexes

sp'60min

Summary

So, the bulls end the week on a positive note, and generally, it was indeed an important week where they held the big sp'1600 level.

With this latest bear failure, the 1650/60s look an easy target for next week, and the only issue in my view is whether things simply melt higher across July.

So long as earnings come in reasonable, we'll just keep on climbing, not least with the ongoing QE-pomo program.

--

*I am back on the sidelines, after bailing this afternoon (from deeply underwater short-positions).

--

*bits and pieces to wrap up what has been a short..but bloody week for those on the bearish side.

Have a good weekend.

--

**next main post, late Saturday, probably on the US monthly indexes

3pm update - capitulation into the weekend

Bears remain utterly powerless in the face of an equity market that is now the only refuge for capital. Weekly index charts have briefly already flipped to outright bullish, and there looks to be easy upside to the sp'1650/60s next week. Ironically, only the Bernanke can ruin the bulls next week.

sp'weekly7

Summary

The 'rainbow' (Elder Impulse) candle flipped to green earlier - with a break over the weekly 10MA, and for me, that's all I needed to see.

I'm out, having now exited a heavy-short position.

-

There is significant risk of a Monday gap higher straight into the mid 1640s, and that will make the 1650/60s an easy hit by next Wednesday.

There is similarly the real risk that Bernanke will upset the cart again - as he did May'22 and the more recent FOMC.

As things are, daily charts are outright bullish, pointless to still be short now. Utterly...pointless.

--

A lousy end to the week.

Bulls are surely going to get a weekly close above the 50 day...

Yet, even if they don't, the laughable thing is that they are STILL going to close the week, net higher anyway.

--

UPDATE 3.12pm... and this is just one of the reasons I have given up...

Trans, weekly'2

From red..to green...this is VERY bullish for next week. Easy upside to 6400/6500.

3.25pm...a little wave lower, but it does nothing to negate the underlying strength on the daily charts..

3.36pm..so, thats almost it for another week in the worlds most rigged casino.

As noted, Bernanke is the one wild card for the bulls next week. So long as he doesn't spook the market (again), we'll just keep rallying, perhaps all the way into early August - when Armstrong has a key ECM cycle turn.

sp'1700s..early August?

Regardless, I'm out..for now. A lot to consider over the weekend.

3.43pm... 5pts down in 60mins..but 3pts up in 3mins....sums up what the bears face EVERY single damn day.

--

sp'weekly7

Summary

The 'rainbow' (Elder Impulse) candle flipped to green earlier - with a break over the weekly 10MA, and for me, that's all I needed to see.

I'm out, having now exited a heavy-short position.

-

There is significant risk of a Monday gap higher straight into the mid 1640s, and that will make the 1650/60s an easy hit by next Wednesday.

There is similarly the real risk that Bernanke will upset the cart again - as he did May'22 and the more recent FOMC.

As things are, daily charts are outright bullish, pointless to still be short now. Utterly...pointless.

--

A lousy end to the week.

Bulls are surely going to get a weekly close above the 50 day...

Yet, even if they don't, the laughable thing is that they are STILL going to close the week, net higher anyway.

--

UPDATE 3.12pm... and this is just one of the reasons I have given up...

Trans, weekly'2

From red..to green...this is VERY bullish for next week. Easy upside to 6400/6500.

3.25pm...a little wave lower, but it does nothing to negate the underlying strength on the daily charts..

3.36pm..so, thats almost it for another week in the worlds most rigged casino.

As noted, Bernanke is the one wild card for the bulls next week. So long as he doesn't spook the market (again), we'll just keep rallying, perhaps all the way into early August - when Armstrong has a key ECM cycle turn.

sp'1700s..early August?

Regardless, I'm out..for now. A lot to consider over the weekend.

3.43pm... 5pts down in 60mins..but 3pts up in 3mins....sums up what the bears face EVERY single damn day.

--

2pm update - stuck around the 50 day MA

The sp' is seemingly stuck - although still notably higher, +10pts @ 1625. Bulls should be content with any positive close (considering soaring bond yields), whilst bears should be desperate for a close at least <1625.

sp'60min

Summary

*hourly index charts might be maxed out, but..we've seen time and again, the bulls managing to pull a last hour ramp. Any close in the 1630s, and next week will be offering 1650/60s.

--

The past six trading days could merely be a holding pattern before the next surge higher.

That IS the problem right now. Bears appear largely powerless, and with ongoing QE, the market is generally inclined to the upside.

-

Bond yields...2.71..and showing no sign of stopping.

Next key level is 2.75..and then 3.20/40

UPDATE 2.17pm.. sp'1629.05...that is 0.3pts shy of the 10MA on the weekly chart.

Arguably, the last of the 'serious' bear money is now getting short-stopped out.

--

Baring a close <1624, which now looks unlikely, it would seem the bears have indeed utterly failed.

Powerless bears, which is ironic, considering the bond market issues.

2.35pm... I have exited my heavy-short position.

Weekly charts are now back to a fully bullish situation, along with the daily charts.

sp'60min

Summary

*hourly index charts might be maxed out, but..we've seen time and again, the bulls managing to pull a last hour ramp. Any close in the 1630s, and next week will be offering 1650/60s.

--

The past six trading days could merely be a holding pattern before the next surge higher.

That IS the problem right now. Bears appear largely powerless, and with ongoing QE, the market is generally inclined to the upside.

-

Bond yields...2.71..and showing no sign of stopping.

Next key level is 2.75..and then 3.20/40

UPDATE 2.17pm.. sp'1629.05...that is 0.3pts shy of the 10MA on the weekly chart.

Arguably, the last of the 'serious' bear money is now getting short-stopped out.

--

Baring a close <1624, which now looks unlikely, it would seem the bears have indeed utterly failed.

Powerless bears, which is ironic, considering the bond market issues.

2.35pm... I have exited my heavy-short position.

Weekly charts are now back to a fully bullish situation, along with the daily charts.

1pm update - still...on the edge

Market has powered back higher, and is hovering around the 50 day MA on most indexes. All that's left for the bulls, is to close >1625. Anything in the 1630s will conclusively turn around the weekly charts.

sp'weekly7

Summary

What else to say, other than 'on the edge'.

-

*Something to think about for next week, the Bernanke will be addressing the House/Senate next Wed/Thursday. The last two occasions King Printer has opened his mouth, have both been key (short term) cycle tops.

--

sp'weekly7

Summary

What else to say, other than 'on the edge'.

-

*Something to think about for next week, the Bernanke will be addressing the House/Senate next Wed/Thursday. The last two occasions King Printer has opened his mouth, have both been key (short term) cycle tops.

--

12pm update - an important afternoon ahead

The market is still struggling, despite the 'reasonable' jobs data. Clearly, the higher bond yields are causing some underlying upset, and the very strong USD is similarly pressuring things lower, not least the precious metals, with Gold -$35.

sp'daily5

10yr yield, 60min

Summary

Suffice to say, it remains a borderline situation.

The bulls are so far failing on their third attempt to break and hold above the 50 day MA.@ 1624

--

*I remain short (deeply underwater), and will likely exit if we close >sp'1628. If the bulls manage a ramp into the close, there seems little point holding short, whilst there is renewed threat of some 'weeks' of further upside.

Difficult day.

12.05pm... sp'1625...a mere 3/4pts from busting the weekly key level..as I see it.

Its not looking good.

sp'daily5

10yr yield, 60min

Summary

Suffice to say, it remains a borderline situation.

The bulls are so far failing on their third attempt to break and hold above the 50 day MA.@ 1624

--

*I remain short (deeply underwater), and will likely exit if we close >sp'1628. If the bulls manage a ramp into the close, there seems little point holding short, whilst there is renewed threat of some 'weeks' of further upside.

Difficult day.

12.05pm... sp'1625...a mere 3/4pts from busting the weekly key level..as I see it.

Its not looking good.

11am update - bears holding on

The main market is struggling to hold significant pre-market gains. The weekly 10MA @ sp'1628 is still holding, but any close above that, and the near term bearish case is thrown out. Bigger moves out there include bond yields..soaring, 10yr into the 2.70s

sp'daily5

sp'weekly7 - bearish count, on the edge

Summary

So...the bullls manage very strong early gains, but they are again failing to hold above the 50 day MA.

As ever..how we close..that is what matters.

--

So long as we close <1628, I will hold short, but this is getting extremely...difficult, not least with the threat of much higher levels by early August.

11.12am .. sp'1619... I'd settle for ANY close <1620,

Best case is 1610/05, but that really will be tough.

--

Many have noted, since most traders are still on holiday, we'll have to wait until Monday for the 'real move' to occur.

sp'daily5

sp'weekly7 - bearish count, on the edge

Summary

So...the bullls manage very strong early gains, but they are again failing to hold above the 50 day MA.

As ever..how we close..that is what matters.

--

So long as we close <1628, I will hold short, but this is getting extremely...difficult, not least with the threat of much higher levels by early August.

11.12am .. sp'1619... I'd settle for ANY close <1620,

Best case is 1610/05, but that really will be tough.

--

Many have noted, since most traders are still on holiday, we'll have to wait until Monday for the 'real move' to occur.

10am update - last chance for the bears

Market is holding moderate gains, and is again making a play to break/close above the key 50 day MA @ sp'1625. Weekly 10MA is 1628, a Friday close above that, and the mid-term trend is back to bullish. How we close..that is what matters.

sp'daily5

Summary

A red close - as unlikely as that currently seems, would at least be 'something', but really, the QE continues, and the delusion in the mainstream..continues.

Why would the bulls not be able to comfortably hold gains?

--

*I am short, but will look to drop/exit near the close of today, if the market is still above the mid 1620s.

There is simply no point holding short into next week, if the bulls manage such a close.

High risk of 1650/60s, if not the 1700s by early August.

-

Hell, just look at 10yr yields, breaking into the 2.70s.

Market simply does NOT care.

10.30am...back from a walk in the sunshine...sp'1615...hmm.

So..the 'last line'..for my weekly'7 @ 1628 is STILL holding, but this sure is the most edgy situation I've seen in many months, maybe over a year.

Bears need at least a marginally red close to confirm a 'triple spiky top' on the daily charts.

sp'daily5

Summary

A red close - as unlikely as that currently seems, would at least be 'something', but really, the QE continues, and the delusion in the mainstream..continues.

Why would the bulls not be able to comfortably hold gains?

--

*I am short, but will look to drop/exit near the close of today, if the market is still above the mid 1620s.

There is simply no point holding short into next week, if the bulls manage such a close.

High risk of 1650/60s, if not the 1700s by early August.

-

Hell, just look at 10yr yields, breaking into the 2.70s.

Market simply does NOT care.

10.30am...back from a walk in the sunshine...sp'1615...hmm.

So..the 'last line'..for my weekly'7 @ 1628 is STILL holding, but this sure is the most edgy situation I've seen in many months, maybe over a year.

Bears need at least a marginally red close to confirm a 'triple spiky top' on the daily charts.

Pre-Market Brief

Good morning. Futures are sharply higher on better than expected jobs data. Sp +18pts, we're set to open in the low 1630s - busting key resistance. USD is sharply higher, and the Euro is in the 1.28s. Precious metals are getting smashed lower, Oil is in the $102s

sp'daily5

Summary

Well, bears...failed.

Next level is the sp'1660s, at which point we will be a mere 1% or so from the all time historic high.

Its white flag waving time.

sp'daily5

Summary

Well, bears...failed.

Next level is the sp'1660s, at which point we will be a mere 1% or so from the all time historic high.

Its white flag waving time.

Awaiting the jobs data

The bulls have seen a rather significant bounce from sp'1560 to the recent high of 1626. The big issue to end this short trading week, will be whether the jobs data is interpreted by Mr Market as 'good data is good data', 'bad data is good data', or 'bad data is bad data'.

sp'weekly7 - bearish count

sp'monthly'3 - rainbow

Summary

In terms of key price levels for tomorrow, arguably bulls should be looking for a weekly close >sp'1628 for a break higher, and bears <sp'1600 for downside.

VIX is back down to what is an unquestionably very low level. The market remains in an almost completely fearless state, but then...the 'supportive' Fed is still out there of course.

--

Something I am keeping in mind for Aug/September is the following. It will apply as much to the other indexes, as it does for the Transports..

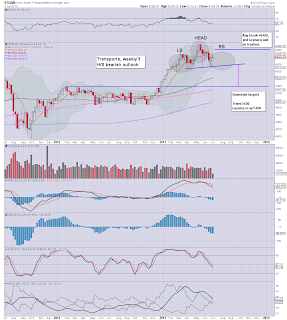

Transports, weekly'3 - H/S scenario

The scenario is pretty clear, and we'll know whether to trash it, or consider it, depending on whether 6400 or 6000 is hit first. As many recognise, there is some potentially very serious EU turmoil viable this Aug/September. The recent surge in Portuguese rates, and the Euro/$ back <1.30, could just be pre-cursors to something very major indeed.

Looking ahead

Market consensus is for 161k net job gains, with the headline rate falling from 7.6 to 7.5%. Those are not exactly bold targets for those bullish the US economy. Anything <125k should give everyone serious concern for Q3.

However, even if I knew the numbers ahead of tomorrow, I can't fathom to guess how the market will decide to interpret the data. As has been the case for the last few years, it is the interpretation of the data that matters, not the data itself.

*There is no QE tomorrow, and only 'minor' on Monday. Next sig' QE is Tuesday

--

I am still short from over a week ago (from sp'1601), and seeking an exit in the 1570s. How we close tomorrow, will - as ever, be infinitely more important than the pre-market/futures. All things considered, so long as we don't break/close >sp'1628, I will hold to my weekly7 outlook.

Goodnight from London

sp'weekly7 - bearish count

sp'monthly'3 - rainbow

Summary

In terms of key price levels for tomorrow, arguably bulls should be looking for a weekly close >sp'1628 for a break higher, and bears <sp'1600 for downside.

VIX is back down to what is an unquestionably very low level. The market remains in an almost completely fearless state, but then...the 'supportive' Fed is still out there of course.

--

Something I am keeping in mind for Aug/September is the following. It will apply as much to the other indexes, as it does for the Transports..

Transports, weekly'3 - H/S scenario

The scenario is pretty clear, and we'll know whether to trash it, or consider it, depending on whether 6400 or 6000 is hit first. As many recognise, there is some potentially very serious EU turmoil viable this Aug/September. The recent surge in Portuguese rates, and the Euro/$ back <1.30, could just be pre-cursors to something very major indeed.

Looking ahead

Market consensus is for 161k net job gains, with the headline rate falling from 7.6 to 7.5%. Those are not exactly bold targets for those bullish the US economy. Anything <125k should give everyone serious concern for Q3.

However, even if I knew the numbers ahead of tomorrow, I can't fathom to guess how the market will decide to interpret the data. As has been the case for the last few years, it is the interpretation of the data that matters, not the data itself.

*There is no QE tomorrow, and only 'minor' on Monday. Next sig' QE is Tuesday

--

I am still short from over a week ago (from sp'1601), and seeking an exit in the 1570s. How we close tomorrow, will - as ever, be infinitely more important than the pre-market/futures. All things considered, so long as we don't break/close >sp'1628, I will hold to my weekly7 outlook.

Goodnight from London

Subscribe to:

Comments (Atom)