With US equity indexes closing broadly lower, the VIX climbed into the weekend, settling +4.4% @ 15.04. Near term outlook offers the 18/21 zone, along with sp'2000/1990s. Across the week, the VIX gained a minor 2.2%.

VIX'60min

VIX'daily3

VIX'weekly

Summary

Broadly, the VIX remains subdued, still stuck in the mid/low teens.

If the market can break into the 2020s next week... the VIX will start to spike, with a viable push into the upper teens, perhaps even a brief foray above the key 20 threshold, but that will clearly require sp'2000/1990s.

However, sustained action in the 20s still looks out of range until late May.

At the current rate of incline, the bigger weekly chart, will see the MACD (blue bar histogram) cycle attain a bullish cross in around 2-3 weeks. That will be when the next hyper spike (>30s) will become viable.

--

more later... on the indexes

Friday, 13 May 2016

Closing Brief

US equities ended the weekly on a pretty negative note, sp -17pts @ 2046. The two leaders - Trans/R2K, settled lower by -1.2% and -0.6% respectively. Near term outlook offers a break of the 2039 low, and that will open up the 2020/1990s next week.. before the next sig' bounce of 2-3%.

sp'60min

Summary

closing hour action: minor chop... leaning weak, as some of the rats were more than happy to jump ship into the weekend.

--

... and another twisted week in the world's nastiest casino comes to a close.

Without question, even as of earlier this afternoon, there still seemed clear threat of yet another push to the 2090/2100s... but the break of 2053 scrubbed that scenario.

Instead.. now the 2030s are a valid target to begin next week.

As has been the case for three weeks, if we can break into the sp'2020s, it would really help give some clarity/confidence that sp'2111 was a key mid term high.

Have a good weekend

--

the usual bits and pieces across the evening.. to wrap up the week

sp'60min

Summary

closing hour action: minor chop... leaning weak, as some of the rats were more than happy to jump ship into the weekend.

--

... and another twisted week in the world's nastiest casino comes to a close.

Without question, even as of earlier this afternoon, there still seemed clear threat of yet another push to the 2090/2100s... but the break of 2053 scrubbed that scenario.

Instead.. now the 2030s are a valid target to begin next week.

As has been the case for three weeks, if we can break into the sp'2020s, it would really help give some clarity/confidence that sp'2111 was a key mid term high.

Have a good weekend

--

the usual bits and pieces across the evening.. to wrap up the week

3pm update - a red candle with a spike

US equity indexes are set for a third consecutive net weekly decline, lead lower by the Transports. Most notable, the weekly candle has a pretty clear spiky top.. indicative of exhaustion to the upside. If the sp'2020s can be seen early next week, it will give initial clarity/confidence that 2111 is indeed a key mid term high.

sp'weekly1b

VIX'60min

Summary

re: VIX.. clearly, still broadly subdued in the 15s, even a move to the 19-21 zone won't rank as anything particularly interesting.

*basic target late May/early June 25/30. The 40/50s look viable on any serious market turmoil with sp'1800s in June/July.

--

So.. after a gods damn large amount of annoying swings.. we're set to close net lower for a third week.. although still above a great many aspects of support.

For the big money.. its pretty simple... a short stop at 2134, 2111... or a fair way tighter.

As has been the case since summer 2015.. we're broadly stuck... and it appears just a matter of weeks before a sustained/significant move lower.

--

A close <2039 would be a bonus right now... along with VIX 16s.

sp'weekly1b

VIX'60min

Summary

re: VIX.. clearly, still broadly subdued in the 15s, even a move to the 19-21 zone won't rank as anything particularly interesting.

*basic target late May/early June 25/30. The 40/50s look viable on any serious market turmoil with sp'1800s in June/July.

--

So.. after a gods damn large amount of annoying swings.. we're set to close net lower for a third week.. although still above a great many aspects of support.

For the big money.. its pretty simple... a short stop at 2134, 2111... or a fair way tighter.

As has been the case since summer 2015.. we're broadly stuck... and it appears just a matter of weeks before a sustained/significant move lower.

--

A close <2039 would be a bonus right now... along with VIX 16s.

2pm update - the old leader is... leading

So much for the 'upside melt', as the sp'500 breaks below yesterday's low. The 'old leader' - Transports, is set for the third consecutive significant net daily decline. Despite the renewed weakness, VIX remains broadly subdued, managing only minor gains of 4% in the 15s.

Transports, daily

sp'60min

Summary

Well, I'm glad to be wrong about further tedious upside melt into the weekend.

The door is now open to make a play for the 2039 low. As has been the case for many weeks.. things only get interesting with a move into the 2020s.

--

On clown finance TV, Robb Lutts of Cabot...

Mr L' was very bullish.. but interestingly, holds a far more bullish outlook for Gold, as he believes inflation will eventually appear as a result of the global QE programs.

--

Meanwhile.. here in the land of overly priced and overly small properties...

Actually kinda chilly with a northerly wind... urghh.

--

stay tuned

-

2.02pm.. With market concerns.. gold picks up a little more, now +$5.. in the $1270s..

Naturally, miners following, GDX +1.5%. Incredible underlying strength.

2.25pm.. the rats are starting to jump ship into the weekend... as 2039 is a valid target by the close.

Hell, if we can close 2039... 2020s for Monday.... which would give some initial clarity/confidence that 2111 is indeed a key mid term high.

VIX still... subdued, +5%.... even 19/20s briefly looks tough.. with sp'2000/1990s.

Transports, daily

sp'60min

Summary

Well, I'm glad to be wrong about further tedious upside melt into the weekend.

The door is now open to make a play for the 2039 low. As has been the case for many weeks.. things only get interesting with a move into the 2020s.

--

On clown finance TV, Robb Lutts of Cabot...

Mr L' was very bullish.. but interestingly, holds a far more bullish outlook for Gold, as he believes inflation will eventually appear as a result of the global QE programs.

--

Meanwhile.. here in the land of overly priced and overly small properties...

Actually kinda chilly with a northerly wind... urghh.

--

stay tuned

-

2.02pm.. With market concerns.. gold picks up a little more, now +$5.. in the $1270s..

Naturally, miners following, GDX +1.5%. Incredible underlying strength.

2.25pm.. the rats are starting to jump ship into the weekend... as 2039 is a valid target by the close.

Hell, if we can close 2039... 2020s for Monday.... which would give some initial clarity/confidence that 2111 is indeed a key mid term high.

VIX still... subdued, +5%.... even 19/20s briefly looks tough.. with sp'2000/1990s.

1pm update - melting to the upside

With no downside power, the equity bears are still unable to break the sp'2053 low. The market is battling to melt upward into the weekend. A move back to the 2080s is clearly viable, before the next concerted attempt to break multiple aspects of support in the 2040/2000 zone.

sp'60min

VIX'60min

Summary

It remains an increasingly tedious borderline situation.

Clearly, any break <2053, and we see increasing weakness into the weekly close.

However, current price action is broadly choppy, and that favour the bulls.. with another push higher next Mon-Wed'.

RE: waves... I could stick all manner of labels on the action since sp'2111.. but most of you could see a clear '1 down to 2039.. and we're in a viable wave'2 UP, ABC/123 wave higher to the 2080/2100s, before a stronger push into end May.

--

Right now, I'm inclined to renewed upside, but I've low confidence in that... as we're only 0.3% from breaking soft support.

-

notable weakness... oil, USO, daily

Yesterday's black-fail daily candle in the WTIC $46s is somewhat bearish.. and we're certainly cooling a little today.

Who wants to be long Oil, or buy energy stocks at these levels?

--

time for some sun.. or rather.. mostly cloud.

1.30pm... sp'2054.... fractionally interesting... VIX sure reflect ANY concern though, +1% in the 14s.

sp'60min

VIX'60min

Summary

It remains an increasingly tedious borderline situation.

Clearly, any break <2053, and we see increasing weakness into the weekly close.

However, current price action is broadly choppy, and that favour the bulls.. with another push higher next Mon-Wed'.

RE: waves... I could stick all manner of labels on the action since sp'2111.. but most of you could see a clear '1 down to 2039.. and we're in a viable wave'2 UP, ABC/123 wave higher to the 2080/2100s, before a stronger push into end May.

--

Right now, I'm inclined to renewed upside, but I've low confidence in that... as we're only 0.3% from breaking soft support.

-

notable weakness... oil, USO, daily

Yesterday's black-fail daily candle in the WTIC $46s is somewhat bearish.. and we're certainly cooling a little today.

Who wants to be long Oil, or buy energy stocks at these levels?

--

time for some sun.. or rather.. mostly cloud.

1.30pm... sp'2054.... fractionally interesting... VIX sure reflect ANY concern though, +1% in the 14s.

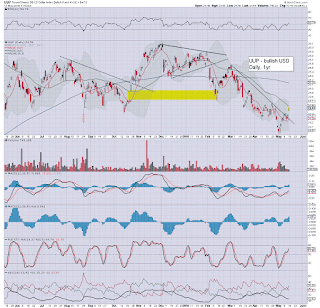

12pm update - 8 of 9 for King Dollar

Whilst the broader US equity market is in minor chop mode, it is highly notable that the USD is currently net high for the last 8 of 9 trading days, currently +0.6% in the DXY 94.70s. Despite the appreciation, the precious metals are holding together, with Gold actually now +$3 around $1270.

UUP, daily

GLD, daily

Summary

You regular readers should be well aware, that I not on the 'dollar doomer' train. Yes, I'll continue to highlight videos from Schiff, but I strongly disagree with him on the notion that the USD will broadly collapse.. and eventually break the <DXY 70s.

A core problem for many nations is that much of their recently acquired debt is denominated in USD, and that puts an underlying bid on the USD for many years to come.

Besides.. the Euro, Yen, and even the UK pound are infinitely more vulnerable to imploding.

*as a side note... its somewhat amusing to see the IMF, and even the BoE's Carney come out and tout doom, if the UK votes to exit the EU.

--

notable strength... AAPL, daily

Regardless of any short term bounces... AAPL looks extremely vulnerable to the $70s this summer.

yours.. never bought an AAPL product.

UUP, daily

GLD, daily

Summary

You regular readers should be well aware, that I not on the 'dollar doomer' train. Yes, I'll continue to highlight videos from Schiff, but I strongly disagree with him on the notion that the USD will broadly collapse.. and eventually break the <DXY 70s.

A core problem for many nations is that much of their recently acquired debt is denominated in USD, and that puts an underlying bid on the USD for many years to come.

Besides.. the Euro, Yen, and even the UK pound are infinitely more vulnerable to imploding.

*as a side note... its somewhat amusing to see the IMF, and even the BoE's Carney come out and tout doom, if the UK votes to exit the EU.

--

notable strength... AAPL, daily

Regardless of any short term bounces... AAPL looks extremely vulnerable to the $70s this summer.

yours.. never bought an AAPL product.

11am update - the battle continues

It remains a mess in market land, as the bulls are battling to hold yesterday's low of sp'2053. If that fails.. a daily close in the 2045/35 zone will be due.. along with VIX 15s. However, current price action just doesn't suggest the bears are going to manage it.

sp'60min

VIX'60min

Summary

Clearly, its a borderline situation. The bigger daily/weekly cycles are STILL increasingly swinging back toward the equity bears... but actual price action remains just broad churn in the sp'2039/2100 zone.

.. the 11am turn.. would currently bode in favour to the bulls.. not least as the weekend looms.

-

notable weakness, CAT, daily

There is nothing pretty in CAT land, the 200dma is set to be tested. Broadly, I'd look for the Jan' low of $55.82 to eventually be broken.

--

time to cook

sp'60min

VIX'60min

Summary

Clearly, its a borderline situation. The bigger daily/weekly cycles are STILL increasingly swinging back toward the equity bears... but actual price action remains just broad churn in the sp'2039/2100 zone.

.. the 11am turn.. would currently bode in favour to the bulls.. not least as the weekend looms.

-

notable weakness, CAT, daily

There is nothing pretty in CAT land, the 200dma is set to be tested. Broadly, I'd look for the Jan' low of $55.82 to eventually be broken.

--

time to cook

10am update - messy open

US equities open moderately lower, then turn fractionally positive, and are currently in minor chop mode. Price action still doesn't offer anything significant to the bears.. and unless sp'2053 is taken out, yet another move to the 2090/2100 zone is due.

sp'60min

VIX'60min

Summary

Frankly, it remains a mess, as broader price action is choppy... and a concerted break <2039 looks extremely difficult.

Considering the current price action... a move to 2090/2100 looks more probable.. before next chance of a down wave.

This is indeed almost an exact replay of spring/summer 2015.. with an eventual big break lower. Obviously, major uncertainty ahead of a BREXIT vote would be a valid excuse for an initial push lower into the 1900s.

For the moment, lousy earnings/growth.. the market just doesn't care.

--

Meanwhile.... in a letter to congress...

More threats of NIRP... and other things from the CEO of Print central... which is of course ironic as the main market is only 3-5% from historic highs.

.. and we know.. the only data the Fed is dependent upon is the level of the sp'500.

-

10.02am. consumer sent' 95.8.... way above expectations.

So.. everything is fine in retail land after all, right?

Business inventories: +0.4%.. a little above expect'... and nothing for the macro-bears to look to.

--

Ohhh.. and I didn't even mention the opening black-fail candle in the VIX. That ain't a good sign for those in bear land.

sp'60min

VIX'60min

Summary

Frankly, it remains a mess, as broader price action is choppy... and a concerted break <2039 looks extremely difficult.

Considering the current price action... a move to 2090/2100 looks more probable.. before next chance of a down wave.

This is indeed almost an exact replay of spring/summer 2015.. with an eventual big break lower. Obviously, major uncertainty ahead of a BREXIT vote would be a valid excuse for an initial push lower into the 1900s.

For the moment, lousy earnings/growth.. the market just doesn't care.

--

Meanwhile.... in a letter to congress...

More threats of NIRP... and other things from the CEO of Print central... which is of course ironic as the main market is only 3-5% from historic highs.

.. and we know.. the only data the Fed is dependent upon is the level of the sp'500.

-

10.02am. consumer sent' 95.8.... way above expectations.

So.. everything is fine in retail land after all, right?

Business inventories: +0.4%.. a little above expect'... and nothing for the macro-bears to look to.

--

Ohhh.. and I didn't even mention the opening black-fail candle in the VIX. That ain't a good sign for those in bear land.

Pre-Market Brief

Good morning. US equity futures are moderately lower, sp -7pts, we're set to open at 2057. USD is +0.2% in the DXY 94.30s. Metals are mixed, Gold +$5, with Silver -0.4%. Oil is -0.5% in the $46s.

sp'60min

Summary

So... the messy price action continues.. and we're back on the slide again.

Clearly though, equity bears need to take out yesterday's low of 2053 - where the 50dma is lurking.

Will that occur? Well, market mood sure ain't pretty this morning... so... I'd guess yes.

Worse case: resumed upside to 2090/2100.. before eventually breaking <2K after opex.

In any case... I can't see the bulls breaking up and away this summer..

See Gundlach @ ZH, its like reading my own outlook. Click HERE.

---

early movers...

JCP -10%.... the retail upset continues

JWN (Nordstrom) -16% .... truly lousy outlook for old school retail

NFLX -1% in the $86s.. no one wants to buy... a move to 50/45 looks viable.

GDX +1%... as Gold is capturing a little fear bid again.

--

Overnight action

Japan: ending the week on a downer, -1.4% @ 16142

China: moderate chop, -0.3% @ 2827

Germany: early declines, but currently back to u/c at 9863

-

Awaiting a quartet of data... not least retail sales and PPI.....

8.31am: retail sales: m/m: 1.3%... better than expected

PPI: m/m +0.2%.. a touch under consensus

--

sp -5pts.. 2059.... hmm

With the broadly weak PPI number... Gold is under deflationary talk pressure, swinging to -$2.

Broadly though.. metals/miners remain massively strong.

-

8.43am... sp -2pts.. 2062... as Liesman on CNBC seems visibly relieved that retail actually printed a positive number.

There is NO question, the mainstream will be on suicide watch if sp'1600s this summer/autumn. Frankly, I'm kinda looking forward to that more than anything.

9.00am.. sp -6pts... 2058.. a mere 5pts shy of the low to break.

After 2053... empty air to 2040/39.... then 2033.. and eventually 200dma.. which would be around 2012/10 zone.

Clearly... sustained action <2K still looks out of range for some weeks.

sp'60min

Summary

So... the messy price action continues.. and we're back on the slide again.

Clearly though, equity bears need to take out yesterday's low of 2053 - where the 50dma is lurking.

Will that occur? Well, market mood sure ain't pretty this morning... so... I'd guess yes.

Worse case: resumed upside to 2090/2100.. before eventually breaking <2K after opex.

In any case... I can't see the bulls breaking up and away this summer..

See Gundlach @ ZH, its like reading my own outlook. Click HERE.

---

early movers...

JCP -10%.... the retail upset continues

JWN (Nordstrom) -16% .... truly lousy outlook for old school retail

NFLX -1% in the $86s.. no one wants to buy... a move to 50/45 looks viable.

GDX +1%... as Gold is capturing a little fear bid again.

--

Overnight action

Japan: ending the week on a downer, -1.4% @ 16142

China: moderate chop, -0.3% @ 2827

Germany: early declines, but currently back to u/c at 9863

-

Awaiting a quartet of data... not least retail sales and PPI.....

8.31am: retail sales: m/m: 1.3%... better than expected

PPI: m/m +0.2%.. a touch under consensus

--

sp -5pts.. 2059.... hmm

With the broadly weak PPI number... Gold is under deflationary talk pressure, swinging to -$2.

Broadly though.. metals/miners remain massively strong.

-

8.43am... sp -2pts.. 2062... as Liesman on CNBC seems visibly relieved that retail actually printed a positive number.

There is NO question, the mainstream will be on suicide watch if sp'1600s this summer/autumn. Frankly, I'm kinda looking forward to that more than anything.

9.00am.. sp -6pts... 2058.. a mere 5pts shy of the low to break.

After 2053... empty air to 2040/39.... then 2033.. and eventually 200dma.. which would be around 2012/10 zone.

Clearly... sustained action <2K still looks out of range for some weeks.

Equities broadly churning

It was a day of swings in the US equity market, but broadly, the market has been stuck for the better part of seven weeks. Equity bulls need a break above sp'2111.. and eventually 2134, whilst the bears need a sustained break back under the giant psy' level of 2K.

sp'weekly1b

Trans, weekly

Summary

It has been not the best of days for yours truly. I'll spare the pitiful and tedious details, but suffice to say.. the market could drop 2000 Dow points next week, and that won't particularly improve my mood.

--

re: sp'500... remaining stuck under 2100.. but comfortably above the 2000 threshold. The situation is much like late spring/summer 2015.

re: Trans: set for a third consecutive sig' net weekly decline.. and remaining well below the Nov'2014 high.

Best guess?

I'm still looking for a major 20% decline to the sp'1600s this summer/early autumn, and clearly, that outlook would get dropped on any new historic highs (sp >2134, Dow >18351).

--

Market chatter from the Schiff

--

Looking ahead

Friday will see a quartet of data: retail sales, PPI, bus' invent', consumer sent'.

*Fed official Williams will be speaking on the economy.. but long after everyone has gone home.

--

Goodnight from London

sp'weekly1b

Trans, weekly

Summary

It has been not the best of days for yours truly. I'll spare the pitiful and tedious details, but suffice to say.. the market could drop 2000 Dow points next week, and that won't particularly improve my mood.

--

re: sp'500... remaining stuck under 2100.. but comfortably above the 2000 threshold. The situation is much like late spring/summer 2015.

re: Trans: set for a third consecutive sig' net weekly decline.. and remaining well below the Nov'2014 high.

Best guess?

I'm still looking for a major 20% decline to the sp'1600s this summer/early autumn, and clearly, that outlook would get dropped on any new historic highs (sp >2134, Dow >18351).

--

Market chatter from the Schiff

--

Looking ahead

Friday will see a quartet of data: retail sales, PPI, bus' invent', consumer sent'.

*Fed official Williams will be speaking on the economy.. but long after everyone has gone home.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed moderately mixed, sp -0.3pts @ 2064. The two

leaders - Trans/R2K, settled lower by -1.4% and -0.5% respectively. Near

term outlook is extremely messy, as there is clear threat of another

push to the 2090/2100 zone.

sp'daily5

Trans

Summary

sp'500: a 20pt (1.0%) range.. swinging from 2073 to 53.. but then a latter day recovery, settling effectively flat. It is notable that the 50dma held today.

Trans: a decisive break of the Friday low, with a second consecutive significant net daily decline. Next support is the price cluster zone of 7500/400s. A break into the 7300s would be pretty bearish, and offer an eventual break <7K in late May/early June.

--

Closing update from Riley

--

a little more later...

sp'daily5

Trans

Summary

sp'500: a 20pt (1.0%) range.. swinging from 2073 to 53.. but then a latter day recovery, settling effectively flat. It is notable that the 50dma held today.

Trans: a decisive break of the Friday low, with a second consecutive significant net daily decline. Next support is the price cluster zone of 7500/400s. A break into the 7300s would be pretty bearish, and offer an eventual break <7K in late May/early June.

--

Closing update from Riley

--

a little more later...

Subscribe to:

Comments (Atom)