With US equities increasingly weak across the day, the VIX managed to again break back above the key 20 threshold... settling +12.0% @ 19.92 (intra high 21.29). Near term outlook offers the 22-24 zone, before the next equity up wave.

VIX'daily3

VIX, weekly

Summary

Suffice to say, the VIX has managed to battle higher from a cycle low of 14.01 to today's high of 21.29 across six trading days.

There is still threat of another push higher to the 22-24s... but overall.. this cycle is going to end soon.

The sp'2100s still look due.. and that will knock the VIX back to the low teens.

--

more later... on the indexes

Monday, 5 January 2015

Closing Brief

US equities settled significantly lower, sp -37pts @ 2020 (intra low 2017). The two leaders - Trans/R2K, settled lower by -2.7% and -1.4% respectively. Near term outlook is for a key floor to be put in this week.. before the sp'2100s.. which are still viable by end month.

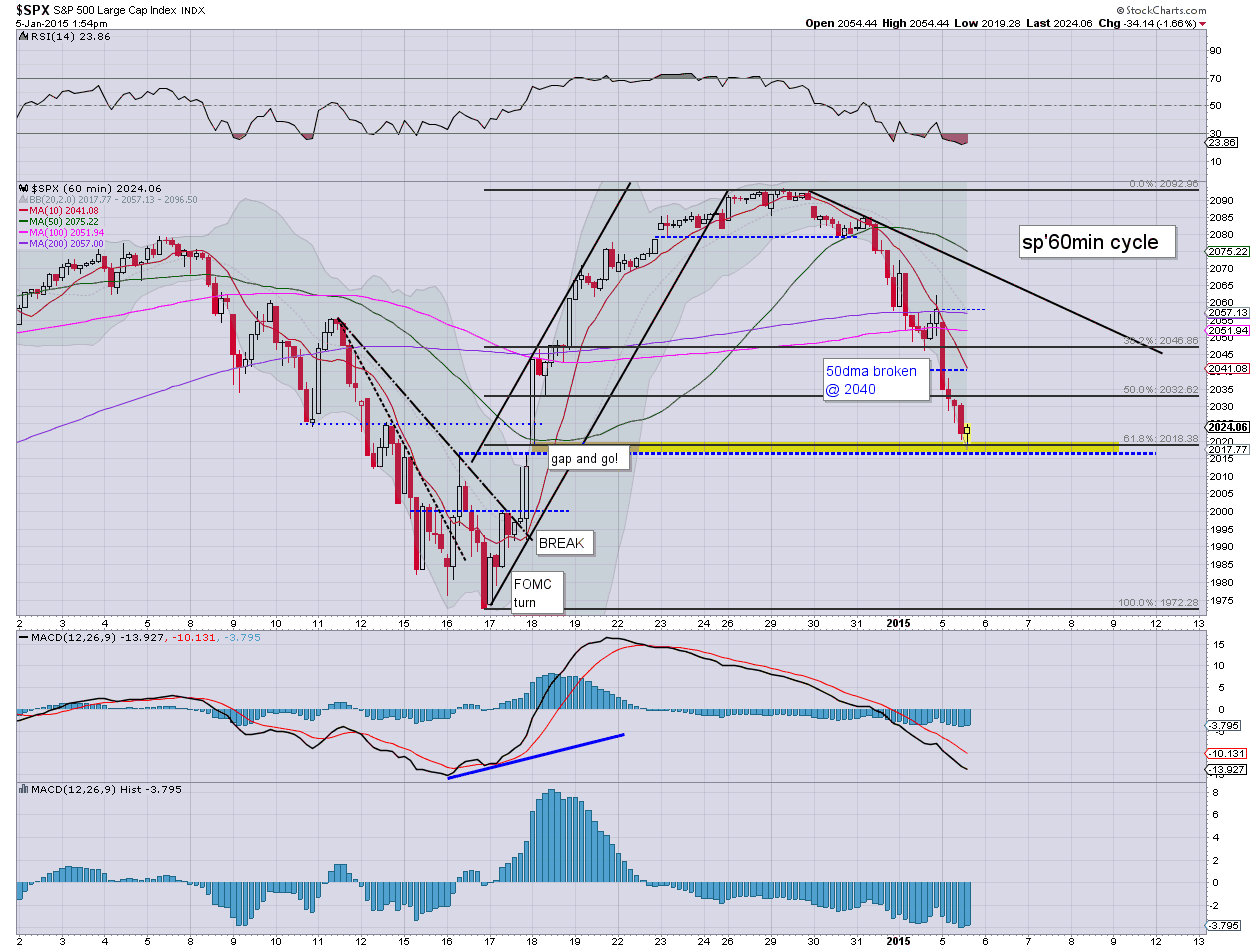

sp'60min

Summary

*hourly cycle offering a key floor at the gap zone/61.8% fib retrace of sp'2017. However, daily/weekly cycles are outright bearish.

--

Interesting start to the week...but unless the recent low of sp'1972 is taken out in the current down wave.. it is merely the same series of higher highs... and higher lows. Bears... beware!

-

With some dynamic action... a full set of updates to wrap up the day... across the evening

sp'60min

Summary

*hourly cycle offering a key floor at the gap zone/61.8% fib retrace of sp'2017. However, daily/weekly cycles are outright bearish.

--

Interesting start to the week...but unless the recent low of sp'1972 is taken out in the current down wave.. it is merely the same series of higher highs... and higher lows. Bears... beware!

-

With some dynamic action... a full set of updates to wrap up the day... across the evening

3pm update - a fourth day for the bears

The sp'500 is set to close lower for the fourth consecutive day... and it remains somewhat laugable how even the bullish cheerleaders on clown finance TV are getting real twitchy again. Gold is set for sig' net daily gains of around $15, but remains choppy. Oil is merely still in collapse mode.. next stop.... $45.

sp'60min

sp'daily5

Summary

Regardless of the exact close.. it has clearly been a day for the equity bears. However, recent counter rallies have been especially powerful.. and when the next floor is put in... bears had better have tight short-stops!

--

... with key jobs data later this week.... a key cycle floor is one day closer!

-

Notable weakness: SDRL, -10.0%... but more on that one... after the close.

-

3.13pm... Sp'500 fully fills the price gap zone... sp'2017.

Overly risky to call a floor here though... the Tuesday open will be pretty interesting!

Metals still building gains.... the old 'fear bid'... Gold +$17

sp'60min

sp'daily5

Summary

Regardless of the exact close.. it has clearly been a day for the equity bears. However, recent counter rallies have been especially powerful.. and when the next floor is put in... bears had better have tight short-stops!

--

... with key jobs data later this week.... a key cycle floor is one day closer!

-

Notable weakness: SDRL, -10.0%... but more on that one... after the close.

-

3.13pm... Sp'500 fully fills the price gap zone... sp'2017.

Overly risky to call a floor here though... the Tuesday open will be pretty interesting!

Metals still building gains.... the old 'fear bid'... Gold +$17

2pm update - blame the Greeks

The equity bull maniacs could feel pretty justified to blame the Greeks for today's rather significant sell off. Yet.. a GREXIT itself is probably many months away.. and that is even if the next Greek leadership (if such a word can be used for an Athens Govt).. decides it wants out of the Euro.

sp'60min

R2K, daily

Summary

We're seeing a touch of support around the gap zone... which also happens to be a key fib retrace.

-

Any consistent break <2018 would be a real problem, and open up the pre-FOMC low of sp'1972... which seemed unthinkable just 3-4 days ago.

-

Regardless of the current little drama... new historic highs are surely still due... not least as suggested by the R2K... which itself is due to gap fill late today/early tomorrow.

-

2.23pm... chop chop.. around sp'2020...

Notable weakness.. coal miners.. BTU -10%.. in the $6.90s... primary target remains $5.00...but that is unlikely until midsummer

sp'60min

R2K, daily

Summary

We're seeing a touch of support around the gap zone... which also happens to be a key fib retrace.

-

Any consistent break <2018 would be a real problem, and open up the pre-FOMC low of sp'1972... which seemed unthinkable just 3-4 days ago.

-

Regardless of the current little drama... new historic highs are surely still due... not least as suggested by the R2K... which itself is due to gap fill late today/early tomorrow.

-

2.23pm... chop chop.. around sp'2020...

Notable weakness.. coal miners.. BTU -10%.. in the $6.90s... primary target remains $5.00...but that is unlikely until midsummer

1pm update - approaching a key level

US equities remain very weak.... and continue to slide. Mr Market is approaching the next support zone... where the 61.8% fib retrace is lurking... at the gap zone. Gold building gains... +$12. Oil remains exceptionally weak, -4.1%... set for a daily close in the 50/49 zone.

sp'60min - with fib retrace.

Summary

... with continued declines... I'm back an hour early.

Without question... things are finally starting to get interesting...

VIX on the rise... next soft target are the 23s... upper bollinger territory...

If we break the 25s this week... well... that would be a surprise.

-

stay tuned...

1.17pm... sp'2019.... set to lose the golden fib'..... next level ... 2000... then 1972....

............ blame the Greeks.

sp'60min - with fib retrace.

Summary

... with continued declines... I'm back an hour early.

Without question... things are finally starting to get interesting...

VIX on the rise... next soft target are the 23s... upper bollinger territory...

If we break the 25s this week... well... that would be a surprise.

-

stay tuned...

1.17pm... sp'2019.... set to lose the golden fib'..... next level ... 2000... then 1972....

............ blame the Greeks.

12pm update - WTIC Oil goes sub $50

US equities continue to slide...with the sp'500 lower for the fourth consecutive day (ohh the humanity!). VIX is confirming the market concern about a GREXIT (Greek euro exit), but that still seems unlikely in the near term. Oil continues to spiral lower, -4.2%.... losing the $50 threshold

sp'60min

USO, weekly'2, rainbow

Summary

*possible spike floor on the smaller 15/60min cycle, but the next target of sp'2020/15 zone looks set to be hit, but more likely tomorrow.

--

The decline in Oil continues... and now we're in the $49s. Next support zone is around $45 (a level Mr Carboni was touting just a few months ago). Armstrong is open to a test of the 2008 collapse lows.. in the 35/30 zone.

With Oil still sliding, energy stocks remain under severe pressure....

CHK -6%

RIG -6%, SDRL -8.5%

BTU -7%

--

VIX update from Mr T

-

time for lunch... back at 2pm

sp'60min

USO, weekly'2, rainbow

Summary

*possible spike floor on the smaller 15/60min cycle, but the next target of sp'2020/15 zone looks set to be hit, but more likely tomorrow.

--

The decline in Oil continues... and now we're in the $49s. Next support zone is around $45 (a level Mr Carboni was touting just a few months ago). Armstrong is open to a test of the 2008 collapse lows.. in the 35/30 zone.

With Oil still sliding, energy stocks remain under severe pressure....

CHK -6%

RIG -6%, SDRL -8.5%

BTU -7%

--

VIX update from Mr T

-

time for lunch... back at 2pm

11am update - marginally interesting

US equities continue to slide, with a clear failure of the 50dma on the sp'500.... next downside support is around 2020/15. VIX has broken into the 20s...+16%. Metals are holding gains, Gold +$10, whilst Oil remains in collapse mode, -3.8% in the $50s.

sp'60min

sp'weekly2, rainbow

Summary

*with the loss of the 50dma, we now have a red candle.. but a long week ahead. Those seeking more sig' downside should be seeking a hit of the lower weekly bol'.. currently a long way down at 1907.

--

So... an interesting start to the week... and so far... ZERO sign of any buyers.

Looks like we're headed for 2020/15 zone...

-

Notable weakness, energy stocks... many showing declines of 5-6%.. breaking new multi-year lows.

Alcoa (AA) -4.1%... a surprisingly large drop... despite the main indexes.

sp'60min

sp'weekly2, rainbow

Summary

*with the loss of the 50dma, we now have a red candle.. but a long week ahead. Those seeking more sig' downside should be seeking a hit of the lower weekly bol'.. currently a long way down at 1907.

--

So... an interesting start to the week... and so far... ZERO sign of any buyers.

Looks like we're headed for 2020/15 zone...

-

Notable weakness, energy stocks... many showing declines of 5-6%.. breaking new multi-year lows.

Alcoa (AA) -4.1%... a surprisingly large drop... despite the main indexes.

10am update - a test of the 50 dma

US equities open moderately lower, with a test of the 50dma due across most indexes - equiv' to sp'2040. Metals are building borderline significant gains, Gold +$10. Oil remains sharply lower, -3.4%. VIX is making another play for the 20 threshold, +12% @ 19.93.

sp'60min

sp'daily5

Summary

*as has been the case for some days, the smaller hourly cycle is already on the low end.. market remains poised for another push.. to new highs.

--

There is a rather obvious price gap around sp'2017, but that is another 1.1% lower... it won't be easy to reach, despite the current downside trend.

-

Notable weakness, oil/gas drillers, copper/coal miners.

-

stay tuned

sp'60min

sp'daily5

Summary

*as has been the case for some days, the smaller hourly cycle is already on the low end.. market remains poised for another push.. to new highs.

--

There is a rather obvious price gap around sp'2017, but that is another 1.1% lower... it won't be easy to reach, despite the current downside trend.

-

Notable weakness, oil/gas drillers, copper/coal miners.

-

stay tuned

Pre-Market Brief

Good morning. Futures are moderately lower, sp -8pts, we're set to open at 2050. Metals are flat. Oil remains in collapse mode, -2.8%, the $50 threshold looks set to be broken in the immediate term. Nat' gas is showing strength on cold US weather, +6.3%. USD continues to climb, +0.6% @ 91.60.

sp'daily5

Summary

So.. some weakness to start the first full trading week of 2015. Hmm.

The 50dma - which will be around sp'2040 this morning, is set to be tested. Even if that fails to hold, there is the giant 2000 threshold, along with the pre-FOMC low of 1972.

Broadly... market still looks set to climb into the spring.

--

Notable weakness, oil/gas drillers, RIG -2.3%, SDRL -6.4%

-

Good wishes for the week ahead!

sp'daily5

Summary

So.. some weakness to start the first full trading week of 2015. Hmm.

The 50dma - which will be around sp'2040 this morning, is set to be tested. Even if that fails to hold, there is the giant 2000 threshold, along with the pre-FOMC low of 1972.

Broadly... market still looks set to climb into the spring.

--

Notable weakness, oil/gas drillers, RIG -2.3%, SDRL -6.4%

-

Good wishes for the week ahead!

Subscribe to:

Comments (Atom)