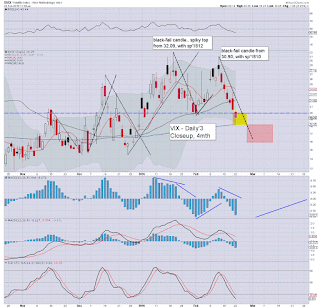

With equity indexes closing significantly higher, the VIX remained in cooling mode, settling lower for the sixth consecutive day, -5.6% @ 19.38 (intra low 19.02). Near term outlook offers the 18s, before threat of a brief bounce into end month. Broadly.. the 16/15s now look probable if sp'2K.

VIX'60min

VIX'daily3

Summary

Suffice to add, yet another daily decline for the VIX.. having lost the key 20 threshold today. It would seem the 18s will be hit tomorrow/Wednesday.. before equities might see a cool down into end month (which has a bonus day next Monday).

Broadly, the 40/50s still look due with an eventual break into the sp'1700s.

--

more later... on the indexes

Monday, 22 February 2016

Closing Brief

US equities closed significantly higher, sp +27pts @ 1945. The two leaders - Trans/R2K, settled higher by 1.8% and 1.2% respectively. Near term outlook is for further upside to the 1950/65 zone. From there, threat of cooling into end month, before resuming higher across first half of March to around sp'2K.

sp'60min

Summary

*closing hour action: micro chop... leaning on the upside.

--

A pretty bullish start to the week, and clearly.. equity bears continue to get ground out of this market as the mainstream are starting to get some confident again that 'everything is gonna be just fine'.

Of course, everything is far from okay.

Just reflect on the mood 7/8 days ago... rumours of DB, talk of Oil <$20, and looming bankruptcies in the oil/gas/mining sector.

All such things remain due. Nothing has changed.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: micro chop... leaning on the upside.

--

A pretty bullish start to the week, and clearly.. equity bears continue to get ground out of this market as the mainstream are starting to get some confident again that 'everything is gonna be just fine'.

Of course, everything is far from okay.

Just reflect on the mood 7/8 days ago... rumours of DB, talk of Oil <$20, and looming bankruptcies in the oil/gas/mining sector.

All such things remain due. Nothing has changed.

--

more later... on the VIX

3pm update - 4 of 7

US equities are set for the fourth positive day of the last seven, since the low of sp'1810. Considering current price momentum on the daily/weekly cycles, a further push into the resistance zone of 1950/65 zone looks due.. before things get somewhat uncertain.

sp'daily5b

Summary

Clearly, the Feb'1st peak of 1947 is offering some resistance, but it won't likely hold.

Mr Market will surely at least want to spook more bears out into the 1950/60s tomorrow/Wednesday.

From there, pretty high threat of a cool down into end month.. as many (even the infamous Gartman) recognise the broader trend is still bearish.

Again, broadly.. the weekly cycles are likely to tick higher for another 2-3 weeks.. so there still doesn't seem any hurry for those looking to place strategic shorts for a major wave lower into the 1700/1600s in April.

--

Going through a fair few individual company charts... Boeing (BA) is a rather good example, why some could argue we're headed a further 3% higher...

BA, daily

First target is an upper gap fill around $127, where the daily upper bollinger and the 50dma will be lurking into March. A major bearish target for BA is the mid $70s... but that is indeed a long... long way down.

-

back at the close

sp'daily5b

Summary

Clearly, the Feb'1st peak of 1947 is offering some resistance, but it won't likely hold.

Mr Market will surely at least want to spook more bears out into the 1950/60s tomorrow/Wednesday.

From there, pretty high threat of a cool down into end month.. as many (even the infamous Gartman) recognise the broader trend is still bearish.

Again, broadly.. the weekly cycles are likely to tick higher for another 2-3 weeks.. so there still doesn't seem any hurry for those looking to place strategic shorts for a major wave lower into the 1700/1600s in April.

--

Going through a fair few individual company charts... Boeing (BA) is a rather good example, why some could argue we're headed a further 3% higher...

BA, daily

First target is an upper gap fill around $127, where the daily upper bollinger and the 50dma will be lurking into March. A major bearish target for BA is the mid $70s... but that is indeed a long... long way down.

-

back at the close

2pm update - no sellers

Equity momentum continues to increasingly swing back toward the equity bulls... as especially seen on the bigger weekly cycles. Next soft resistance is the Feb'1st spike high of sp'1947.20, and that is set to be imminently broken. From there.. the 50dma @ 1951, then the 50% fib retrace of everything since last Nov' @ 1964/65.

sp'60min

VIX'daily3

Summary

The decline in the VIX remains even more stark than the equity rebound from sp'1810.

We're set for the 18s late today/early tomorrow.

--

notable weakness: TVIX -10.5% in the $8.20s... leveraged horror, urgh.

sp'60min

VIX'daily3

Summary

The decline in the VIX remains even more stark than the equity rebound from sp'1810.

We're set for the 18s late today/early tomorrow.

--

notable weakness: TVIX -10.5% in the $8.20s... leveraged horror, urgh.

1pm update - holding the gains

US equities are holding the morning gains, with the sp +24pts @ 1941, a mere 0.4% from next resistance zone of 1950/65. VIX remains extremely subdued, -5% in the 19.30s... with the 18s probable in the near term. Metals remain weak, Gold -$19, with Silver -1.2%.

sp'60min

GLD, daily

Summary

Little to add.

Price structure on the smaller hourly cycle is looking like a mini castle top - as I call them. Its a touch bearish, but really, daily/weekly cycles look bullish into tomorrow.

Next chance for the equity bears looks to be Wed'... the next EIA report..., and the Durables goods and GDP on Thurs/Friday respectively... won't likely be pretty.

--

notable relative strength... miners

GDX, daily

The miners were whacked lower in pre-market.. but have been battling back.. and relative lt gold.. they are very strong.

--

back at 2pm

sp'60min

GLD, daily

Summary

Little to add.

Price structure on the smaller hourly cycle is looking like a mini castle top - as I call them. Its a touch bearish, but really, daily/weekly cycles look bullish into tomorrow.

Next chance for the equity bears looks to be Wed'... the next EIA report..., and the Durables goods and GDP on Thurs/Friday respectively... won't likely be pretty.

--

notable relative strength... miners

GDX, daily

The miners were whacked lower in pre-market.. but have been battling back.. and relative lt gold.. they are very strong.

--

back at 2pm

12pm update - VIX continuing to cool

With US equities holding sig' gains, the VIX is naturally still in cooling mode, -6.2% in the 19.20s. The 18s look due with sp'1950/60s. If 2K.. then VIX in the 16/15s... before things get wild in late March/April.

VIX'daily3

sp'daily5b

Summary

So.. we've seen VIX cool from 30 to the 19s across just 7 trading days.

Clearly, the bulk of the decline has now completed... even if we keep grinding up to sp'2K... the VIX will only trade a little further lower, as the market makers/option writers are not going to price things too cheaply.

notable weakness, TVIX, -9% or so in the mid 8s.

--

VIX update from Mr T.

--

time for lunch :)

VIX'daily3

sp'daily5b

Summary

So.. we've seen VIX cool from 30 to the 19s across just 7 trading days.

Clearly, the bulk of the decline has now completed... even if we keep grinding up to sp'2K... the VIX will only trade a little further lower, as the market makers/option writers are not going to price things too cheaply.

notable weakness, TVIX, -9% or so in the mid 8s.

--

VIX update from Mr T.

--

time for lunch :)

11am update - sunshine for the bulls

US equities are comfortably holding significant gains, and it would seem we'll at least hit the sp'1950/65 zone in the current wave from 1902. The only issue is whether the market will manage the 2K threshold, and right now.. the bigger weekly charts support that notion.

sp'weekly1b

VIX'daily3

Summary

The VIX is notably back under the 20 threshold. 18s look due this week. If sp'2K... then 16/15s... briefly. Frankly... that looks a bizarrely good level to build an initial VIX-long position.

Fed official Fischer is speaking tomorrow AH, and that might give the excuse for 1960s.. before a short term pull back.

--

Here in London city...

About as good as it gets for February.

--

time to cook

sp'weekly1b

VIX'daily3

Summary

The VIX is notably back under the 20 threshold. 18s look due this week. If sp'2K... then 16/15s... briefly. Frankly... that looks a bizarrely good level to build an initial VIX-long position.

Fed official Fischer is speaking tomorrow AH, and that might give the excuse for 1960s.. before a short term pull back.

--

Here in London city...

About as good as it gets for February.

--

time to cook

10am update - opening gains

US equities are building significant gains, and look set for the sp'1950/65 zone - where there are multiple aspects of resistance - notably the 50dma @ 1951. The bigger weekly cycles are more suggestive of 2K. Metals are under increasing pressure, Gold -$20, with Silver -1.8%. VIX has naturally lost the key 20 threshold.

sp'daily5b

sp'weekly6

Summary

*PMI manu': 51.0... a clear miss, and that should concern the macro-bulls.

--

Note the weekly equity MACD (green bar histogram) cycle. We remain on the low side, and look set to tick higher at least for a few more weeks.

That sure doesn't mean we'll continue climbing at the current rate.. otherwise we'd be in the 2100s by mid March! What it does mean though... equity bears should be in no hurry.

-

notable weakness... Gold

GLD, daily2

Gold is set for a bearish daily MACD cross tomorrow.. or Wednesday. In either case, it bodes for sub $1200, at least 1180/70s. At worse... a test of the 50/200dma in the $1150/40s.. equating to GLD 110/108 zone.

I am seeking to pick up a GLD-long position by mid March. I suppose I could also go long miners (via GDX), but initially, I'll likely just stick to a straight Gold play.

--

stay tuned

sp'daily5b

sp'weekly6

Summary

*PMI manu': 51.0... a clear miss, and that should concern the macro-bulls.

--

Note the weekly equity MACD (green bar histogram) cycle. We remain on the low side, and look set to tick higher at least for a few more weeks.

That sure doesn't mean we'll continue climbing at the current rate.. otherwise we'd be in the 2100s by mid March! What it does mean though... equity bears should be in no hurry.

-

notable weakness... Gold

GLD, daily2

Gold is set for a bearish daily MACD cross tomorrow.. or Wednesday. In either case, it bodes for sub $1200, at least 1180/70s. At worse... a test of the 50/200dma in the $1150/40s.. equating to GLD 110/108 zone.

I am seeking to pick up a GLD-long position by mid March. I suppose I could also go long miners (via GDX), but initially, I'll likely just stick to a straight Gold play.

--

stay tuned

Pre-Market Brief

Good morning. US equity futures are significantly higher sp +20pts, we're set to open at 1937. USD is powering upward (esp' against the weak GBP), +0.8% in the DXY 97.40s. Metals are cooling, Gold -$14, set to lose the $1200 threshold. Oil is bouncing, +2.8% in the $32s.

sp'60min

Summary

*GBP/USD: -2.0% @ 1.40, as talk of the UK leaving the EU jumps as PM Cameron announces a referendum for June.

So.... GBP parity to the USD. Great.... just great. I suppose the upside is my trading acc' funds are USD... so technically, I'm up 2% already this week ;)

--

Significant gains to start the week, and if you're counting the days from the sp'1810 low, today is day'7 UP (inc' the low itself).

The 1950/65 zone looks a relatively easy target, but with multiple aspects of resistance, it won't be easy to break above.

The bigger weekly cycles are threatening another 2-3 weeks higher before the next rollover...so... a hit of the 200dma and 10mma look viable.

Best guess; Mr Market being the monster that it is.... wash out the bears >1970.... and draw in a large amount of bulls..... but then whipsawing lower from around 2K.

Even a move to around sp'2K won't wreck the bigger bearish outlook... so long as we don't sustainably trade above it.

--

early movers

GDX -2.1%... as the precious metals cool

TVIX -5% in the $8.70s.. as volatility is set for the upper teens.

CHK, FCX, both +5%.... as even the trash is being marked up.

CREE +3.6%

DISCA +9.8%

--

Update from Oscar

-

Overnight action

Japan: +0.9% @ 16111

China: +2.3% @ 2927

Germany: currently +1.7% @ 9543

--

Have a good Monday

sp'60min

Summary

*GBP/USD: -2.0% @ 1.40, as talk of the UK leaving the EU jumps as PM Cameron announces a referendum for June.

So.... GBP parity to the USD. Great.... just great. I suppose the upside is my trading acc' funds are USD... so technically, I'm up 2% already this week ;)

--

Significant gains to start the week, and if you're counting the days from the sp'1810 low, today is day'7 UP (inc' the low itself).

The 1950/65 zone looks a relatively easy target, but with multiple aspects of resistance, it won't be easy to break above.

The bigger weekly cycles are threatening another 2-3 weeks higher before the next rollover...so... a hit of the 200dma and 10mma look viable.

Best guess; Mr Market being the monster that it is.... wash out the bears >1970.... and draw in a large amount of bulls..... but then whipsawing lower from around 2K.

Even a move to around sp'2K won't wreck the bigger bearish outlook... so long as we don't sustainably trade above it.

--

early movers

GDX -2.1%... as the precious metals cool

TVIX -5% in the $8.70s.. as volatility is set for the upper teens.

CHK, FCX, both +5%.... as even the trash is being marked up.

CREE +3.6%

DISCA +9.8%

--

Update from Oscar

-

Overnight action

Japan: +0.9% @ 16111

China: +2.3% @ 2927

Germany: currently +1.7% @ 9543

--

Have a good Monday

Four years, and still here

A fourth year is now complete for this growing part of the financial blogosphere.

Notable thanks to...

mcverryreport.com, one of the best link sites out there.

elliotwavetrader1.blogspot.com, just a single post each day, but balanced.

chartramblings.blogspot.com, good link site, with regular charts

--

The fourth year

Many financial blogs/sites have disappeared across the last few years, but I'm still here!

Despite the overly bearish name, I continue to endeavour to offer as balanced a view as anyone out there, and one far superior to the general hysteria of the polar opposites of Zerohedge - CNBC/Bloomberg/Fox.

--

Links - I'm always looking for new sites to add to my lists... let me know if you think I'm missing something good.

Emails are always welcome - more than anything across the last few years... I prize YOUR emails. I understand not everyone wants to send messages via the public Disqus messaging system.

Taking requests - I'm always pleased to hear about a new stock/ETF, one that you might want me to take a look at.

Subscriber base? - Maybe one day, but I've nothing scheduled right now... as I also said last year.

The Big Short

... was a great movie, but I'm thinking of the ultimate trade that most of the remaining bears have been looking to achieve since this QE/paper inspired rally started in March 2009.

Frankly, most of us deserve a gods damn medal just for being able to endure the increasingly crazy financial casino that we continue to trade.

By mid March, this market should be close to maxing out - whether sp'1950/60s or around the 2K threshold, making for another important lower high. In theory, a 'big short' trade will soon be due.

Let the fifth year begin!

--

Macro chatter from Armstrong

--

Mr Long with Mr Faber

Faber sure has said some wild things across the last few years, but still... his commentary is never dull.

--

Hunter with Holter

As ever, make of that... what you will. I sure don't agree with all of it, but I think the issue of NIRP and future gold upside merits serious consideration.

--

Back at the Monday open :)

Notable thanks to...

mcverryreport.com, one of the best link sites out there.

elliotwavetrader1.blogspot.com, just a single post each day, but balanced.

chartramblings.blogspot.com, good link site, with regular charts

--

The fourth year

Many financial blogs/sites have disappeared across the last few years, but I'm still here!

Despite the overly bearish name, I continue to endeavour to offer as balanced a view as anyone out there, and one far superior to the general hysteria of the polar opposites of Zerohedge - CNBC/Bloomberg/Fox.

--

Links - I'm always looking for new sites to add to my lists... let me know if you think I'm missing something good.

Emails are always welcome - more than anything across the last few years... I prize YOUR emails. I understand not everyone wants to send messages via the public Disqus messaging system.

Taking requests - I'm always pleased to hear about a new stock/ETF, one that you might want me to take a look at.

Subscriber base? - Maybe one day, but I've nothing scheduled right now... as I also said last year.

The Big Short

... was a great movie, but I'm thinking of the ultimate trade that most of the remaining bears have been looking to achieve since this QE/paper inspired rally started in March 2009.

|

| Margot Robbie will explain everything |

Frankly, most of us deserve a gods damn medal just for being able to endure the increasingly crazy financial casino that we continue to trade.

|

| Moody market skies ahead |

By mid March, this market should be close to maxing out - whether sp'1950/60s or around the 2K threshold, making for another important lower high. In theory, a 'big short' trade will soon be due.

Let the fifth year begin!

--

Macro chatter from Armstrong

--

Mr Long with Mr Faber

Faber sure has said some wild things across the last few years, but still... his commentary is never dull.

--

Hunter with Holter

As ever, make of that... what you will. I sure don't agree with all of it, but I think the issue of NIRP and future gold upside merits serious consideration.

--

Back at the Monday open :)

Subscribe to:

Comments (Atom)