Another very quiet day in the US equity market.. although (for the equity bears) there were no new index highs, sp -1.5pts @ 2038. Near term outlook offers a very viable retrace to the 1980/50 zone.. before renewed upside into early 2015.

sp'60min

Summary

Little to add on what was a quiet day.

A great day for ESA, with the landing of the Rosetta probe 'Philae' on the comet. At the very least, it took away a great deal of attention from 'that woman', with the plastic ass.

yours... 100% real.

-

A daily wrap at 8pm EST>

Wednesday, 12 November 2014

3pm update - weakness into the close

US equities look set for some renewed weakness into the close. The daily 10MA of sp'2024 should be first target for the bears in the remainder of the weak, and that will open up a broader downside retrace target zone of 1980/50 before month end.

sp'daily5

Summary

Little to add... on what is another rather quiet day.

Right now, bears should be merely looking for a break to the 2020/10s by the Friday close. In scheme of things..not very exciting.. and I certainly won't be meddling in the indexes - either side, for rest of the year.

--

Metals remain weak, Gold -$5, which is keeping the pressure on miners... which I remain short.

sp'daily5

Summary

Little to add... on what is another rather quiet day.

Right now, bears should be merely looking for a break to the 2020/10s by the Friday close. In scheme of things..not very exciting.. and I certainly won't be meddling in the indexes - either side, for rest of the year.

--

Metals remain weak, Gold -$5, which is keeping the pressure on miners... which I remain short.

2pm update - broader micro chop

The broader US equity market remains seeing broader micro chop, but holding under the recent high of sp'2041. Metals are starting to slide, Gold -$7, which is impacting the miners, GDX -0.9%. The rising USD is not helping, +0.4%

sp'60min

Summary

Not much to add. Pretty tedious overall.... retail sales data on Friday, that is really the only scheduled thing this week.

--

Meanwhile, miners are weak..

GDX, 60min

Kinda interesting... but still.. a long way to fall.

sp'60min

Summary

Not much to add. Pretty tedious overall.... retail sales data on Friday, that is really the only scheduled thing this week.

--

Meanwhile, miners are weak..

GDX, 60min

Kinda interesting... but still.. a long way to fall.

12pm update - meanwhile.. back on Earth

Whilst the Probe 'Philae' has successfully landed on the comet... back at the worlds most rigged and twisted casino... price action remains a touch weak. VIX has broken the giant down trend.. and looks set to begin a climb into the upper teens.

sp'60min

Summary

Not much to say. I suppose we could still claw to 2045/55 zone, but really, this market looks increasingly tired with each hour.

We're due a retrace... best guess right now... 1980/50 zone.

--

Metals are starting to slide, Gold -$3.

Despite opening a little higher, we have a micro double top on the miners...

GDX, 60min

I remain seeking much lower levels...

--

VIX update from Mr T.

--

time for a long lunch... back at 2pm

sp'60min

Summary

Not much to say. I suppose we could still claw to 2045/55 zone, but really, this market looks increasingly tired with each hour.

We're due a retrace... best guess right now... 1980/50 zone.

--

Metals are starting to slide, Gold -$3.

Despite opening a little higher, we have a micro double top on the miners...

GDX, 60min

I remain seeking much lower levels...

--

VIX update from Mr T.

--

time for a long lunch... back at 2pm

11am update - awaiting touchdown

US equities remain moderately weak, sp -5pts @ 2034. Commodities look under extra pressure as the USD is trying to push higher, but really...the real action is far... far away. The Rosetta probe 'Philae' is due to touch down on a comet.

sp'daily5

Summary

Little to add....

back to the live show...

Twitter is actually serving a useful purpose today.. spreading the word...

see: cometlanding

-

11.08am.. TOUCHDOWN......

meanwhile... VIX +5%... a daily close in the 15s would offer something interesting...

sp'daily5

Summary

Little to add....

back to the live show...

Twitter is actually serving a useful purpose today.. spreading the word...

see: cometlanding

-

11.08am.. TOUCHDOWN......

meanwhile... VIX +5%... a daily close in the 15s would offer something interesting...

10am update - back to Rosetta

Whilst equities remain moderately weak, there are far more important matters. The Rosetta probe 'Philae' is due to land on the comet around 4.02 GMT (11.02am EST). It is a pretty historic event, and frankly... my attention will remain there.

sp'60min

VIX'60min

Summary

*opening black-fail candle on the VIX, not exactly inspiring for those seeking further declines this morning.

--

So.. early equity declines.. but nothing significant, and it is a wonder where the excuse/reason will come from for a push back under sp'2000. Retail sales this Friday... or something next week?

--

FULL coverage of the comet landing @ livestream

-

10.06am.. Commodities look weak, metals are a little lower, energy remains especially weak.

sp'60min

VIX'60min

Summary

*opening black-fail candle on the VIX, not exactly inspiring for those seeking further declines this morning.

--

So.. early equity declines.. but nothing significant, and it is a wonder where the excuse/reason will come from for a push back under sp'2000. Retail sales this Friday... or something next week?

--

FULL coverage of the comet landing @ livestream

-

10.06am.. Commodities look weak, metals are a little lower, energy remains especially weak.

Pre-Market Brief

Good morning. Futures are moderately lower,sp - 8pts , we're set to open at 2031. Metals are broadly flat. Energy prices are on the slide, Nat'gas -0.9%, whilst Oil -0.4%. Equity bears should be seeking a weekly close at least in the 2020s.

sp'weekly

Summary

So... we're set to open a little lower, with the first target of the 50 day MA... some 3% lower. Clearly, that is not going to be hit this week.... but perhaps.. later this month.

Anyway... I'm not expecting too much from today. Trading vol' is likely to remain very light.

Early mover, BTU -1.4% @ $10.98... broader target is $5... but that is likely to take another 6-9mths.

--

Doom chat with Hunter and Turk

More dollar doom discussion, along with the usual insane talk of 'Gold/Silver shortages'..... utter nonsense talk of course. King $ remains... King, and there are enough precious metals for everyone who wants any.

Ohh, and I've no doubt some of you will vehemently disagree with that, but hey... stay short $ and long metals. See how that continues to work out.

-

9.34am... VIX jumps almost 6%.. but still only in the mid 13s. Tis a long way to go.. just for 15/16s.

9.43am.. Opening black-fail candle on the VIX... should not inspire the equity bears.

sp'weekly

Summary

So... we're set to open a little lower, with the first target of the 50 day MA... some 3% lower. Clearly, that is not going to be hit this week.... but perhaps.. later this month.

Anyway... I'm not expecting too much from today. Trading vol' is likely to remain very light.

Early mover, BTU -1.4% @ $10.98... broader target is $5... but that is likely to take another 6-9mths.

--

Doom chat with Hunter and Turk

More dollar doom discussion, along with the usual insane talk of 'Gold/Silver shortages'..... utter nonsense talk of course. King $ remains... King, and there are enough precious metals for everyone who wants any.

Ohh, and I've no doubt some of you will vehemently disagree with that, but hey... stay short $ and long metals. See how that continues to work out.

-

9.34am... VIX jumps almost 6%.. but still only in the mid 13s. Tis a long way to go.. just for 15/16s.

9.43am.. Opening black-fail candle on the VIX... should not inspire the equity bears.

Daily Wrap

US equities continued to break another trio of new index highs, with sp' 2041, Dow 17638, and Trans 9104. A retrace to the sp'1980/50 zone looks very likely, but that will likely be all the equity bears get in the remainder of the year.

sp'daily5

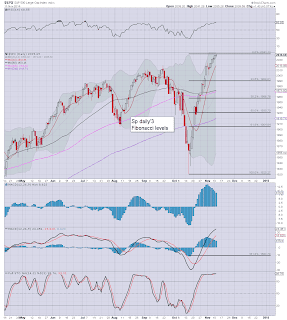

sp'daily3 - fib levels

Summary

Little to add, on what was a very quiet day. I've added a fib' chart, and its kinda interesting to see the 61% fib retrace at the Aug' low of 1904, but really, that looks almost impossible to hit.. its a very significant 7% lower.

--

VIX daily'3

A new up wave in the VIX is way overdue... but 18/20 at most, before year end. The 30s now look an extremely long way up... and I can't believe that high will be surpassed for many months.

-

Looking ahead

There is wholesale trade data (10am), but really, few will have much interest in that.

--

Goodnight from London

sp'daily5

sp'daily3 - fib levels

Summary

Little to add, on what was a very quiet day. I've added a fib' chart, and its kinda interesting to see the 61% fib retrace at the Aug' low of 1904, but really, that looks almost impossible to hit.. its a very significant 7% lower.

--

VIX daily'3

A new up wave in the VIX is way overdue... but 18/20 at most, before year end. The 30s now look an extremely long way up... and I can't believe that high will be surpassed for many months.

-

Looking ahead

There is wholesale trade data (10am), but really, few will have much interest in that.

--

Goodnight from London

Subscribe to:

Comments (Atom)