With equities sliding to sp'1820 (a level unthinkable just four weeks ago), the VIX exploded this week to a peak of 31.06. Volatility is back, and despite slipping to a Friday low of 20.23, and settling -12.7% @ 21.99, the VIX has confirmed a broader trend change in equities.

VIX'60min

VIX'daily3

VIX'weekly

Summary

So, the week concluded strongly in favour of the equity bulls, as reflected in a VIX that has been whacked lower from the 31s to 21s across just 3 trading days.

Despite the VIX pull back though, last weeks close above the weekly 200MA was decisive, and with the new highs this week, traders should remain focused on the bigger picture, which has now shifted in favour of much lower equity levels.

It would seem that VIX 40s are due in the next multi-week down cycle, which would likely begin somewhere in the sp'1920/50 zone in November.

--

more later... on the indexes

Friday, 17 October 2014

Closing Brief

The broader US equity market closed higher for the second consecutive day, sp +23pts @ 1886, but having cooled from an earlier high of 1898. The two leaders - Trans/R2K, settled +1.5% and -0.3% respectively. Near term outlook is still offering another wave lower to 1815/00 zone.

sp'15min

sp'60min

Summary

...and another week in crazy market land comes to a close.

The closing level should be seen as a real disappointment to the bears, not least in the two leaders, both of which saw very significant net weekly gains of around 3%.

Where do we go from here?

So, this week we saw the low 1800s, along with VIX in the 31s, something that very few had expected as recently as last week.. but what now?

Scenario'1, a further minor wave lower to 1815/00.. before a bounce to 1920/50.. and then a major wave lower.

S'2 continued strength to 1920/50... and then a huge wave lower to the 1600s.

S'3... up up up... breaking new historic highs (in most indexes) by year end.

--

To me, the notion of new historic highs this side of spring 2015 seems nothing less than crazy talk. The monthly charts ARE broken. The damage has been done... and it is not going to be reversed, even with a move to the mid 1900s by early November.

Regardless, its the weekend.... have a good one.

--

*I hold a minor short-index block across the weekend, but it ain't looking good, with the real threat of a straight run to the 1920/50 zone.. before next wave.

--

the usual bits and pieces to wrap up the week... across the evening.

sp'15min

sp'60min

Summary

...and another week in crazy market land comes to a close.

The closing level should be seen as a real disappointment to the bears, not least in the two leaders, both of which saw very significant net weekly gains of around 3%.

Where do we go from here?

So, this week we saw the low 1800s, along with VIX in the 31s, something that very few had expected as recently as last week.. but what now?

Scenario'1, a further minor wave lower to 1815/00.. before a bounce to 1920/50.. and then a major wave lower.

S'2 continued strength to 1920/50... and then a huge wave lower to the 1600s.

S'3... up up up... breaking new historic highs (in most indexes) by year end.

--

To me, the notion of new historic highs this side of spring 2015 seems nothing less than crazy talk. The monthly charts ARE broken. The damage has been done... and it is not going to be reversed, even with a move to the mid 1900s by early November.

Regardless, its the weekend.... have a good one.

--

*I hold a minor short-index block across the weekend, but it ain't looking good, with the real threat of a straight run to the 1920/50 zone.. before next wave.

--

the usual bits and pieces to wrap up the week... across the evening.

3pm update - cooling into the weekend

Having built gains from sp'1820 to 1898, US equities have started to cool, with the VIX holding the psy' level of 20. Metals remain a touch weak, Gold -$2. Oil has lost almost all of the opening gains (1.2%), now just +0.2%.

sp'60min

VIX'60min

Summary

Its been one hell of a dynamic week.. with sp'1820, and a VIX of 31. Just a month ago that seemed impossible to almost everyone... including yours truly.

-

With one hour to go, equity bears should be looking at least for a close <1880.. something in the 1875/70 zone would be 'useful', and would break the near term up trend.

Similarly, look to the VIX, for a close in the 23/24s which will keep open the door to a sub 5'th wave down to sp'1815/10 next week.

Notable weakness: RIG, -5.3%... with continued talk of renewed lower oil/gas prices into next year.

3.09pm chop chop.... bulls struggling to hold the 1880 threshold... the hourly 10MA is 1879....a weekly close in the 1875/70 zone looks very viable, with VIX 24s.

3.16pm.. and another jump higher..... sp'1888... with VIX cooling to the low 22s.

This is starting to get real annoying.

3.39pm.. a close <1880 looks out of range now.... which is pretty depressing. We'll close within the near term up trend... with the threat of 1900s on Monday.

oh well, at least volatility is back... so the weeks ahead won't be dull.

3.51pm... tiresome end to the week.... with sp'1890s... and VIX 21/22s.

back at the close...

sp'60min

VIX'60min

Summary

Its been one hell of a dynamic week.. with sp'1820, and a VIX of 31. Just a month ago that seemed impossible to almost everyone... including yours truly.

-

With one hour to go, equity bears should be looking at least for a close <1880.. something in the 1875/70 zone would be 'useful', and would break the near term up trend.

Similarly, look to the VIX, for a close in the 23/24s which will keep open the door to a sub 5'th wave down to sp'1815/10 next week.

Notable weakness: RIG, -5.3%... with continued talk of renewed lower oil/gas prices into next year.

3.09pm chop chop.... bulls struggling to hold the 1880 threshold... the hourly 10MA is 1879....a weekly close in the 1875/70 zone looks very viable, with VIX 24s.

3.16pm.. and another jump higher..... sp'1888... with VIX cooling to the low 22s.

This is starting to get real annoying.

3.39pm.. a close <1880 looks out of range now.... which is pretty depressing. We'll close within the near term up trend... with the threat of 1900s on Monday.

oh well, at least volatility is back... so the weeks ahead won't be dull.

3.51pm... tiresome end to the week.... with sp'1890s... and VIX 21/22s.

back at the close...

2pm update - maxed out?

US equities have cooled somewhat from the earlier high of sp'1898, but still remain hugely above the Wed' low of 1820. VIX is clawing back some of the declines, back in the 21s. Notably, the R2K has turned fractionally negative.

sp'15min

sp'daily5b

Summary

*chart 5b remains 'best guess', but I realise after this mornings huge gains, many would be completely dismissive of it.

--

Still two hours to go of a crazy week... bears need to break back under 1880

Notable weakness: RIG, -4.6%

NFLX -3.5%, despite Cuban calling into clown finance TV to pump his latest 'I will never sell' investment.

2.17pm.. The break <1880 is interesting... but need at least a weekly close under it... VIX 23s imminent

2.34pm.. chop chop..in the low 1880s. Hourly 10MA will be around 1880 in the closing hour..and that will be key to break/hold under.

R2K -0.3%... pretty weak, exhausted on the buy side?

sp'15min

sp'daily5b

Summary

*chart 5b remains 'best guess', but I realise after this mornings huge gains, many would be completely dismissive of it.

--

Still two hours to go of a crazy week... bears need to break back under 1880

Notable weakness: RIG, -4.6%

NFLX -3.5%, despite Cuban calling into clown finance TV to pump his latest 'I will never sell' investment.

2.17pm.. The break <1880 is interesting... but need at least a weekly close under it... VIX 23s imminent

2.34pm.. chop chop..in the low 1880s. Hourly 10MA will be around 1880 in the closing hour..and that will be key to break/hold under.

R2K -0.3%... pretty weak, exhausted on the buy side?

1pm update - still within near term up trend

Equities continue to hold within the near term up trend, having ramped from sp'1820 to 1898. VIX has so far managed to hold the key 20 threshold. Oil is holding moderate gains, +0.4%, but well below opening levels.

sp'15min

Summary

Suffice to say, 3 hours to go of what has been a wacky week.

Right now, equity bears need a daily close <1880...if not 1870 to offer some hope for early next week.

--

Notable weakness, coal miners, ANR, ACI, both -10%, with the bigger BTU -3.5%.

1.18pm.. Interesting little down wave, 13pts from the earlier high of sp'1898....

VIX clawing back...if slowly... 22s look due.

sp'15min

Summary

Suffice to say, 3 hours to go of what has been a wacky week.

Right now, equity bears need a daily close <1880...if not 1870 to offer some hope for early next week.

--

Notable weakness, coal miners, ANR, ACI, both -10%, with the bigger BTU -3.5%.

1.18pm.. Interesting little down wave, 13pts from the earlier high of sp'1898....

VIX clawing back...if slowly... 22s look due.

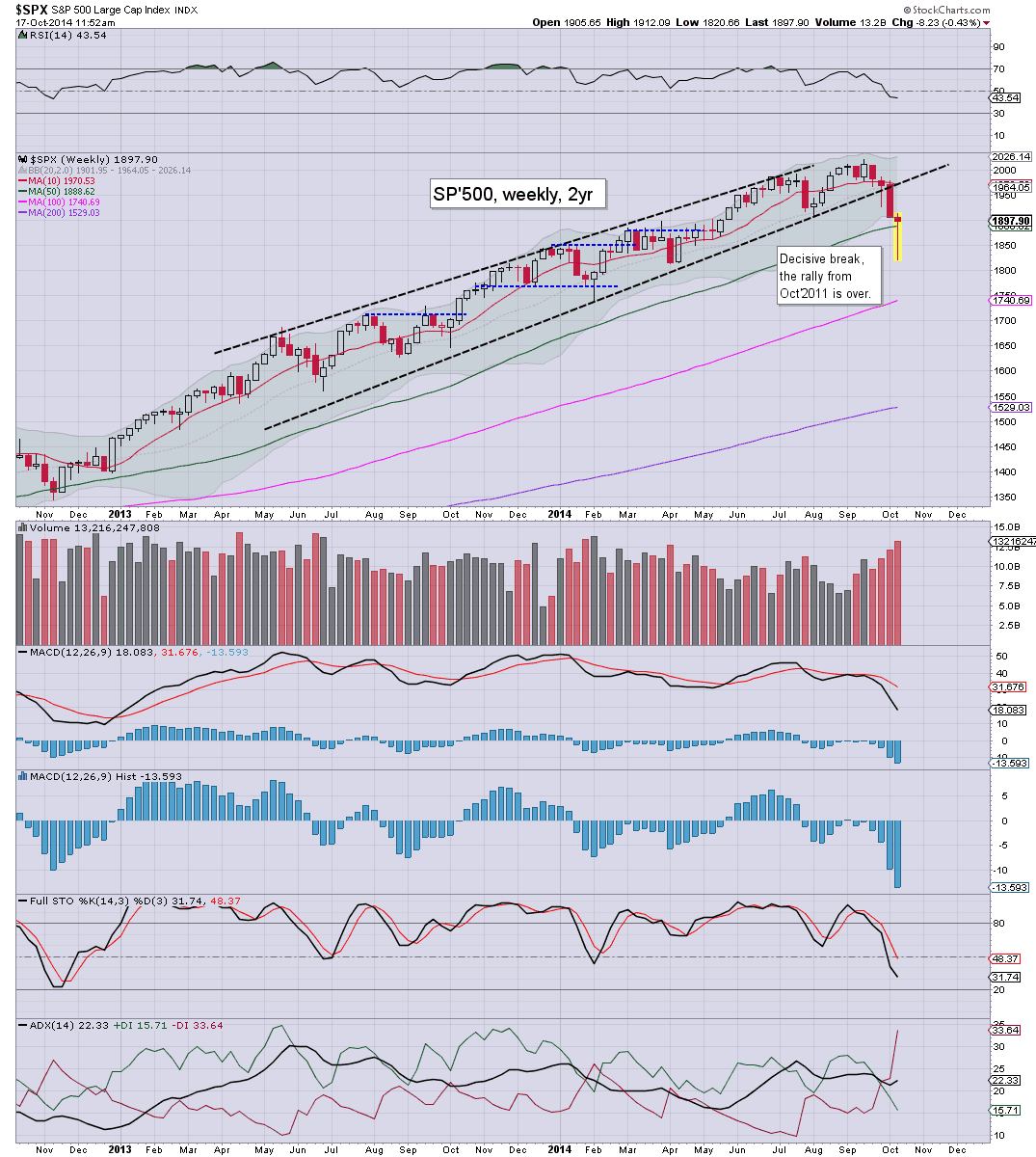

12pm update - net weekly gains?

US indexes continues to battle higher, with the big sp'1900 threshold set to be tested. VIX continues to melt lower, -19% in the 20.20s. With the capital markets in a calmer mood, precious metals are weak, Gold -$6, whilst Oil is holding moderate gains of 0.6%.

sp'daily5

sp'weekly

Summary

*what is especially bizarre is seeing the weekly charts getting close to net weekly gains. The Trans/R2K already are.

--

Well, its clearly getting rough now for those currently short.

Those who believe a key low has been set at sp'1820 should be seeking a straight run to 1920/50 zone.. although I realise, a fair few are completely giving up.. and looking for new historic highs before year end.

Considering the monthly cycles... I still can't agree with that, even with this latest run of almost 4% in just over two days.

VIX update from Mr T.

--

time for tea.. or something sedative.

sp'daily5

sp'weekly

Summary

*what is especially bizarre is seeing the weekly charts getting close to net weekly gains. The Trans/R2K already are.

--

Well, its clearly getting rough now for those currently short.

Those who believe a key low has been set at sp'1820 should be seeking a straight run to 1920/50 zone.. although I realise, a fair few are completely giving up.. and looking for new historic highs before year end.

Considering the monthly cycles... I still can't agree with that, even with this latest run of almost 4% in just over two days.

VIX update from Mr T.

--

time for tea.. or something sedative.

11am update - market teasing the bulls

US equities have managed a 62pt (3.1%) rally to sp'1892 across just 12 trading hours, and there are already many calling for new historic highs. Yet, this is likely Mr Market just teasing (for once) the bulls. VIX remains smacked lower by -17%, just managing to hold the 20 threshold.

sp'60min

VIX'60min

Summary

Well, its 11am.. typical turn time.

At the very least, equity bears should be seeking a weekly close back under 1870... which frankly, is not expecting too much, considering the recent intraday swings.

-

Notable weakness, NFLX -4.6% @ $345... no buyers until 310/320.

sp'60min

VIX'60min

Summary

Well, its 11am.. typical turn time.

At the very least, equity bears should be seeking a weekly close back under 1870... which frankly, is not expecting too much, considering the recent intraday swings.

-

Notable weakness, NFLX -4.6% @ $345... no buyers until 310/320.

10am update - opening gains

US equities open significantly higher, with the sp' back in the 1880s, a full 3% above the Wed' low of 1820. VIX is naturally cooling -16% in the 21s. Metals are weak, Gold -$3, whilst Oil is holding moderate gains of 0.5%.

sp'60min

sp'daily5b

Summary

Barring a daily close much above current levels, I'm holding to the original outlook.

We've seen so many sharp swings across the past four weeks, why would today be any different?

The fact it is opex, will only add to the volatility.. especially this afternoon.

Notable weakness, NFLX -3% @ $350, still seemingly headed for 310/300

--

stay tuned.

sp'60min

sp'daily5b

Summary

Barring a daily close much above current levels, I'm holding to the original outlook.

We've seen so many sharp swings across the past four weeks, why would today be any different?

The fact it is opex, will only add to the volatility.. especially this afternoon.

Notable weakness, NFLX -3% @ $350, still seemingly headed for 310/300

--

stay tuned.

Pre-Market Brief

Good morning. Futures are significantly higher, sp +19pts, we're set to open at 1881. Metals are weak, Gold -$3. Oil is strongly higher for a second day, +1.7%. Recent price structure is still suggestive of a further equity wave lower, before a sustained rally is possible.

sp'60min

sp'weekly

Summary

*even with a higher open, price structure on the hourly chart is still a rather clear bear flag

--

So, we're set to open higher, and not surprisingly, I'm already seeing talk of 'new historic highs' within the next few months.

Frankly, to me, this seems ludicrous. One up day, and everyone already loses sight of the bigger picture... seriously?

Equity bears should look for at least a moderately red close. Considering the likely opening gains, the notion of a break <1820 looks out of range for today... so.. those seeking 1815/00 zone, are going to need to wait until next Mon/Tuesday.

On any basis, the broader market is set for a net weekly decline, the fourth consecutive down week.

--

Doom chatter to end the week from Hunter

--

Have a good Friday

sp'60min

sp'weekly

Summary

*even with a higher open, price structure on the hourly chart is still a rather clear bear flag

--

So, we're set to open higher, and not surprisingly, I'm already seeing talk of 'new historic highs' within the next few months.

Frankly, to me, this seems ludicrous. One up day, and everyone already loses sight of the bigger picture... seriously?

Equity bears should look for at least a moderately red close. Considering the likely opening gains, the notion of a break <1820 looks out of range for today... so.. those seeking 1815/00 zone, are going to need to wait until next Mon/Tuesday.

On any basis, the broader market is set for a net weekly decline, the fourth consecutive down week.

--

Doom chatter to end the week from Hunter

--

Have a good Friday

First major wave down almost complete

Since the Alibaba (now infamous) top of sp'2019 of Sept'19th, equities have seen what appears to be a clear 5 wave decline, with a VIX that has exploded to levels not seen since late 2011. A bounce looks due from 1815/00 zone... back into the sp'1900s.

sp'weekly7

sp'weekly9 - fib retrace levels

Summary

A long day, I'm tired... so this needs to be brief.

Market looks set for a marginally lower low (but not all indexes) tomorrow/early Monday. From there, a major bounce... but a bounce...is all it will be.

--

Looking ahead

The week concludes with housing stats and consumer sentiment. The Yellen is due to speak in early morning on 'inequality of economic opportunity'. I don't expect that to be of any real importance.

Tomorrow is opex, so expect some extra chop, especially in the late afternoon!

*next QE is Monday.

--

Goodnight from London

sp'weekly7

sp'weekly9 - fib retrace levels

Summary

A long day, I'm tired... so this needs to be brief.

Market looks set for a marginally lower low (but not all indexes) tomorrow/early Monday. From there, a major bounce... but a bounce...is all it will be.

--

Looking ahead

The week concludes with housing stats and consumer sentiment. The Yellen is due to speak in early morning on 'inequality of economic opportunity'. I don't expect that to be of any real importance.

Tomorrow is opex, so expect some extra chop, especially in the late afternoon!

*next QE is Monday.

--

Goodnight from London

Daily Index Cycle update

US equities saw some pretty dynamic swings, rallying from a pre-market low of around sp'1822, to an afternoon peak of 1876, and settling u/c @ 1862. The two leaders - Trans/R2K, settled higher by 1.1% and 1.2% respectively.

sp'daily5b, count

Dow, daily

Summary

The Dow notably closed lower for the sixth consecutive day, I'm not sure how long its been since that kind of downside.

--

Suffice to say, a day of swings, a strong rally into the afternoon, but late day 'moderate' weakness.

The two leaders - Trans/R2K, continue to suggest a key low in the broader market is increasingly close.

--

a little more later....

sp'daily5b, count

Dow, daily

Summary

The Dow notably closed lower for the sixth consecutive day, I'm not sure how long its been since that kind of downside.

--

Suffice to say, a day of swings, a strong rally into the afternoon, but late day 'moderate' weakness.

The two leaders - Trans/R2K, continue to suggest a key low in the broader market is increasingly close.

--

a little more later....

Subscribe to:

Comments (Atom)