Despite the main indexes climbing for a fourth day, the VIX also managed a daily gain, +1.3% @ 12.83 Yet, today's gain is arguably nothing more than 'mere noise'. As we've seen many times, the VIX could simply meander in the 15-12s for weeks, if not months.

VIX'daily3

Summary

There really isn't much to take from any of the VIX charts now. The intra-day action is so minor, it barely registers at all.

Any hopes of VIX above the key 20 threshold...are arguably to be put on hold until the late summer.

--

more later, on those melting indexes

Tuesday, 7 May 2013

Closing Brief

The market saw the fourth consecutive daily gain, lead once again by the transports, +1.5% in the high 6300s. The other indexes saw more moderate gains of around 0.5%. Whilst the QE-POMO continues, bears face relentless problems.

sp'60min

Summary

Four days up..and I can't see this nonsense ending any time soon. Ohh sure we could pull back, a day..maybe two, but considering the weekly and monthly charts, we'll surely just melt right back up.

If this is the start of a 3-4 month algo-bot melt into the sp'1800s, its going to make the summer of 2013 one which the bears should simply just step aside from.

*I remain on the sidelines, Long Oil and Short silver are trades I will be looking for in the days ahead...when entry levels/conditions look better.

have a good evening.

sp'60min

Summary

Four days up..and I can't see this nonsense ending any time soon. Ohh sure we could pull back, a day..maybe two, but considering the weekly and monthly charts, we'll surely just melt right back up.

If this is the start of a 3-4 month algo-bot melt into the sp'1800s, its going to make the summer of 2013 one which the bears should simply just step aside from.

*I remain on the sidelines, Long Oil and Short silver are trades I will be looking for in the days ahead...when entry levels/conditions look better.

have a good evening.

3pm update - holding gains into the close

There would seem little reason why the market won't be able to hold the current gains into the close. SP' is +7pts @ 1624..only another 175pts to go. 11% across 3-4 months? It just looks as though the market is in the early phase of a relentless new up wave.

sp'daily5

Summary

We've seen this kinda action before, and it can last MONTHS.

The notion that this is merely the tail end of an up cycle...errr, no,..I can't see that.

--

I have to say it is a disturbing thought of sp'1800s by late summer, but hey, at least if I'm right, I can choose NOT to short it, maybe go long sometimes, and then be able to launch a major re-short in the autumn from the 1800s - which is a hell of a lot better than shorting from 1500s..

*consumer credit data due @ 3pm. Look for higher debt, but hey, that's a good thing, right?

-

Gold...is a problem, clearly outside of its bear flag/channel.

back at the close

sp'daily5

Summary

We've seen this kinda action before, and it can last MONTHS.

The notion that this is merely the tail end of an up cycle...errr, no,..I can't see that.

--

I have to say it is a disturbing thought of sp'1800s by late summer, but hey, at least if I'm right, I can choose NOT to short it, maybe go long sometimes, and then be able to launch a major re-short in the autumn from the 1800s - which is a hell of a lot better than shorting from 1500s..

*consumer credit data due @ 3pm. Look for higher debt, but hey, that's a good thing, right?

-

Gold...is a problem, clearly outside of its bear flag/channel.

back at the close

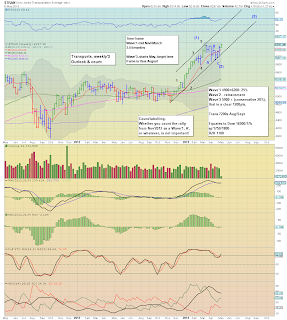

2pm update - Transports soaring into the stratosphere

All the indexes are holding moderate gains..and building upon them. Yet again though, the Transports is the real star, and is now +1.5%, and is making a play for a close in the 6400s. Truly incredible, and that will be a mere 800pts short of my August 7200 target!

Trans,daily

Summary

The old leader is leading...with the fourth consecutive significant daily gain.

Literally..the sky is the limit.

--

I remain content on the sidelines.

On no basis can I understand why anyone would be shorting the market right now. The market mood is not in the least bit gloomy. Quite the opposite.

*VIX is a touch higher, but...that's to be ignored.

Trans,daily

Summary

The old leader is leading...with the fourth consecutive significant daily gain.

Literally..the sky is the limit.

--

I remain content on the sidelines.

On no basis can I understand why anyone would be shorting the market right now. The market mood is not in the least bit gloomy. Quite the opposite.

*VIX is a touch higher, but...that's to be ignored.

1pm update - still moderately higher

Most indexes are moderately higher. Tech is a little weak, largely due to AAPL. Precious metals are mixed, Gold is -$20, but Silver is unusually not following. Oil is back to flat. There remains of course the usual latter day algo-bot melt still viable.

sp'daily5

AAPL, daily

Summary

Back!

--

*I thought I'd highlight AAPL, even though its a touch lower, it is still significantly above its recent lows, and the monthly chart looks floored. Perhaps a back test of the 50 day MA @ 435 ?

Equity bears are facing a real problem if AAPL just rallies across the next few months. I realise AAPL is not the entire market, but if AAPL is rising, you'd have to think the rest of the techs will 'generally' follow.

--

VIX update from Mr T

**consumer credit @ 3pm, although maybe the market can just spin more student debt as a good thing?

sp'daily5

AAPL, daily

Summary

Back!

--

*I thought I'd highlight AAPL, even though its a touch lower, it is still significantly above its recent lows, and the monthly chart looks floored. Perhaps a back test of the 50 day MA @ 435 ?

Equity bears are facing a real problem if AAPL just rallies across the next few months. I realise AAPL is not the entire market, but if AAPL is rising, you'd have to think the rest of the techs will 'generally' follow.

--

VIX update from Mr T

**consumer credit @ 3pm, although maybe the market can just spin more student debt as a good thing?

Pre-Market Brief

Good morning. Futures are moderately higher, sp +3pts, we're set to open around 1620. Precious metals are weak, with silver -1%. Oil is similarly moderately weak. USD is also a touch weak, -0.2% @ 82.17. There remains the persistent issue of algo-bot melt.

sp'60min

sp'daily5

Summary

So, we're set to open a little higher. With very little to move the market, there is more likelihood of upside..than downside, and that also applies to the rest of the week.

*I will be away this morning. Next post probably at 1pm.

--

In the meantime, two videos...

First...Oscar, who is side-stepping the market today.

--

Second, some macro-economics, from Mr Long and Mr Smith

--

as noted...I will probably be back around lunch time

sp'60min

sp'daily5

Summary

So, we're set to open a little higher. With very little to move the market, there is more likelihood of upside..than downside, and that also applies to the rest of the week.

*I will be away this morning. Next post probably at 1pm.

--

In the meantime, two videos...

First...Oscar, who is side-stepping the market today.

--

Second, some macro-economics, from Mr Long and Mr Smith

--

as noted...I will probably be back around lunch time

Melting higher across the summer?

The bears critically failed to break the market decisively lower last week. That failure has now resulted in the weekly charts going back to bullish. The transports are suggestive of the low 7000s this summer, which would equate to sp'1800s, with VIX <10.

sp'weekly2, rainbow

trans'weekly3, rainbow, outlook/count

Summary

Today's gains were enough to provide initial green candles for the SP'500 and Transports weekly charts. The transports is indeed leading the way higher, and that price action from mid-March to last week, sure looks like a wave'2/B. Regardless of how you want to label/count it, the trend is clearly up.

The 7000s look a very viable target, and if that is correct, its not too bold to extrapolate what that might mean for the other indexes. The sp'1800s look very viable, and that is barely 10% higher from where we currently are.

What am I doing?

Having bailed on two major positions last Friday, I'm somewhat adverse to doing anything for at least a few more days. However, I do have eyes for going Long Oil, and short Silver. Current price levels for either are not attractive though, so I'm just sitting back.

Looking ahead

There really isn't anything much at all this week. There is consumer credit tomorrow at 3pm, but really, the main market probably won't even care.

This market is in 100% algo-bot melt mode...bears beware.

Goodnight from London

sp'weekly2, rainbow

trans'weekly3, rainbow, outlook/count

Summary

Today's gains were enough to provide initial green candles for the SP'500 and Transports weekly charts. The transports is indeed leading the way higher, and that price action from mid-March to last week, sure looks like a wave'2/B. Regardless of how you want to label/count it, the trend is clearly up.

The 7000s look a very viable target, and if that is correct, its not too bold to extrapolate what that might mean for the other indexes. The sp'1800s look very viable, and that is barely 10% higher from where we currently are.

What am I doing?

Having bailed on two major positions last Friday, I'm somewhat adverse to doing anything for at least a few more days. However, I do have eyes for going Long Oil, and short Silver. Current price levels for either are not attractive though, so I'm just sitting back.

Looking ahead

There really isn't anything much at all this week. There is consumer credit tomorrow at 3pm, but really, the main market probably won't even care.

This market is in 100% algo-bot melt mode...bears beware.

Goodnight from London

Daily Index Cycle update

With no news, and very little trading volume, we're back to a market where the HFT algo-bots are in total control. The default result is the usual inexorably slow melt upward. Most indexes closed moderately higher, although the Transports saw rather strong gains of 1.3%.

sp'daily5

Trans

Summary

More than anything, I think the breakout on the Transports remains the most important one for traders to keep in mind. The immediate trend remains to the upside, and there is absolutely no sign of a turn/levelling phase.

--

Lets be clear, bears had their chance to break lower last week, and all they could muster was a Wednesday decline of 1% for the headline indexes. The Thursday recovery, and strong gains on Friday are enough to convince me that any hope of downside should be dismissed.

With yet another daily close above the recent sp' high of 1597, those bears still in short positions, should be at least 'concerned', if not already making a run for the exit.

It could be a VERY long summer of market algo-bot melt, and if that's the case, then anyone thinking of shorting the broader market should arguably just turn off their screen and check back in late August.

a little more later...

sp'daily5

Trans

Summary

More than anything, I think the breakout on the Transports remains the most important one for traders to keep in mind. The immediate trend remains to the upside, and there is absolutely no sign of a turn/levelling phase.

--

Lets be clear, bears had their chance to break lower last week, and all they could muster was a Wednesday decline of 1% for the headline indexes. The Thursday recovery, and strong gains on Friday are enough to convince me that any hope of downside should be dismissed.

With yet another daily close above the recent sp' high of 1597, those bears still in short positions, should be at least 'concerned', if not already making a run for the exit.

It could be a VERY long summer of market algo-bot melt, and if that's the case, then anyone thinking of shorting the broader market should arguably just turn off their screen and check back in late August.

a little more later...

Subscribe to:

Comments (Atom)