Despite a touch of weakness across the day, the VIX was itself weak, settling -0.4% @ 12.87. Near term outlook is for the VIX to remain in the 14/11 zone. It continues to look increasingly unlikely that the VIX will be breaking above 20 in the next down wave of late Jan/early February.

VIX'60min

VIX'daily3

Summary

Next to nothing to add on the VIX.

If sp'1850s later this week..or early next, then VIX will surely drop into the low 12s/11s..at least briefly.

--

more later, on what remain..pretty strong indexes

Wednesday, 8 January 2014

Closing Brief

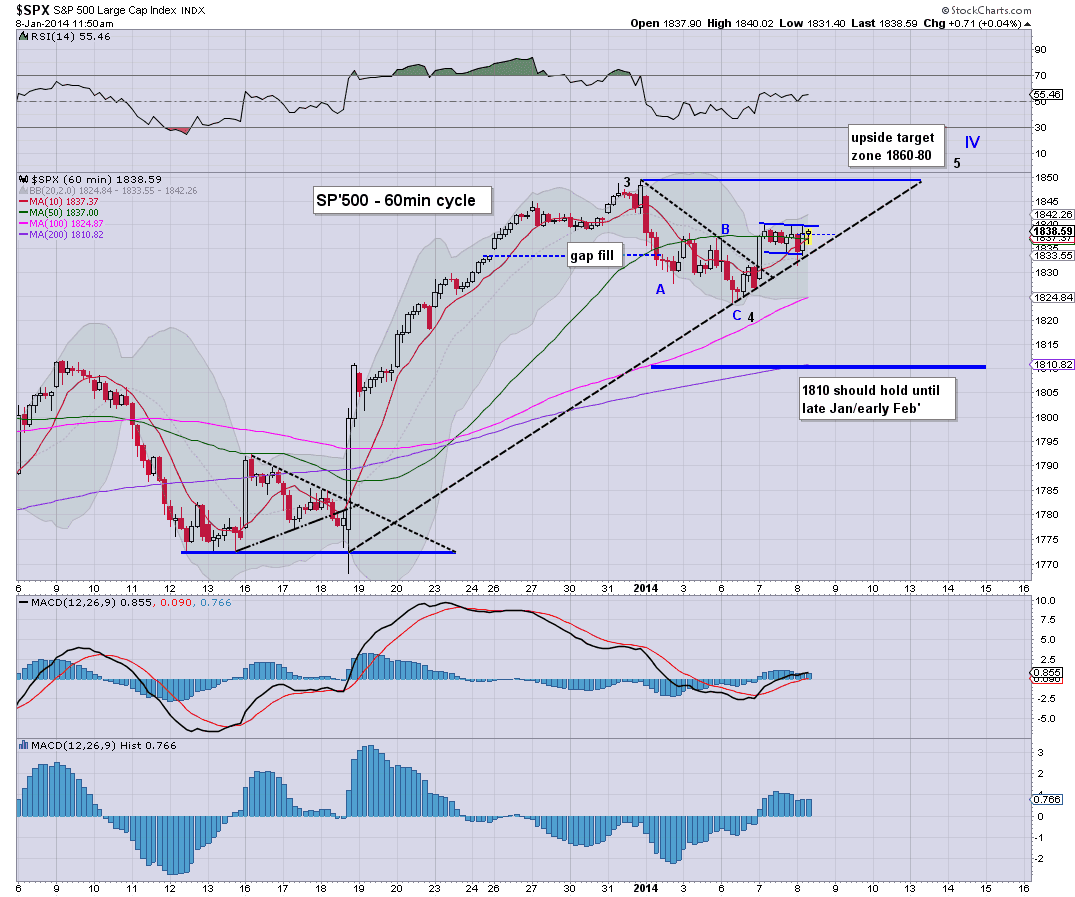

The main indexes closed somewhat mixed, with the sp -0.4pts @ 1837, whilst the Dow slipped 69pts. The two leaders - Trans/R2K, settled +0.3% and unchanged respectively. The near term remains a little choppy, but with underlying upside still very much the case.

sp'60min

Summary

A quiet day...where was everyone today?

--

The price action today was yet another classic example of how the bears get teased every so often, with little drops of 5, 10pts..only to see the market turn right back upward.

Broader trend remains to the upside...a weekly close in the 1850s remains very likely.

---

the usual bits and pieces across the evening.

sp'60min

Summary

A quiet day...where was everyone today?

--

The price action today was yet another classic example of how the bears get teased every so often, with little drops of 5, 10pts..only to see the market turn right back upward.

Broader trend remains to the upside...a weekly close in the 1850s remains very likely.

---

the usual bits and pieces across the evening.

3pm update - closing hour upside

The smaller 5/15min index cycles are prone to breaking to the upside into the close, and a daily close in the low sp'1840s remains viable. Gold and Oil are both weak, lower by -0.7% and -1.5% respectively. VIX continues to reflect a market that has little concern about anything for some weeks to come.

sp'60min

Summary

The situation is very much like yesterday. Bears again showed how weak they are, with the early

morning drop to 1831..only to be swiftly flipped to 1840.

Next issue for the market will be the Friday jobs data, and with sig' QE, even if the market doesn't particularly like the number, what sell side there is..will be greatly negated.

--

Arguably, stock of the day is UAL, +5.9%...now in the $41s, only another $7 to go

-

3.03pm.. VIX looks set to slip fractionally red into the close.

3.25pm...well, hopes of the 1840s can be just about thrown out. Issue now..does 1831 hold.

no doubt, some will be screaming for the 1750s again this evening.

3.33pm..5min cycle offering a floor @ 1832. Buy the dip? ;0

3.48pm.. nasty market...doing a short-stop run...back to 1836....surely not the 1840s at the close?

3.54pm.. 15min cycle set to go + cycle at the Thursday open...bears beware!

sp'60min

Summary

The situation is very much like yesterday. Bears again showed how weak they are, with the early

morning drop to 1831..only to be swiftly flipped to 1840.

Next issue for the market will be the Friday jobs data, and with sig' QE, even if the market doesn't particularly like the number, what sell side there is..will be greatly negated.

--

Arguably, stock of the day is UAL, +5.9%...now in the $41s, only another $7 to go

-

3.03pm.. VIX looks set to slip fractionally red into the close.

3.25pm...well, hopes of the 1840s can be just about thrown out. Issue now..does 1831 hold.

no doubt, some will be screaming for the 1750s again this evening.

3.33pm..5min cycle offering a floor @ 1832. Buy the dip? ;0

3.48pm.. nasty market...doing a short-stop run...back to 1836....surely not the 1840s at the close?

3.54pm.. 15min cycle set to go + cycle at the Thursday open...bears beware!

2pm update - time for some fed speak

Its that time of the month, time to find out what the edited/censored FOMC minutes were from the last month. So long as the market can hold the earlier low of sp'1831 - seemingly likely, equity bulls have little to be concerned about. Metals are sure to get a bit twitchy this hour...Gold currently -$6

sp'60min

Summary

No doubt, the rest of the day will see the mainstream swing to talk of when the next QE-taper might be.

Best guess remains, we close the day in the sp'1840/45 zone, with 1850s by the Friday close.

--

*notable strength: UAL, +4.8%, and continuing to strength.

The upper 40s are well within range.

-

2.07pm.. well, the usual nonsense from the Fed, inc' a probable eventual target of 6.0% headline unemployment. The comedy aspect was the note that the fed debated the participation rate issue.

Anyway, market is holding together, and a close in the 1840s..very likely.

-

UAL continues to build gains....+5.6%...

Notable weakness in the coal miners...

2.19pm.. chop chop...+3pts...-2pts.. +2pts... fun huh?

The 1840s..are a'coming....and you know what follows that?

sp'60min

Summary

No doubt, the rest of the day will see the mainstream swing to talk of when the next QE-taper might be.

Best guess remains, we close the day in the sp'1840/45 zone, with 1850s by the Friday close.

--

*notable strength: UAL, +4.8%, and continuing to strength.

The upper 40s are well within range.

-

2.07pm.. well, the usual nonsense from the Fed, inc' a probable eventual target of 6.0% headline unemployment. The comedy aspect was the note that the fed debated the participation rate issue.

Anyway, market is holding together, and a close in the 1840s..very likely.

-

UAL continues to build gains....+5.6%...

Notable weakness in the coal miners...

2.19pm.. chop chop...+3pts...-2pts.. +2pts... fun huh?

The 1840s..are a'coming....and you know what follows that?

1pm update - ten hours of minor chop

We've had around ten hours of minor price chop in the sp'1830s. It is very likely just a baby bull flag, with upside into the 1850s by the Friday close. Metals are weak, Gold -$10, Silver -2.3%.

sp'60min

Summary

Just another hour until the FOMC minutes...where no doubt, the algo-bots will run rampant for a little while, as the mainstream start wondering about taper part'2.

--

Notable strength: UAL,

No doubt, part of the rise is due to continuing weakness in Oil prices. Upside target - by late spring, remains the 2007 double top of $48

sp'60min

Summary

Just another hour until the FOMC minutes...where no doubt, the algo-bots will run rampant for a little while, as the mainstream start wondering about taper part'2.

--

Notable strength: UAL,

No doubt, part of the rise is due to continuing weakness in Oil prices. Upside target - by late spring, remains the 2007 double top of $48

12pm update - clawing higher into the afternoon

The main indexes are showing their underlying upward pressure, with most of the indexes now slightly positive. A daily close in the sp'1840/45 zone looks...probable. Metals are weak, Gold -$10, Silver -2.2%. Oil remains generally weak, -0.7%.

sp'60min

Summary

Little to add. Lets just see if the market can jump into the mid 1840s after the FOMC minutes are released at 2pm.

---

notable strength in...STX

Only another $40 until triple digits..there is no doubt on that one..and if you think about it for just a little..it has very broad implications for the main market into late 2015.

sp'60min

Summary

Little to add. Lets just see if the market can jump into the mid 1840s after the FOMC minutes are released at 2pm.

---

notable strength in...STX

Only another $40 until triple digits..there is no doubt on that one..and if you think about it for just a little..it has very broad implications for the main market into late 2015.

11am update - normal service continues

The sp'500 has already broken into the 1840s after a very brief micro snap lower to 1831. Nothing has changed, and it remains bizarre how some were getting overly excited at the decline from 1849-1823. Just what part of the recent price action was suggestive of 1750s?

sp'60min

Summary

It remains a laughable market. A classic opening hour..with a micro snap lower..to wash out the weaker bulls, suck in the dumbest of bears...and then whipsaw back to the upside.

The fact the indexes are already a touch higher should be seen as merely a bonus to the bulls.

What will be real interesting is how the market interprets the FOMC minutes at 2pm.

--

Notable weakness: RIG, -2% in the low $48s.

Baring a swift recovery-reversal across the remainder of this week, RIG looks in serious danger of breaking the recent $47 low, and if that occurs, then further downside to 44/43.

sp'60min

Summary

It remains a laughable market. A classic opening hour..with a micro snap lower..to wash out the weaker bulls, suck in the dumbest of bears...and then whipsaw back to the upside.

The fact the indexes are already a touch higher should be seen as merely a bonus to the bulls.

What will be real interesting is how the market interprets the FOMC minutes at 2pm.

--

Notable weakness: RIG, -2% in the low $48s.

Baring a swift recovery-reversal across the remainder of this week, RIG looks in serious danger of breaking the recent $47 low, and if that occurs, then further downside to 44/43.

10am update - opening minor weakness

The indexes open with very minor chop, and again its apparent that the bears have no significant downside power. Market looks set for a very viable latter day ramp..after the FOMC minutes are released. Metals are weak, Gold -$11.

sp'60min

GLD, daily

Summary

Not much to note.

I have to guess we'll close in the 1840/45 range today, and that still keeps open the door for a weekly close in the 1850s.

No one out there should have the audacity to claim the market is weak right now. Is no one looking at the low VIX anymore?

--

Notable weakness, GDX, RIG, TWTR

--

As for the metals...broader trend is still down, but hey..the gold bugs would still dispute that.

--

10.21am.. indexes already set to turn green, great huh? Is anyone really surprised?

anyone still think the mid 1700s viable in this cycle?

10.39am.. and there are the 1840s..and its not even 11am yet.

sp'60min

GLD, daily

Summary

Not much to note.

I have to guess we'll close in the 1840/45 range today, and that still keeps open the door for a weekly close in the 1850s.

No one out there should have the audacity to claim the market is weak right now. Is no one looking at the low VIX anymore?

--

Notable weakness, GDX, RIG, TWTR

--

As for the metals...broader trend is still down, but hey..the gold bugs would still dispute that.

--

10.21am.. indexes already set to turn green, great huh? Is anyone really surprised?

anyone still think the mid 1700s viable in this cycle?

10.39am.. and there are the 1840s..and its not even 11am yet.

Pre-Market Brief

Good morning. Futures are moderately lower, sp -4pts, we're set to open at 1833. Metals are similarly weak, with Gold -$4. Equity bulls need to hold the recent 1823 low, but even then..the real support is not until 1810/00.

sp'60min

Summary

*ADP jobs data came in better than expected @ 238k.

--

So, we're set to open a little lower, but really, price formation is a bull flag on the hourly cycle, and baring a break <1830, and then 1823, we should in theory just battle upward as the day progresses.

Market has the FOMC minutes report to deal with at 2pm..so..look for that as the excuse for a latter day ramp.

--

notable early mover: TWTR -4%, F, +1.3%, although the latter is still holding within a bear flag.

sp'60min

Summary

*ADP jobs data came in better than expected @ 238k.

--

So, we're set to open a little lower, but really, price formation is a bull flag on the hourly cycle, and baring a break <1830, and then 1823, we should in theory just battle upward as the day progresses.

Market has the FOMC minutes report to deal with at 2pm..so..look for that as the excuse for a latter day ramp.

--

notable early mover: TWTR -4%, F, +1.3%, although the latter is still holding within a bear flag.

Just another bullish day

For the equity bulls out there, today was just another day...one of hundreds across the past 4.8yrs, where the market has battled upward. Of course, the QE continues, and today's $2-3bn dose no doubt helped take the edge off what little selling is going on.

sp'weekly8

Summary

There was a bizarrely large amount of bearish talk across the past weekend about how we're going to see a correction into the 1750s..or even lower. As I keep noting...price action simply doesn't suggest that. Bears lack any downside power..and hey..the QE continues!

There is the increasing possibility that we won't even breach <1800 until the summer. How does that sound?

Looking ahead

Tomorrow will see the ADP jobs data - released pre-market, that should be enough to set the tone for much of the day. However, far more important, we have the FOMC minutes (2pm), which will no doubt get everyone into renewed taper talk. A further 10/15bn looks very likely, but probably not until March/April.

Regardless, I suspect the market will use any talk of QE-taper as a positive (ohh the irony!)..and a Wednesday close in the 1850s is very viable.

*next sig' QE is not until Friday

--

Goodnight from London

-

Video update from Oscar

Oscar was bearish for Tuesday, which was surprising to me, since his Trans' chart was highly suggestive of a hold on support. I think his near term ceiling on the sp' is around 1900 by early Feb - not that he has yet said it..but that is where the top channel is on his chart.

--

sp'weekly8

Summary

There was a bizarrely large amount of bearish talk across the past weekend about how we're going to see a correction into the 1750s..or even lower. As I keep noting...price action simply doesn't suggest that. Bears lack any downside power..and hey..the QE continues!

There is the increasing possibility that we won't even breach <1800 until the summer. How does that sound?

Looking ahead

Tomorrow will see the ADP jobs data - released pre-market, that should be enough to set the tone for much of the day. However, far more important, we have the FOMC minutes (2pm), which will no doubt get everyone into renewed taper talk. A further 10/15bn looks very likely, but probably not until March/April.

Regardless, I suspect the market will use any talk of QE-taper as a positive (ohh the irony!)..and a Wednesday close in the 1850s is very viable.

*next sig' QE is not until Friday

--

Goodnight from London

-

Video update from Oscar

Oscar was bearish for Tuesday, which was surprising to me, since his Trans' chart was highly suggestive of a hold on support. I think his near term ceiling on the sp' is around 1900 by early Feb - not that he has yet said it..but that is where the top channel is on his chart.

--

Daily Index Cycle update

The main indexes all closed moderately higher, with the sp +11pts @ 1837. The two leaders - Trans/R2K, settled up by 0.7% and 0.9% respectively. Near term outlook is for the sp' to close the week in the 1850s, and eventually battle into the 1860/80 zone before end month.

sp'daily5

Dow

Trans

Summary

Not much to add.

We have what I believe are bull flags on the daily charts, and there is clear upside of 2-3% for most indexes.

There is little reason why the market won't close this week in the sp'1850s, along with VIX 12/11s.

-

a little more later...

sp'daily5

Dow

Trans

Summary

Not much to add.

We have what I believe are bull flags on the daily charts, and there is clear upside of 2-3% for most indexes.

There is little reason why the market won't close this week in the sp'1850s, along with VIX 12/11s.

-

a little more later...

Subscribe to:

Comments (Atom)