The VIX put in a classic reversal candle in the opening 30 minutes, but by the closing hour, the VIX had taken out the morning low, with the VIX closing -4% @ 15.90. This remains a fearless market, seemingly completely unconcerned about the looming $500bn in tax rises and spending cuts.

VIX'60min

VIX'daily

Summary

A disappointing end to the week for the bears, especially after what is often a classic reversal candle. Oh well, there is always next week.

The VIX remains at bizarrely low levels, and frankly there is only minimal downside, whilst the upside is massive.

From a chart perspective, the bears now need to close back in the mid 16s..and then take out the recent 17.50 peak. A challenge of 19/20 will then be viable.

FOMC is next Wednesday, so things 'in theory' should get more volatile.

--

More later..on the indexes

Friday, 7 December 2012

Closing Brief

A choppy end to the week, and it looked like we were back in low volume algo-bot melt up mode this afternoon. The VIX slipped lower, although the $ managed gains for a third day. It remains a very twisted and frustrating market. There are just 11 trading days before Santa appears.

The closing hourly charts:

dow'60min

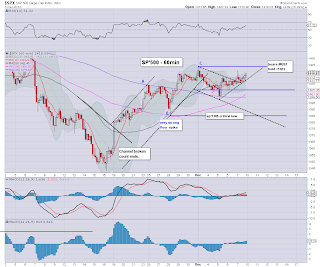

sp'60min

trans'60min

Summary

A frustrating day..and indeed..the week.

We remain trapped within a tight trading range, Bulls seeking >1423...bears.... <1398. A break of either, will probably open up at least a 2-3% move in each direction.

What remains remarkable..there is absolutely NO sign of an agreement to delay (partly or wholly) any of the fiscal cliff changes.

Unless something changes, Mr Market will have to imminently price in Q1 2013 GDP -2 to -4% recession. Or maybe that's bullish?

--

The usual bits and pieces across the evening.

Have a good weekend everyone! ...hope to see you all return next week :)

*there will be a weekend posting, late on Saturday, probably on the weekly index cycles.

The closing hourly charts:

dow'60min

sp'60min

trans'60min

Summary

A frustrating day..and indeed..the week.

We remain trapped within a tight trading range, Bulls seeking >1423...bears.... <1398. A break of either, will probably open up at least a 2-3% move in each direction.

What remains remarkable..there is absolutely NO sign of an agreement to delay (partly or wholly) any of the fiscal cliff changes.

Unless something changes, Mr Market will have to imminently price in Q1 2013 GDP -2 to -4% recession. Or maybe that's bullish?

--

The usual bits and pieces across the evening.

Have a good weekend everyone! ...hope to see you all return next week :)

*there will be a weekend posting, late on Saturday, probably on the weekly index cycles.

3pm update - closing hour confusion

The market now appears in low volume melt mode. The gains are minor.. but they are enough to again challenge the Monday morning highs. A close >1420 would be a lousy end to the week for the bears. Baring a number of the big money bull rats bailing into the close, this market looks set to close moderately higher.

sp'60min

VIX'60min

Summary

VIX is close to taking out the earlier low, which would be very disappointing.

Lets be clear, we could still closer flat, or even a touch lower, but any hopes of <1405/00 by the close..now look out of range.

A frustrating week.

We are (Permabearish) traders

--

UPDATE 3.12pm. I'd like a close <5100 in the transports...

UPDATE 3.27 VIX breaks the earlier low. disappointing.

At least the indexes are showing a touch of weakness though, with sp1414/15

back after the close

sp'60min

VIX'60min

Summary

VIX is close to taking out the earlier low, which would be very disappointing.

Lets be clear, we could still closer flat, or even a touch lower, but any hopes of <1405/00 by the close..now look out of range.

A frustrating week.

We are (Permabearish) traders

--

UPDATE 3.12pm. I'd like a close <5100 in the transports...

UPDATE 3.27 VIX breaks the earlier low. disappointing.

At least the indexes are showing a touch of weakness though, with sp1414/15

back after the close

2pm update - on the edge

The market is still in a slow motion slug fest, trying to find a direction. The bulls could understandably be a little disappointed at the failed opening gains, after the 'better than everyone expected' jobs data. Clearly, the underlying weakness is still there.

trans'60min

vix'60min

Summary

VIX is again failing to spike higher, but..there is still time. So long as it doesn't break the morning low of 16.65, bears shouldn't be overly concerned.

--

Meanwhile, the stock that could never fall, is a mere 41 cents from a death cross. Target in the days and weeks ahead..is somewhere in the mid 400s.

With two hours to go, lets see if we can see a surprise (at least to the mainstream) close <sp'1400.

trans'60min

vix'60min

Summary

VIX is again failing to spike higher, but..there is still time. So long as it doesn't break the morning low of 16.65, bears shouldn't be overly concerned.

--

Meanwhile, the stock that could never fall, is a mere 41 cents from a death cross. Target in the days and weeks ahead..is somewhere in the mid 400s.

With two hours to go, lets see if we can see a surprise (at least to the mainstream) close <sp'1400.

1pm update - battling it out

Mr Market is trying to find a direction. The earlier gains are all faded away, so..you'd have to think the bears once again have a chance at finally breaking the market out of this very tight trading range of 1398-1423. Eyes to the VIX, which right now..back to moderate red, but it could easily see a mini-explosion into the close.

sp'60min

vix'60min

Summary

After those earlier pre-market gains where we were brushing up against the sp'1423 Monday high, I was worried we'd be in the 1430s by this afternoon.

But no, the weakness IS still out there, and lets see if we can see some selling to end the week on a downer. A close <sp'1400 would be a significant victory for the bears.

I remain short, and currently..will be comfortable to hold across the weekend.

*just now on Bloomberg TV, an analyst touting AAPL @ $325.

I think he been looking at my monthly AAPL chart ;) for 2013.

sp'60min

vix'60min

Summary

After those earlier pre-market gains where we were brushing up against the sp'1423 Monday high, I was worried we'd be in the 1430s by this afternoon.

But no, the weakness IS still out there, and lets see if we can see some selling to end the week on a downer. A close <sp'1400 would be a significant victory for the bears.

I remain short, and currently..will be comfortable to hold across the weekend.

*just now on Bloomberg TV, an analyst touting AAPL @ $325.

I think he been looking at my monthly AAPL chart ;) for 2013.

12pm update - bears need give it a few more hours

The opening gains have already completely faded from most indexes. Those bears seeking much lower levels need to give the market a few more hours to churn, battle it out, and then show some weakness into the close. Whether we can spiral lower to close <sp'1400, looks kinda optimistic right now, but everything IS in place.

trans'60min

vix'60min

Summary

The VIX is pulling back right now, and is a little close to the earlier floor. A break of that would not be good! The VIX sure can get twitchy though, this kind of crazy pullback is kinda normal.

-

I remain short, seeking my next exit around sp'1395, although my primary target is 1385/75 by late Tuesday.

With FOMC next Wednesday, I am very concerned about a mini ramp (wave C ?) to take us into Christmas week.

Time for lunch..on this cold day..in London city.

UPDATE 12.30pm. AAPL 1-3 hours away from getting the death cross, that I warned about on Monday.

All those dumb knife catchers buying AAPL yesterday are now getting the smack down.

--

trans'60min

vix'60min

Summary

The VIX is pulling back right now, and is a little close to the earlier floor. A break of that would not be good! The VIX sure can get twitchy though, this kind of crazy pullback is kinda normal.

-

I remain short, seeking my next exit around sp'1395, although my primary target is 1385/75 by late Tuesday.

With FOMC next Wednesday, I am very concerned about a mini ramp (wave C ?) to take us into Christmas week.

Time for lunch..on this cold day..in London city.

UPDATE 12.30pm. AAPL 1-3 hours away from getting the death cross, that I warned about on Monday.

All those dumb knife catchers buying AAPL yesterday are now getting the smack down.

--

11am update - VIX reversal...was the tell

The opening index gains have failed to hold, and we're seeing red starting to appear. The early tell was the VIX, which put in a hollow red candle, a classic reversal sign. There is VIX upside to the low 19s within the next few trading days, which would probably equate to sp'1370s.

vix'60min

sp'60min

Summary

Bears are battling back, and we already have a few red indexes.

As I do like to say...'who wants to go long into the weekend...thats right..I didn't think so'.

A close <sp'1400 would be a real achievement for the bears this week.

--

UPDATE 11.30am Bears need to give this a few hours...

Transports..still holding below the Monday spike high, and seeking a few hours lower into the close, anywhere <5080 would be a start.

How we close today...will be important.

vix'60min

sp'60min

Summary

Bears are battling back, and we already have a few red indexes.

As I do like to say...'who wants to go long into the weekend...thats right..I didn't think so'.

A close <sp'1400 would be a real achievement for the bears this week.

--

UPDATE 11.30am Bears need to give this a few hours...

Transports..still holding below the Monday spike high, and seeking a few hours lower into the close, anywhere <5080 would be a start.

How we close today...will be important.

10am update - last gasp spike?

The monthly jobs data was better than anyone had been seeking, and it was understandable to see futures flip back to green from earlier pre-market declines. So..what now? The question once again is...'who wants to go long into the weekend?'. That's right..I didn't think so.

sp'60min

Trans'60min

spdaily5

Summary

A rough start to the end of the week for the bears. The Dow has taken out the Monday spike high, although the sp' and transports are still holding under.

-

Without doubt, the most notable aspect of the last few days..the strength of the dollar, now up another 0.3% in the USD 80.50s. The downward pressure on equities/commodities IS increasing. despite this mornings opening gains.

*Gold is having a wild ride this morning, -$11...now +$7..despite the dollar. There is chatter out there that Gold might explode highner next week, on the 'QE4' FOMC announcement. Even though such measures were already announced in mid-September.

sigh.

--

UPDATE 10.30am. looks like we've got stuck just under sp1420..so..the line..held.

Even better though...

we have a reversal in the VIX. A classic early warning of index declines...

So, lets see if we can get the indexes red by early afternoon.

That opening VIX hourly candle is the best signal I have right now.

sp'60min

Trans'60min

spdaily5

Summary

A rough start to the end of the week for the bears. The Dow has taken out the Monday spike high, although the sp' and transports are still holding under.

-

Without doubt, the most notable aspect of the last few days..the strength of the dollar, now up another 0.3% in the USD 80.50s. The downward pressure on equities/commodities IS increasing. despite this mornings opening gains.

*Gold is having a wild ride this morning, -$11...now +$7..despite the dollar. There is chatter out there that Gold might explode highner next week, on the 'QE4' FOMC announcement. Even though such measures were already announced in mid-September.

sigh.

--

UPDATE 10.30am. looks like we've got stuck just under sp1420..so..the line..held.

Even better though...

we have a reversal in the VIX. A classic early warning of index declines...

So, lets see if we can get the indexes red by early afternoon.

That opening VIX hourly candle is the best signal I have right now.

Pre-Market Brief

Good morning. Futures are slightly lower, sp -4pts, we're set to open around 1409. We have the big monthly jobs data today, and a few other pieces of econ-data. The Dollar is up again this morning @ 80.50, a break into the 81s would put some serious downside pressure onto the market.

Update: Monthly jobs data: 146k, 7.7% vs 80k, 8.0%, hmm, way above expectations, although earlier months were revised significantly lower.

*futures flip green, we're now sp+9pts, set to open @ 1422

spdaily5

sp'60min

Summary

I still think there is a fair chance we can close the week <sp'1400, that would open up a brief move down to the 1370s, before the FOMC next Wednesday.

*I've updated the daily chart, to highlight my current near term 'best guess'. I have the suspicion though that we simply won't be able to take out the sp'1343 low in this down cycle though.

We'll likely have to wait until after Christmas day.

--

Hopefully...today will be much kinder to the bears..with a clear downward direction, and open up much lower levels for early next week.

Good wishes for today everyone!

--

UPDATE 8.40am.. So...futures flipped to moderate gains, after data, that is frankly..even the cheer leaders on clown network don't quite understand.

7.7%, really? lol, talk about near worthless data.

According to the data, the US economy is almost at the boom levels of the mid 1980s again. Clearly, everything is fine again.

Futures seem to be levelling @ 0.5 gains, around sp 5/6pts...so..sp'1420 at the open.

Absolutely critical...the Monday spike high of sp'1423. If we break that, then...1430s..at least 'briefly'.

Dow..has broken above the recent high in pre-market...so far..other indexes still holding under their Monday spike highs.

SP' futures, set to open @ 1421, thats too close for comfort, and considering the Dow'...1423 looks set to also be broken through.

* the most disturbing thing about all of this.... we're just 3.5% from the index (mid-Sept) peak.

Update: Monthly jobs data: 146k, 7.7% vs 80k, 8.0%, hmm, way above expectations, although earlier months were revised significantly lower.

*futures flip green, we're now sp+9pts, set to open @ 1422

spdaily5

sp'60min

Summary

I still think there is a fair chance we can close the week <sp'1400, that would open up a brief move down to the 1370s, before the FOMC next Wednesday.

*I've updated the daily chart, to highlight my current near term 'best guess'. I have the suspicion though that we simply won't be able to take out the sp'1343 low in this down cycle though.

We'll likely have to wait until after Christmas day.

--

Hopefully...today will be much kinder to the bears..with a clear downward direction, and open up much lower levels for early next week.

Good wishes for today everyone!

--

UPDATE 8.40am.. So...futures flipped to moderate gains, after data, that is frankly..even the cheer leaders on clown network don't quite understand.

7.7%, really? lol, talk about near worthless data.

According to the data, the US economy is almost at the boom levels of the mid 1980s again. Clearly, everything is fine again.

Futures seem to be levelling @ 0.5 gains, around sp 5/6pts...so..sp'1420 at the open.

Absolutely critical...the Monday spike high of sp'1423. If we break that, then...1430s..at least 'briefly'.

Dow..has broken above the recent high in pre-market...so far..other indexes still holding under their Monday spike highs.

SP' futures, set to open @ 1421, thats too close for comfort, and considering the Dow'...1423 looks set to also be broken through.

* the most disturbing thing about all of this.... we're just 3.5% from the index (mid-Sept) peak.

Mr Dollar and the Markets

The US dollar saw its second consecutive day higher, and it was thus surprising to see the equity markets still hold together. If the USD breaks into the 81s early next week, I find it very difficult to imagine equity prices still above the big sp'1400 level.

USD, daily

USD, monthly, rainbow

Summary

So, two days up for the dollar, and we're back in the low 80s. Yet, only with a break into the 81s can the equity (and commodity) bears start to get excited.

The monthly USD charts offer massive upside to 84/85 in early 2013, but that of course is a mere possibility, and right now, we're still extremely close to the lower rising channel - that now spans almost two years. Indeed a break <77.50 would be extremely bullish for the indexes, and even more so..for WTIC Oil and the precious metals.

As at Monday, the $ rainbow monthly chart candle was red, its now back to blue, and I'm looking for it to flip back to bullish green next week. It will be an important signal to watch for.

--

As for the equity markets, we're on the edge of a breakout. Anything over sp'1423 tomorrow would suggest a challenge of the mid Sept' QE spike high of sp'1474.

The doomer bears need a weekly close <sp'1400, which would really help make up for what has been a very frustrating week in bear land.

sp'daily5b - scenarios

If we break sp'1423 tomorrow, then A' is viable once again, which is a scary thought.

My revised 'best guess' is now C, where we are going to see a minor decline across the next few days - prior to FOMC next Wednesday, but then a final C' wave higher into Christmas.

Scenario B' was always faced with the problem of the seasonal 'Santa rally'. It would appear - based on the price action this week - and the widespread mild hysteria, that B' is now very unlikely.

sp'daily7 - fibs, near term

I still think there is a chance - so long as don't go above 1423 tomorrow, that the next target is somewhere in the 1385/75 zone.

--

As for Friday, its very difficult to guess. Considering the action in the past few days, it wouldn't surprise me if the market rallied despite 'worse than expected' jobs data, or any data for that matter.

It is frankly, disturbing to see how this market is trading in the past few days. On any basis, it should at least be lurking in the sp'1380s. I shall hope we close tomorrow <sp'1400.

Goodnight from London

USD, daily

USD, monthly, rainbow

Summary

So, two days up for the dollar, and we're back in the low 80s. Yet, only with a break into the 81s can the equity (and commodity) bears start to get excited.

The monthly USD charts offer massive upside to 84/85 in early 2013, but that of course is a mere possibility, and right now, we're still extremely close to the lower rising channel - that now spans almost two years. Indeed a break <77.50 would be extremely bullish for the indexes, and even more so..for WTIC Oil and the precious metals.

As at Monday, the $ rainbow monthly chart candle was red, its now back to blue, and I'm looking for it to flip back to bullish green next week. It will be an important signal to watch for.

--

As for the equity markets, we're on the edge of a breakout. Anything over sp'1423 tomorrow would suggest a challenge of the mid Sept' QE spike high of sp'1474.

The doomer bears need a weekly close <sp'1400, which would really help make up for what has been a very frustrating week in bear land.

sp'daily5b - scenarios

If we break sp'1423 tomorrow, then A' is viable once again, which is a scary thought.

My revised 'best guess' is now C, where we are going to see a minor decline across the next few days - prior to FOMC next Wednesday, but then a final C' wave higher into Christmas.

Scenario B' was always faced with the problem of the seasonal 'Santa rally'. It would appear - based on the price action this week - and the widespread mild hysteria, that B' is now very unlikely.

sp'daily7 - fibs, near term

I still think there is a chance - so long as don't go above 1423 tomorrow, that the next target is somewhere in the 1385/75 zone.

--

As for Friday, its very difficult to guess. Considering the action in the past few days, it wouldn't surprise me if the market rallied despite 'worse than expected' jobs data, or any data for that matter.

It is frankly, disturbing to see how this market is trading in the past few days. On any basis, it should at least be lurking in the sp'1380s. I shall hope we close tomorrow <sp'1400.

Goodnight from London

Daily Index Cycle update

The broader equity market closed largely flat, although the big dow and SP' both managed close at the highs of the day. The VIX closed fractionally higher, and was certainly not a confirmation of any index strength, and there is still distinct weakness apparent at times.

IWM, daily

SP'daily5

Trans

Summary

Today was painfully annoying, and at times..even somewhat boring.

I'm getting really tired of waiting for some decent dynamic trading. Yet, we are getting close to Christmas, and trading volume is likely to largely evaporate once we get past Dec'14.

Bulls regaining control ?

The underlying momentum is starting to level out on some indexes, and even tick higher on a few.

The bears..including yours truly, had better hope the market does not break >sp'1423 tomorrow, or it could signal a very strong end to the year - despite the endless problems, but hey, since when did the market care about fundamentals?

A little more later

IWM, daily

SP'daily5

Trans

Summary

Today was painfully annoying, and at times..even somewhat boring.

I'm getting really tired of waiting for some decent dynamic trading. Yet, we are getting close to Christmas, and trading volume is likely to largely evaporate once we get past Dec'14.

Bulls regaining control ?

The underlying momentum is starting to level out on some indexes, and even tick higher on a few.

The bears..including yours truly, had better hope the market does not break >sp'1423 tomorrow, or it could signal a very strong end to the year - despite the endless problems, but hey, since when did the market care about fundamentals?

A little more later

Subscribe to:

Comments (Atom)