With some underlying geo-political concerns, the VIX held up for most of the day, but was knocked lower into the close settling -0.6% @ 11.98. Near term outlook is for continued equity strength, which will likely keep the VIX within the 13/10 zone.

VIX'60min

VIX'daily3

VIX'weekly

Summary

*across the week, the VIX gained a moderate 4.4% .

--

As is often the case, the VIX was duly knocked lower in the closing hour.. ahead of the long weekend.

VIX in the 11s remains a bizarrely low level, and reflects a market that has effectively zero fear of anything 'significantly scary' in the near term.

VIX 20s look unlikely until at least October.

--

more later.. on the indexes

Friday, 29 August 2014

Closing Brief

US indexes clawed higher into the holiday weekend, sp +6pts @ 2003. The two leaders - Trans/R2K, settled u/c and +0.7% respectively. Near term outlook is for 2020s next week, with 2030/50 in the latter half of September.

sp'60min

Summary

...and another month in the crazy & twisted market comes to a close.

--

It has been a really bullish month, having seen a ramp from sp'1904 to a new historic high of 2005.

Daily/weekly cycles are offering the 2020s next week, which seems very probable.

Sincerely.. have a great holiday weekend everyone!

-

more later... on the VIX

sp'60min

Summary

...and another month in the crazy & twisted market comes to a close.

--

It has been a really bullish month, having seen a ramp from sp'1904 to a new historic high of 2005.

Daily/weekly cycles are offering the 2020s next week, which seems very probable.

Sincerely.. have a great holiday weekend everyone!

-

more later... on the VIX

3pm update - micro melt into the holiday weekend

US equities look set to close the day..week..and the trading month around the giant sp'2000 threshold. It has unquestionably been a very bullish month, with the sp' ramping from 1904 to a new historic high of 2005, along with a VIX that has fallen from the mid 17s.

sp'60min

Summary

Well, it has been one hell of a month.

Many I know were touting sp'1860s at the start of the month.. we never got there..and with a break above the giant psy' level of 2000, Mr Market continues on a very bullish path.

To be clear..

I am VERY open to a short/mid term top in mid/late September, somewhere in the 2030/50 zone.

Problem is..I still fear a pull back in October might only be 3% or so.

-

*I hold long across the weekend, via SDRL, (almost back to flat, after the post earnings miss). Will hold until next Wed/Thursday, seeking 38.50/39s.

--

3.39pm... Indexes all currently fractionally green... and with the 3.33pm howling out of the way.. market looks set for melt higher into the close.

....back at the close.

sp'60min

Summary

Well, it has been one hell of a month.

Many I know were touting sp'1860s at the start of the month.. we never got there..and with a break above the giant psy' level of 2000, Mr Market continues on a very bullish path.

To be clear..

I am VERY open to a short/mid term top in mid/late September, somewhere in the 2030/50 zone.

Problem is..I still fear a pull back in October might only be 3% or so.

-

*I hold long across the weekend, via SDRL, (almost back to flat, after the post earnings miss). Will hold until next Wed/Thursday, seeking 38.50/39s.

--

3.39pm... Indexes all currently fractionally green... and with the 3.33pm howling out of the way.. market looks set for melt higher into the close.

....back at the close.

2pm update - Transports bull flag

US equities continue to quietly churn ahead of a holiday weekend. The sp'500 looks set for a monthly close around the giant 2000 threshold. The 'old leader' Transports is offering a 2 week bull flag.. with the 8500/600s next week.

Trans'daily

Summary

Little to add..

--

Notable weakness: airlines, DAL -1.4%, UAL, 2.1%

Trans'daily

Summary

Little to add..

--

Notable weakness: airlines, DAL -1.4%, UAL, 2.1%

1pm update - net weekly gains

US indexes are holding minor net gains, with the sp'500 hovering around the giant 2000 threshold. VIX is +1%, but will likely get knocked back to negative into the monthly close.

sp'weekly8

Summary

All indexes look set for another net weekly gain. For the sp'500, that will make for the fourth consecutive gain..pretty impressive..and we're almost a clear 100pts above the 1904 low.

-

Weekly MACD cycle will turn positive at the Tuesday open.... the 2020s look an easy target.

sp'weekly8

Summary

All indexes look set for another net weekly gain. For the sp'500, that will make for the fourth consecutive gain..pretty impressive..and we're almost a clear 100pts above the 1904 low.

-

Weekly MACD cycle will turn positive at the Tuesday open.... the 2020s look an easy target.

12pm update - melting higher

With no 'spooky news' this morning, the bears have zero downside power, and market is back into slow algo-bot melt mode to sp'2002. VIX is a touch lower...set for a weekly close in the 11s. Metals remain a touch weak, Gold -$2.

sp'daily5

Summary

...Mr Riley returns... :)

--

VIX update from Mr T.

--

time for lunch

sp'daily5

Summary

...Mr Riley returns... :)

--

VIX update from Mr T.

--

time for lunch

11am update - micro chop

Equities are back to flat, and look set for micro chop across the rest of the day. With the Chicago PMI coming in at a very strong 64.3, and consumer sentiment at 82, there is little for the econ-bears to tout.

sp'60min

Summary

Little to add... micro chop...

Sp'2020s look very likely next week, if the ECB can placate the QE needy markets.

--

Notable strength: TSLA +2%

sp'60min

Summary

Little to add... micro chop...

Sp'2020s look very likely next week, if the ECB can placate the QE needy markets.

--

Notable strength: TSLA +2%

10am update - opening minor gains

US equities open a little higher, back above the giant sp'2000 threshold. Hourly cycles are offering upside into the Friday/monthly close. VIX is melting lower, with a likely close in the 11s. Metals are weak, Gold -$3, and that is not helping the miners.

sp'60min

VIX'60min

Summary

*Most notable, the upper bollinger on the daily, now in the 2020s. Consider that the weekly cycle is also offering the 2020s... it seems a viable level next week.

-

As things are.. we have opening gains... failing.. .and a reversal candle on the VIX.

The problem for the bears... barring a sporadic 'spooky' news headline... just where is the downside power going to come from?

At best.. 1985/80...if that... and then up next week.

10.33am.. sp -1pt..... exciting huh?

Really, for most, nothing to see here today.... turn off ya screens...and enjoy the last days of summer.

sp'60min

VIX'60min

Summary

*Most notable, the upper bollinger on the daily, now in the 2020s. Consider that the weekly cycle is also offering the 2020s... it seems a viable level next week.

-

As things are.. we have opening gains... failing.. .and a reversal candle on the VIX.

The problem for the bears... barring a sporadic 'spooky' news headline... just where is the downside power going to come from?

At best.. 1985/80...if that... and then up next week.

10.33am.. sp -1pt..... exciting huh?

Really, for most, nothing to see here today.... turn off ya screens...and enjoy the last days of summer.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +5pts, we're set to open at 2001. Metals are a touch weak, Gold -$4, whilst Oil is +0.3%. Equity bulls look set to close higher for the fourth consecutive week.

sp'daily5

Summary

*awaiting a trio of econ-data, most notably, Chicago PMI @ 9.45am.

---

So..we're set to open back in the 2000s. Whether the bull maniacs can attain a weekly/monthly close in the 2000s, it is not really important...would merely be a bonus.

Once this mornings econ-data is out of the way, it will likely be a very quiet day..leading into a 3 day holiday weekend.

There are of course end-month trading issues, with (I believe) some degree of rebalancing.

--

9.15am.. Notable early strength: TSLA +2%

9.34am.. Upper bollinger on the daily is now up to 2024..... so..we could easily be in the 2020s next week.

9.45am.. PMI: 64.3 vs 56.4 exp' .. a hugely bullish number... best since May.

sp'daily5

Summary

*awaiting a trio of econ-data, most notably, Chicago PMI @ 9.45am.

---

So..we're set to open back in the 2000s. Whether the bull maniacs can attain a weekly/monthly close in the 2000s, it is not really important...would merely be a bonus.

Once this mornings econ-data is out of the way, it will likely be a very quiet day..leading into a 3 day holiday weekend.

There are of course end-month trading issues, with (I believe) some degree of rebalancing.

--

9.15am.. Notable early strength: TSLA +2%

9.34am.. Upper bollinger on the daily is now up to 2024..... so..we could easily be in the 2020s next week.

9.45am.. PMI: 64.3 vs 56.4 exp' .. a hugely bullish number... best since May.

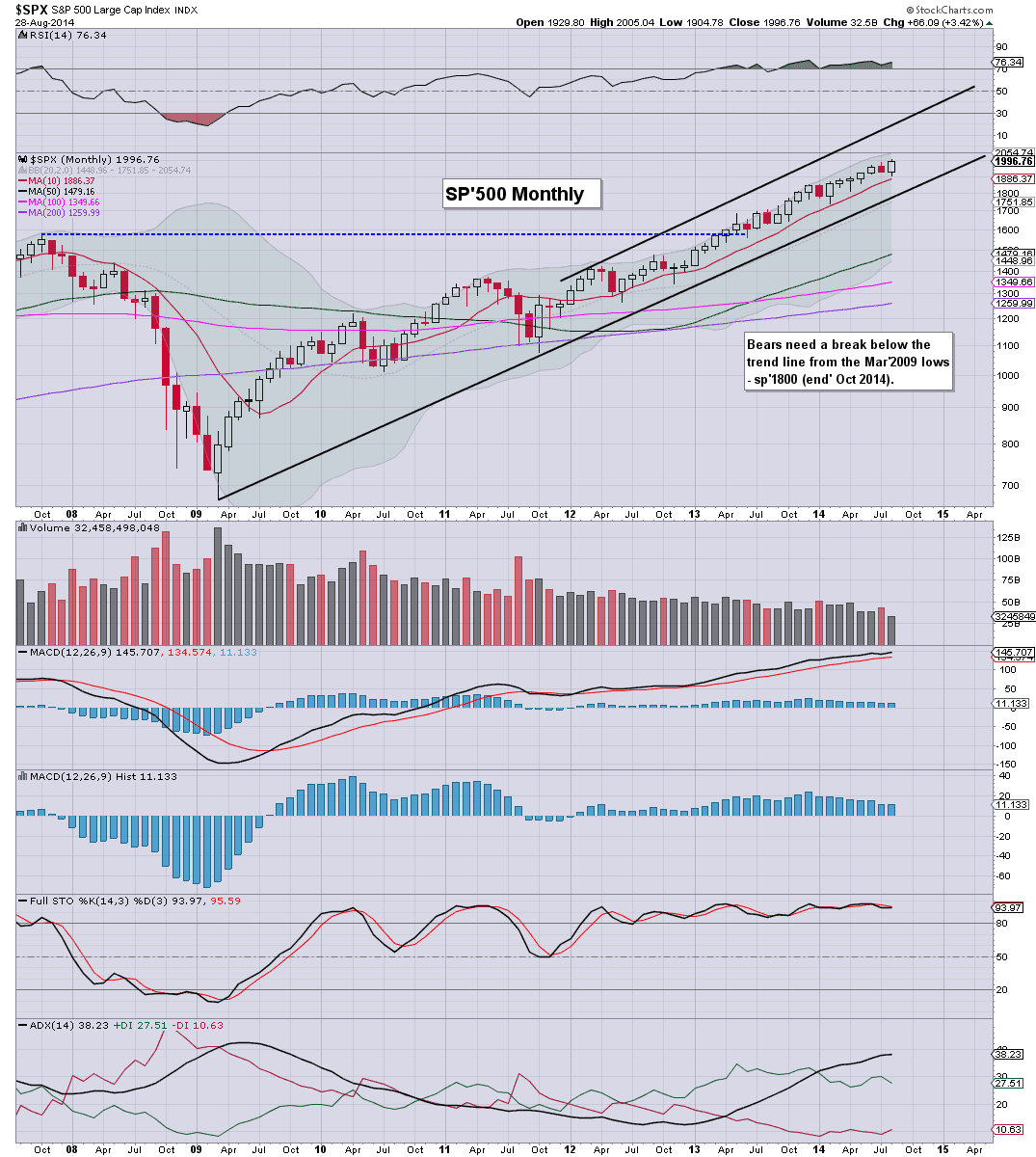

Minor churn into end month

US equities continued to see subdued trading conditions ahead of the long holiday weekend. All US indexes are set for powerful net monthly gains, and with bullish engulfing candles all over the place, the outlook for September is for further upside of another 1-3%.

sp'weekly8

sp'monthly

Summary

Barring some bizarre Friday decline of 25/30pts, the weekly 'rainbow' chart is set to conclude the week with a second consecutive green candle.

Far more important though, the monthly charts are set to close with very powerful net monthly gains of 3-5%.

Looking ahead

There is a trio of econ-data to wrap up the week... Pers' income/outlays, Chicago PMI, and consumer sentiment. Those should give the market the excuse it needs to either wash out the weaker bulls in another minor down wave to the 1985/80 zone... or just gap right back into the 2000s.

Regardless of any minor moves tomorrow, net week looks set for new highs, into the sp'2010/20s.

*the next QE schedule will be issued tomorrow afternoon at 3pm.

--

Goodnight from London

sp'weekly8

sp'monthly

Summary

Barring some bizarre Friday decline of 25/30pts, the weekly 'rainbow' chart is set to conclude the week with a second consecutive green candle.

Far more important though, the monthly charts are set to close with very powerful net monthly gains of 3-5%.

Looking ahead

There is a trio of econ-data to wrap up the week... Pers' income/outlays, Chicago PMI, and consumer sentiment. Those should give the market the excuse it needs to either wash out the weaker bulls in another minor down wave to the 1985/80 zone... or just gap right back into the 2000s.

Regardless of any minor moves tomorrow, net week looks set for new highs, into the sp'2010/20s.

*the next QE schedule will be issued tomorrow afternoon at 3pm.

--

Goodnight from London

Daily Index Cycle update

US indexes saw minor weak chop across the day, sp -3pts @ 1996. The two leaders - Trans/R2K, settled lower by -0.3% and -0.6% respectively. Near term outlook offers 1985/80 for the bears (at best), but with broader upside across September.

sp'daily5

NYSE Comp'

Summary

Another day closer to a 3 day holiday weekend, and the market is naturally very subdued.

Contrary to what some are saying, whether the sp'500 manages a weekly/monthly close in the 2000s is of no importance. The primary trend remains strongly bullish.

--

a little more later...

sp'daily5

NYSE Comp'

Summary

Another day closer to a 3 day holiday weekend, and the market is naturally very subdued.

Contrary to what some are saying, whether the sp'500 manages a weekly/monthly close in the 2000s is of no importance. The primary trend remains strongly bullish.

--

a little more later...

Subscribe to:

Comments (Atom)