With the main indexes recovering very strongly across the day, the VIX failed to hold the morning gains. Having peaked at 17.74, the VIX settled higher by just +2.2% @ 16.07. Despite uncertainty about the US shutdown/debt ceiling, the market simply doesn't take it seriously.

VIX'60min

VIX'daily3

Summary

All things considered, the VIX is remarkably low, considering there is still no agreement to raise the debt ceiling..never mind ending the (if limited) US Govt. shutdown.

From the perspective of 'Mr Market', it simply does not believe a US default is viable.

I agree!

--

more later..on the indexes

Monday, 14 October 2013

Closing Brief

The main indexes strongly recovered from opening declines of almost 1%, with the sp +7pts @ 1710. Near term trend is very much back to the upside. The two leaders - Trans/R2K, closed +0.1% and +0.5% respectively. Mr Market has little real fear of an actual US debt default.

sp'60min

Summary

For the bears, a truly lousy and disappointing day. For those buying the opening drop...(which I guess would include Mr Carboni and his legion of followers)...congrats.

*having watched a lot of Bloomberg TV today, it remains laughable how even they are playing the 'doomsday' debt ceiling game.

It is merely a game to the political and financial elite in Washington and NYC.

There will be no default.

-

more later, on the VIX

sp'60min

Summary

For the bears, a truly lousy and disappointing day. For those buying the opening drop...(which I guess would include Mr Carboni and his legion of followers)...congrats.

*having watched a lot of Bloomberg TV today, it remains laughable how even they are playing the 'doomsday' debt ceiling game.

It is merely a game to the political and financial elite in Washington and NYC.

There will be no default.

-

more later, on the VIX

3pm update - battered bears

Regardless of how the indexes close today, the bears have unquestionably suffered again. The overnight drop of barely 1% is now a distant memory, with sp' already hitting 1709. New historic highs look viable in the days ahead..and again I shall ask..why will it ever stop?

sp'60min

Summary

The micro 5/15min index cycle charts are offering a turn to the downside, but really, bulls should be able to hold the big 1700 threshold..which would still make for one major recovery from the opening declines.

-

For many out there, I realise today was rough, never mind the disappointment after overnight price action.

You have my sympathies.

updates into the close...

*yours truly will hold USO overnight...

Looks okay for the mid 37s..but it still needs to break the down trend resistance.

-

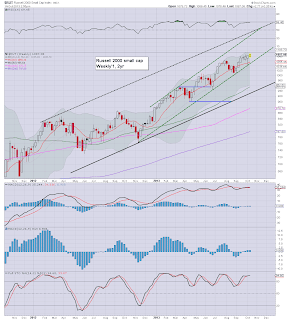

R2K..new highs...the 1200s look possible by end year.

I'd guess is R2K 1200, the sp'1850/1900 ..urghh

-

3.16pm..and there go the sp'1710 stops. Well, there really isn't any resistance now until the 1729 high.

So..if a provisional agreement is announced..it looks like we'll be testing the old high..and likely break it. Not least..since the R2K already has.

3.48pm...micro 5/15min cycles look weak..a little move lower into the close. The hourly 10MA should provide support at 1702/00.

back at the close.

sp'60min

Summary

The micro 5/15min index cycle charts are offering a turn to the downside, but really, bulls should be able to hold the big 1700 threshold..which would still make for one major recovery from the opening declines.

-

For many out there, I realise today was rough, never mind the disappointment after overnight price action.

You have my sympathies.

updates into the close...

*yours truly will hold USO overnight...

Looks okay for the mid 37s..but it still needs to break the down trend resistance.

-

R2K..new highs...the 1200s look possible by end year.

I'd guess is R2K 1200, the sp'1850/1900 ..urghh

-

3.16pm..and there go the sp'1710 stops. Well, there really isn't any resistance now until the 1729 high.

So..if a provisional agreement is announced..it looks like we'll be testing the old high..and likely break it. Not least..since the R2K already has.

3.48pm...micro 5/15min cycles look weak..a little move lower into the close. The hourly 10MA should provide support at 1702/00.

back at the close.

2pm update - bears throwing bricks

With the indexes all moderately positive, it is somewhat understandable if some equity bears have thrown a few bricks at their trading screens today. Mr Market has little concern, and does not believe the US will default on debt/interest payments. VIX is reflecting the lack of concern.

sp'60min

vix'60min

Summary

Last nights futures of sp-15pts..is now a fuzzy memory/dream.

--

Obviously, until we get an agreement, it is risky to be involved on the long side, but clearly, today again showed...underlying pressure remains to the upside.

*metals look weak...whilst Oil is trying to hold onto the earlier moderate gains.

sp'60min

vix'60min

Summary

Last nights futures of sp-15pts..is now a fuzzy memory/dream.

--

Obviously, until we get an agreement, it is risky to be involved on the long side, but clearly, today again showed...underlying pressure remains to the upside.

*metals look weak...whilst Oil is trying to hold onto the earlier moderate gains.

1pm update - normal service resumes

The indexes are already starting to turn positive, and no doubt there is a great deal of dismay amongst the equity bears. What happened to last nights big declines huh? Metals look weak, and could even close red. Oil (as expected)..has turned higher, and looks set to build gains into tomorrow.

sp'daily5

vix'daily3

Summary

*black candle on the VIX, with a fail-spike...not a good sign for equity bears.

---

For the bears, this is simply another major disappointment, yet...we've been here a hundred times before.

It is kinda hard to guess if the market will manage further strong gains on the eventual news of an agreement. The bullish outlook would suggest 1740/60s within 2-3 weeks.

I realise many are looking for a turn at that point, yet...I see little reason why it can't keep going from there...into spring 2014.

--

*USO is going really well, underlying strength, even apparent in overnight action. Should be good for the mid 37s, as early as tomorrow.

--

stock of the day..NFLX.

The hysteria returns in full.

-

1.15pm... sp'1706...bears will be throwing bricks at their screens about now.

--

sp'daily5

vix'daily3

Summary

*black candle on the VIX, with a fail-spike...not a good sign for equity bears.

---

For the bears, this is simply another major disappointment, yet...we've been here a hundred times before.

It is kinda hard to guess if the market will manage further strong gains on the eventual news of an agreement. The bullish outlook would suggest 1740/60s within 2-3 weeks.

I realise many are looking for a turn at that point, yet...I see little reason why it can't keep going from there...into spring 2014.

--

*USO is going really well, underlying strength, even apparent in overnight action. Should be good for the mid 37s, as early as tomorrow.

--

stock of the day..NFLX.

The hysteria returns in full.

-

1.15pm... sp'1706...bears will be throwing bricks at their screens about now.

--

12pm update - no downside power

The main indexes are recovering from the opening declines, and a marginally higher close is very viable. If today was merely a wave'2/B, the next move higher should at least be into the sp'1720s. Metals are starting to struggle, whilst Oil is back to flat.

sp'daily5

uso'daily2

Summary

*I am long Oil, via USO, and I'd like the mid 37s for an exit.

--

No doubt, many equity bears who were overly excited about the overnight futures declines..are starting to get real mad right now.

VIX update from Mr T.

time for tea.

sp'daily5

uso'daily2

Summary

*I am long Oil, via USO, and I'd like the mid 37s for an exit.

--

No doubt, many equity bears who were overly excited about the overnight futures declines..are starting to get real mad right now.

VIX update from Mr T.

time for tea.

11am update - very quiet morning

The main indexes are moderately lower, with the sp -0.4%. The only notable move is in the VIX, +12% in the 17.60s. Metals are holding gains, Gold +$12. Oil is a touch lower, but looks set to jump higher across the next day or two.

sp'60min

dow'daily2

Summary

It really is quiet out there, although partly, that is likely due to the US holiday.

-

Today is probably just a minor retracement before the next lurch higher.

For the big money, the obvious stop area are the dow 14700s. Anything under that, and it makes the mid-term picture bearish.

The question remains....do you think a zombie apocalypse is coming this weekend?

If so, then you have far more important things to be concerned with, than this sleepy market.

sp'60min

dow'daily2

Summary

It really is quiet out there, although partly, that is likely due to the US holiday.

-

Today is probably just a minor retracement before the next lurch higher.

For the big money, the obvious stop area are the dow 14700s. Anything under that, and it makes the mid-term picture bearish.

The question remains....do you think a zombie apocalypse is coming this weekend?

If so, then you have far more important things to be concerned with, than this sleepy market.

10am update - opening declines, but nothing major

There remains some uncertainty about whether the US political maniacs are going to be able to reach a debt ceiling agreement this week. Yet, the market has only opened moderately lower, and the VIX is already warning the bears of underlying upward pressure from last week.

sp'60min

dow'weekly'3

Summary

*across this week, I will be highlighting what remains a particularly weak index...the Dow.

The snap/break level is absolutely crystal clear. If the 200 day MA @ 14758 is once again broken, Mr Market will be in real trouble.

Anyway, as is usually the case, the market should be level out by 11am.

-

*i remain long Oil, via USO. Its holding up particularly well, and I have to guess it'll close somewhat higher. I will probably hold that into tomorrow.

10.32am.. its quiet out there. Even the lower traffic on this site is indicative of a market that just isn't that concerned.

VIX'60min

Certainly, the VIX is higher, but we're under the 20s, and a break <15.50 looks likely once the market decides an agreement will be made.

*I would imagine a fair few are shorting TVIX/UVXY this morning, although that is not without risk, until that agreement is actually made.

sp'60min

dow'weekly'3

Summary

*across this week, I will be highlighting what remains a particularly weak index...the Dow.

The snap/break level is absolutely crystal clear. If the 200 day MA @ 14758 is once again broken, Mr Market will be in real trouble.

Anyway, as is usually the case, the market should be level out by 11am.

-

*i remain long Oil, via USO. Its holding up particularly well, and I have to guess it'll close somewhat higher. I will probably hold that into tomorrow.

10.32am.. its quiet out there. Even the lower traffic on this site is indicative of a market that just isn't that concerned.

VIX'60min

Certainly, the VIX is higher, but we're under the 20s, and a break <15.50 looks likely once the market decides an agreement will be made.

*I would imagine a fair few are shorting TVIX/UVXY this morning, although that is not without risk, until that agreement is actually made.

Pre-Market Brief

Good morning. Futures are lower, sp -12pts, we're set to open at 1691. Precious metals are significantly higher, with Gold +$16, Silver +30 cents (1.5%) Oil is holding up relatively strong, just 0.3% lower. After last weeks stark reversal to the upside, equity bulls are pretty much back in control.

sp'60min

Summary

So...a lower open to start the week, but even 1685 won't do too much damage to the recent hyper-ramp.

I certainly do not anticipate the recent gains all being given back this week, not least with some pretty major QE due.

--

*I would guess many of the chartists out there this morning will be labelling today's price action as a pull back/retracement, and a fair few will actually be going long.

Video update from Mr Permabull..who is not surprisingly...bullish.

A green omni, I guess he is buying the lower open then. If I were him, I'd at least wait until 11am, give the market some time to level out.

--

9.39am... black candles on the hourly/daily VIX charts. Bears...already in trouble.

sp'60min

Summary

So...a lower open to start the week, but even 1685 won't do too much damage to the recent hyper-ramp.

I certainly do not anticipate the recent gains all being given back this week, not least with some pretty major QE due.

--

*I would guess many of the chartists out there this morning will be labelling today's price action as a pull back/retracement, and a fair few will actually be going long.

Video update from Mr Permabull..who is not surprisingly...bullish.

A green omni, I guess he is buying the lower open then. If I were him, I'd at least wait until 11am, give the market some time to level out.

--

9.39am... black candles on the hourly/daily VIX charts. Bears...already in trouble.

Subscribe to:

Comments (Atom)