With equities continuing to unravel for a second consecutive day, the VIX battled higher (intra high 19.35), settling +13.8% @ 18.11. Near term outlook is borderline, and will be largely dependent on how the market interprets the Friday jobs data. Clearly, a brief foray into the 20s is now viable.

VIX'60min

VIX'daily3

Summary

Suffice to say.. the second consecutive net daily gain in the VIX.

The last two hourly candles of the day were highly suggestive of a short term top.

Best guess... equities to resume higher.. with a weekly close in the sp'2070s, and that will likely equate to VIX in the 16/15s.

--

more later... on the indexes

Thursday, 3 December 2015

Closing Brief

US equities closed significantly lower, sp -29pts @ 2049 (intra low 2042). The two leaders - Trans/R2K, both settled lower by -1.8%. With the loss of the 200dma, near term outlook is borderline. Equity bulls need a strong counter rally on jobs Friday to at least partly negate the Wed/Thursday decline of -3.1%.

sp'60min

Summary

closing hour action: a test of the 2pm hour low of 2042.. and then rebounding.

--

The 2pm and 3pm hourly candles are both of the spike-floor type, highly suggestive market is building a floor.

Clearly, with the jobs data and an OPEC meeting, there will be straight forward risk of a sig' gap lower tomorrow, however, I am guessing not.

Best guess: Friday upside.. at least to the sp'2070/75 zone. Right now, equity bulls should be relieved on any weekly close in the 2070s.

yours... long.... helped via a flak jacket, tin helmet, and large quantities of tea/chocolates.

--

more later... on the VIX

sp'60min

Summary

closing hour action: a test of the 2pm hour low of 2042.. and then rebounding.

--

The 2pm and 3pm hourly candles are both of the spike-floor type, highly suggestive market is building a floor.

Clearly, with the jobs data and an OPEC meeting, there will be straight forward risk of a sig' gap lower tomorrow, however, I am guessing not.

Best guess: Friday upside.. at least to the sp'2070/75 zone. Right now, equity bulls should be relieved on any weekly close in the 2070s.

yours... long.... helped via a flak jacket, tin helmet, and large quantities of tea/chocolates.

--

more later... on the VIX

3pm update - surprised

US equities have been utterly unable to build a floor, with a new low of sp'2043... a full 61pts (3.0%) lower since yesterdays open. USD continues to cool, with an unquestionably severe fall of -2.2% in the DXY 97.70s. Commodities are seeing natural gains, Gold +$10, with Oil +2.2%.. but well below the earlier high.

sp'daily5

UUP, daily

Summary

The decline in the USD is unquestionably a major part of today's upset.

You can't see the reserve currency of the world fall over 2% without ricochet effects across all capital markets.

... and with the jobs data tomorrow.. and an OPEC meeting tomorrow... this is turning into a real crazy week.

Next support is around sp'2040.. where the 50dma is lurking... if that doesn't hold.. then its 2020/00 zone.

--

notable movers....

CHK -12%

DIS -2%

INTC -2%

--

As for volatility... VIX'60min

The big 20 threshold is within range.. and to me.. that is a surprise.

--

updates into the close.............

3.18pm.. VIX +20% in the low 19s...

Hourly cycle RSI is 75.. and that is VERY high for the VIX. On any basis.. this is very high end of the cycle.

--

To be clear.. from a pure cyclical perspective, the risk tomorrow will be against the equity bears.... especially those short energy stocks.. if OPEC at least seriously threaten some cuts.

notable weakness: bonds, TLT -2.8%.... very rough day in bond land.. but more on that later.

3.29pm.. USD -2.3% in the DXY 97.70s.... a crazy strong move.. from the big 100 threshold.

-

3.36pm.. again, its only provisional..

...another attempt at a spike floor.. this time from sp'2042.

A close in the 2050s would be HIGHLY suggestive of a floor.. ahead of the jobs data.

--

3.43pm. Market is FIERCELY battling to secure a second hourly spiky-floor candle.

From a pure cyclical perspective, equity bears are at EXTREME risk of a whipsaw higher tomorrow, even though multiple key levels were broken today.

sp'daily5

UUP, daily

Summary

The decline in the USD is unquestionably a major part of today's upset.

You can't see the reserve currency of the world fall over 2% without ricochet effects across all capital markets.

... and with the jobs data tomorrow.. and an OPEC meeting tomorrow... this is turning into a real crazy week.

Next support is around sp'2040.. where the 50dma is lurking... if that doesn't hold.. then its 2020/00 zone.

--

notable movers....

CHK -12%

DIS -2%

INTC -2%

--

As for volatility... VIX'60min

The big 20 threshold is within range.. and to me.. that is a surprise.

--

updates into the close.............

3.18pm.. VIX +20% in the low 19s...

Hourly cycle RSI is 75.. and that is VERY high for the VIX. On any basis.. this is very high end of the cycle.

--

To be clear.. from a pure cyclical perspective, the risk tomorrow will be against the equity bears.... especially those short energy stocks.. if OPEC at least seriously threaten some cuts.

notable weakness: bonds, TLT -2.8%.... very rough day in bond land.. but more on that later.

3.29pm.. USD -2.3% in the DXY 97.70s.... a crazy strong move.. from the big 100 threshold.

-

3.36pm.. again, its only provisional..

...another attempt at a spike floor.. this time from sp'2042.

A close in the 2050s would be HIGHLY suggestive of a floor.. ahead of the jobs data.

--

3.43pm. Market is FIERCELY battling to secure a second hourly spiky-floor candle.

From a pure cyclical perspective, equity bears are at EXTREME risk of a whipsaw higher tomorrow, even though multiple key levels were broken today.

2pm update - the wild action continues

US capital markets continue to see some rather wild price action. Now its a case of whether a close above.. or below the 200dma of sp'2064. USD continues to weaken, on any basis, a rather severe drop of -2.0% in the DXY 97.90s. Gold +$11. Oil +3.0%.

sp'60min

TLT, daily

Summary

*again, I want to highlight the bonds.. adjusting to a near certainty of higher int' rates.

TLT -3.1% in the $119s... first soft target is 110.. by mid/late spring.

--

So much for the earlier spike floor hope of sp'2058.

The 2.30pm time offers next opportunity for a floor/turn.

Those currently short.... are getting a chance to tighten stops... ahead of OPEC and the monthly jobs data.

--

re: Oil....

Oil is still battling to break AND hold above declining trend. Right now.. its marginal.. oil bulls should be seeking the $13s tomorrow. Cyclically.. the pressure is turning UP.

-

Finally... for those who think I am crazy bullish... here is the most bearish chart out there...

Trans, daily

Not pretty... not least for what is often, a leading index.

2.42pm.. sp'2104 to 2044.... 60pts.. 3%.. in just 2 days...

sp'60min

TLT, daily

Summary

*again, I want to highlight the bonds.. adjusting to a near certainty of higher int' rates.

TLT -3.1% in the $119s... first soft target is 110.. by mid/late spring.

--

So much for the earlier spike floor hope of sp'2058.

The 2.30pm time offers next opportunity for a floor/turn.

Those currently short.... are getting a chance to tighten stops... ahead of OPEC and the monthly jobs data.

--

re: Oil....

Oil is still battling to break AND hold above declining trend. Right now.. its marginal.. oil bulls should be seeking the $13s tomorrow. Cyclically.. the pressure is turning UP.

-

Finally... for those who think I am crazy bullish... here is the most bearish chart out there...

Trans, daily

Not pretty... not least for what is often, a leading index.

2.42pm.. sp'2104 to 2044.... 60pts.. 3%.. in just 2 days...

1pm update - very dynamic price action

The sp'500 breaks a new intra low of 2059, decisively taking out the 200dma of 2064. USD remains severely weak, -1.9% in the DXY 98.10s. Oil is seeing a mini explosion to the upside, +3.4% in the $41s - with OPEC looming. Meanwhile, US bonds are notably weak, the ETF of TLT -2.7%.

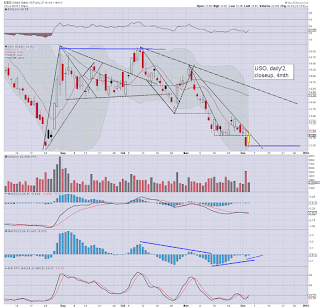

USO'daily2

TLT, daily

Summary

*there is a great deal going on today.. hard to keep up.

For this hour.. I at least wanted to highlight bonds.. will likely cover them in far more depth in my late day post at 11pm EST.

Suffice to say.. bond prices are falling.. as yields are (naturally) on the rise.. ahead of the next FOMC.

--

As for equities... very difficult to call the close.

Clearly, the market will have massive excuse for a major move tomorrow... with the jobs data.

--

notable strength, RIG +4.3%... as oil climbs... and a short-stop cascade is likely underway. I remain LONG... seeking a higher exit in the $15s.

--

stay tuned!

1.19pm.. We have a viable spike floor from sp'2058.

Equity bulls should be battling for a daily close back above the 200dma (2064).

USO'daily2

TLT, daily

Summary

*there is a great deal going on today.. hard to keep up.

For this hour.. I at least wanted to highlight bonds.. will likely cover them in far more depth in my late day post at 11pm EST.

Suffice to say.. bond prices are falling.. as yields are (naturally) on the rise.. ahead of the next FOMC.

--

As for equities... very difficult to call the close.

Clearly, the market will have massive excuse for a major move tomorrow... with the jobs data.

--

notable strength, RIG +4.3%... as oil climbs... and a short-stop cascade is likely underway. I remain LONG... seeking a higher exit in the $15s.

--

stay tuned!

1.19pm.. We have a viable spike floor from sp'2058.

Equity bulls should be battling for a daily close back above the 200dma (2064).

12pm update - moderately weak

US equities remain moderately weak, and a little choppy in the low sp'2070s. USD remains very significantly lower, -1.9% in the DXY 98.10s. A daily close in the 97s would be suggestive that the USD has a double top - from March... of DXY 100, with at least short term implications for Oil and the metals.

sp'daily5

UUP, daily

Summary

The drop in the dollar is getting borderline severe.

As for whether we have a clear double top - from the March high, that is going to take some days, if not a few weeks to have clarity.

In any case... King dollar is having a rough day. I'd imagine the FOREX retail amateurs are having a wild day!

--

Next support for the sp'500 is the 200dma @ 2065/64.

--

-

VIX update from Mr T.

---

time for tea :)

-

12.18pm... USD -2.0%... rather severe indeed.

Oil is benefiting... +2.0%... and that is helping some of the energy stocks.

notable strength: RIG +3.3%

... sp'500 testing the 200dma of 2065/64.

If this is a tease to the equity bears before a jobs data hyper-ramp... this is truly cruel.

-

12.27pm... sp'2062.... so.. now its case of whether we close above.. or below the 200dma.

Clearly.. a weekly close in the 2100s is now off the menu.

notable weakness, CHK -9.8%.. having lost the $5.00 threshold.... a lot of institutions are likely going to clear the deck on that one.

sp'daily5

UUP, daily

Summary

The drop in the dollar is getting borderline severe.

As for whether we have a clear double top - from the March high, that is going to take some days, if not a few weeks to have clarity.

In any case... King dollar is having a rough day. I'd imagine the FOREX retail amateurs are having a wild day!

--

Next support for the sp'500 is the 200dma @ 2065/64.

--

-

VIX update from Mr T.

---

time for tea :)

-

12.18pm... USD -2.0%... rather severe indeed.

Oil is benefiting... +2.0%... and that is helping some of the energy stocks.

notable strength: RIG +3.3%

... sp'500 testing the 200dma of 2065/64.

If this is a tease to the equity bears before a jobs data hyper-ramp... this is truly cruel.

-

12.27pm... sp'2062.... so.. now its case of whether we close above.. or below the 200dma.

Clearly.. a weekly close in the 2100s is now off the menu.

notable weakness, CHK -9.8%.. having lost the $5.00 threshold.... a lot of institutions are likely going to clear the deck on that one.

11am update - the Yellen continues

Whilst Yellen is answering the often laughably benign questions from the US finance committee, equities are struggling, having broken the second marginally higher low of sp'2070. USD remains -1.4% in the DXY 98.50s. That is helping inspire commodities, Gold +$4, with Oil +0.6%

sp'daily5

Trans, daily

Summary

*the 11am hour.. a typical turn time. Indexes could easily turn positive into the afternoon.

--

Far more notable than the sp'500 - the loss of 8K for the Transports. It is a key trend break from the Aug' lows. I suppose it could just be a brief tease to the bears... but really... it is an alarm bell of some degree.

Despite the morning weakness... certainly lower than I expected... my bullish outlook into end year is unchanged.

--

Meanwhile... here in London city....

A rather nice end to the day.

--

time to cook !

-

11.16am... we're seeing a clear turn upward.... short-stop cascade... bears are ON the run!

indexes turning positive.

sp'daily5

Trans, daily

Summary

*the 11am hour.. a typical turn time. Indexes could easily turn positive into the afternoon.

--

Far more notable than the sp'500 - the loss of 8K for the Transports. It is a key trend break from the Aug' lows. I suppose it could just be a brief tease to the bears... but really... it is an alarm bell of some degree.

Despite the morning weakness... certainly lower than I expected... my bullish outlook into end year is unchanged.

--

Meanwhile... here in London city....

A rather nice end to the day.

--

time to cook !

-

11.16am... we're seeing a clear turn upward.... short-stop cascade... bears are ON the run!

indexes turning positive.

10am update - busy times

With the ECB out of the way, it remains a very busy time, with Yellen at 10am (will last 2-3hrs), OPEC are due to meet... with the last big data point before the FOMC - monthly jobs data (Friday). USD has snapped lower, -1.2% in the DXY 98.80s... and that is helping metals/oil.. and indeed.. US equities.

sp'60min

USO'daily2

Summary

re: oil. An inside day? Probably.... with a viable snap above declining trend tomorrow.

--

Reminder on ECB changes...

Deposit rate: -10bps to -0.3%

monthly QE of €60bn extended from Sept'2016 to March 2017.

--

Clearly, currency changes are causing all manner of price moves this morning.

Regardless of the opening equity swings.... the broader upward trend should resume no later than 11am.

--

notable strength... energy stocks...

APC, daily

Price structure offers an extremely secure floor. First soft target is the 50dma @ $65.

I am long oil/energy via RIG... seeking a sig' Friday jump!

--

time for a little sun... back soon

-

10.30am.. sp -10pts... 2068... Hmm... that is a clear 1% swing from pre-market highs.

Broadly though... I'm still bullish. I ain't getting rattled with this.

sp'60min

USO'daily2

Summary

re: oil. An inside day? Probably.... with a viable snap above declining trend tomorrow.

--

Reminder on ECB changes...

Deposit rate: -10bps to -0.3%

monthly QE of €60bn extended from Sept'2016 to March 2017.

--

Clearly, currency changes are causing all manner of price moves this morning.

Regardless of the opening equity swings.... the broader upward trend should resume no later than 11am.

--

notable strength... energy stocks...

APC, daily

Price structure offers an extremely secure floor. First soft target is the 50dma @ $65.

I am long oil/energy via RIG... seeking a sig' Friday jump!

--

time for a little sun... back soon

-

10.30am.. sp -10pts... 2068... Hmm... that is a clear 1% swing from pre-market highs.

Broadly though... I'm still bullish. I ain't getting rattled with this.

Pre-Market Brief

Good morning. US equity futures are moderately higher, sp +10pts, we're set to open at 2089. USD is cooling, -0.3% in the DXY 99.60s. Metals are bouncing, Gold +$3, from a new multi-year (overnight) low of $1045. Oil is +1.0%

sp'60min

Summary

ECB: initial news... deposit rate cut 10bps, from -0.2% to -0.3%.

Other measures due to be announced at the press conf'.

--

Update from Mr C.

--

Overnight Asia action

Japan: a lot of chop.. closing effectively flat.

China: again, opening weak chop, but then latter day rally, +1.3% @ 3584.

--

Have a good Thursday

8.35am... ECB announce: extending monthly QE of €60bn from Sept'2016 to March 2017.

Equities a little choppy, sp +2pts.

Oil +1.4%... with the OPEC meeting tomorrow.

8.40am.. Euro is soaring. +1.8%...

sp' has cooled from +12pts to -2...... as the market battles it out to pick a direction.

Broadly.. we should still climb from current levels... not least if Oil can climb.

8.56am.. sp' +1pt.

Euro +2.4%..... and that is helping the metals/oil.

Q. Has the Euro seen a key floor, with the USD seeing a double top at DXY 100?

Hmmmmmmmmmmm

9.00am.. USD flash-crashing.... -1.3%...... was rather stable at -0.3%.....

Price action is getting increasingly wild.

sp'60min

Summary

ECB: initial news... deposit rate cut 10bps, from -0.2% to -0.3%.

Other measures due to be announced at the press conf'.

--

Update from Mr C.

--

Overnight Asia action

Japan: a lot of chop.. closing effectively flat.

China: again, opening weak chop, but then latter day rally, +1.3% @ 3584.

--

Have a good Thursday

8.35am... ECB announce: extending monthly QE of €60bn from Sept'2016 to March 2017.

Equities a little choppy, sp +2pts.

Oil +1.4%... with the OPEC meeting tomorrow.

8.40am.. Euro is soaring. +1.8%...

sp' has cooled from +12pts to -2...... as the market battles it out to pick a direction.

Broadly.. we should still climb from current levels... not least if Oil can climb.

8.56am.. sp' +1pt.

Euro +2.4%..... and that is helping the metals/oil.

Q. Has the Euro seen a key floor, with the USD seeing a double top at DXY 100?

Hmmmmmmmmmmm

9.00am.. USD flash-crashing.... -1.3%...... was rather stable at -0.3%.....

Price action is getting increasingly wild.

China continuing to battle upward

After Monday's net decline of -5.5%, the Shanghai comp' was on the edge of losing key support. There is little doubt the PBOC have been 'meddling' again. The Wednesday gain of 2.3% @ 3536, brings the SSEC within range of the 200dma, but more importantly.. the monthly 10MA, both in the upper 3700s.

China, daily

China, monthly

Summary

Suffice to say.. we have a clear spike floor from the Monday low of 3327.. on rising support.

More than anything, if the Shanghai comp' can break back into the 3800s.. and hold above, it will open the door to 6K by end 2016.

I realise that is a crazy scenario, but then.. in summer 2014, when I touted 5K 'by late 2015', that too was deemed crazy. It happened 3-6 months earlier than even I had expected.

I will be keeping a close eye on the China market.. but then... I always do!

--

Looking ahead

Thursday is packed...

The ECB are set to announce another policy update, with a Draghi press conf'.

Data: weekly jobs, PMI/ISM service sector, factory orders

*Yellen is set to give testimony to the US joint finance committee, and that will likely get blanket coverage from 10am-1pm.

--

Goodnight from London

China, daily

China, monthly

Summary

Suffice to say.. we have a clear spike floor from the Monday low of 3327.. on rising support.

More than anything, if the Shanghai comp' can break back into the 3800s.. and hold above, it will open the door to 6K by end 2016.

I realise that is a crazy scenario, but then.. in summer 2014, when I touted 5K 'by late 2015', that too was deemed crazy. It happened 3-6 months earlier than even I had expected.

I will be keeping a close eye on the China market.. but then... I always do!

--

Looking ahead

Thursday is packed...

The ECB are set to announce another policy update, with a Draghi press conf'.

Data: weekly jobs, PMI/ISM service sector, factory orders

*Yellen is set to give testimony to the US joint finance committee, and that will likely get blanket coverage from 10am-1pm.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed significantly weak, sp -23pts @ 2079 (intra

range 2104-2077). The two leaders - Trans/R2K, settled lower by -2.1%

and -1.0% respectively. Near term outlook remains unchanged, with

further upside to the 2115/20 zone... whether on the excuse of the ECB

or the monthly jobs data.

sp'daily5

Trans

Summary

*Transports closed the day on a pretty lousy note, having tested rising support. A Thursday close <8K would be a real red flag.

A weekly close <8K would be a serious early warning... and will need to be carefully kept in mind.

--

As for the sp'500, the daily candle was of the bearish engulfing type, and that does favour the equity bears in the near term.

Despite the daily close, renewed upside into the 2100s still looks highly probable.

--

a little more later...

sp'daily5

Trans

Summary

*Transports closed the day on a pretty lousy note, having tested rising support. A Thursday close <8K would be a real red flag.

A weekly close <8K would be a serious early warning... and will need to be carefully kept in mind.

--

As for the sp'500, the daily candle was of the bearish engulfing type, and that does favour the equity bears in the near term.

Despite the daily close, renewed upside into the 2100s still looks highly probable.

--

a little more later...

Subscribe to:

Comments (Atom)