With equities rebounding back to the sp'2060s, the VIX was naturally back in cooling mode, settling -8.7% @ 14.85. Near term outlook is extremely borderline, with threat of sp>2075.. and if so.. then VIX 13/12s, otherwise... briefly..17/18s.. with sp'2020/10s.

VIX'60min

VIX'daily3

Summary

Suffice to add, the short term upward trend has been broken.

Underlying daily MACD (blue bar histogram) is starting to tick lower. There is clear threat of a move >sp'2075.. and VIX 13/12s.

*I remain long VIX from the mid 14s.. and the ongoing moderate chop is increasingly frustrating.

--

more later... on the indexes

Tuesday, 12 April 2016

Closing Brief

US equities closed broadly higher, sp +19pts @ 2061 (intra low 2039). The two leaders - Trans/R2K, settled higher by 0.8% and 1.0% respectively. Near term outlook is extremely borderline, as there is threat of a break above the key high of 2075. Best case near term downside is the 2025/15 zone.

sp'60min

Summary

*closing hour action: a reaction-turn from a new intra high of 2065 - with VIX 14.84

--

So... opening gains, a swing lower to 2039.. but then the bloody oil headline resulted in a swift surge back upward, with algo-bot melt across much of the afternoon.

A really annoying day... but effectively, we're just stuck within a relatively narrow range of 2075-2020s.

--

yours truly remains short.. and (to my own surprise) reasonably content.

(the fact I'm not using margin sure helps me sleep)

--

more later... on the VIX

sp'60min

Summary

*closing hour action: a reaction-turn from a new intra high of 2065 - with VIX 14.84

--

So... opening gains, a swing lower to 2039.. but then the bloody oil headline resulted in a swift surge back upward, with algo-bot melt across much of the afternoon.

A really annoying day... but effectively, we're just stuck within a relatively narrow range of 2075-2020s.

--

yours truly remains short.. and (to my own surprise) reasonably content.

(the fact I'm not using margin sure helps me sleep)

--

more later... on the VIX

3pm update - still building gains

US equity indexes continue to grind upward, above soft resistance of sp'2060, with the VIX on the edge of losing the 15s. USD remains broadly flat around the DXY 94.00 threshold. Metals are mixed, Gold u/c, whilst Silver +1.6%. Oil has built powerful gains of 4%.. back into the $42s.

sp'60min

VIX'60min

Summary

A very annoying day...and unlike yesterday afternoon, there is currently zero sign of a turn/renewed cooling.

The 2075 high is not looking so secure anymore.

If the market likes the next set of inventory reports... the bears are going to get washed out.... without even seeing a basic retrace to the 2020/10s.

-

notable movers...

CHK +34%

SDRL +26%

.. both stocks remain utterly smashed though... and SDRL is ironically barely half of the price it was from the most recent hyper ramp.

--

back at the close

sp'60min

VIX'60min

Summary

A very annoying day...and unlike yesterday afternoon, there is currently zero sign of a turn/renewed cooling.

The 2075 high is not looking so secure anymore.

If the market likes the next set of inventory reports... the bears are going to get washed out.... without even seeing a basic retrace to the 2020/10s.

-

notable movers...

CHK +34%

SDRL +26%

.. both stocks remain utterly smashed though... and SDRL is ironically barely half of the price it was from the most recent hyper ramp.

--

back at the close

2pm update - redemption at the roulette table

US equities remain moderately higher, sp +15pts @ 2057, with VIX -5% in the 15.30s. Much like yesterday, it remains a very borderline situation. Equity bears should be desperate for a daily close back in the 2040s.. along with VIX 16s.

sp'60min

VIX'60min

Summary

*a marginal break of rising trend in the VIX.

--

Little to add.

With two hours left of the day, are we going to get latter day weakness once again?

yours...

back at 3pm

sp'60min

VIX'60min

Summary

*a marginal break of rising trend in the VIX.

--

Little to add.

With two hours left of the day, are we going to get latter day weakness once again?

yours...

|

| 'I'm going to try to find moral redemption at the roulette table' |

1pm update - beyond tedious

US equities are holding moderate gains, with soft resistance around sp'2060. A daily close >2057 would seriously threaten another major push higher, taking out the 2075 high... and not stopping. For the moment, the mainstream cheerleaders are comfortable once again. After all, higher oil prices are good for consumer, right?

sp'60min

VIX'60min

Summary

So... how long until the latest Oil rumour is denied?

VIX is on the edge of breaking trend.

-

notable strength, CHK, daily

+33% @ $6... clearly, its all 'fine' now, yes? So.. who wants to buy at the 200dma?

sp'60min

VIX'60min

Summary

So... how long until the latest Oil rumour is denied?

VIX is on the edge of breaking trend.

-

notable strength, CHK, daily

+33% @ $6... clearly, its all 'fine' now, yes? So.. who wants to buy at the 200dma?

12pm update - sunshine for the bull maniacs

With a sporadic headline that Russia and the house of Saud have provisionally agreed to freeze oil output, 'normal service' has resumed for US equities. With the sp' +14pts @ 2056, a net daily decline is off the menu... and now its a case of whether 2075 will hold.

sp'60min

VIX'60min

Summary

*for the moment, VIX is holding rising trend.

--

What can be said other than its the usual nonsense once again.

Yet again, a sporadic news story about Oil has been the excuse for renewed equity strength.

Its beyond tedious.

--

Here in London city..

Right now, the sunshine is small consolation for the semi-nightmare that is happening in equity land.

--

time to cook

sp'60min

VIX'60min

Summary

*for the moment, VIX is holding rising trend.

--

What can be said other than its the usual nonsense once again.

Yet again, a sporadic news story about Oil has been the excuse for renewed equity strength.

Its beyond tedious.

--

Here in London city..

Right now, the sunshine is small consolation for the semi-nightmare that is happening in equity land.

--

time to cook

11am update - moderate chop

US equity indexes have (not surprisingly) already turned negative, as the bigger daily/weekly cycles continue to swing back toward the equity bears. Net daily declines look due, along with VIX in the 17s. Metals have cooled from early gains, Gold -$1. Oil is +1.5% after a news headline.

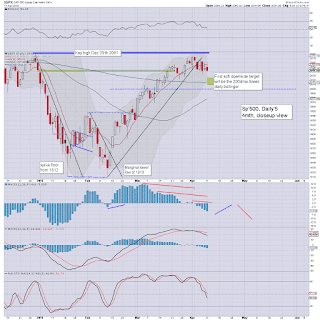

sp'daily5

VIX'daily3

Summary

*around 10.30am.. a micro hyper-ramp occurred as a news headline about a 'consensus for Russia/Saudi Oil freeze', which saw indexes flip almost 0.5% higher within 90 seconds.

Again, the word 'freeze' sure doesn't mean actual cuts. The over-supply issue is STILL not being remotely resolved.

--

From a pure cyclical perspective, underlying MACD (blue bar histogram) for the equity cycle is on the lower end, with the VIX naturally on the higher side.

Frankly, anyone expecting sustained/significant downside in the near term is almost certainly going to remain frustrated.

--

Best guess.. A Tuesday close in the sp'2030/25 zone.. with VIX 17s

If I can get that... I'll likely close out.

-

time for some sun............

sp'daily5

VIX'daily3

Summary

*around 10.30am.. a micro hyper-ramp occurred as a news headline about a 'consensus for Russia/Saudi Oil freeze', which saw indexes flip almost 0.5% higher within 90 seconds.

Again, the word 'freeze' sure doesn't mean actual cuts. The over-supply issue is STILL not being remotely resolved.

--

From a pure cyclical perspective, underlying MACD (blue bar histogram) for the equity cycle is on the lower end, with the VIX naturally on the higher side.

Frankly, anyone expecting sustained/significant downside in the near term is almost certainly going to remain frustrated.

--

Best guess.. A Tuesday close in the sp'2030/25 zone.. with VIX 17s

If I can get that... I'll likely close out.

-

time for some sun............

10am update - highly vulnerable

US equity indexes open a little higher, but look highly vulnerable across today. A daily close in the low sp'2020s - with VIX 17s, remains well within range. USD is trying to halt the broader downward trend, currently +0.2% in the DXY 94.10s.

sp'60min

VIX'60min

Summary

Little to add.

Its already a little tedious, but we should close net lower. The only issue is whether it will be above or below last Thursday's low of sp'2033.

-

notable strength... CHK, daily

Continued utter nonsense in CHK land. The company has basically pledged just about every asset to backup a $4bn credit line. If Nat' gas prices remain broadly subdued... it remains just a matter of time before the creditors pull the plug.

*It is notable that despite the last two days of hyper gains, CHK is still below the high (a black-fail candle no less) from early March.

--

stay tuned

10.21am.. not surprisingly.. red indexes.. with a positive VIX.

Now its just a case of whether > or < 2033. Daily cycles suggest 2025/20 - with VIX >17.50.. at today's close.

Broadly though... no sustained bearish action for some weeks.

sp'60min

VIX'60min

Summary

Little to add.

Its already a little tedious, but we should close net lower. The only issue is whether it will be above or below last Thursday's low of sp'2033.

-

notable strength... CHK, daily

Continued utter nonsense in CHK land. The company has basically pledged just about every asset to backup a $4bn credit line. If Nat' gas prices remain broadly subdued... it remains just a matter of time before the creditors pull the plug.

*It is notable that despite the last two days of hyper gains, CHK is still below the high (a black-fail candle no less) from early March.

--

stay tuned

10.21am.. not surprisingly.. red indexes.. with a positive VIX.

Now its just a case of whether > or < 2033. Daily cycles suggest 2025/20 - with VIX >17.50.. at today's close.

Broadly though... no sustained bearish action for some weeks.

Pre-Market Brief

Good morning. US equity futures are moderately higher, sp +5pts, we're set to open at 2046. USD is u/c in the DXY 93.90s. Metals continue to climb, Gold +$5, with Silver +1.2%. Oil is +1.0% in the $40s.

sp'60min

Summary

So, yet again we're set to open higher, although not by much.

I would be surprised if we don't see increasing weakness across today, with a close in the sp'2020s, along with VIX 17s.

--

notable early movers...

AA -3.2%, on what were lousy (underlying) earnings

GDX, +0.9%... as the metals/miners just keep on pushing.

-

Overnight action:

Japan: +1.1% @ 15928

China: -0.3% @ 3023

Germany: currently +0.2% @ 9705

--

Have a good Tuesday

sp'60min

Summary

So, yet again we're set to open higher, although not by much.

I would be surprised if we don't see increasing weakness across today, with a close in the sp'2020s, along with VIX 17s.

--

notable early movers...

AA -3.2%, on what were lousy (underlying) earnings

GDX, +0.9%... as the metals/miners just keep on pushing.

-

Overnight action:

Japan: +1.1% @ 15928

China: -0.3% @ 3023

Germany: currently +0.2% @ 9705

--

Have a good Tuesday

A second blue candle

It was a pretty tedious day in the US equity market, with the sp'500 seeing early gains to 2062, but then a clear failure to hold above declining trend/resistance, a great deal of chop, and settling -5pts @ 2041. More broadly, the bigger weekly cycle is offering another subtle indicator that 2075 is a key mid term high.

sp'weekly6

sp'monthly1b

Summary

We now have two blue candles on the weekly 'rainbow' (Elder impulse) chart. That is certainly not 100% clarification of a key top, but its an important provisional warning.

Equity bull maniacs should be increasingly worried 2075 is indeed yet another 'marginally lower high'.. with a new lower low (<1810) due by late May/June.

re: monthly1b: equity bears should be fighting hard for an April close under the 10MA @ 2017. Anything <2K would give good clarity that May.. and more so - June... will be 'entertaining'.

--

Market/econ chatter from Schiff

--

Looking ahead

Tuesday will see import/export prices.

*Fed officials Harper and Williams will be on the loose during market hours.

--

Goodnight from London

sp'weekly6

sp'monthly1b

Summary

We now have two blue candles on the weekly 'rainbow' (Elder impulse) chart. That is certainly not 100% clarification of a key top, but its an important provisional warning.

Equity bull maniacs should be increasingly worried 2075 is indeed yet another 'marginally lower high'.. with a new lower low (<1810) due by late May/June.

re: monthly1b: equity bears should be fighting hard for an April close under the 10MA @ 2017. Anything <2K would give good clarity that May.. and more so - June... will be 'entertaining'.

--

Market/econ chatter from Schiff

--

Looking ahead

Tuesday will see import/export prices.

*Fed officials Harper and Williams will be on the loose during market hours.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed moderately weak, sp -5pts @ 2041 (intra high

2062). The two leaders - Trans/R2K, settled lower by -0.5% and -0.3%

respectively. Near term outlook offers the 2025/15 zone this

Tues/Wednesday, before crawling upward into the Friday opex.

sp'daily5

Nasdaq comp'

Summary

sp'500: a second spiky daily candle... bodes in favour of further downside, at least to the 2025/15 zone.. close to the 200dma (2014).

Nasdaq: an intra high of 4897.. and notably, unable to close above key 4900 threshold. The daily net decline of -0.4% is somewhat interesting. Next support: 4750/4700.

--

a little more later...

sp'daily5

Nasdaq comp'

Summary

sp'500: a second spiky daily candle... bodes in favour of further downside, at least to the 2025/15 zone.. close to the 200dma (2014).

Nasdaq: an intra high of 4897.. and notably, unable to close above key 4900 threshold. The daily net decline of -0.4% is somewhat interesting. Next support: 4750/4700.

--

a little more later...

Subscribe to:

Comments (Atom)