It was a quiet day in volatility land, with the VIX trading in a very tight range. Despite the indexes occasionally going green, VIX held the 14s, closing -0.3% @ 14.28. The gap-zone of 16-18 remains the primary target for this up cycle, which will surely be completed next week.

VIX'60min

VIX'daily

Summary

I suppose the VIX at least held the 14s, but certainly, this battle up from the low 12s is taking its time. At this rate of increase its going to take 6-8 weeks to hit 20, and I don't think 20 is viable anyway.

The MACD (blue bar histogram) cycle is already getting a little high, and VIX closed just under the upper bollinger band. Its going to be VERY difficult to break above, and close in the 16s.

The upper gap zone of 18 is going to be a severely difficult level to hit. Certainly, its possible if the indexes get down to the low 1460s, but those levels are going to be difficult to hit.

As I keep noting, the bears 'lack power'. They have been destroyed since the two hyper-ramp of Dec'31/Jan'2, and the 4 subsequent weeks of algo-bot melt have ground them down.

How we trade Friday will be critical. Bears need a close <sp'1490, with VIX in the 15s.

more later..on the indexes

Thursday, 31 January 2013

Closing Brief

A little weakness in the closing hour, and its possible that the bear flag I had suggested has already now been confirmed. The VIX crossing back to green into the close was a further small positive sign for the bears.

Dow

SP

Trans

Summary

A pretty mess closing few minutes, and it sure looked like 'someone' wanted to pin the sp @ 1500 to close the first month of the year.

Regardless, we didn't close @ 1500, but the daily close is certainly a little disappointing for the bears.

The index cycles go negative cycle tomorrow, so...either we see our first 0.75/1.25% move lower tomorrow...or this down cycle is dead on arrival.

more later...

Dow

SP

Trans

Summary

A pretty mess closing few minutes, and it sure looked like 'someone' wanted to pin the sp @ 1500 to close the first month of the year.

Regardless, we didn't close @ 1500, but the daily close is certainly a little disappointing for the bears.

The index cycles go negative cycle tomorrow, so...either we see our first 0.75/1.25% move lower tomorrow...or this down cycle is dead on arrival.

more later...

3pm update - bear flag on the hourly?

If a retracement is indeed underway, then what we're seeing right now are little bear flags develop on the hourly index charts. VIX is holding together - with an appropriate, and contrary bull flag. Metals remain weak, with Gold -$13

sp'60min

vix'60min

Summary

Tis the last trading hour of January. We're almost one month down already on the year!

I do hope the bear flags are indeed just that. If so, they probably count as a minute'2, and thus we should indeed see a major move lower - with the indexes going negative MACD cycle.

The price action to start February..and lead into the weekend will be VERY important.

*Bears need to close the week <sp'1490, with VIX in the 15s.

--

back after the close

sp'60min

vix'60min

Summary

Tis the last trading hour of January. We're almost one month down already on the year!

I do hope the bear flags are indeed just that. If so, they probably count as a minute'2, and thus we should indeed see a major move lower - with the indexes going negative MACD cycle.

The price action to start February..and lead into the weekend will be VERY important.

*Bears need to close the week <sp'1490, with VIX in the 15s.

--

back after the close

2pm update - tough to build downside momentum

Once again we're reminded just how hard it is it for the bears to get any downside momentum. A mere 4-5pts lower on the sp', and now we're back to evens, with the Trans/Rus'2000 showing upside of 0.3 and 0.7% respectively.

sp'daily5

vix'daily3

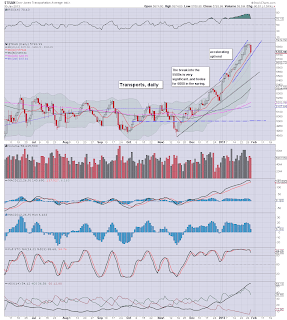

Trans'daily

Summary

Two hours to go, which is plenty of time to still swing lower, and close at the lows of the day, but...it ain't looking so great is it?

Bears need to a clean break below what is an accelerated channel on ALL indexes, not least the transports. On the sp', that would be <1490

VIX is still holding together..and rising in a slow stair step higher, but is VIX 15/16 going to be all the bears get before another few weeks of dismal slow motion algo-bot ramp?

Stay tuned.

sp'daily5

vix'daily3

Trans'daily

Summary

Two hours to go, which is plenty of time to still swing lower, and close at the lows of the day, but...it ain't looking so great is it?

Bears need to a clean break below what is an accelerated channel on ALL indexes, not least the transports. On the sp', that would be <1490

VIX is still holding together..and rising in a slow stair step higher, but is VIX 15/16 going to be all the bears get before another few weeks of dismal slow motion algo-bot ramp?

Stay tuned.

12pm update - trying to break lower

A failed attempt to rally higher, and the bears have a window...they'd better not fail to seize this opportunity. A close <sp'1495 is arguably essential to build at least a little downside momentum for tomorrow..and early next week. The VIX is so far showing no power though...whilst the metals continue to get the hammer.

sp'daily5

vix'daily3

Summary

Nothing particularly dynamic so far.

Best bear case for the close..sp<1490/95..with VIX in the upper 14s.

-

Gold weak..and looking like 158s going to fail to hold..with a wash-out next week to 155/54.

VIX video...from Mr T

time for lunch

--

UPDATE 1pm transports still holding within the broad up channel.

Target for the tranny would be 5500/5400 next week.

sp'daily5

vix'daily3

Summary

Nothing particularly dynamic so far.

Best bear case for the close..sp<1490/95..with VIX in the upper 14s.

-

Gold weak..and looking like 158s going to fail to hold..with a wash-out next week to 155/54.

VIX video...from Mr T

time for lunch

--

UPDATE 1pm transports still holding within the broad up channel.

Target for the tranny would be 5500/5400 next week.

11am update - battling it out

Its turning into a battle this morning. Despite the arguably 'great' PMI number, the bulls can't ramp this market more than 0.2%. Metals are taking the hammer, with Mr $ seeing yet further weakness. The VIX is red, but its managing to hold the 14s.

sp'daily5

vix'daily3

Summary

Look at the MACD (blue bar histogram) on the sp' daily, we're set to go negative cycle tomorrow. So..those bears seeking some more dynamic action, prime time will be tomorrow.

Frankly, if we dont see a 1% fall tomorrow, with VIX in the 15s, I'm going to be very concerned that the retracement - as highly suggested by the Trans/R2K declines yesterday, is just another tease. We'll soon find out.

I remain on the short side, with a major VIX long position from the low 12s. Seeking 16s.

--

GLD looks set to break the 158 low early next week.

That'll give the gold-bugs a good scare!

sp'daily5

vix'daily3

Summary

Look at the MACD (blue bar histogram) on the sp' daily, we're set to go negative cycle tomorrow. So..those bears seeking some more dynamic action, prime time will be tomorrow.

Frankly, if we dont see a 1% fall tomorrow, with VIX in the 15s, I'm going to be very concerned that the retracement - as highly suggested by the Trans/R2K declines yesterday, is just another tease. We'll soon find out.

I remain on the short side, with a major VIX long position from the low 12s. Seeking 16s.

--

GLD looks set to break the 158 low early next week.

That'll give the gold-bugs a good scare!

10am update - lousy open for the bears

Minor opening declines, but with the Chicago PMI coming in much better than expected, with an absolutely non-recessionary 55.6 reading, the market now has an excuse to challenge the recent 1509 high. Bears...are once again in serious trouble, and it ain't even lunch time.

sp'daily5

vix'daily3

Summary

Any of the serious bear money should probably be running for the hills now.

After all, the micro-cycles all look floored, and we're now set to see another 2-4 hours higher.

A very bad opening 30mins for those short.

-

sp'daily5

vix'daily3

Summary

Any of the serious bear money should probably be running for the hills now.

After all, the micro-cycles all look floored, and we're now set to see another 2-4 hours higher.

A very bad opening 30mins for those short.

-

Pre-Market Brief

Good morning. Futures are marginally lower, sp-4pts, we're set to open around Tuesday's low of 1498. It will be important for the bears today to see at least a moderately lower close, anything <1495 would be acceptable, with VIX >14.50.

sp'daily5

vix'daily3

Summary

We have the Chicago PMI @ 9.45am, that will be important. Bears should seek a reading <50, which is recessionary.

LVS is higher on earnings, FB -5%, QCOM +6%

Lets see how we go this morning. Can we see some morning declines..but just keep going?

Good wishes for Thursday..the last day of January!

sp'daily5

vix'daily3

Summary

We have the Chicago PMI @ 9.45am, that will be important. Bears should seek a reading <50, which is recessionary.

LVS is higher on earnings, FB -5%, QCOM +6%

Lets see how we go this morning. Can we see some morning declines..but just keep going?

Good wishes for Thursday..the last day of January!

Retracement underway

The market reacted with a touch of weakness to the FOMC announcement in the late afternoon. More importantly though, the two indexes which lead the way up - Transports & Rus'2000, both closed with significant declines of 1.5 and 1.2% respectively. The Sp, Dow, and Nasdaq should (in theory) see similar falls within the next few days.

sp'60min4 - fib levels

sp'weekly

sp'monthly3, rainbow

Summary

So, the three main indexes only declined a minor 0.3-0.5%, but it is the move in the Trans and R2K that I think bears can justifiably focus on. The decline in the Tranny was the biggest since the mid November lows, so its kinda important.

The near term retracement - if that's what it is, will likely get stuck somewhere in the sp'1460/50s. The 1440s look out of range after this Friday.

The mid-term trend remains fiercely higher, and as the weekly chart shows, by next week, key rising-channel support will be in the sp'1450s.

If rising support holds - as I'm sure it will, then a further major wave higher to the sp'1520-50 level seems likely in Feb/early March, along with the big dow 14k level..and then quickly surpassing the Oct'2007 high of 14198.

Looking ahead

Thursday will see the usual jobs data, but also Personal income/outlays, the Chicago PMI..and the Natural Gas report. That is plenty for Mr Market to use as an excuse to pick a direction and run with it, all the way into the close.

We could easily open a touch higher tomorrow, but regardless of the open, bears should be seeking a Thursday close <1495..preferably 1490. Anything in the 1480s by the end of this week would be good, and open up those 1460/50s for next week.

Goodnight from London

sp'60min4 - fib levels

sp'weekly

sp'monthly3, rainbow

Summary

So, the three main indexes only declined a minor 0.3-0.5%, but it is the move in the Trans and R2K that I think bears can justifiably focus on. The decline in the Tranny was the biggest since the mid November lows, so its kinda important.

The near term retracement - if that's what it is, will likely get stuck somewhere in the sp'1460/50s. The 1440s look out of range after this Friday.

The mid-term trend remains fiercely higher, and as the weekly chart shows, by next week, key rising-channel support will be in the sp'1450s.

If rising support holds - as I'm sure it will, then a further major wave higher to the sp'1520-50 level seems likely in Feb/early March, along with the big dow 14k level..and then quickly surpassing the Oct'2007 high of 14198.

Looking ahead

Thursday will see the usual jobs data, but also Personal income/outlays, the Chicago PMI..and the Natural Gas report. That is plenty for Mr Market to use as an excuse to pick a direction and run with it, all the way into the close.

We could easily open a touch higher tomorrow, but regardless of the open, bears should be seeking a Thursday close <1495..preferably 1490. Anything in the 1480s by the end of this week would be good, and open up those 1460/50s for next week.

Goodnight from London

Daily Index Cycle update

The main indexes appear to be beginning a retracement. The two indexes that lead the way up -Transports and Rus'2000, are appropriately the ones leading the way lower. A multi-day fall of 3-4% would seem very reasonable, with a primary target of sp'1460/50 by end of next week, with VIX'17/18

IWM, daily

SP'daily5

Trans

Summary

Its been two months since we've seen the transports decline by >1.5% - we have to go way back to the post US election November lows. With the Rus'2000 (see IWM chart) similarly falling by 1.2%, I feel confident enough to say that today's close in the two leaders is a good warning that the main indexes will see similar big falls within the next few days.

Transports could fall to 5500 without doing any damage to the primary uptrend, and that equates to sp'1460/50.

So, I think its fair to assume a moderate 3-4% decline in a near term retracement. That is not too bold a call, and as noted, it does nothing to damage in what remain VERY strong up trends - as seen on the weekly/monthly charts.

A little more later

IWM, daily

SP'daily5

Trans

Summary

Its been two months since we've seen the transports decline by >1.5% - we have to go way back to the post US election November lows. With the Rus'2000 (see IWM chart) similarly falling by 1.2%, I feel confident enough to say that today's close in the two leaders is a good warning that the main indexes will see similar big falls within the next few days.

Transports could fall to 5500 without doing any damage to the primary uptrend, and that equates to sp'1460/50.

So, I think its fair to assume a moderate 3-4% decline in a near term retracement. That is not too bold a call, and as noted, it does nothing to damage in what remain VERY strong up trends - as seen on the weekly/monthly charts.

A little more later

Subscribe to:

Comments (Atom)