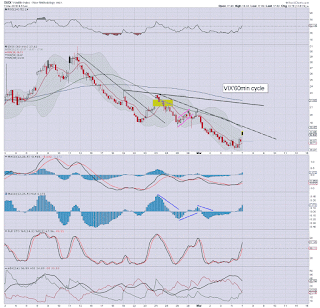

With US equity indexes closing moderately mixed, the VIX managed a second consecutive net daily gain (intra high 18.04), settling +2.9% @ 17.35. Near term outlook threatens further equity upside, at least to the 200dma of sp'2022, with the 2030/40s viable next week.

VIX'60min

VIX'daily3

Summary

The opening hourly VIX candle was a black-fail, and that sure didn't bode well for the equity bears.

Despite moderate equity weakness in the afternoon, the VIX only managed a brief venture to the low 18s, before cooling into the close.

Volatility bulls are probably going to need to be patient until the ECB and the FOMC are out of the way, before VIX has any realistic opportunity of sustained upside above the key 20 threshold.

VIX 30s look out of range until early April, with hyper upside to the 40/50s viable from around mid May.

--

more later... on the indexes

Monday, 7 March 2016

Closing Brief

US equity indexes closed moderately mixed, sp +1pt @ 2001 (intra high 2006). The two leaders - Trans/R2K, settled higher by 0.4% and 1.1% respectively. Near term outlook is for further chop, but leaning on the upside. Next target is the 200dma of sp'2022, with the 2030/40 zone more viable next week.

sp'60min

Summary

*closing hour action: micro chop, and once again... leaning on the upside, as the equity bears lack any sig' downside power.

--

Little to note... on what was a relatively subdued day.

As things are, Tuesday will likely be even quieter than today.

For the moment, equity bears remain powerless, and there is zero realistic hope until the ECB this Thursday. Even then, the market will likely have a fairly high chance of holding together into next Wednesday's FOMC.

--

Kinda bizarre to think that Indepedence Day is now approaching its 20'th anniversary. Hopefully, the sequel will be at least 'reasonable'.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: micro chop, and once again... leaning on the upside, as the equity bears lack any sig' downside power.

--

Little to note... on what was a relatively subdued day.

As things are, Tuesday will likely be even quieter than today.

For the moment, equity bears remain powerless, and there is zero realistic hope until the ECB this Thursday. Even then, the market will likely have a fairly high chance of holding together into next Wednesday's FOMC.

--

|

| Bullish construction sector |

|

| '... you had the bodies, locked up in a bunker!' |

Kinda bizarre to think that Indepedence Day is now approaching its 20'th anniversary. Hopefully, the sequel will be at least 'reasonable'.

--

more later... on the VIX

3pm update - moderate bearish hysteria

With a swing from sp'2006 to 1989, some of the equity bears will no doubt be a little excited... but rising support - from the sp'1810 low, remains intact. It would seem the 2020s are still due, with the 2030/40s viable on FOMC day (March 16th).

sp'60min

Summary

Little to add, on what remains a subdued day.. and Tuesday will likely be much the same.

Clearly, the main upward trend remains intact, and with the ECB a full 2 trading days away, bears still at risk of first seeing 2020s.

Even then, I remain very cautious about getting involved on the short side ahead of FOMC.

notable strength: miners, GDX +2.7%, as Gold has re-built gains of $7.

--

If you can guess the movie... the prize is that of being right

-

back at the close

sp'60min

Summary

Little to add, on what remains a subdued day.. and Tuesday will likely be much the same.

Clearly, the main upward trend remains intact, and with the ECB a full 2 trading days away, bears still at risk of first seeing 2020s.

Even then, I remain very cautious about getting involved on the short side ahead of FOMC.

notable strength: miners, GDX +2.7%, as Gold has re-built gains of $7.

--

If you can guess the movie... the prize is that of being right

-

back at the close

2pm update - the chop continues

US equity indexes are moderately mixed, with the sp -1pt, whilst the Dow is +49pts. VIX is +3% in the mid 17s. The key 20 threshold looks out of range until at least the ECB this Thursday. Metals are choppy, Gold +$5.. having briefly turned negative.

GLD, daily2

USO, daily2

Summary

Little to add.. on what is a quiet day.... tomorrow will likely be quieter.. and such light conditions favour the bulls.. via algo-bot upside melt.

--

*I am aware, the infamous Gartman is lightening up on the long side.. so.. that probably confirms we're headed for 2020/40 zone into the FOMC.

--

back at 3pm

GLD, daily2

USO, daily2

Summary

Little to add.. on what is a quiet day.... tomorrow will likely be quieter.. and such light conditions favour the bulls.. via algo-bot upside melt.

--

*I am aware, the infamous Gartman is lightening up on the long side.. so.. that probably confirms we're headed for 2020/40 zone into the FOMC.

--

back at 3pm

1pm update - kinda close

US equities remain moderately higher, with most indexes on track to hit their respective 200dma's later this week. VIX remains broadly subdued, +2% in the low 17s. Metals are starting to struggle, Gold +$1, with Silver +0.2%.

sp'daily5b

GLD,daily2

Summary

I realise many might disagree, but even a simple 'add 20 days' to the sp'1810 low gives a target peak of this Friday (+/- a few days either way).

If we're trading in the sp'2020s this Wed-Friday, that might well be it, with a more decisive turn after the FOMC (March 16th) is out of the way.

For the moment, there seems zero reason for the bears to be involved until late Wednesday at the earliest, and even then, if we're only in the 2010s.. is still seems marginally risky.

-

re: Gold/Silver. From a cyclical MACD perspective, its a lousy setup for those holding long. I still fear a sig' retrace ahead of the FOMC. That won't negate the broader bullish trend break of course.

Miners will be equally vulnerable into middle of next week.

--

Back at 2pm.. maybe

sp'daily5b

GLD,daily2

Summary

I realise many might disagree, but even a simple 'add 20 days' to the sp'1810 low gives a target peak of this Friday (+/- a few days either way).

If we're trading in the sp'2020s this Wed-Friday, that might well be it, with a more decisive turn after the FOMC (March 16th) is out of the way.

For the moment, there seems zero reason for the bears to be involved until late Wednesday at the earliest, and even then, if we're only in the 2010s.. is still seems marginally risky.

-

re: Gold/Silver. From a cyclical MACD perspective, its a lousy setup for those holding long. I still fear a sig' retrace ahead of the FOMC. That won't negate the broader bullish trend break of course.

Miners will be equally vulnerable into middle of next week.

--

Back at 2pm.. maybe

12pm update - not surprisingly positive

With powerless equity bears, US equity indexes have already turned marginally positive, and it seems just a matter of which day this week the sp'500 will be trading in the 2020s. VIX is +1% in the low 17s.. but looks vulnerable for a red close. Gold is +$5, with the miner ETF of GDX +3.6% in the $20.40s.

sp'daily

Summary

*it is notable that we're currently net higher for the fifth consecutive day, the best run since mid Dec'2014.

--

Little to add.

There is zero reason to see the market see any sig' weakness until the ECB this Thursday. That would be the valid excuse.

--

notable weakness, TVIX, daily

With the VIX remaining broadly subdued, TVIX is already negative, and the 5s look viable if sp'2030/40s, and VIX 14/13s.

--

time for tea

sp'daily

Summary

*it is notable that we're currently net higher for the fifth consecutive day, the best run since mid Dec'2014.

--

Little to add.

There is zero reason to see the market see any sig' weakness until the ECB this Thursday. That would be the valid excuse.

--

notable weakness, TVIX, daily

With the VIX remaining broadly subdued, TVIX is already negative, and the 5s look viable if sp'2030/40s, and VIX 14/13s.

--

time for tea

11am update - micro chop

US equities remain moderately mixed, stuck in micro chop mode, as some sellers are understandably appearing as indexes are close to their respective 200dmas. VIX remains relatively subdued, +3% in the mid 17s. Metals are battling to hold moderate gains, Gold +$6.

sp'weekly1b

Summary

Not the underlying MACD (blue bar histogram)... positive cycle for the first time since late December.

Equity bears really need to halt that increase by late next week.

--

notable weakness, CREE, daily

... downgraded by some barely heard of group. If sp'1600s, CREE will hit $20.. if not the mid teens.

--

sp'weekly1b

Summary

Not the underlying MACD (blue bar histogram)... positive cycle for the first time since late December.

Equity bears really need to halt that increase by late next week.

--

notable weakness, CREE, daily

... downgraded by some barely heard of group. If sp'1600s, CREE will hit $20.. if not the mid teens.

--

10am update - opening weakness

US equities open moderately lower, but once again, the equity bears appear powerless, with high threat of renewed upside for an initial attempt to clear the 200dma @ sp'2022. VIX opens higher, but the opening black-fail candle should not inspire those seeking downside ahead of the ECB this Thursday.

sp'daily

VIX'60min

Summary

So.. a little lower, but it should be clear to most there really isn't any downside power.. and considering the bigger weekly cycles (a bullish MACD cross has occurred)... the bulls are increasingly in control.

The next 8-10 trading days will be critical. Equity bears must hold the line at the 2020/40 zone... with renewed cooling into end month.

If March closes strong.. then any talk of broader downside will cease.

--

notable weakness: SDRL, daily

Not surprisingly, last Friday's bullish hysteria is starting to fade. Target: $0.00

sp'daily

VIX'60min

Summary

So.. a little lower, but it should be clear to most there really isn't any downside power.. and considering the bigger weekly cycles (a bullish MACD cross has occurred)... the bulls are increasingly in control.

The next 8-10 trading days will be critical. Equity bears must hold the line at the 2020/40 zone... with renewed cooling into end month.

If March closes strong.. then any talk of broader downside will cease.

--

notable weakness: SDRL, daily

Not surprisingly, last Friday's bullish hysteria is starting to fade. Target: $0.00

Pre-Market Brief

US equity futures are moderately lower, sp -10pts, we're set to open at 1989. USD is +0.3% in the DXY 95.50s. Metals remain strong, Gold +$10, with Silver +1.8%. Oil is +0.4% in the $36s.

sp'60min

Summary

By the the close of today, rising support will be 1990, so.. the bulls need a close above that.

Another push to the 200dma looks likely... and that will be around 2022 across this week.

Regardless of today though, what next matters is whether the ECB/Draghi can placate the market enough this Thursday.

Clearly, having ramped from sp'1810 to 2009, the market will be looking for an excuse for at least a minor retrace.

--

early movers...

CNX +10%, unsustainable recent gains

SDRL -9%, the wild action continues

GDX +2.2%... as the metals simply still won't retrace

--

Overnight action

Japan: -0.6% @ 16911

China: latter day recovery, +0.8% @ 2897

Germany: currently -0.9% @ 9738

--

sp'60min

Summary

By the the close of today, rising support will be 1990, so.. the bulls need a close above that.

Another push to the 200dma looks likely... and that will be around 2022 across this week.

Regardless of today though, what next matters is whether the ECB/Draghi can placate the market enough this Thursday.

Clearly, having ramped from sp'1810 to 2009, the market will be looking for an excuse for at least a minor retrace.

--

early movers...

CNX +10%, unsustainable recent gains

SDRL -9%, the wild action continues

GDX +2.2%... as the metals simply still won't retrace

--

Overnight action

Japan: -0.6% @ 16911

China: latter day recovery, +0.8% @ 2897

Germany: currently -0.9% @ 9738

--

Subscribe to:

Comments (Atom)