Whilst the main indexes closed moderately higher, the VIX closed 1.5% higher @ 15.31. At these very low levels though, the VIX is arguably 'all noise'.

VIX'60min

VIX,daily

Summary

So the VIX closed a little higher, after being -1% in the morning, but it really is...all noise.

Until we see the big break >20, the VIX is largely to be ignored.

--

If my index outlook (sp'daily4) is correct, we should see VIX break above 20 in December.

Wednesday, 21 November 2012

Closing Brief

The market closed moderately higher, on what was (as expected) a low volume algo-bot melt upward. Primary target zone remains sp'1410/25 to be hit next week.

Dow

Sp'

Trans

Summary

As expected, the market was in low volume mode, which allowed those nasty algo-bots to take command, and melt the market very slowly...oh so slowly.... upward.

There is simply no point in trading just prior to most holiday breaks, I'm glad to be sitting this nonsense out.

--

bits and pieces across the evening.

*I'll post something tomorrow, maybe a look at the $ or WTIC Oil.

Dow

Sp'

Trans

Summary

As expected, the market was in low volume mode, which allowed those nasty algo-bots to take command, and melt the market very slowly...oh so slowly.... upward.

There is simply no point in trading just prior to most holiday breaks, I'm glad to be sitting this nonsense out.

--

bits and pieces across the evening.

*I'll post something tomorrow, maybe a look at the $ or WTIC Oil.

3pm update - closing hour tedium

Mr Market in holiday mood, there is very little going on, and we're set to close moderately higher.

sp'daily5

Summary

Low volume melt continues....

back after the close

sp'daily5

Summary

Low volume melt continues....

back after the close

2pm update - so.err...where we going?

Mr Market remains in low volume algo-bot melt land..little else needs to be said. So, lets ponder the big question, where are we headed from here?

sp'daily5b - 3 scenarios

Summary

Yes, there are infinite scenarios, but the above three cover the important ones.

So, how about A ? A rally into Christmas..and we just keep on going, taking out the QE high of sp'1474 ?

I find that VERY difficult to envision, not least since the monthly and weekly charts say 'NO!'

B', is without question a doomer near term outlook. A bounce to around 1410/25 next week, and then a train wreck down cycle of around 2 weeks, where we take out the recent 1343 low, and make a challenge of the June 1266 low.

Such a move would be real fast, take many by surprise - not least, this close to Christmas, but would..ironically, VERY likely inspire the politicians on capitol hill to agree to delaying (almost entirely) the tax rises/spending cuts that are the 'fiscal cliff'.

Scenario C' is more of a 'choppy Christmas trading', but declining into January, and eventually hitting the low 1200s by early spring.

B would be nice, but..I'd settle for C :)

back at 3pm

sp'daily5b - 3 scenarios

Summary

Yes, there are infinite scenarios, but the above three cover the important ones.

So, how about A ? A rally into Christmas..and we just keep on going, taking out the QE high of sp'1474 ?

I find that VERY difficult to envision, not least since the monthly and weekly charts say 'NO!'

B', is without question a doomer near term outlook. A bounce to around 1410/25 next week, and then a train wreck down cycle of around 2 weeks, where we take out the recent 1343 low, and make a challenge of the June 1266 low.

Such a move would be real fast, take many by surprise - not least, this close to Christmas, but would..ironically, VERY likely inspire the politicians on capitol hill to agree to delaying (almost entirely) the tax rises/spending cuts that are the 'fiscal cliff'.

Scenario C' is more of a 'choppy Christmas trading', but declining into January, and eventually hitting the low 1200s by early spring.

B would be nice, but..I'd settle for C :)

back at 3pm

12pm update - slow motion market

Pre-holiday trading, low volume, the algo-bots are in full control. This is absolutely not the time for the bears to have a chair at the blackjack table. VIX is 1% lower, lurking in the high 14s.

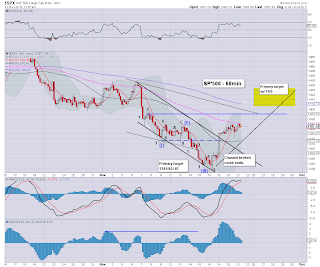

sp'60min

sp'daily5

Summary

The hourly index cycle is about 2-3 trading hours from going negative on the MACD (blue bar histogram) cycle, so there is a threat of late day downside, but really, it is nothing the bears should be chasing.

Downside is surely limited with most of the market already in semi-closed status.

With the holiday break - which effectively takes us into next week, there is no point in trying to trade it.

Maybe I can find a few interesting charts to post this afternoon.

time for lunch, back around 2pm.

--

ohh, here is something...

FB, daily

FB trying to break above the giant gap level. A few closes in the 26s, would be admittedly bullish into next year. Fair value remains $4 though. I certainly am just keeping an eye on it..for now.

sp'60min

sp'daily5

Summary

The hourly index cycle is about 2-3 trading hours from going negative on the MACD (blue bar histogram) cycle, so there is a threat of late day downside, but really, it is nothing the bears should be chasing.

Downside is surely limited with most of the market already in semi-closed status.

With the holiday break - which effectively takes us into next week, there is no point in trying to trade it.

Maybe I can find a few interesting charts to post this afternoon.

time for lunch, back around 2pm.

--

ohh, here is something...

FB, daily

FB trying to break above the giant gap level. A few closes in the 26s, would be admittedly bullish into next year. Fair value remains $4 though. I certainly am just keeping an eye on it..for now.

10am update - the bounce continues

The market continues to rally, with the VIX breaking back into the 14s, a level not seen for a month. The 'holiday reversal' rally looks set to continue into early next week. Primary target zone for this wave'2 bounce remains sp'1410/25.

sp'daily5

VIX'daily

Summary

Santa opened the market this morning, and is now strolling around the floor of the NYSE.

That probably sums up all that needs to be said about this casino today.

--

I remain on the sidelines, no button hitting until early next week..at the earliest.

back at 12pm.

sp'daily5

VIX'daily

Summary

Santa opened the market this morning, and is now strolling around the floor of the NYSE.

That probably sums up all that needs to be said about this casino today.

--

I remain on the sidelines, no button hitting until early next week..at the earliest.

back at 12pm.

Pre-Market Brief

Good morning. Those bears short from the Tuesday close will be annoyed. Overnight futures has swung from sp -8pts to +2pts, we're set to open around 1390. Today will likely be very quiet, giving the algo-bots the opportunity to melt this market into the 1390s for thanksgiving.

sp'60min

sp'daily5

Summary

So, a quiet day is ahead of us. I don't think we'll break into the 1400s today, thats far more likely for Friday, once the media get hysterical about black Friday retail sales.

Just watching Santelli and Liesman on clown network...always amusing.

*two pieces of econ-data around 10am, although I'd guess the market will rally on regardless.

Good wishes

sp'60min

sp'daily5

Summary

So, a quiet day is ahead of us. I don't think we'll break into the 1400s today, thats far more likely for Friday, once the media get hysterical about black Friday retail sales.

Just watching Santelli and Liesman on clown network...always amusing.

*two pieces of econ-data around 10am, although I'd guess the market will rally on regardless.

Good wishes

Almost time for a holiday break

The main indexes closed flat today, look set for further gains into the thanksgiving break, and continuing into next week. Primary target zone for the completion of this wave'2 bounce remains sp'1410/25.

sp'daily3 - news to come

sp'daily4 - bearish scenario

sp'daily7- fibs

Summary

Wednesday will see normal trading hours, but it will likely be very muted trading.

*Thursday, US markets closed. Friday trading: 9.30am-1pm

--

The daily'4 chart displays my primary outlook, although the time frame is the tricky part. I'm pretty certain on the price target, but it might take until January to really see the big downside action - not least because of the seasonal 'Santa' factor.

I like the Fib' charts, and would like to see the sp'500 get stuck somewhere between the 50 and 61.8% levels - hence my target 1410/25 zone.

Still a spectator

I remain content to watch this market battle higher from the sidelines. I 'might' consider a brief re-short as early as next Monday if we are stuck around sp'1410.

However, the bigger strategy is merely to wait for a rollover on the daily MACD cycle, which at the moment, appears unlikely to happen until the very end of next week - at the earliest.

Goodnight from London

sp'daily3 - news to come

sp'daily4 - bearish scenario

sp'daily7- fibs

Summary

Wednesday will see normal trading hours, but it will likely be very muted trading.

*Thursday, US markets closed. Friday trading: 9.30am-1pm

--

The daily'4 chart displays my primary outlook, although the time frame is the tricky part. I'm pretty certain on the price target, but it might take until January to really see the big downside action - not least because of the seasonal 'Santa' factor.

I like the Fib' charts, and would like to see the sp'500 get stuck somewhere between the 50 and 61.8% levels - hence my target 1410/25 zone.

Still a spectator

I remain content to watch this market battle higher from the sidelines. I 'might' consider a brief re-short as early as next Monday if we are stuck around sp'1410.

However, the bigger strategy is merely to wait for a rollover on the daily MACD cycle, which at the moment, appears unlikely to happen until the very end of next week - at the earliest.

Goodnight from London

Daily Index Cycle update

The main markets closed largely flat. This was a very natural pause/holding day whilst the smaller cycles reset in prep' for the next leg higher. Primary target zone remains sp'1410/25 within the next 3-7 trading days.

Dow, daily

Sp'daily5

Trans

Summary

So we had a pause day, and tomorrow is the lead into thanksgiving. The general near term trend is most certainly still UP.

Take a look at the daily MACD (blue bar histogram) cycle, we are only day'2 UP in this cycle, and we could easily see another 3-5 ticks to the upside. Best guess, I'd be looking for the cycle to level out at the end of next week.

Wednesday - dull ?

It will probably be a very quiet day, near zero volume, and thus the algo-bots will get the opportunity to melt this market higher, into the 1390/95 zone. That would set up a gap straight into the 1400/10 zone this Friday morning.

If the clown networks can somehow spin the 'black Friday' retail sales as super bullish, we certainly could end the week in the low 1400s. I can only imagine the bullish hysteria at that point.

A little more later.

Dow, daily

Sp'daily5

Trans

Summary

So we had a pause day, and tomorrow is the lead into thanksgiving. The general near term trend is most certainly still UP.

Take a look at the daily MACD (blue bar histogram) cycle, we are only day'2 UP in this cycle, and we could easily see another 3-5 ticks to the upside. Best guess, I'd be looking for the cycle to level out at the end of next week.

Wednesday - dull ?

It will probably be a very quiet day, near zero volume, and thus the algo-bots will get the opportunity to melt this market higher, into the 1390/95 zone. That would set up a gap straight into the 1400/10 zone this Friday morning.

If the clown networks can somehow spin the 'black Friday' retail sales as super bullish, we certainly could end the week in the low 1400s. I can only imagine the bullish hysteria at that point.

A little more later.

Subscribe to:

Comments (Atom)