Despite the hyper ramp in the equity market in the afternoon, the VIX remains in the broader up channel, on ALL cycles.

VIX'60min

VIX, daily

VIX, weekly

Summary

So...unless we see VIX break below 21..and more definitively <20, the VIX is still trending UP. The daily and weekly cycles are strong evidence for the general bearish outlook.

If the market drops Thursday, the first main target on VIX is 27. That would probably equate to sp'1280.

Wednesday, 23 May 2012

Closing Brief

A hyper ramp into the close...great. That's just great. I should probably turn my screen off...for good. This is really getting too annoying, and the VIX remains low. If I'm getting smashed around whilst VIX is a mere 24, this is not going to end well trading whilst VIX is 40/50 in the distant months ahead.

I feel like I've spent the last three days in a washing machine on 1400rpm. Is there a dry cycle next?

IWM, 60min

Dow'60min

Sp'60min

Summary

The question now is...what that the fifth wave lower? There have been plenty of occasions when the fifth puts in a marginally higher low, before blasting off on a multi-day rally.

The hourly cycles did close just within the down channels. We are also still below the daily 10MA - and within the broader down channel. Yet...this is day'16..at some point we are going to explode higher, more likely on a gap up..after a long weekend.

Horrible day.

As for me...I'm effectively nuked. Its probably time to get back into that washing machine again.

I feel like I've spent the last three days in a washing machine on 1400rpm. Is there a dry cycle next?

IWM, 60min

Dow'60min

Sp'60min

Summary

The question now is...what that the fifth wave lower? There have been plenty of occasions when the fifth puts in a marginally higher low, before blasting off on a multi-day rally.

The hourly cycles did close just within the down channels. We are also still below the daily 10MA - and within the broader down channel. Yet...this is day'16..at some point we are going to explode higher, more likely on a gap up..after a long weekend.

Horrible day.

As for me...I'm effectively nuked. Its probably time to get back into that washing machine again.

3pm update - time for a last hour sell off?

During this sixteen day down cycle we've seen almost every day end with a closing hour sell off, on balance, we are more than likely to get another one today. Maybe its time for another comment from the ex Greek leader? Or perhaps, a baseless rumour across the wires...about 'LTRO'3...4, 5, 6. imminent?'

SP'60min

Summary

First target remains sp'1280 sometime tomorrow. The bigger weekly and monthly cycles warn of much lower levels ahead.

The daily 10MA has held the line so far - and interestingly did so again yesterday (I was not looking closely enough). Arguably, the more careful and wiser bulls will wait for a break back above the daily 10MA. Until such time, the down trend can be said to be continuing.

Right now, only a move above the upper channel of sp'1320 would violate what remains a bizarrely long down cycle.

More after the close.

SP'60min

Summary

First target remains sp'1280 sometime tomorrow. The bigger weekly and monthly cycles warn of much lower levels ahead.

The daily 10MA has held the line so far - and interestingly did so again yesterday (I was not looking closely enough). Arguably, the more careful and wiser bulls will wait for a break back above the daily 10MA. Until such time, the down trend can be said to be continuing.

Right now, only a move above the upper channel of sp'1320 would violate what remains a bizarrely long down cycle.

More after the close.

2pm update - minor intra-day bounce

A natural bounce is underway, but its just noise. Whether it last into the close probably doesn't even matter. This sick and nasty market is surely headed lower. The failure yesterday afternoon in the mid 1320s was a key sign.

The only thing the bears are still waiting for is a new high in the VIX...probably tomorrow, 27/29

Sp'60min

VIX'60min

--

A quick reminder on the sp'weekly...

The weekly candle is turning into a real train-wreck for the bulls. Its a real warning of much lower prices. Arguably..a break under the blue support line of 1270...and this market one-day crashes to 1160.

Yeah..1160.

More later...

The only thing the bears are still waiting for is a new high in the VIX...probably tomorrow, 27/29

Sp'60min

VIX'60min

--

A quick reminder on the sp'weekly...

The weekly candle is turning into a real train-wreck for the bulls. Its a real warning of much lower prices. Arguably..a break under the blue support line of 1270...and this market one-day crashes to 1160.

Yeah..1160.

More later...

1pm update - Ugly Market..day'16

The market continues to slide. The hourly cycle charts show no sign of a floor until at least sp'1280 - which would appear likely early Thursday. VIX is still trying to break the recent 25.50 highs. A close in the VIX today in the 26s..would open up a possible brief spike into the 30s tomorrow. More on that idea later.

SP'60min

SP'daily, bearish outlook

Summary

The daily chart down-channel would allow sp'1270 tomorrow. Anything under 1265..and we would see freefall to probably 1200/1175 - with VIX in the mid 30s.

A fall to the 200day MA @ 1280, would make for 135pts down across 17 days. That is one very strong minor wave'1 down. We are of course still due a minor wave'2 UP. If 1280 is the floor, then a move all the way to 1370 would still be viable, although 1340 would be first target.

I am holding short until sp'1280 tomorrow morning.

SP'60min

SP'daily, bearish outlook

Summary

The daily chart down-channel would allow sp'1270 tomorrow. Anything under 1265..and we would see freefall to probably 1200/1175 - with VIX in the mid 30s.

A fall to the 200day MA @ 1280, would make for 135pts down across 17 days. That is one very strong minor wave'1 down. We are of course still due a minor wave'2 UP. If 1280 is the floor, then a move all the way to 1370 would still be viable, although 1340 would be first target.

I am holding short until sp'1280 tomorrow morning.

12pm update - next target..sp'1280

I'm getting tired, this market is again really starting to annoy me. We are in a relentless SIXTEEN day down cycle, and we are still yet to see ANY real panic, never mind a capitulation day. The thing is, we're only 20pts from the next main level on the sp' of 1280. Another 20pts sure won't be enough to merit capitulation. I'd look for a 35/50pt move. How low we going in this wave, 1275, 1250, 1200 ?

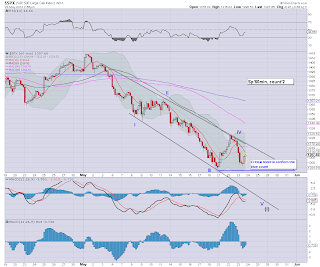

Sp'60min, count'2

Dow'60min

VIX'60min

Summary

Whilst the key support level on the sp' to break is 1292, the dow has already broken the equivalent recent floor, and arguably confirms we are in a new wave lower, wave 5 of 5 - of minor'1.

As for the SP', first target remains the 200 day MA@ 1280, which 'should' in theory occur tomorrow. If that is the case, that should take the VIX to at least 27.

Time for lunch..back later

Sp'60min, count'2

Dow'60min

VIX'60min

Summary

Whilst the key support level on the sp' to break is 1292, the dow has already broken the equivalent recent floor, and arguably confirms we are in a new wave lower, wave 5 of 5 - of minor'1.

As for the SP', first target remains the 200 day MA@ 1280, which 'should' in theory occur tomorrow. If that is the case, that should take the VIX to at least 27.

Time for lunch..back later

11am update - minute wave'5 underway

Urghh...what a week, what a month! So....the bulls were faked from Monday-Tuesday early afternoon. Whilst the Dow broke out of the down channel, other indexes were somewhat weaker. Someone had even pointed out to me the weakness in the Rus'2000 index. I was too dismissive, and clearly should have been bailing out of index-longs yesterday afternoon.

SP'60min, count'2

The above count is partly inspired by none other than Daneric (see chartists links). It assumes 5 waves down, forming minor wave'1 down - of what should be a bigger decline to what I believe will be around sp'1100.

The monthly charts have been warning of trouble for weeks of course, and the world indexes continue to warn of declines of around 30% in many indexes from current levels.

So, I'm short, looking to exit around 1280 tomorrow.

More later...

SP'60min, count'2

The above count is partly inspired by none other than Daneric (see chartists links). It assumes 5 waves down, forming minor wave'1 down - of what should be a bigger decline to what I believe will be around sp'1100.

The monthly charts have been warning of trouble for weeks of course, and the world indexes continue to warn of declines of around 30% in many indexes from current levels.

So, I'm short, looking to exit around 1280 tomorrow.

More later...

10am update - abandoning ship

Do the bulls put the blame solely on the ex Greek PM ? Everything was looking fine until he commented yesterday about Greek plans to leave the Euro. Now, we've the market back in the down channel (although some indexes did not decisively break above anyway), and we are back on the slide.

Sp'60min, count'2

VIX'60min

Summary

It would appear the bulls have a real problem again. A 2 day rally which moderately collapsed in the closing hour. This is bad...very bad.

So...lets re-start the clock..we are day'16 in this down cycle.

Primary target on the sp' is the 200day MA at 1280.

Secondary 'soft' support levels, 1250, 1225, and then major support at 1200.

My concern is that something spooks the market in the next day or two and we will just spiral much lower.

---

*I bailed on a long index position at the open, and am now short. If the market is going to at least sp'1280, I sure can't be holding long down to that level. I realise that may well be the ultimate in ill-timed decisions of the year, or it may actually help keep me in this insane casino.

yours... in a state of moderate dismay.

Sp'60min, count'2

VIX'60min

Summary

It would appear the bulls have a real problem again. A 2 day rally which moderately collapsed in the closing hour. This is bad...very bad.

So...lets re-start the clock..we are day'16 in this down cycle.

Primary target on the sp' is the 200day MA at 1280.

Secondary 'soft' support levels, 1250, 1225, and then major support at 1200.

My concern is that something spooks the market in the next day or two and we will just spiral much lower.

---

*I bailed on a long index position at the open, and am now short. If the market is going to at least sp'1280, I sure can't be holding long down to that level. I realise that may well be the ultimate in ill-timed decisions of the year, or it may actually help keep me in this insane casino.

yours... in a state of moderate dismay.

Pre-Market Brief

Futures are showing dow -90pts, that could easily extend in the early morning to -125/150. For those looking for a minute wave'5 lower (as part of what some still believe to be ongoing minor wave'1 down), we need to see dow -166 to break a new low. Of course, that doesn't have to happen today for the bears.

For the bulls, they have to be desperate to see today close green. Real desperate. The only realistic hope of that is some kind of statement/rumour from the EU. Right now, chances of that seem low on any given day.

Dow'60min

Summary

A rough opening looks set for the bulls. If we break a new low at any point today, that would really bode badly for the rest of this week. In which case it would be clear, yesterday morning was a cruel fake out to the bulls. The next prime target below sp'1292 would be the 200 day MA at 1279.

One aspect to watch as ever, the VIX. Can it break a new high into the 26s ? If we do see 26s, then that opens the door to the next level of 29/31 .

Good wishes for Wednesday

For the bulls, they have to be desperate to see today close green. Real desperate. The only realistic hope of that is some kind of statement/rumour from the EU. Right now, chances of that seem low on any given day.

Dow'60min

Summary

A rough opening looks set for the bulls. If we break a new low at any point today, that would really bode badly for the rest of this week. In which case it would be clear, yesterday morning was a cruel fake out to the bulls. The next prime target below sp'1292 would be the 200 day MA at 1279.

One aspect to watch as ever, the VIX. Can it break a new high into the 26s ? If we do see 26s, then that opens the door to the next level of 29/31 .

Good wishes for Wednesday

Greece - 89% gone...11% left

To conclude today, lets take a quick look at the Greek stock market. Also keep in mind that both Spanish and Italian indexes are following right behind.

Greece, monthly, 20yr historic

Summary

The Greek market has lost around 89% since the late 2007 peak (although there were slightly higher levels in 1999/2000). The 11% that remains is of course an extremely 'cheap' level, but I'd still guess the Greek market will lose around 8/9% of the remaining 11%.

With an eventual exit from the Euro seemingly assured, and a number of 'depression' years yet to pass, the Greek market will probably lose around 99% of its 2007 value.

For those outside of Greece, at some point, there will be some real bargains to be had. I personally know nothing of what Greece actually makes these days. Aside from the tourist industry, just what do they do with themselves?

Here is one link to maybe bookmark for the years ahead. Eventually, it might be worth doing some serious in-depth stock research for some of these Greek companies

Athens Composite Share Price Index - component list, with links for each stock.

--

Well, it sure was an interesting and choppy Tuesday. Bulls will need to see a decent move higher this Wednesday. We've an EU meeting, so lets see if that leads to some hyper-bullish ramps across the European and US markets.

Goodnight from London

Greece, monthly, 20yr historic

Summary

The Greek market has lost around 89% since the late 2007 peak (although there were slightly higher levels in 1999/2000). The 11% that remains is of course an extremely 'cheap' level, but I'd still guess the Greek market will lose around 8/9% of the remaining 11%.

With an eventual exit from the Euro seemingly assured, and a number of 'depression' years yet to pass, the Greek market will probably lose around 99% of its 2007 value.

For those outside of Greece, at some point, there will be some real bargains to be had. I personally know nothing of what Greece actually makes these days. Aside from the tourist industry, just what do they do with themselves?

Here is one link to maybe bookmark for the years ahead. Eventually, it might be worth doing some serious in-depth stock research for some of these Greek companies

Athens Composite Share Price Index - component list, with links for each stock.

--

Well, it sure was an interesting and choppy Tuesday. Bulls will need to see a decent move higher this Wednesday. We've an EU meeting, so lets see if that leads to some hyper-bullish ramps across the European and US markets.

Goodnight from London

Daily Cycle Update

So we've seen a bullish Monday, with Tuesday trading being 'mixed' to put it politely. The daily cycle counts listed below outline a 5 wave decline. Assuming that last Friday was the floor of a 13 day down cycle - wave'1, we are now due wave'2 UP, probably to sp'1370/80 by first week of June.

The most important issue would be then to look for a flat top/rollover in early June, and then the start of a collapse wave'3 - which should be much more severe than wave'1. Since wave'1 was a loss of around 100pts, I'd guess we have a fair chance of -150/200pts in the SP'500, maybe even more if the market really gets upset about some scary developments in the EU this June..

IWM, daily, bearish outlook

Sp, daily, bearish outlook

SP', weekly

Summary

I've added the weekly cycle to put both daily charts into perspective. I think what is especially important is the moderately declining (grey) trend line from the recent weekly candle peaks. It hints at a possible lower high in early June of around 1390. However, I'd again note the weekly 10MA of 1369 which will be primary resistance next week - if the current up cycle continues.

In terms of the two daily cycle charts noted above, both still look reasonably bullish for the rest of this week. I'd still look for at least a test of sp'1340 (equivalent to IWM 78.00) later this week. Only if we close over sp'1352 would the ultra-bullish outlook for new index highs come into play.

For the moment, I remain very bearish about the coming few months. My best guess remains sp'1150/00, no later than end July.

The most important issue would be then to look for a flat top/rollover in early June, and then the start of a collapse wave'3 - which should be much more severe than wave'1. Since wave'1 was a loss of around 100pts, I'd guess we have a fair chance of -150/200pts in the SP'500, maybe even more if the market really gets upset about some scary developments in the EU this June..

IWM, daily, bearish outlook

Sp, daily, bearish outlook

SP', weekly

Summary

I've added the weekly cycle to put both daily charts into perspective. I think what is especially important is the moderately declining (grey) trend line from the recent weekly candle peaks. It hints at a possible lower high in early June of around 1390. However, I'd again note the weekly 10MA of 1369 which will be primary resistance next week - if the current up cycle continues.

In terms of the two daily cycle charts noted above, both still look reasonably bullish for the rest of this week. I'd still look for at least a test of sp'1340 (equivalent to IWM 78.00) later this week. Only if we close over sp'1352 would the ultra-bullish outlook for new index highs come into play.

For the moment, I remain very bearish about the coming few months. My best guess remains sp'1150/00, no later than end July.

Subscribe to:

Comments (Atom)